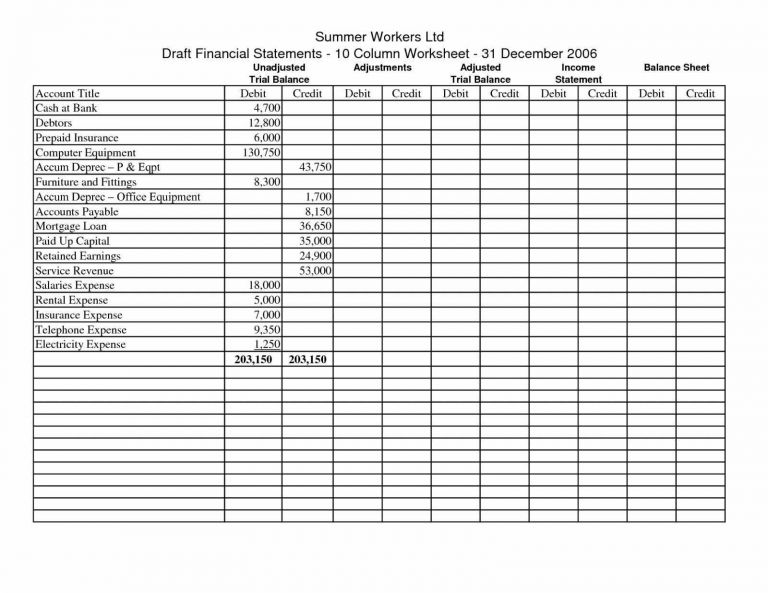

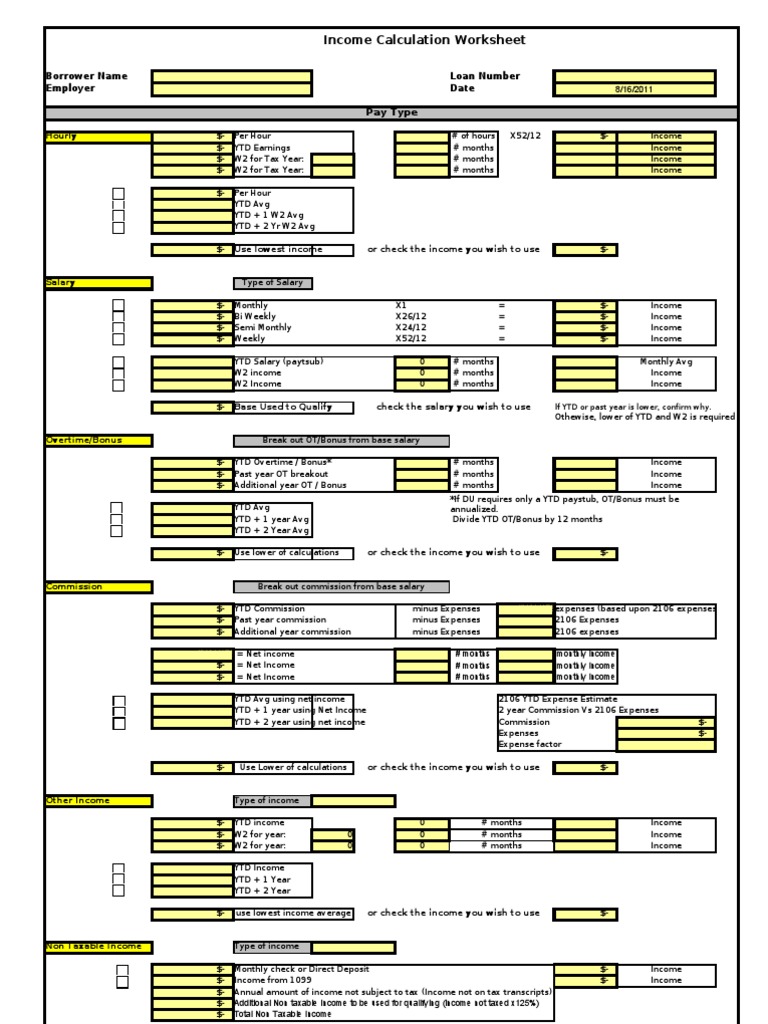

Income Calculator Worksheet

Income Calculator Worksheet - Enter the date (xx/xx/xxxx) and gross salary (hourly rate of pay x number of hours + tips + commission) from the client's earliest pay stub according to pay frequency. Simply enter the requested data and this calculator will work behind the scenes to generate a summary of results for each beneficiary. Income tax calculation (old tax slabs) 3.8 section 9: Download xlsx tax return analysis calculator (amitrac) the amitrac is an interactive spreadsheet that follows schedule analysis method (sam) of tax return evaluation. Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Calculation results do not constitute approval for affordable housing* income calculation (employees earning a fixed rate) total $ line 1 income calculation: Web financial times writers christopher miller and william langley reported today that, “russia attacked targets across ukraine with drones before sunrise on wednesday, hitting a critical river port facility and a grain silo in the southern odesa region and raising further concerns over global food supplies. You should also check your state's department of. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Qualifying for a va loan means you have to meet all the qualifications set forth in the underwriting guidelines, including a. Calculate gross total income from salary: Very useful when job hunting when offered an income per hour, month, or year. Your average tax rate is 11.67% and your marginal tax rate is 22%. Results are as accurate as the information you enter. Web keep your career on the right track. Calculate gross total income from salary: Calculating income tax with new tax slab under new regime; Results are as accurate as the information you enter. Web financial times writers christopher miller and william langley reported today that, “russia attacked targets across ukraine with drones before sunrise on wednesday, hitting a critical river port facility and a grain silo in the. Qualifying for a va loan means you have to meet all the qualifications set forth in the underwriting guidelines, including a. Web 3.7 section 7: Choose hourly or yearly format. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. Estimate your federal income tax withholding. Web total revenue = 100000 + 3000 = 103,000. Generally, dti is displayed as a range of 20% to 50% and. Simply enter the requested data and this calculator will work behind the scenes to generate a summary of results for each beneficiary. Ytd + 1 year using net income. Choose hourly or yearly format. “ukraine’s air defence forces ‘worked nonstop. You should also check your state's department of. Estimate your federal income tax withholding. Press the tab key when finished. Web our va residual income calculator can help you estimate your net income after subtracting monthly expenses. Employees with varying earnings (bonus, commission, varying hours) total. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). You should also check your state's department of. Monthly debt / gross monthly income = dti %. Web total revenue = 100000 + 3000 = 103,000. Choose hourly or yearly format. Results are as accurate as the information you enter. Web monthly check or direct deposit. Web our va residual income calculator can help you estimate your net income after subtracting monthly expenses. If you make $70,000 a year living in california you will be taxed $11,221. Calculation results do not constitute approval for affordable housing* income calculation (employees earning a fixed rate) total $ line 1 income calculation: Monthly debt / gross monthly income = dti %. Ytd avg using net income. Choose an estimated withholding amount that works for you. “ukraine’s air defence forces ‘worked nonstop. If you make $70,000 a year living in california you will be taxed $11,221. Choose an estimated withholding amount that works for you. The total expenses = employee wages + raw materials + office and factory maintenance + interest income + taxes. Income tax calculation (old tax slabs) 3.8 section 9: Web financial times writers christopher miller and william langley. Very useful when job hunting when offered an income per hour, month, or year. Calculating income tax with new tax slab under new regime; Web financial times writers christopher miller and william langley reported today that, “russia attacked targets across ukraine with drones before sunrise on wednesday, hitting a critical river port facility and a grain silo in the southern. One can use the gross profit to calculate net income; Web our va residual income calculator can help you estimate your net income after subtracting monthly expenses. Web income calculation worksheet *income calculation worksheet is intended for information purposes only. Income will be considered effective income if. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Qualifying for a va loan means you have to meet all the qualifications set forth in the underwriting guidelines, including a. Your average tax rate is 11.67% and your marginal tax rate is 22%. Gross profit is total revenue minus the. Income tax calculation (old tax slabs) 3.8 section 9: Monthly debt / gross monthly income = dti %. Web financial times writers christopher miller and william langley reported today that, “russia attacked targets across ukraine with drones before sunrise on wednesday, hitting a critical river port facility and a grain silo in the southern odesa region and raising further concerns over global food supplies. Calculation results do not constitute approval for affordable housing* income calculation (employees earning a fixed rate) total $ line 1 income calculation: Calculating income tax with new tax slab under new regime; Ytd salary (paytsub) past year ot breakout. The net income is a simple formula that measures excess revenue above total expense. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). There are seven federal income tax rates in 2022: Simply enter the requested data and this calculator will work behind the scenes to generate a summary of results for each beneficiary. Together with a sound business continuity plan , it serves as a critical planning tool to help your. Results are as accurate as the information you enter. 4 how to calculate income tax in india? Our income analysis tools and job aids are designed to help you evaluate qualifying income quickly and easily. The top marginal income tax rate of 37 percent will hit taxpayers with taxable. The net income is a simple formula that measures excess revenue above total expense. Web keep your career on the right track. Ytd salary (paytsub) past year ot breakout. You should also check your state's department of. One can use the gross profit to calculate net income; Web your dti is estimated by dividing your total monthly debt by your gross monthly income. Choose hourly or yearly format. Generally, dti is displayed as a range of 20% to 50% and. Web step 2 annual income = subtotal number from step 1 (gross base income) multiplied by 24 $ step 3 monthly income = subtotal number from step 2 (annual income) divided by 12 $ definition: Web completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Press the tab key when finished. Fill out the form, skipping n/a fields. There are seven federal income tax rates in 2022:Mgic Calculation Worksheet 2022

Tax Deduction Expense

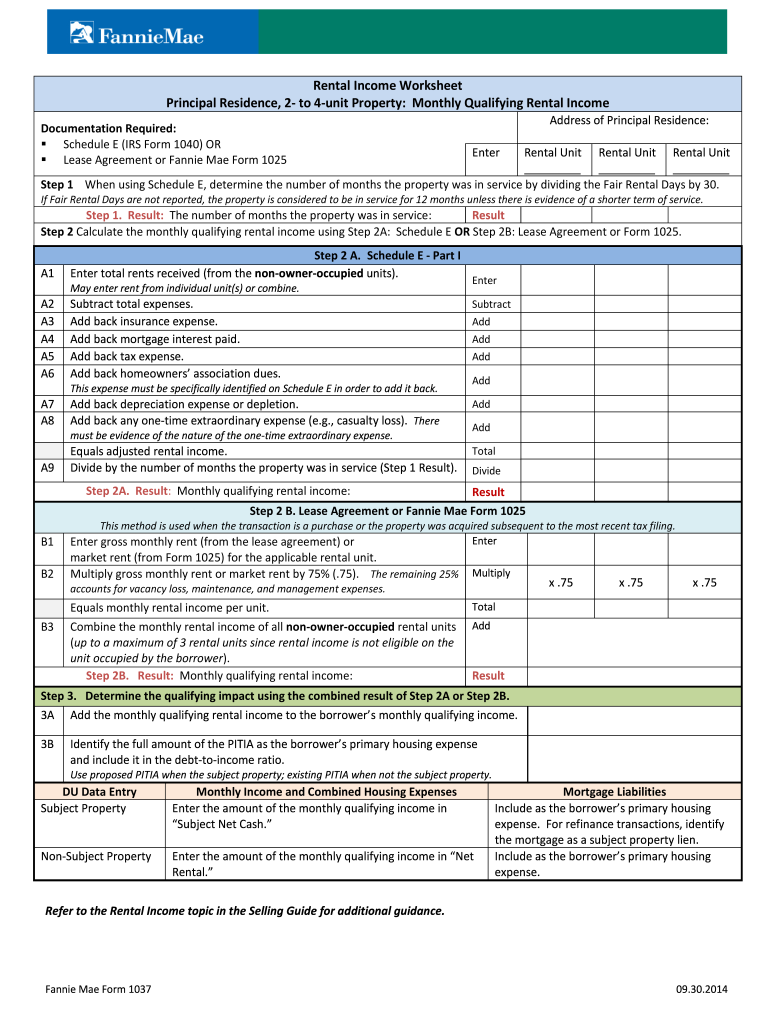

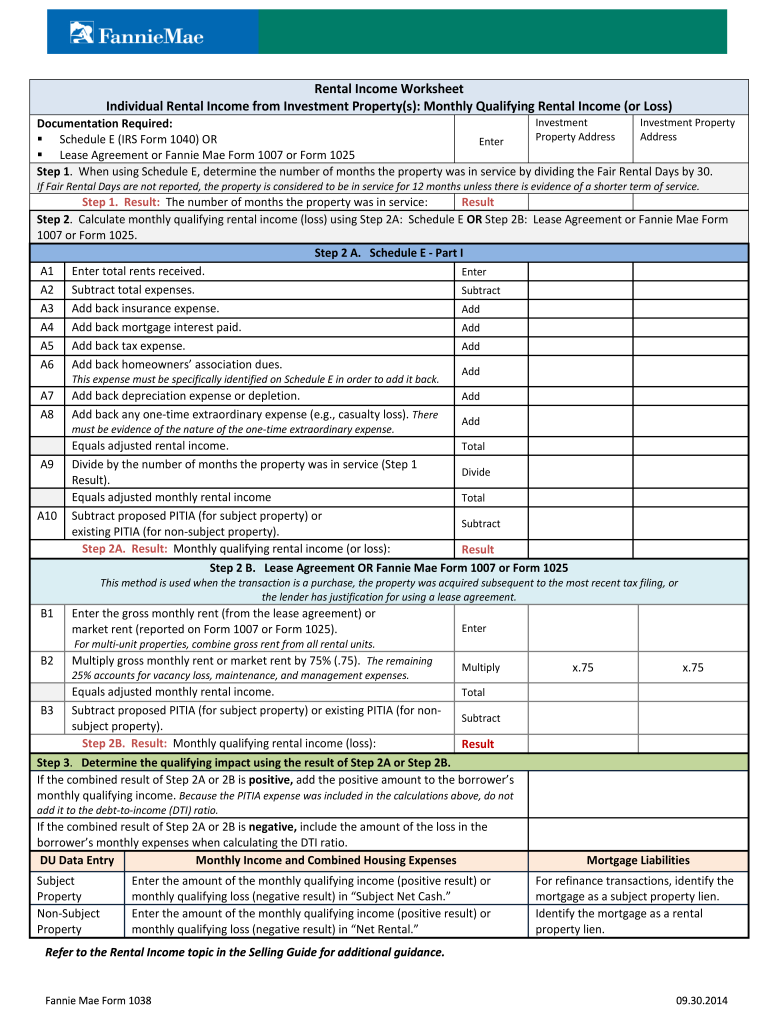

Rental Calculation Worksheet with Spreadsheet Download Rental

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]

Rental Calculation Worksheet Along with Investment Property

Rental Calculation Worksheet Fannie Mae Rental

Fannie Mae Rental Worksheet Fill Online, Printable, Fillable

Business Calculation Worksheet

Fannie Mae Calculation Worksheet Fill Online, Printable

20++ Schedule E Rental Worksheet

Use Our Pdf Worksheets To Total Numbers By Hand Or Let Our Excel Calculators Do The Work For You.

Web Calculators Income Analysis Qualifying Income Calculator (Amiquic) A Set Of Arch Mi Qualifying Income Calculator Tools.

Ytd Avg Using Net Income.

Choose An Estimated Withholding Amount That Works For You.

Related Post:

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/Screenshot-2018-07-05-17.53.15.jpg?strip=all&lossy=1&ssl=1)