Insolvency Worksheet 982

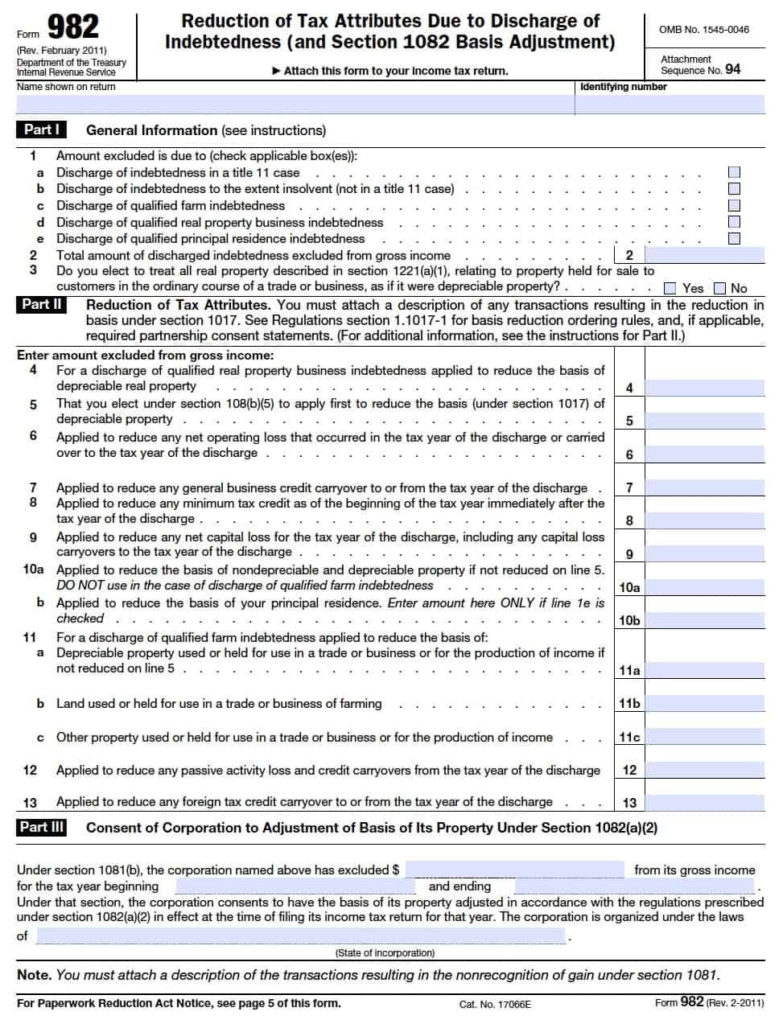

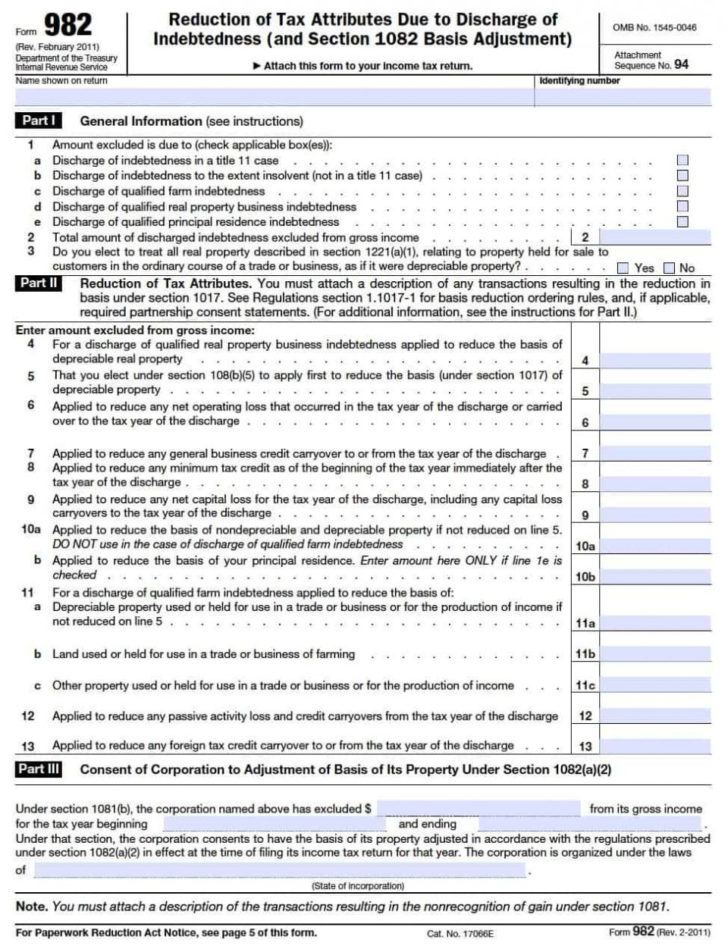

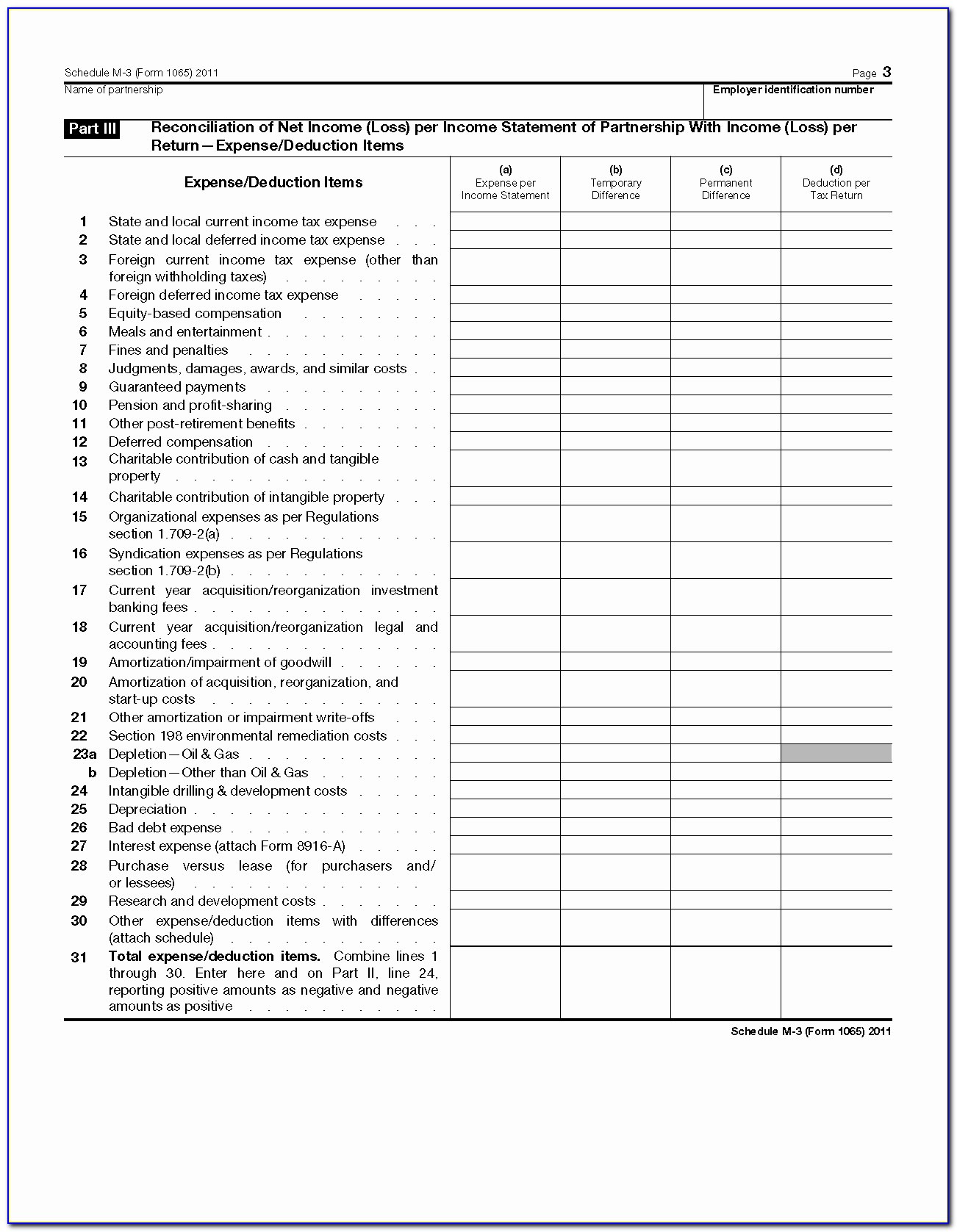

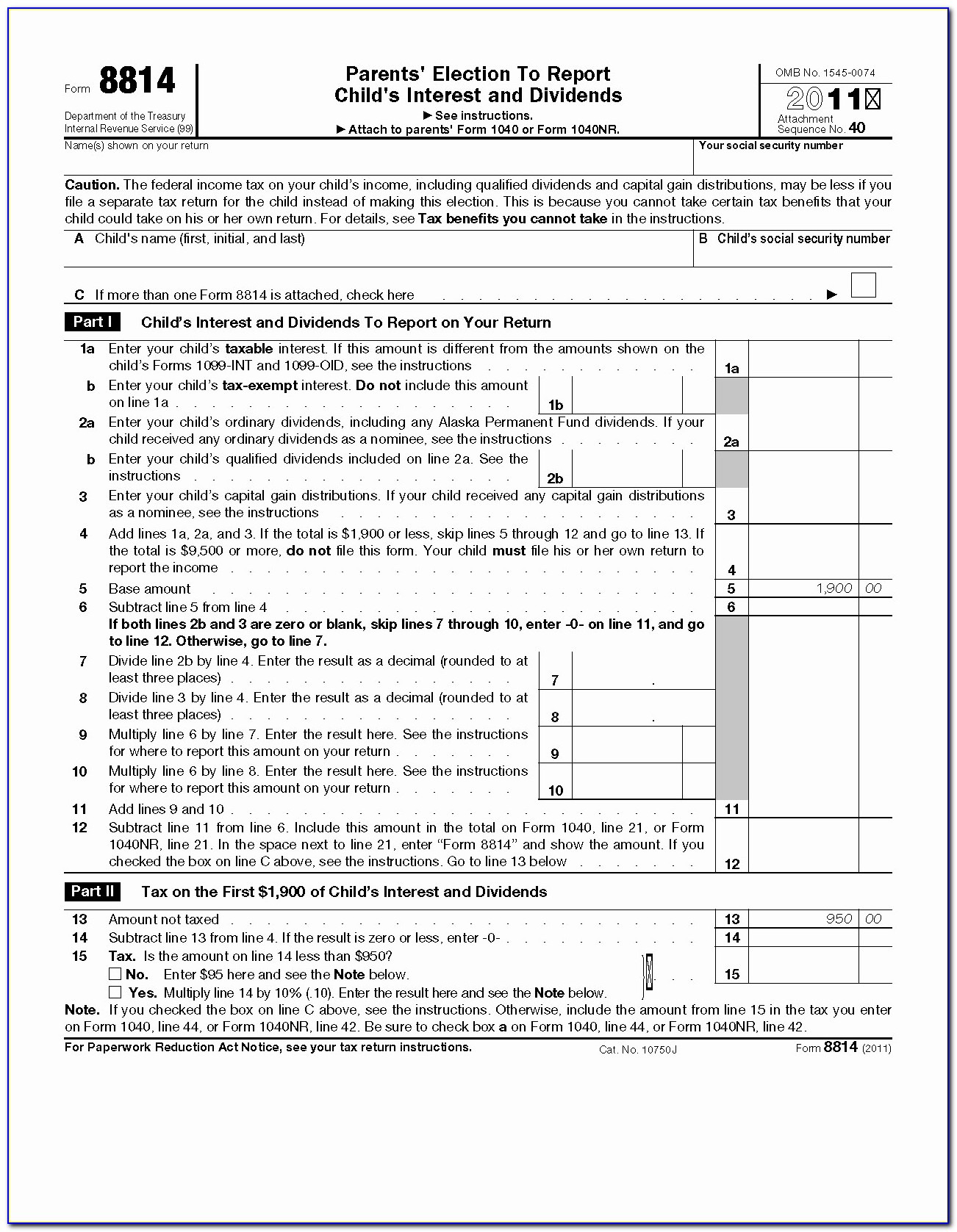

Insolvency Worksheet 982 - Reduce document preparation complexity by getting the most out of this. Attributes in part ii of form. Web video instructions and help with filling out and completing sample of completed form 982 for insolvency. Line 5 of form 982 contains an amount but no statement was created. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. If you had debt cancelled and are no longer obligated to repay the. Open the sch screen (from the link on screen 982. Scroll down to the alimony and other incomesection. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Insolvency determination worksheet assets (fmv) homes $ cars. Get access to thousands of forms. Insolvency determination worksheet assets (fmv) homes $ cars. Line 5 of form 982 contains an amount but no statement was created. If you had debt cancelled and are no longer obligated to repay the. Open (continue) your return, if it's not already open. Web details and a worksheet to help calculate insolvency, see pub. Form 982 is used to determine, under certain. If you had debt cancelled and are no longer obligated to repay the. You were released from your obligation to pay your credit card debt in the amount of $5,000. According to irs publication 4681: Scroll down to the alimony and other incomesection. If you had debt cancelled and are no longer obligated to repay the. Web enter net amount of loss after insolvency in total gain (loss) [override]. Open (continue) your return, if it's not already open. Web details and a worksheet to help calculate insolvency, see pub. Line 5 of form 982 contains an amount but no statement was created. Web insolvency is a condition in which the fmv of all assets is less than one’s liabilities. Get access to thousands of forms. Web up to $40 cash back to open your insolvency worksheet sample filled out form, upload it from your device or cloud storage, or. Open (continue) your return, if it's not already open. The amount or level of insolvency is expressed as a negative net worth. Get access to thousands of forms. Web details and a worksheet to help calculate insolvency, see pub. Click on the sign icon and make an e. Form 982 is used to determine, under certain. The amount or level of insolvency is expressed as a negative net worth. Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. Reduce document preparation complexity by getting the most out of this. Web in order to show that the insolvency exception applies and some or all of. Irs publication 4681 (link opens pdf) includes an insolvency. Web form 982 insolvency worksheet create this form in 5 minutes! Attributes in part ii of form. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Reduce document preparation complexity by getting the most out of this. Scroll down to the alimony and other incomesection. In the turbotax program, search for. Open the sch screen (from the link on screen 982. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the. Get access to thousands of forms. Form 982 is used to determine, under certain. Line 5 of form 982 contains an amount but no statement was created. Open (continue) your return, if it's not already open. Click on the sign icon and make an e. Web details and a worksheet to help calculate insolvency, see pub. Open the sch screen (from the link on screen 982. Web form 982 insolvency worksheet create this form in 5 minutes! According to irs publication 4681: Attributes in part ii of form. What is a discharge of indebtedness to the extent insolvent? Scroll down to the alimony and other incomesection. Web check form 982 1. In the turbotax program, search for. Open (continue) your return, if it's not already open. Attributes in part ii of form. Web to show that you are excluding canceled debt from income under the insolvency exclusion, attach form 982 to your federal income tax return and check the. Open the sch screen (from the link on screen 982. Indicate the date to the document using the date feature. Click on the sign icon and make an e. Reduce document preparation complexity by getting the most out of this. You were released from your obligation to pay your credit card debt in the amount of $5,000. Form 982 is used to determine, under certain. Web enter net amount of loss after insolvency in total gain (loss) [override]. Web details and a worksheet to help calculate insolvency, see pub. According to irs publication 4681: Web up to $40 cash back to open your insolvency worksheet sample filled out form, upload it from your device or cloud storage, or enter the document url. The amount or level of insolvency is expressed as a negative net worth. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Web insolvency determination worksheet determining insolvency is out of scope for the volunteer. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Go to screen 14.1, ss benefits, alimony, miscellaneous inc. Open (continue) your return, if it's not already open. You were released from your obligation to pay your credit card debt in the amount of $5,000. Insolvency determination worksheet assets (fmv) homes $ cars. Form 982 is used to determine, under certain. Web first, make a list of the total assets you owned immediately before the debt was canceled. Web check form 982 1. Line 5 of form 982 contains an amount but no statement was created. Attributes in part ii of form. Web in order to show that the insolvency exception applies and some or all of the canceled debt is not taxable due to insolvency, the debtor needs to complete form 982. Get access to thousands of forms. Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Web enter net amount of loss after insolvency in total gain (loss) [override]. Web details and a worksheet to help calculate insolvency, see pub. Web form 982 insolvency worksheet create this form in 5 minutes! Indicate the date to the document using the date feature.Tax Form 982 Insolvency Worksheet —

Form 982 Insolvency Worksheet

Irs Insolvency Worksheet Form Printable Worksheets and Activities for

Insolvency Worksheet Example Studying Worksheets

Tax form 982 Insolvency Worksheet Along with 1099 form Utah

Insolvency Worksheet Example Studying Worksheets

Form 982 Insolvency Worksheet —

Debt Form 982 Form 982 Insolvency Worksheet —

Form 982 Insolvency Worksheet Educational worksheets, Insolvency

Fresh Form 982 For 2016 Insolvency Worksheet Kidz —

Web Insolvency Determination Worksheet Determining Insolvency Is Out Of Scope For The Volunteer.

Web Video Instructions And Help With Filling Out And Completing Sample Of Completed Form 982 For Insolvency.

Reduce Document Preparation Complexity By Getting The Most Out Of This.

Irs Publication 4681 (Link Opens Pdf) Includes An Insolvency.

Related Post: