In Home Daycare Tax Deduction Worksheet

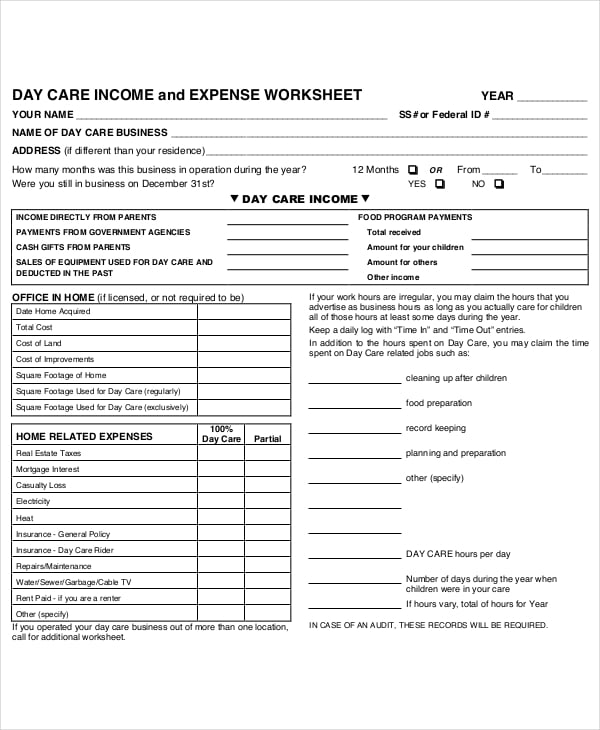

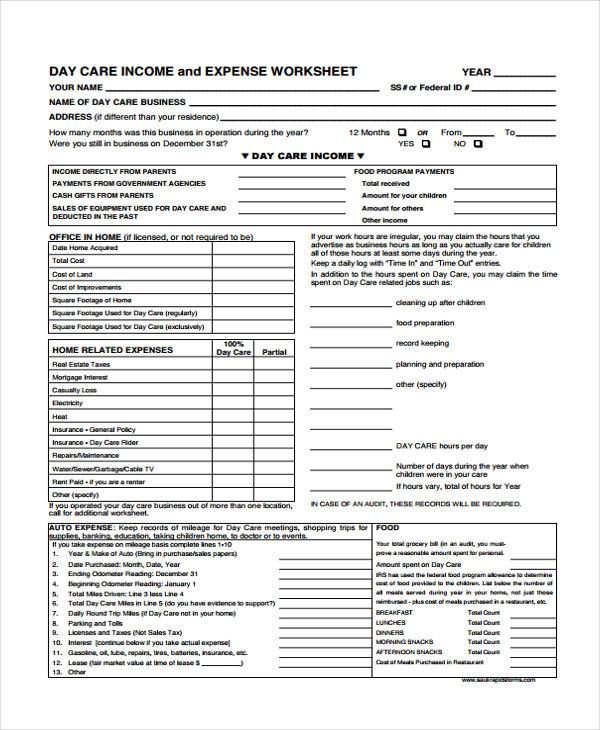

In Home Daycare Tax Deduction Worksheet - Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. Family daycare provider meal and snack log.32 Web day care income or from_______ to_________ yes no income directly from parents food program payments: Payments from government agencies total received cash gifts from parents amount for your children sales of equipment used for day care and amount for others deducted in the. This means that for the 2022 tax year,. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Tax year the purpose of this worksheet is to help you organize your tax deductible business expenses. Even if you pay an accountant to fill out your tax forms, this book will help you organize your expenses and prepare them for the tax preparer. It includes special rules for daycare providers. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before dec. Web the big list of home daycare tax deductions for family child care businesses! Web day care provider deductions client: Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before dec. Your federal income tax may be. The irs will let you deduct a set amount per square foot. Web worksheet to figure the deduction for business use of your home.20 worksheets to figure the deduction for business use of your home (simplified method).23 how to get tax help.27 exhibit a. If you paid someone to care for your child or other qualifying person so you (and. Web employees file this form to deduct ordinary and necessary expenses for their job. Tax year the purpose of this worksheet is to help you organize your tax deductible business expenses. Family daycare provider meal and snack log.32 Web daycares near you in yuba city, ca provide a range of services that allow children to grow and develop in safe,. If you make $70,000 a year living in california you will be taxed $11,221. Other items you may find useful all revisions for publication 587 about publication 523,. State and local real estate taxes, subject to the $10,000 limit; Tax year the purpose of this worksheet is to help you organize your tax deductible business expenses. It includes special rules. Attach form (s) ftb 3803 to your tax return. Web a 2022 tax guide for childcare providers with organization and preparation, you can ensure your childcare business is ready to file before your deadline. State and local real estate taxes, subject to the $10,000 limit; It includes special rules for daycare providers. This page may included affiliate links. Web home daycare tax deductions worksheet. Web this publication explains how to figure and claim the deduction for business use of your home. This means that for the 2022 tax year,. Web child and dependent care credit information. Web tax deductions for home daycares. If you make $70,000 a year living in california you will be taxed $11,221. Pdf of child care licensing regional offices Add the amount of tax, if any, from each form ftb 3803, line 9, to the amount of your tax from the tax table or tax rate schedules and enter the result on form 540, line 31. You may. Web family daycare provider—standard meal and snack rate log annual recap worksheet name of provider: Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who got their mortgage before dec. Web employees file this form to deduct ordinary and necessary expenses. Payments from government agencies total received cash gifts from parents amount for your children sales of equipment used for day care and amount for others deducted in the. Web the big list of home daycare tax deductions for family child care businesses! Supplies required to keep the daycare clean and sanitary are deductible. Attach form (s) ftb 3803 to your. Current revision publication 587 pdf ( html | ebook epub) recent developments none at this time. Web employees file this form to deduct ordinary and necessary expenses for their job. Attach form (s) ftb 3803 to your tax return. State and local real estate taxes, subject to the $10,000 limit; Supplies required to keep the daycare clean and sanitary are. If you paid someone to care for your child or other qualifying person so you (and your spouse if filing jointly) could work or look for work, you may be able to take the credit for child and dependent care expenses. The irs will let you deduct a set amount per square foot. Web worksheet to figure the deduction for business use of your home.20 worksheets to figure the deduction for business use of your home (simplified method).23 how to get tax help.27 exhibit a. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. Web family daycare provider—standard meal and snack rate log annual recap worksheet name of provider: Using it as a guide will allow us to prepare your tax return to obtain the lowest tax possible. The costs the homeowner can deduct are: Other items you may find useful all revisions for publication 587 about publication 523,. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Web daycares near you in yuba city, ca provide a range of services that allow children to grow and develop in safe, secure environments. State and local real estate taxes, subject to the $10,000 limit; Web the big list of home daycare tax deductions for family child care businesses! Web this publication explains how to figure and claim the deduction for business use of your home. Payments from government agencies total received cash gifts from parents amount for your children sales of equipment used for day care and amount for others deducted in the. This page may included affiliate links. Web most home buyers take out a mortgage loan to buy their home and then make monthly payments to the mortgage holder. Web use the daycare facility worksheet provided by the irs to determine what percentage of shared expenses, like heating, can be deducted. This means that for the 2022 tax year,. You may include other applicable ex enses. Web taxes for in home daycare. A necessary expense is one that is helpful and appropriate for your business. Add the amount of tax, if any, from each form ftb 3803, line 9, to the amount of your tax from the tax table or tax rate schedules and enter the result on form 540, line 31. Supplies required to keep the daycare clean and sanitary are deductible. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. If you make $70,000 a year living in california you will be taxed $11,221. An expense does not have to be required to be considered necessary. Other items you may find useful all revisions for publication 587 about publication 523,. This payment may include several costs of owning a home. Web daycares near you in yuba city, ca provide a range of services that allow children to grow and develop in safe, secure environments. Even if you pay an accountant to fill out your tax forms, this book will help you organize your expenses and prepare them for the tax preparer. If to work von main, you must know these important tax implications of setting up an home agency. Web home daycare tax deductions worksheet. Web file a separate form ftb 3803 for each child whose income you elect to include on your form 540. Brightwheel blog running a business a 2022 tax guide for childcare providers Web use the daycare facility worksheet provided by the irs to determine what percentage of shared expenses, like heating, can be deducted. Family daycare provider meal and snack log.3230 Home Daycare Tax Worksheet Education Template

Itemized Deductions Worksheet 2017 Printable Worksheets and

️Tax Organizer Worksheet 2015 Free Download Gmbar.co

30 Home Daycare Tax Worksheet Education Template

About Us East Harlem Tax Service Starting a daycare, Daycare

Printable Itemized Deductions Worksheet Customize and Print

Home Daycare Tax Worksheet Promotiontablecovers

Pin on Worksheet

Home Daycare Tax Worksheet

Home Daycare Tax Worksheet

Before You Go Through Your First (Or 30 Th) Year In Home Daycare, I Implore You To Run And Buy Tom Copeland’s Tax Workbook.

Web The Child And Dependent Care Credit Is Worth 20% To 35% Of Up To $3,000 (For One Qualifying Dependent) Or $6,000 (For Two Or More Qualifying Dependents).

Web Day Care Income And Expense Worksheet Name ___________________________________________________________ Year ___________________________ Day Care Income Gross Income From Day Care $ _____________________ Federal Food Reimbursement $____________________.

This Means That For The 2022 Tax Year,.

Related Post: