Itemized Deduction Small Business Tax Deductions Worksheet

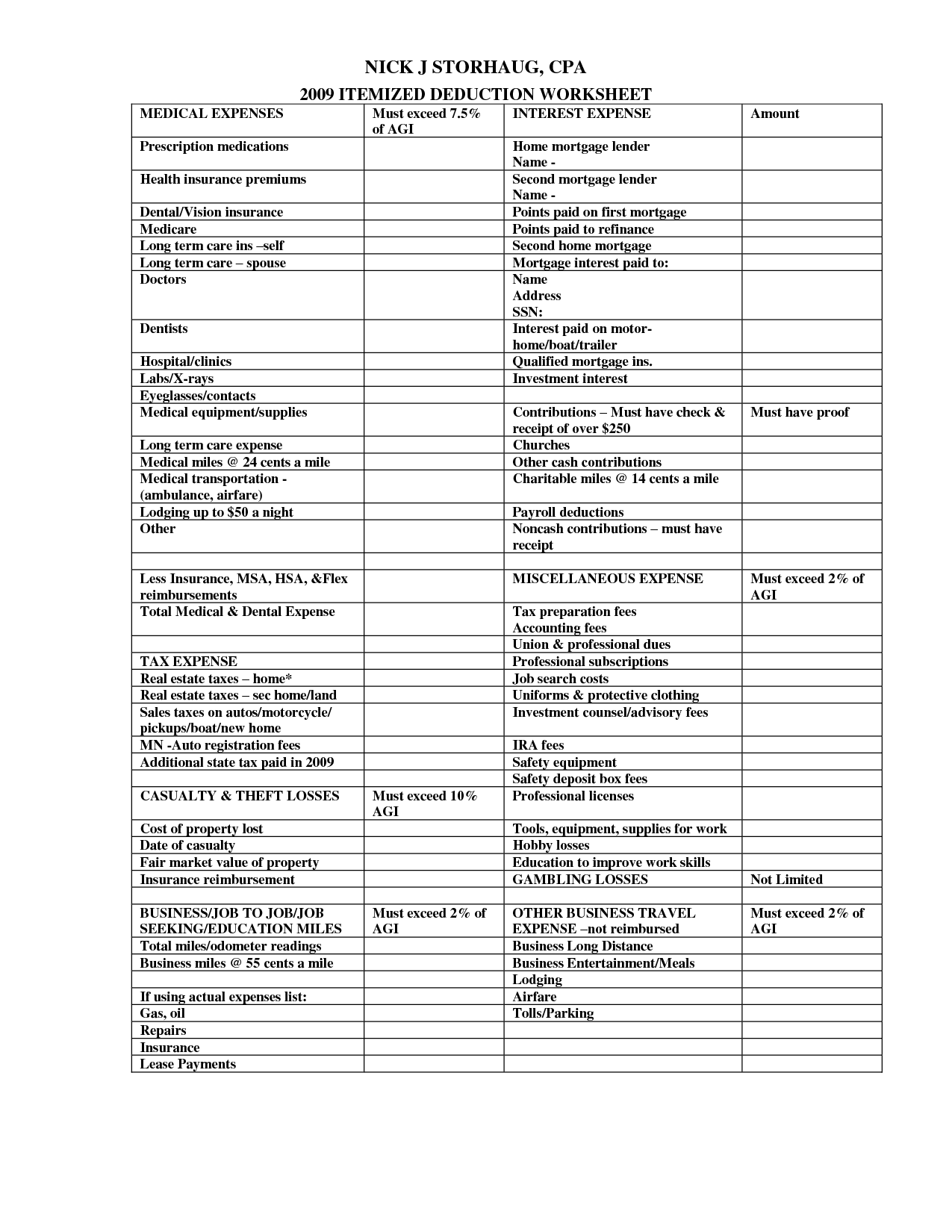

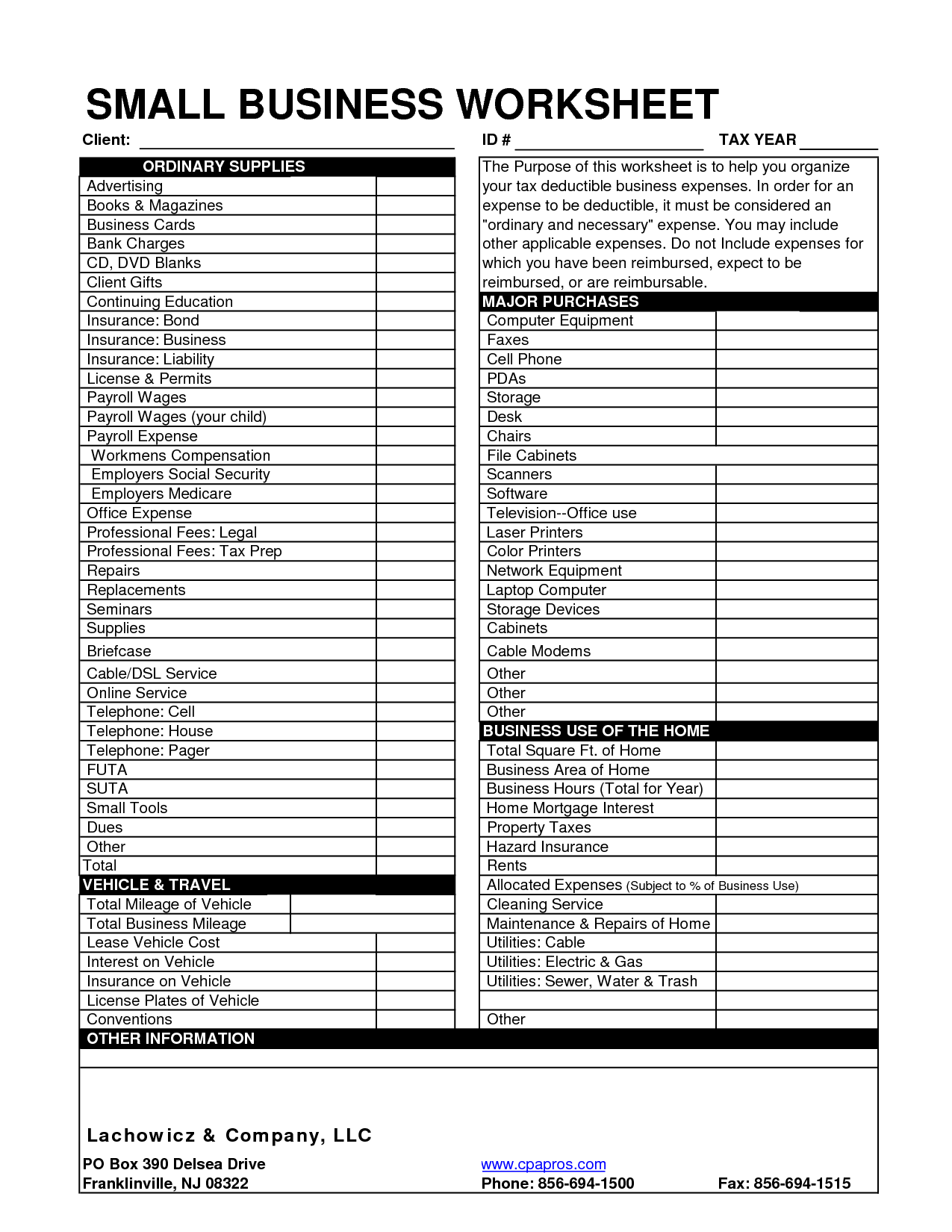

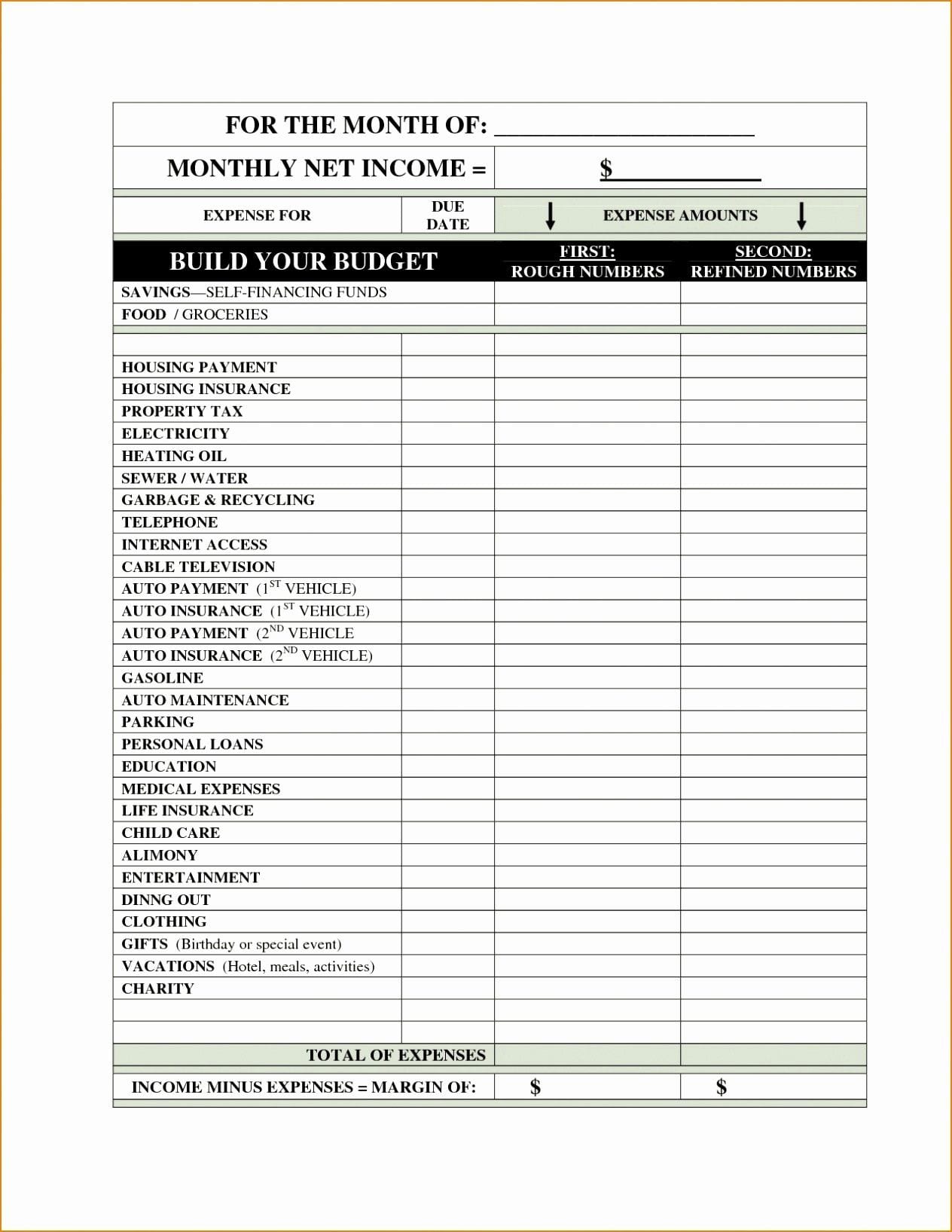

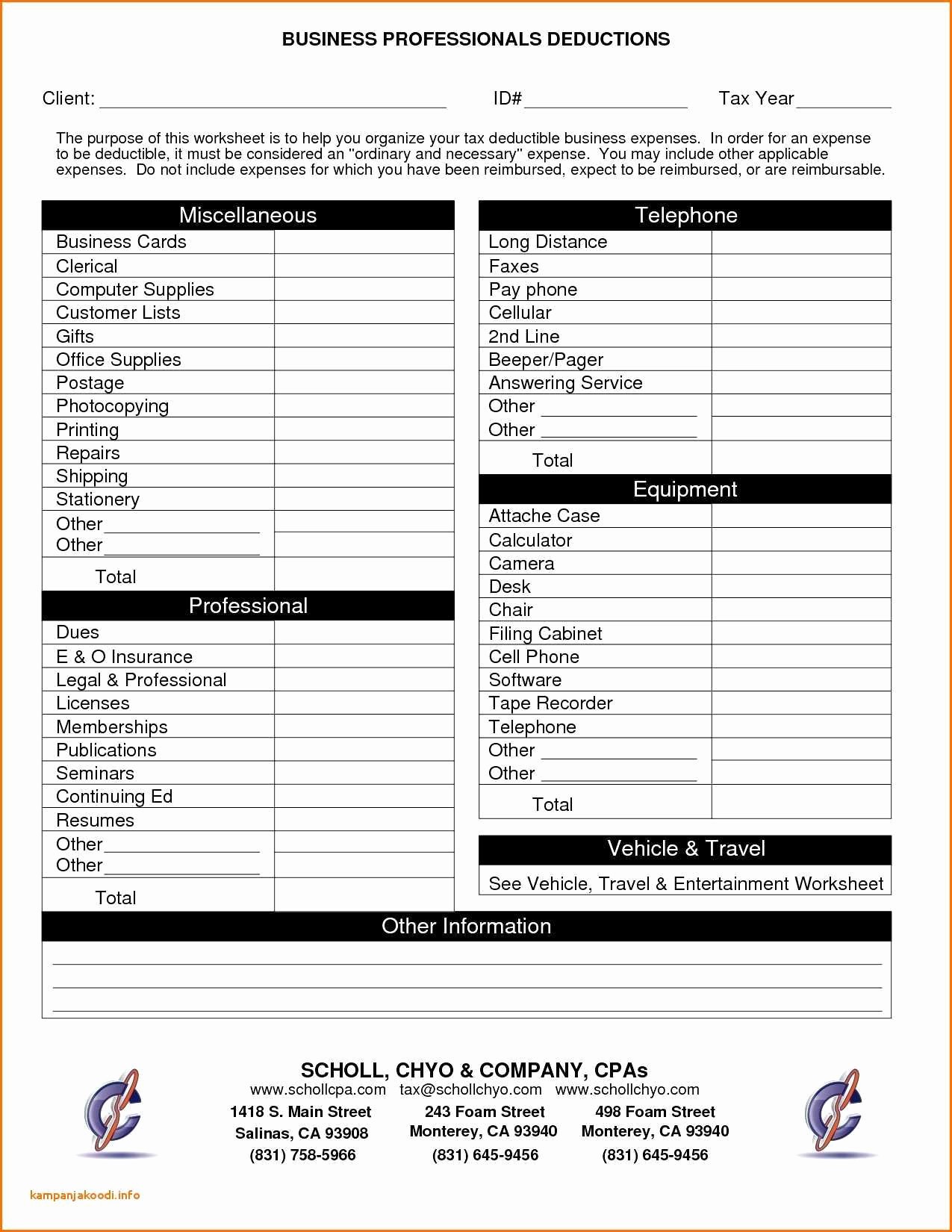

Itemized Deduction Small Business Tax Deductions Worksheet - Web for 2022, this deduction maxes out at $2,500 for every student. This schedule is used by filers to. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Web reimbursements for business expenses. Web get our free printable small business tax deduction worksheet. Mortgage interest you pay on. Web what is the schedule a? Ad get a free guided quickbooks® setup. It ultimately reduces the amount of. Maximum $250 each ($500 joint). Client(s) who actually operate business. Tax deductions for calendar year 2 0 ___ ___ hired help space $_____ accountant Use this form to figure your qualified business income deduction. This schedule is used by filers to. In most cases, your federal income tax will be less if you. Web get our free printable small business tax deduction worksheet. Schedule a is an irs form used to claim itemized deductions on your tax return. If you make $70,000 a year living in california you will be taxed $11,221. Mortgage interest you pay on. Web tax year 2022 small business checklist. This worksheet allows you to itemize your tax deductions for a given year. Manage all your business expenses in one place with quickbooks®. At casey moss tax, we have a free spreadsheet template that you can use to organize all. Manage all your business expenses in one place with quickbooks®. Explore updated credits, deductions, and exemptions, including the standard. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add $1,750 or $1,400 if married): Web itemized deductions are specific types of expenses the taxpayer incurred that may reduce taxable income. Web as you can only choose to take the standard deduction or itemize your deductions (not both) you should. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Web 1 day agotaxable income. Ad get a free guided quickbooks® setup. Maximum $250 each ($500 joint). Remember, you'll need proof of your. Mortgage interest you pay on. You can generally deduct the amount you pay or reimburse employees for business expenses incurred for your business. Ad work with federal tax credits and incentives specialists who have decades of experience. In most cases, your federal income tax will be less if you. Use separate schedules a, b, c, and/or d, as. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Section 179 deduction is for equipment purchases up to. Best overall payroll software for small businesses by business.com. Web the depreciation deduction is an allowance for the cost of buying real estate property or equipment for your business. Next, you’re going to add the amount on. Best overall payroll software for small businesses by business.com. Expenses to enable individuals, who are physically or mentally impaired, to work are generally deductible. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind,. Types of itemized deductions include mortgage. Web get our free printable small business tax deduction worksheet. Web 2022 instructions for schedule aitemized deductions use schedule a (form 1040) to figure your itemized deductions. Web reimbursements for business expenses. Ad get a free guided quickbooks® setup. Web itemized deductions for businesses are the expenses incurred for the purpose of conducting business that you can claim; Mortgage interest you pay on. Ad work with federal tax credits and incentives specialists who have decades of experience. You should then add the standard or itemized deduction amount to the planned adjustments amount with the final calculation being placed on. Web expenses are deductible only if related to producing or collecting taxable income. Web 1 day agotaxable income. In most cases, your federal income tax will be less if you. Section 179 deduction is for equipment purchases up to. Web for 2022, this deduction maxes out at $2,500 for every student. Web as you can only choose to take the standard deduction or itemize your deductions (not both) you should only choose the itemized deduction route if you think. Use this form to figure your qualified business income deduction. With the right expertise, federal tax credits and incentives could benefit your business. Automatically track all your income and expenses. Your average tax rate is 11.67% and your marginal tax rate is. If you make $70,000 a year living in california you will be taxed $11,221. You should then add the standard or itemized deduction amount to the planned adjustments amount with the final calculation being placed on line five of the. At casey moss tax, we have a free spreadsheet template that you can use to organize all. Web the depreciation deduction is an allowance for the cost of buying real estate property or equipment for your business. Automatically track all your income and expenses. Expenses to enable individuals, who are physically or mentally impaired, to work are generally deductible. Web itemized deductions include a range of expenses that are only deductible when you choose to itemize. Web reimbursements for business expenses. Worksheet to figure the deduction for business use of your home Web what is the schedule a? Federal section>deductions>itemized deductions>medical and dental expenses schedule a deductible and nondeductible medical expenses you. Types of itemized deductions include mortgage. At casey moss tax, we have a free spreadsheet template that you can use to organize all. Web tax worksheets & logs here are a variety of logs and worksheets to help in accurately reporting your income and deductions. With the right expertise, federal tax credits and incentives could benefit your business. Web get our free printable small business tax deduction worksheet. You should then add the standard or itemized deduction amount to the planned adjustments amount with the final calculation being placed on line five of the. Web 1 day agotaxable income. Schedule a is an irs form used to claim itemized deductions on your tax return. If you make $70,000 a year living in california you will be taxed $11,221. Ad get a free guided quickbooks® setup. Maximum $250 each ($500 joint). Your average tax rate is 11.67% and your marginal tax rate is. Mortgage interest you pay on. You fill out and file a schedule a at tax time and attach it. Tax deductions for calendar year 2 0 ___ ___ hired help space $_____ accountant10 Business Tax Deductions Worksheet /

Self Employment Printable Small Business Tax Deductions Worksheet

8 Best Images of Tax Preparation Organizer Worksheet Individual

Small Business Expenses Spreadsheet With Small Business Tax Deductions

Landscaping Business Tax Deductions Lanscaping 101

5 Best Images of Itemized Tax Deduction Worksheet 1040 Forms Itemized

Hair Stylist Tax Deduction Worksheet Pdf Fill Online, Printable

Clothing Donation Tax Deduction Worksheet —

Small Business Deductions Worksheet petermcfarland.us

Hairstylist Tax Write Offs Checklist for 2023

Web Tax Year 2022 Small Business Checklist.

Manage All Your Business Expenses In One Place With Quickbooks®.

Web Itemized Deductions For Businesses Are The Expenses Incurred For The Purpose Of Conducting Business That You Can Claim;

It Ultimately Reduces The Amount Of.

Related Post: