K1 Reconciliation Worksheet

K1 Reconciliation Worksheet - Select the links below for solutions to. Web (use separate worksheet for rental income analysis) 1. Web instead, see the instructions for form 4797 for details on how to report it. It is the partner's responsibility to. Section 751 gain/loss reported will. Click the advanced properties button. Line 4, (applicable columns) 2. Department of the treasury internal revenue service see back of form and instructions. If these difference are the result of input error (not. Scroll down three quarters of the page,. It is the partner's responsibility to. Line 4, (applicable columns) 2. Click the advanced properties button. State amounts, federal amounts, and the total difference. If these difference are the result of input error (not. Click the advanced properties button. • lacerte • 1 • updated september 23, 2022. Select the links below for solutions to. This one is no different. Web (use separate worksheet for rental income analysis) 1. Department of the treasury internal revenue service see back of form and instructions. If these difference are the result of input error (not. Web (use separate worksheet for rental income analysis) 1. Section 751 gain/loss reported will. This one is no different. Click the advanced properties button. Scroll down three quarters of the page,. Section 751 gain/loss reported will. Some of the worksheets for this concept are first reconciliation and first communion. Go to the general > return options worksheet. Department of the treasury internal revenue service see back of form and instructions. Web (use separate worksheet for rental income analysis) 1. In the 1040 client, choose file > client properties. Section 751 gain/loss reported will. Web instead, see the instructions for form 4797 for details on how to report it. Web instead, see the instructions for form 4797 for details on how to report it. State amounts, federal amounts, and the total difference. Line 4, (applicable columns) 2. Web (use separate worksheet for rental income analysis) 1. Department of the treasury internal revenue service see back of form and instructions. Web instead, see the instructions for form 4797 for details on how to report it. If these difference are the result of input error (not. Scroll down three quarters of the page,. Section 751 gain/loss reported will. Select the links below for solutions to. State amounts, federal amounts, and the total difference. Scroll down three quarters of the page,. Go to the general > return options worksheet. Web instead, see the instructions for form 4797 for details on how to report it. Some of the worksheets for this concept are first reconciliation and first communion. Section 751 gain/loss reported will. Select the links below for solutions to. • lacerte • 1 • updated september 23, 2022. Some of the worksheets for this concept are first reconciliation and first communion. Web instead, see the instructions for form 4797 for details on how to report it. Web instead, see the instructions for form 4797 for details on how to report it. Select the links below for solutions to. Section 751 gain/loss reported will. Department of the treasury internal revenue service see back of form and instructions. Web (use separate worksheet for rental income analysis) 1. Select the links below for solutions to. Click the advanced properties button. Web (use separate worksheet for rental income analysis) 1. • lacerte • 1 • updated september 23, 2022. Scroll down three quarters of the page,. Some of the worksheets for this concept are first reconciliation and first communion. This one is no different. It is the partner's responsibility to. If these difference are the result of input error (not. Section 751 gain/loss reported will. Department of the treasury internal revenue service see back of form and instructions. Go to the general > return options worksheet. Web instead, see the instructions for form 4797 for details on how to report it. Web line 1 reconciliation worksheet. State amounts, federal amounts, and the total difference. Line 4, (applicable columns) 2. In the 1040 client, choose file > client properties. Select the links below for solutions to. Go to the general > return options worksheet. Some of the worksheets for this concept are first reconciliation and first communion. Department of the treasury internal revenue service see back of form and instructions. Section 751 gain/loss reported will. Line 4, (applicable columns) 2. Scroll down three quarters of the page,. Click the advanced properties button. If these difference are the result of input error (not. Web (use separate worksheet for rental income analysis) 1. Web instead, see the instructions for form 4797 for details on how to report it. In the 1040 client, choose file > client properties. • lacerte • 1 • updated september 23, 2022.Bank Reconciliation Exercises and Answers Free Downloads in 2020

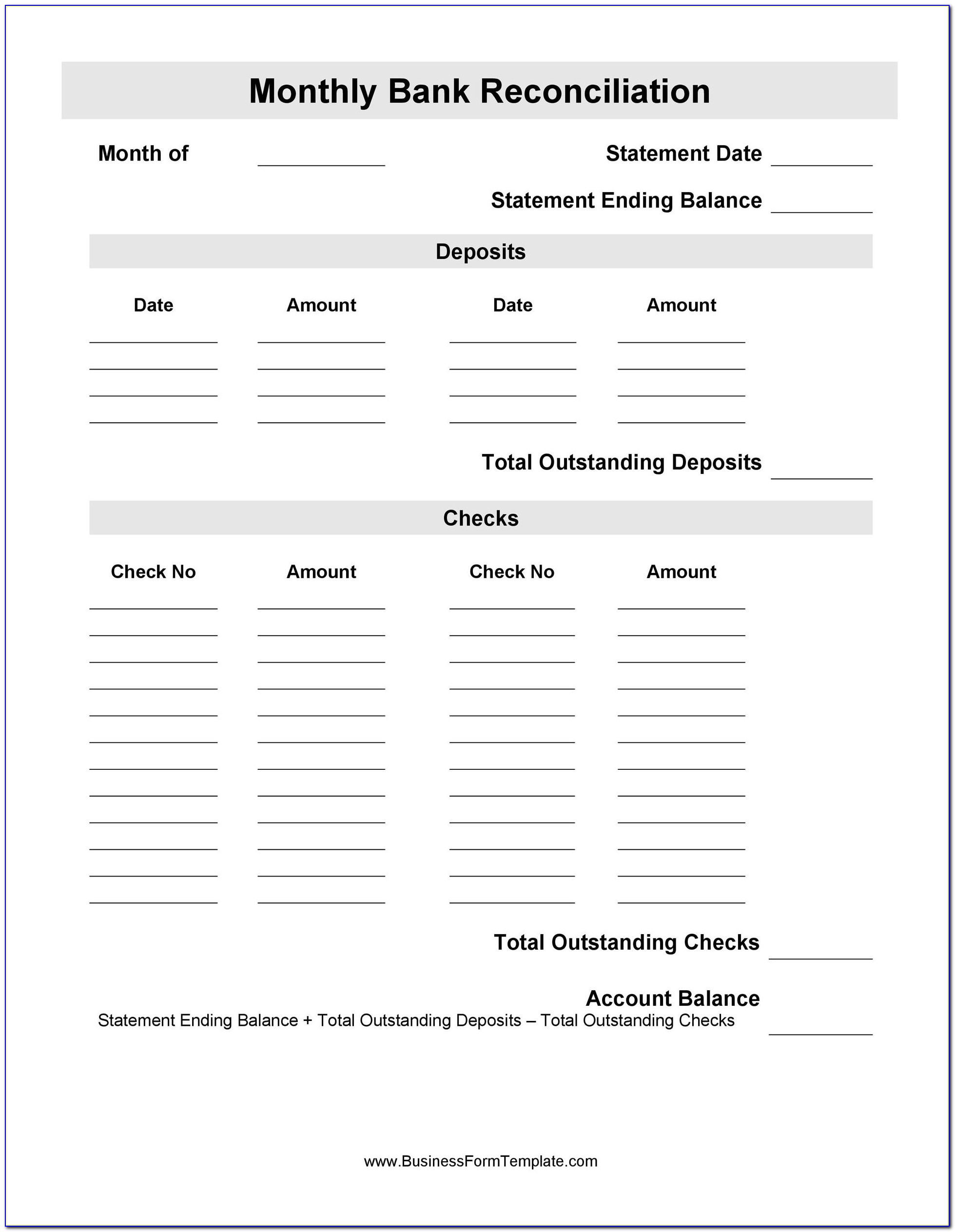

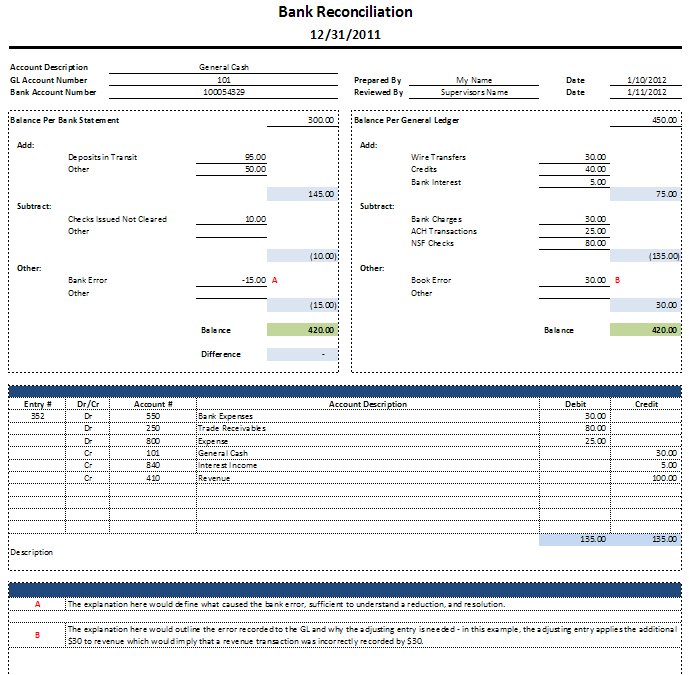

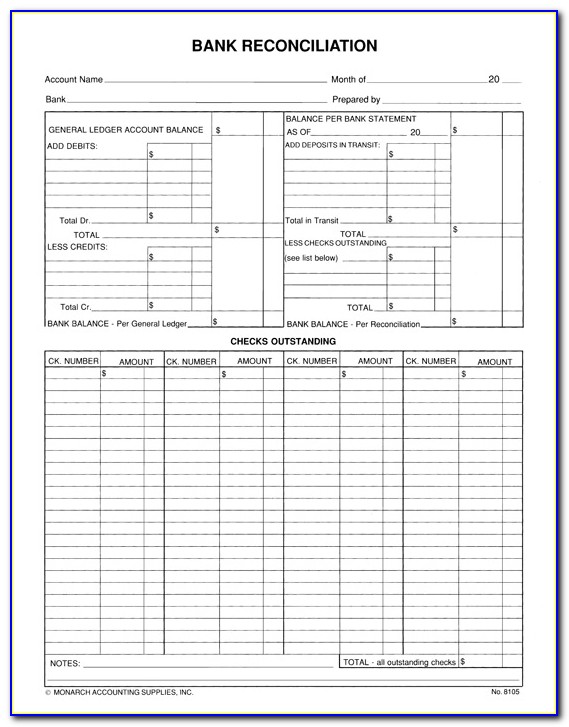

Simple Bank Reconciliation Template Excel

Bank Statement Reconciliation Template Best Of Free Bank Reconciliation

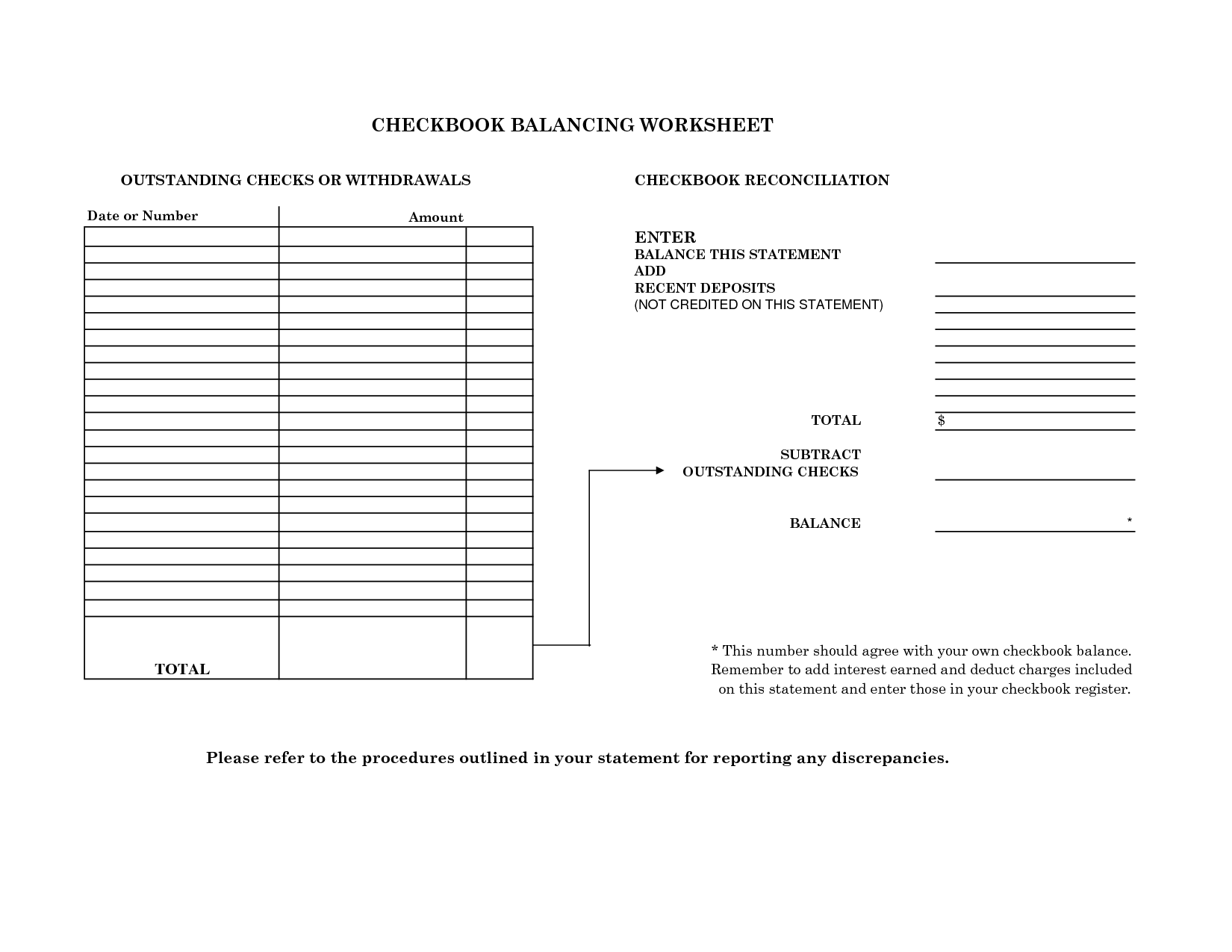

Checkbook Reconciliation Practice Worksheets best photos of blank

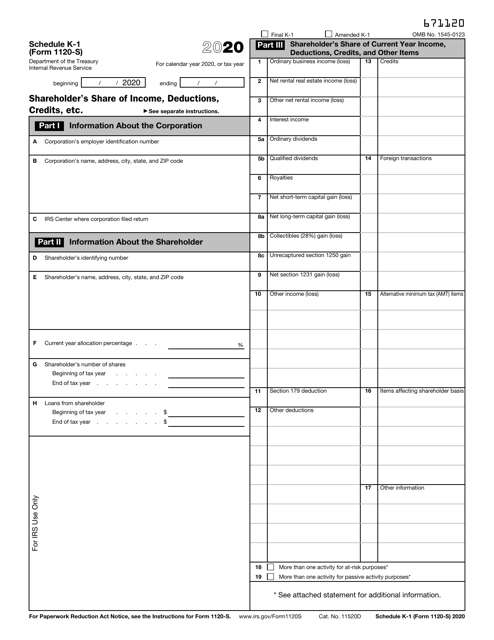

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

K1 Basis Worksheet

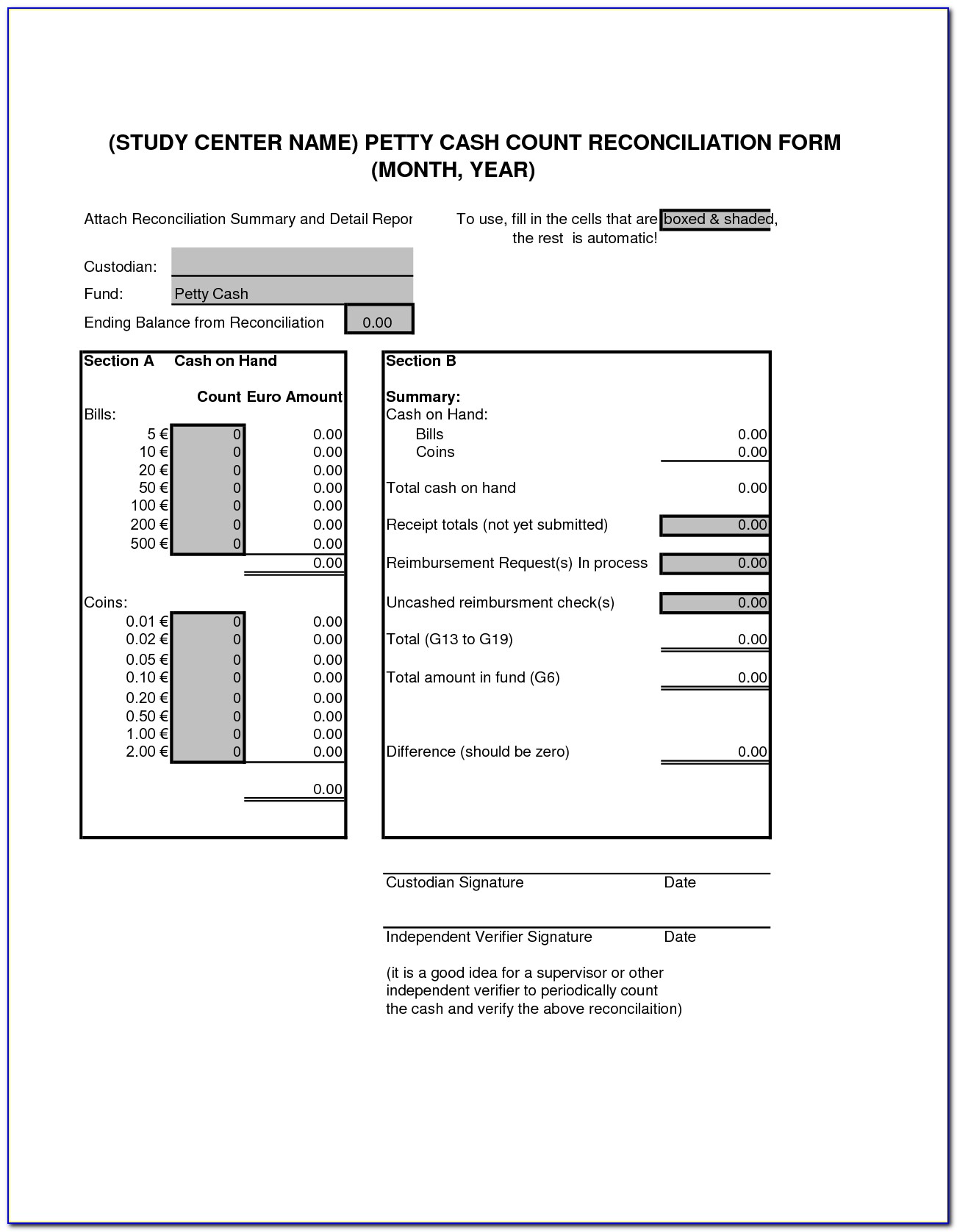

Petty Cash Reconciliation Form Template

Daily Cash Reconciliation Worksheet Daily Cash Transaction Report

Checkbook Reconciliation Practice Worksheets checking account

Free Bank Reconciliation Form

This One Is No Different.

Web Line 1 Reconciliation Worksheet.

State Amounts, Federal Amounts, And The Total Difference.

It Is The Partner's Responsibility To.

Related Post: