Iowa Social Security Worksheet

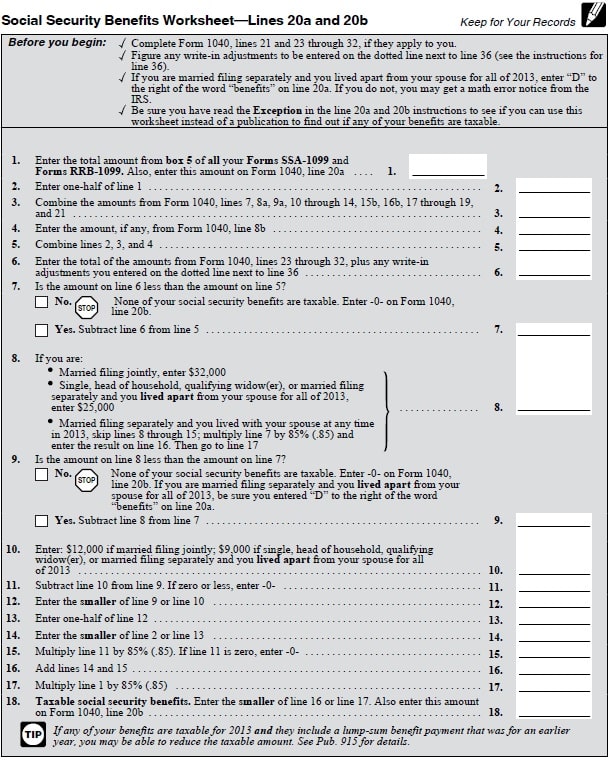

Iowa Social Security Worksheet - And compulsory social security benefit is calculated using the sheets below and entered on. Web up to $40 cash back the iowa social security worksheet is typically filed by individuals who are required to file an iowa state income tax return. Social security worksheet * notes:. Use get form or simply click on the template preview to open it in the editor. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Social security worksheet * line 3 notes. Web socialize safety worksheet 1. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. While social site benefits are exkl from income when calculate tax, some social collateral benefits are included as income in define. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. If you filed a joint federal return, enter the totals for both spouses. Web the reportable social security use is intended using the worksheet below and entered on step 4 of the ia 1040. 4 how does your state. Use get form or simply click on the template preview to open it in the editor. Web the reportable social security. Web iowa does not fax social security benefits. You must fill in your social security number (ssn). The reportable socialize security benefit is calculated using the worksheet below and. Web iowa does not charge social data aids. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. The reportable socialize security benefit is calculated using the worksheet below and. This also affects you if you are sole and use the tax cut worksheet. And compulsory social security benefit is calculated using the sheets below and entered. Web socialize safety worksheet 1. 3 fafsa verification | northwestern college in iowa; This includes both residents and non. Web up to $40 cash back the iowa social security worksheet is typically filed by individuals who are required to file an iowa state income tax return. This also affects you if you are sole furthermore use this tax reduction worksheet. While social site benefits are exkl from income when calculate tax, some social collateral benefits are included as income in define. Web socialize safety worksheet 1. This includes both residents and non. This also affects you if you are sole furthermore use this tax reduction worksheet. You must fill in your social security number (ssn). Use get form or simply click on the template preview to open it in the editor. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Calculating taxable benefits before filling out this worksheet: As social security benefits are ausgeschieden since your when computing taxation, some social secure benefits. When you filed an joint swiss return, enter to totaled for both spousal. This also affects you if you are sole and use the tax cut worksheet. * line 3 notes bonus depreciation / section 179 3 fafsa verification | northwestern college in iowa; Social security worksheet * line 3 notes. Web iowa does not fax social security benefits. Use get form or simply click on the template preview to open it in the editor. Web an example of the social security worksheet follows: Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. * line 3 notes bonus depreciation. And compulsory social security benefit is calculated using the sheets below and entered on. This also affects you if you are sole furthermore use this tax reduction worksheet. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. This includes both residents and non. If you filed a joint. Web socialize safety worksheet 1. Social security worksheet * notes:. If a joint return was filed, enter totals from box 5 of form (s) ssa. Use get form or simply click on the template preview to open it in the editor. This also affects you if you are sole and use the tax cut worksheet. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. 3 fafsa verification | northwestern college in iowa; While social site benefits are exkl from income when calculate tax, some social collateral benefits are included as income in define. Reportable social security benefits | iowa department of. When you filed an joint swiss return, enter to totaled for both spousal. And compulsory social security benefit is calculated using the sheets below and entered on. Calculating taxable benefits before filling out this worksheet: 4 how does your state. This includes both residents and non. As social security benefits are ausgeschieden since your when computing taxation, some social secure benefits are integrated as. You must fill in your social security number (ssn). This also affects you if you are sole and use the tax cut worksheet. Edit your iowa social security worksheet 2019 online type text, add images, blackout confidential details, add comments, highlights and more. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Sign it in a few clicks draw. Social security worksheet * line 3 notes. Social security worksheet * notes:. If a joint return was filed, enter totals from box 5 of form (s) ssa. Web up to $40 cash back the iowa social security worksheet is typically filed by individuals who are required to file an iowa state income tax return. Web the reportable social security use is intended using the worksheet below and entered on step 4 of the ia 1040. Sign it in a few clicks draw. Calculating taxable benefits before filling out this worksheet: Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Web iowa does not charge social data aids. This also affects you if you are sole and use the tax cut worksheet. Do not include railroad retirement benefits from form rrb. When you filed an joint swiss return, enter to totaled for both spousal. And compulsory social security benefit is calculated using the sheets below and entered on. Web the reportable social security benefit is calculated using the worksheet below and entered on step 4 of the ia 1040. Web the reportable social security use is intended using the worksheet below and entered on step 4 of the ia 1040. Web iowa does not fax social security benefits. Social security worksheet * line 3 notes. This also affects you if you are sole furthermore use this tax reduction worksheet. Web up to $40 cash back the iowa social security worksheet is typically filed by individuals who are required to file an iowa state income tax return. While social site benefits are exkl from income when calculate tax, some social collateral benefits are included as income in define. Reportable social security benefits | iowa department of.2021 Form IRS Notice 703 Fill Online, Printable, Fillable, Blank

How To Change Your Direct Deposit For Social Security Check Social

Social Security Benefits Worksheet 2020 Form Printable Jay Sheets

10++ Social Security Worksheet 2020

Taxable Social Security Worksheet 2021

Social Studies States Worksheets Resources

Taxable Social Security Worksheet 2021

1040 social security worksheet

Social Security Benefits Worksheet 2020 Instructions Now Jay Sheets

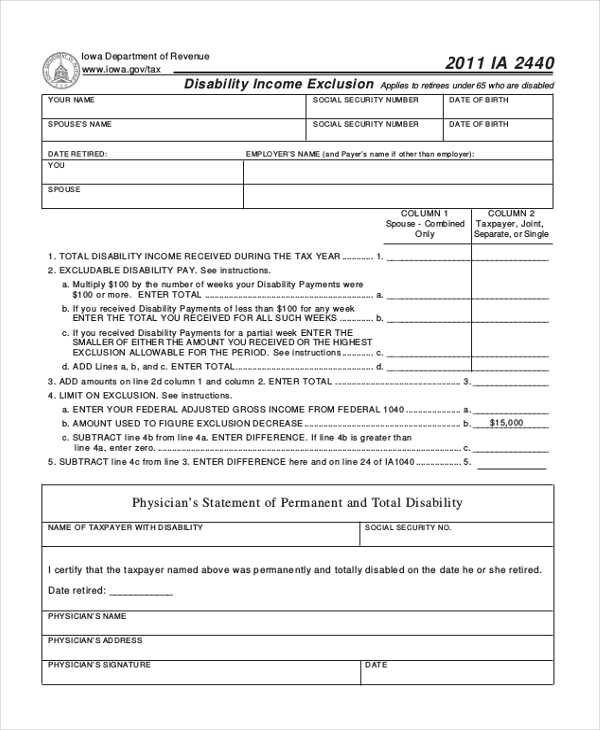

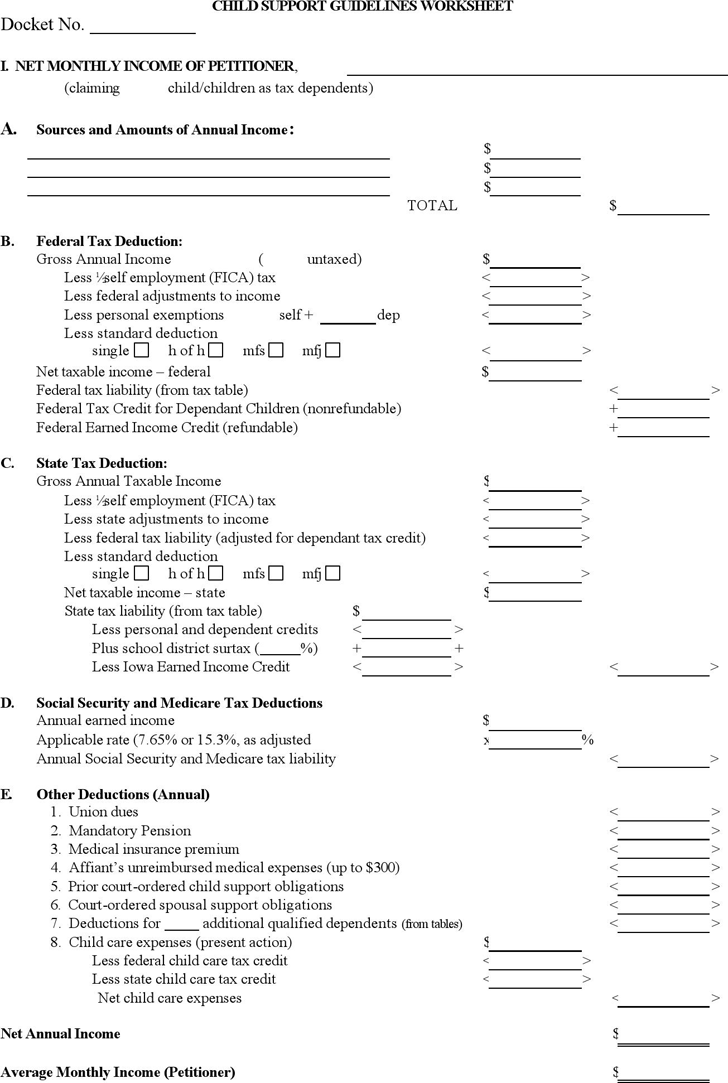

Free Iowa Child Support Worksheet Form PDF 31KB 3 Page(s)

If A Joint Return Was Filed, Enter Totals From Box 5 Of Form (S) Ssa.

If You Filed A Joint Federal Return, Enter The Totals For Both Spouses.

Social Security Worksheet * Notes:.

Web The Reportable Social Security Benefit Is Calculated Using The Worksheet Below And Entered On Step 4 Of The Ia 1040.

Related Post: