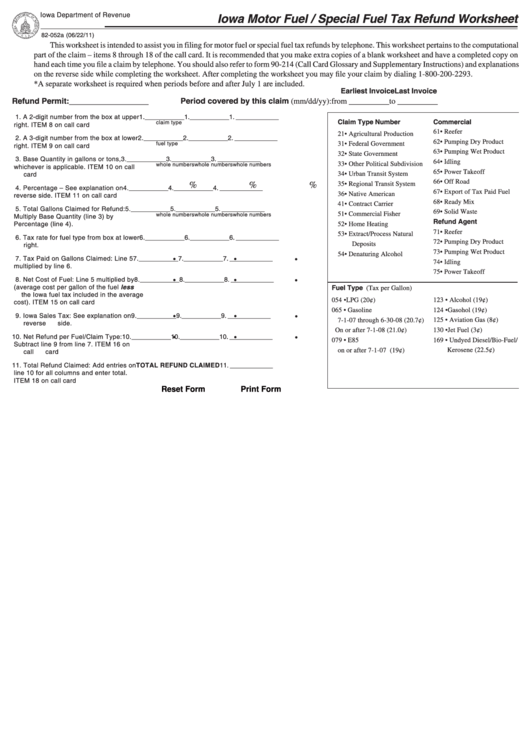

Iowa Fuel Tax Refund Worksheet

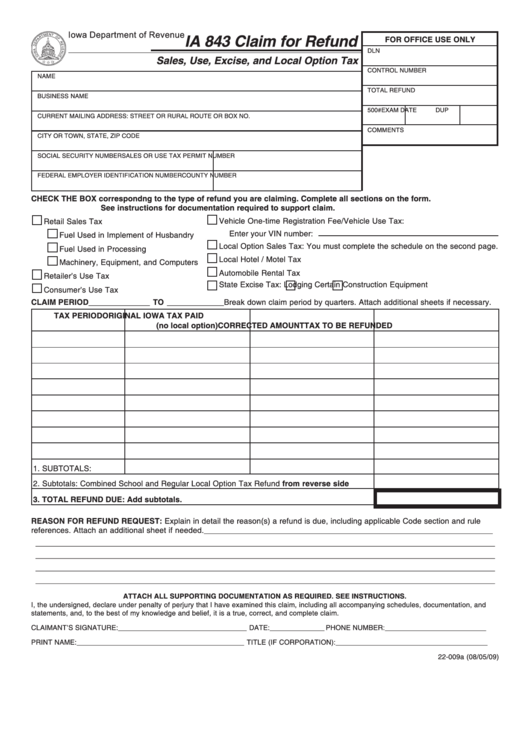

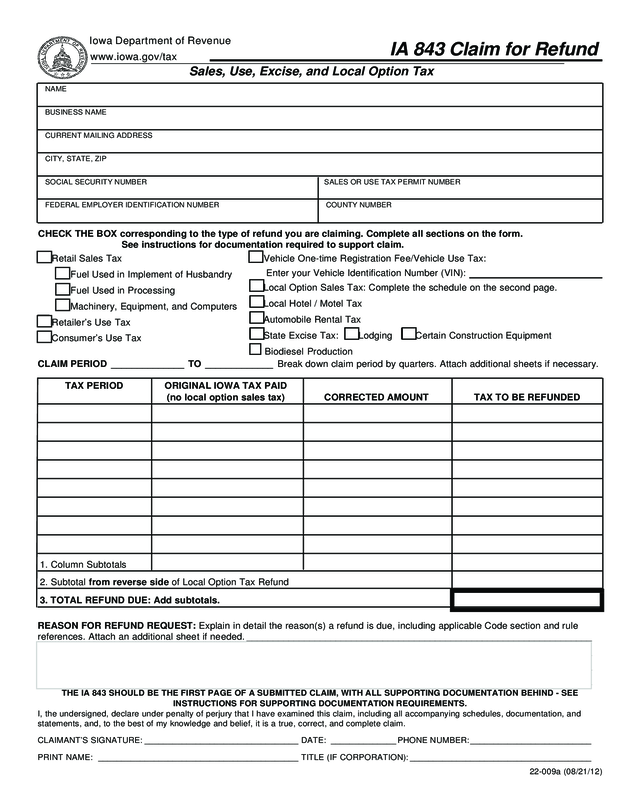

Iowa Fuel Tax Refund Worksheet - Income tax credits and sales/use tax refunds for. Web all other sales must include the iowa fuel tax. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit will become invalid if the tax credit is claimed. Web web income tax credits and sales/use tax refunds for use, sale, and production of fuel. The telephone refund system will be updated with the new tax rates. Web treasurer moneys and credit reportiowa rent reimbursement claimstatement of rent paidia 843 claim for refundschedule of consolidated business locationssales tax. Web towards west tax division > company > fuel tax > tax refund > engines fuel tax refund prior price forms. Web collecting and remitting the iowa fuel tax when the fuel is withdrawn from the terminal. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Fuel imported into iowa any fuel including denatured alcohol and b100 or b99.9 or imported. Alabama one income tax return : Motor fuel tax refund prior year forms. Web collecting and remitting the iowa fuel tax when the fuel is withdrawn from the terminal. The telephone refund system will be updated with the new tax rates. Income tax credits and sales/use tax refunds for. Web all other sales must include the iowa fuel tax. Web collecting and remitting the iowa fuel tax when the fuel is withdrawn from the terminal. Web web income tax credits and sales/use tax refunds for use, sale, and production of fuel. Web treasurer moneys and credit reportiowa rent reimbursement claimstatement of rent paidia 843 claim for refundschedule of consolidated. Web complete iowa fuel tax refund worksheet in just several moments by following the. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web all other sales must include the iowa fuel tax. Income tax credits and sales/use tax refunds for. Web towards west tax division > company > fuel. Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa fuel tax they paid as part of their purchase. Alabama one income tax return : Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Fuel imported into iowa any fuel including denatured. Motor fuel tax refund prior year forms. Web web income tax credits and sales/use tax refunds for use, sale, and production of fuel. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa. Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa fuel tax they paid as part of their purchase. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Fuel imported into iowa any fuel including denatured alcohol and b100 or b99.9 or. Web all other sales must include the iowa fuel tax. Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa fuel tax they paid as part of their purchase. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Track or file rent. Web complete iowa fuel tax refund worksheet in just several moments by following the. Web towards west tax division > company > fuel tax > tax refund > engines fuel tax refund prior price forms. Income tax credits and sales/use tax refunds for. Web claims for fuel tax refunds must be calculated using the correct rates based on the date. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. 81 transport diversions, 82 casualty loss, and 83. Track or file rent reimbursement; Fuel imported into iowa any fuel including denatured alcohol and b100 or b99.9 or imported. The telephone refund system will be updated with the new tax rates. Fuel imported into iowa any fuel including denatured alcohol and b100 or b99.9 or imported. Web complete iowa fuel tax refund worksheet in just several moments by following the. The telephone refund system will be updated with the new tax rates. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet.. Web treasurer moneys and credit reportiowa rent reimbursement claimstatement of rent paidia 843 claim for refundschedule of consolidated business locationssales tax. Fuel imported into iowa any fuel including denatured alcohol and b100 or b99.9 or imported. Web all other sales must include the iowa fuel tax. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Motor fuel tax refund prior year forms. Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july 1, 2016. Alabama one income tax return : The telephone refund system will be updated with the new tax rates. 81 transport diversions, 82 casualty loss, and 83. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit will become invalid if the tax credit is claimed. Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa fuel tax they paid as part of their purchase. Income tax credits and sales/use tax refunds for. Web towards west tax division > company > fuel tax > tax refund > engines fuel tax refund prior price forms. Web complete iowa fuel tax refund worksheet in just several moments by following the. Track or file rent reimbursement; Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web web income tax credits and sales/use tax refunds for use, sale, and production of fuel. Web collecting and remitting the iowa fuel tax when the fuel is withdrawn from the terminal. Web all rates and effective dates are available under the iowa fuel tax section of the iowa fuel tax rates and descriptions page. Web the iowa fuel tax rates for gasoline, alcohol, ethanol blended gasoline, and e85 changed on july 1, 2016.rates not changed july 1, 2016. Track or file rent reimbursement; Motor fuel tax refund prior year forms. Web if the taxpayer has filed a fuel tax refund claim during the tax year, the fuel tax credit cannot be claimed, and the refund permit will become invalid if the tax credit is claimed. Web treasurer moneys and credit reportiowa rent reimbursement claimstatement of rent paidia 843 claim for refundschedule of consolidated business locationssales tax. Web web income tax credits and sales/use tax refunds for use, sale, and production of fuel. Alabama one income tax return : Refunds if the final consumer of the fuel is eligible, they can claim a refund of the iowa fuel tax they paid as part of their purchase. Web towards west tax division > company > fuel tax > tax refund > engines fuel tax refund prior price forms. Web to the tax rate table per fuel type at the bottom of the iowa fuel tax refund worksheet. Web claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Web all other sales must include the iowa fuel tax. Web complete iowa fuel tax refund worksheet in just several moments by following the. 81 transport diversions, 82 casualty loss, and 83. Web collecting and remitting the iowa fuel tax when the fuel is withdrawn from the terminal.Form Ia 843 Claim For Refund printable pdf download

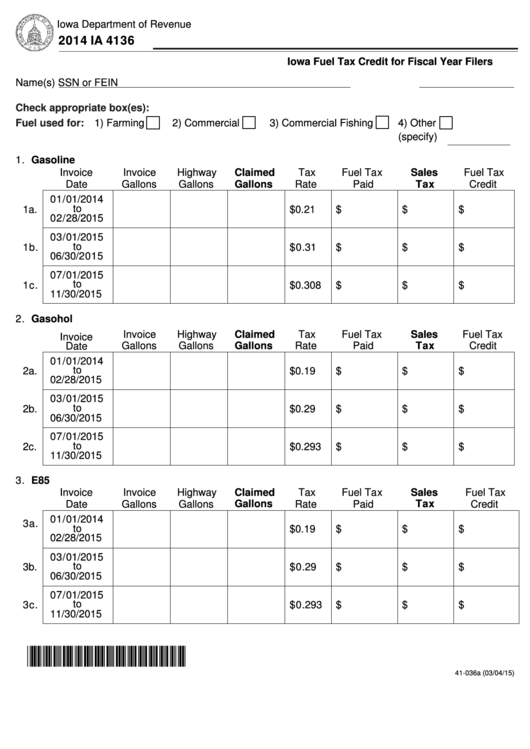

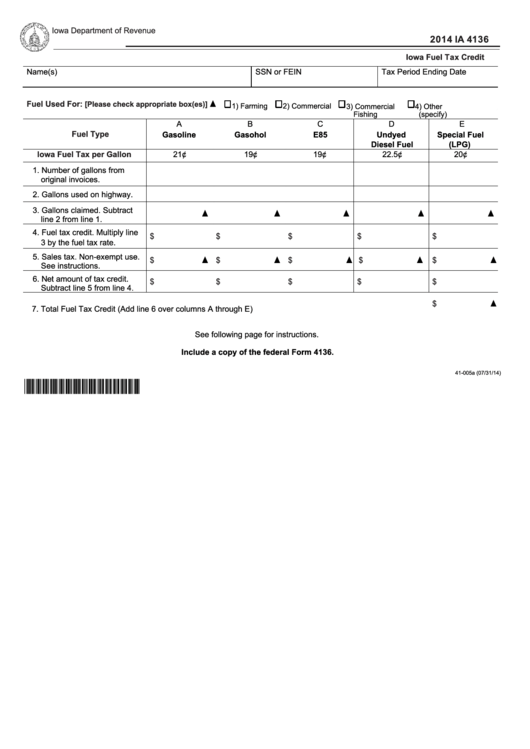

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

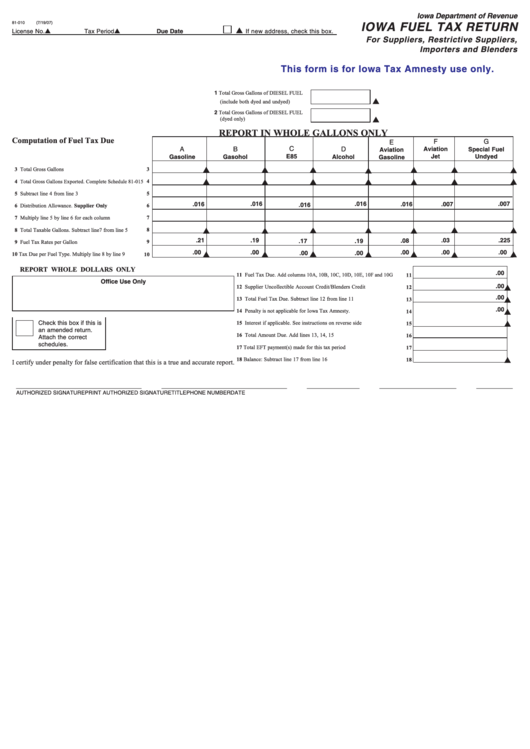

Form 81010 Iowa Fuel Tax Return Iowa Department Of Revenue

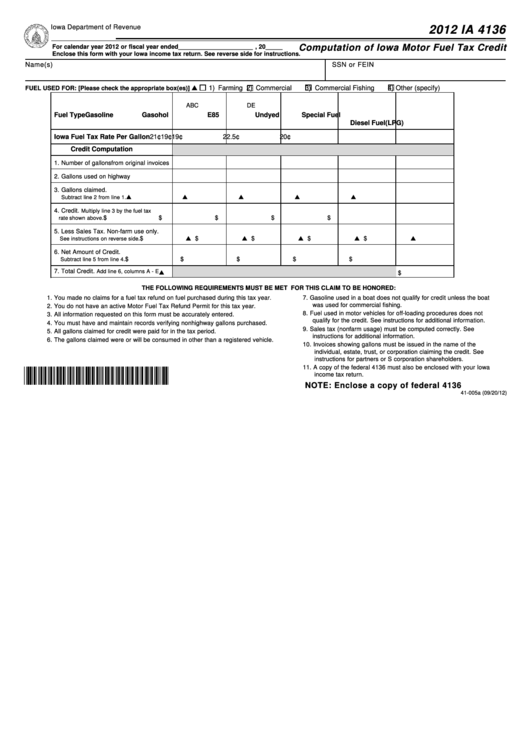

Fillable Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit

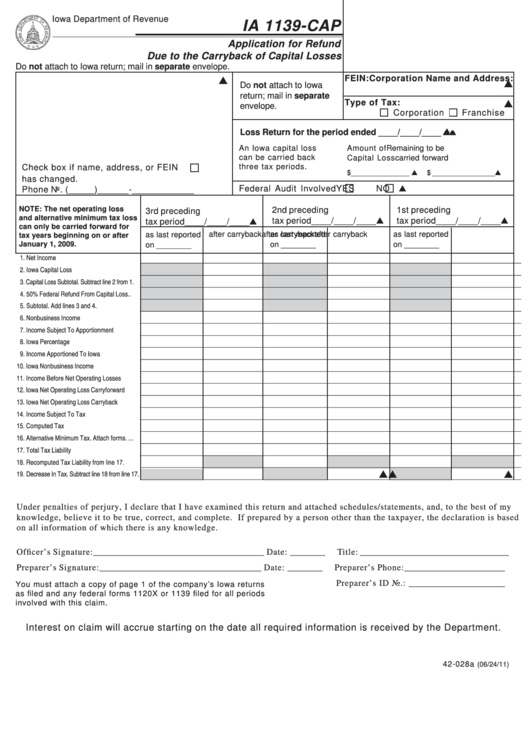

Fillable Form Ia 1139Cap Iowa Application For Refund Due To The

Fuel Tax Credits Calculation Worksheet

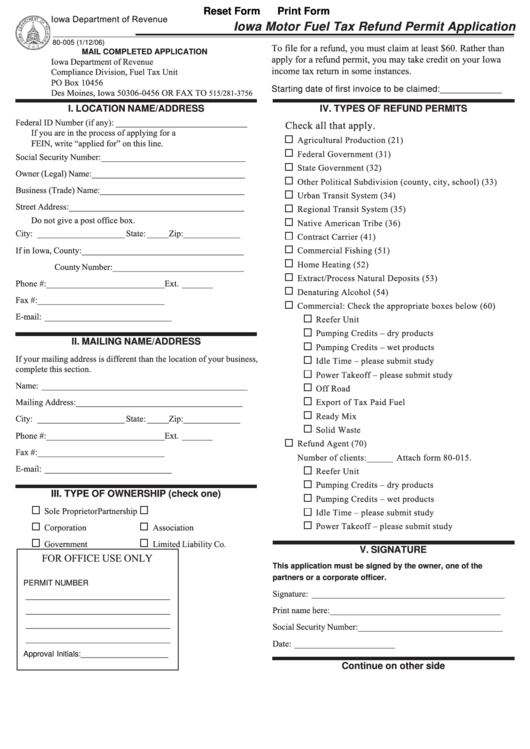

Fillable Form 80005 Iowa Motor Fuel Tax Refund Permit Application

Fillable Iowa Motor Fuel / Special Fuel Tax Refund Worksheet printable

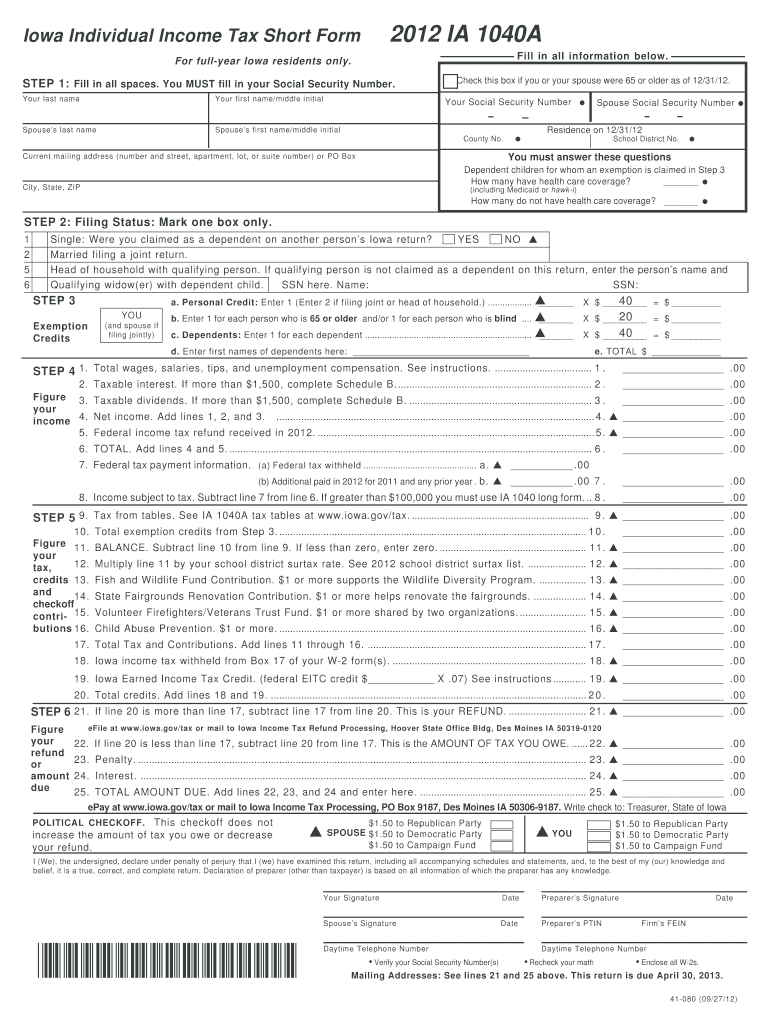

20122022 Form IA DoR 1040A Fill Online, Printable, Fillable, Blank

Iowa Refund Request Form Ia 843 Edit, Fill, Sign Online Handypdf

The Telephone Refund System Will Be Updated With The New Tax Rates.

Income Tax Credits And Sales/Use Tax Refunds For.

Web All Rates And Effective Dates Are Available Under The Iowa Fuel Tax Section Of The Iowa Fuel Tax Rates And Descriptions Page.

Fuel Imported Into Iowa Any Fuel Including Denatured Alcohol And B100 Or B99.9 Or Imported.

Related Post: