Lihtc Income Calculation Worksheet

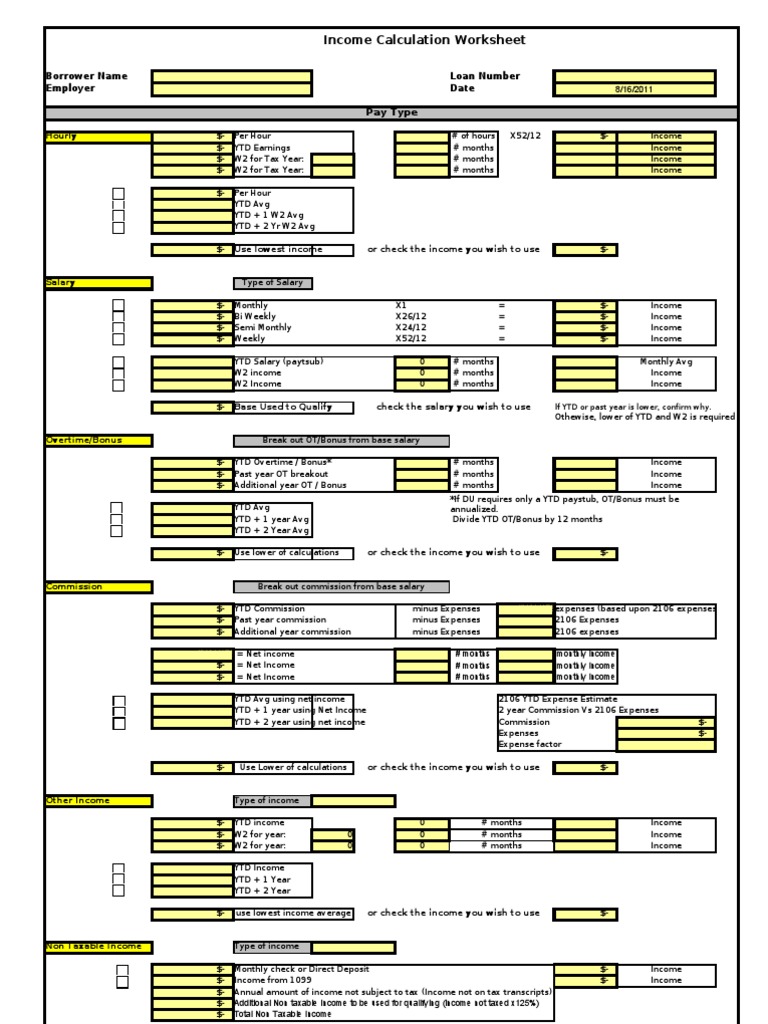

Lihtc Income Calculation Worksheet - Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). Employees with varying earnings (bonus, commission, varying hours) total $ line 2 asset calculation income calculation worksheet total. Income and adjustments to income. Based on this updated guidance, this blog. Hud's lihtc database contains information on 52,006 projects and 3.55 million housing units placed in service between 1987 and 2021. Lihtc set asides (income averaging | 20/50 | 40/60 ) and. Web lihtc (low income housing tax credits) overview and calculator. Use this form to create a record of your income and rent limits along with the income and asset calculations for each household. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. 9% credits vs 4% credits; The start and end years of the credit, compliance and extended use periods [chapter 8]. 7, 2022, the internal revenue service released final plus temporary regulations for the average income exam. Wages, salaries, and other earnings. Below is an overview of how lihtc (low income housing tax credits) are calculated and applied. Lihtc set asides (income averaging | 20/50 |. If you qualify, you can use the credit to reduce the. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. The year that the tax credit was first claimed for each building [chapter 8]. Tenant income certification (income restriction) excel. There. Web line 1 income calculation: Based on this updated guidance, this blog. Income and adjustments to income. Web sheet1 income & asset worksheet for lihtc properties county/msa: This video, excerpted from the lihtc property compliance webinar series, explains how to calculate income from assets when. 7, 2022, the internal revenue service released final plus temporary regulations for the average income exam. 9% credits vs 4% credits; There are seven federal income tax rates in. Hud's lihtc database contains information on 52,006 projects and 3.55 million housing units placed in service between 1987 and 2021. Employees with varying earnings (bonus, commission, varying hours) total $ line. The start and end years of the credit, compliance and extended use periods [chapter 8]. Web this video, excerpted from the lihtc property compliance webinar series, discusses how to account for an anticipated raise when calculating employment income. Web line 1 income calculation: Lihtc set asides (income averaging | 20/50 | 40/60 ) and. Web in 2022, the income limits. Based on this updated guidance, this blog. The year that the tax credit was first claimed for each building [chapter 8]. Tenant income certification (income restriction) excel. Created by the tax reform act of. The start and end years of the credit, compliance and extended use periods [chapter 8]. Web line 1 income calculation: If you qualify, you can use the credit to reduce the. 9% credits vs 4% credits; 7, 2022, the internal revenue service released final plus temporary regulations for the average income exam. Web this video, excerpted from the lihtc property compliance webinar series, discusses how to account for an anticipated raise when calculating employment income. Created by the tax reform act of. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. Web 14k views 10 years ago. Employees with varying earnings (bonus, commission, varying hours) total $ line 2 asset calculation income calculation worksheet total. Hud's lihtc database contains information on 52,006. Web sheet1 income & asset worksheet for lihtc properties county/msa: Use this form to create a record of your income and rent limits along with the income and asset calculations for each household. Web lihtc income & asset worksheet: There are seven federal income tax rates in. Employees with varying earnings (bonus, commission, varying hours) total $ line 2 asset. This video, excerpted from the lihtc property compliance webinar series, explains how to calculate income from assets when. Web this video, excerpted from the lihtc property compliance webinar series, discusses how to account for an anticipated raise when calculating employment income. Wages, salaries, and other earnings. Income and adjustments to income. Web in 2022, the income limits for all tax. Based on this updated guidance, this blog. Web in 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The start and end years of the credit, compliance and extended use periods [chapter 8]. There are seven federal income tax rates in. 7, 2022, the internal revenue service released final plus temporary regulations for the average income exam. Wages, salaries, and other earnings. Use this form to create a record of your income and rent limits along with the income and asset calculations for each household. Lihtc set asides (income averaging | 20/50 | 40/60 ) and. 9% credits vs 4% credits; This video, excerpted from the lihtc property compliance webinar series, explains how to calculate income from assets when. Web sheet1 income & asset worksheet for lihtc properties county/msa: Employees with varying earnings (bonus, commission, varying hours) total $ line 2 asset calculation income calculation worksheet total. Web lihtc (low income housing tax credits) overview and calculator. Web this video, excerpted from the lihtc property compliance webinar series, discusses how to account for an anticipated raise when calculating employment income. Web income & asset worksheet for lihtc properties income calculations multiply the payment rate by the appropriate pay frequency for each source. Tenant income certification (income restriction) excel. Income and adjustments to income. If you qualify, you can use the credit to reduce the. Web lihtc income & asset worksheet: Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. If you qualify, you can use the credit to reduce the. Based on this updated guidance, this blog. The start and end years of the credit, compliance and extended use periods [chapter 8]. This video, excerpted from the lihtc property compliance webinar series, explains how to calculate income from assets when. Lihtc set asides (income averaging | 20/50 | 40/60 ) and. 9% credits vs 4% credits; Created by the tax reform act of. Web capital gains and losses are taxed differently from income like wages, interest, rents, or royalties, which are taxed at your federal income tax rate (up to 37%. There are seven federal income tax rates in. Web lihtc income & asset worksheet: Web sheet1 income & asset worksheet for lihtc properties county/msa: Web lihtc (low income housing tax credits) overview and calculator. Web line 1 income calculation: Employees with varying earnings (bonus, commission, varying hours) total $ line 2 asset calculation income calculation worksheet total. Web introducing the low income housing tax credit (lihtc) historic tax credit (htc) lihtc: The year that the tax credit was first claimed for each building [chapter 8].Tax Deduction Expense

Simple Tax Calculation Sheet for Fy 2017 18 Taxes Services

Hud Budget Worksheet Fill Out and Sign Printable PDF Template signNow

34 Rental Calculation Worksheet support worksheet

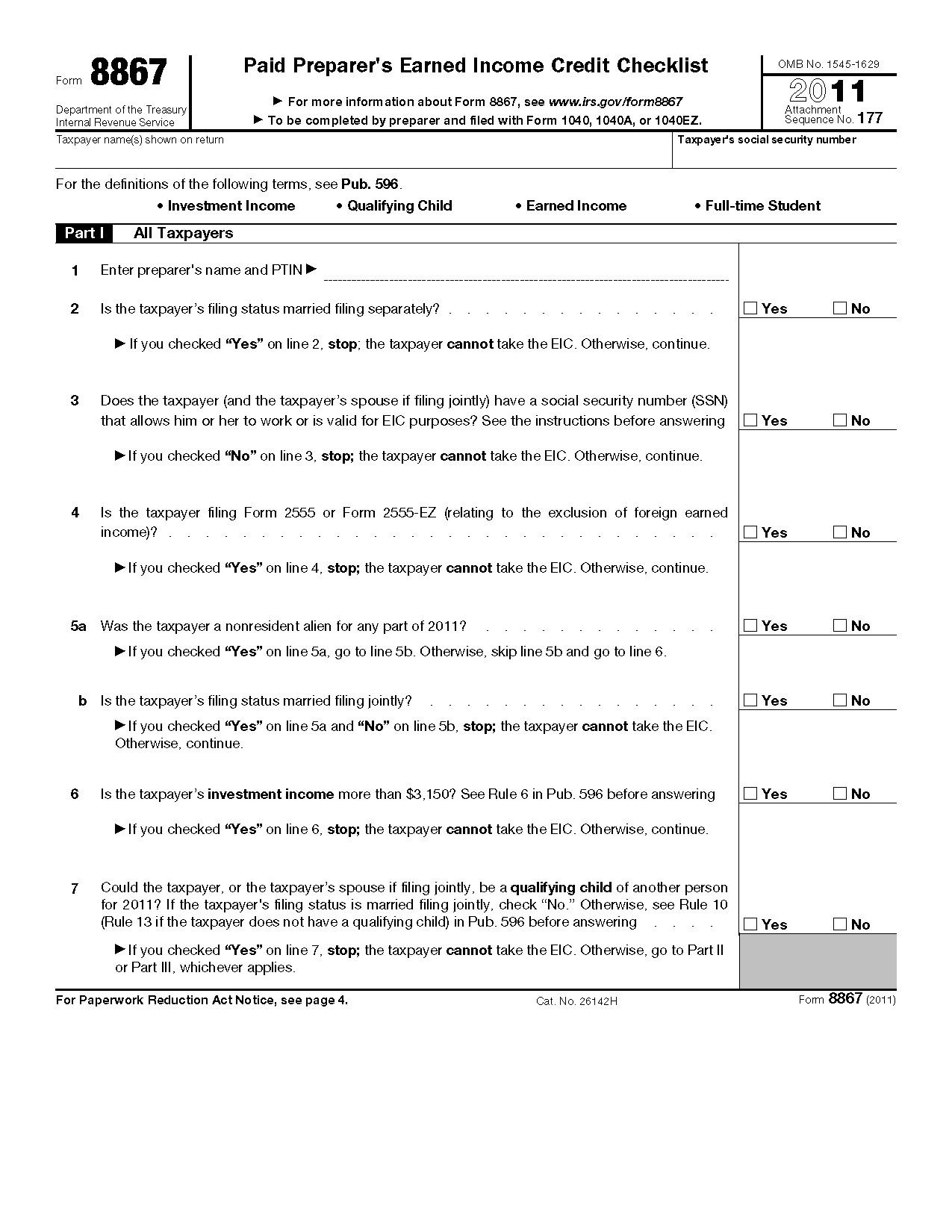

Earned Credit Worksheet • Worksheetforall —

FREE 23+ Asset Worksheet Templates in PDF Excel

rental calculation worksheet

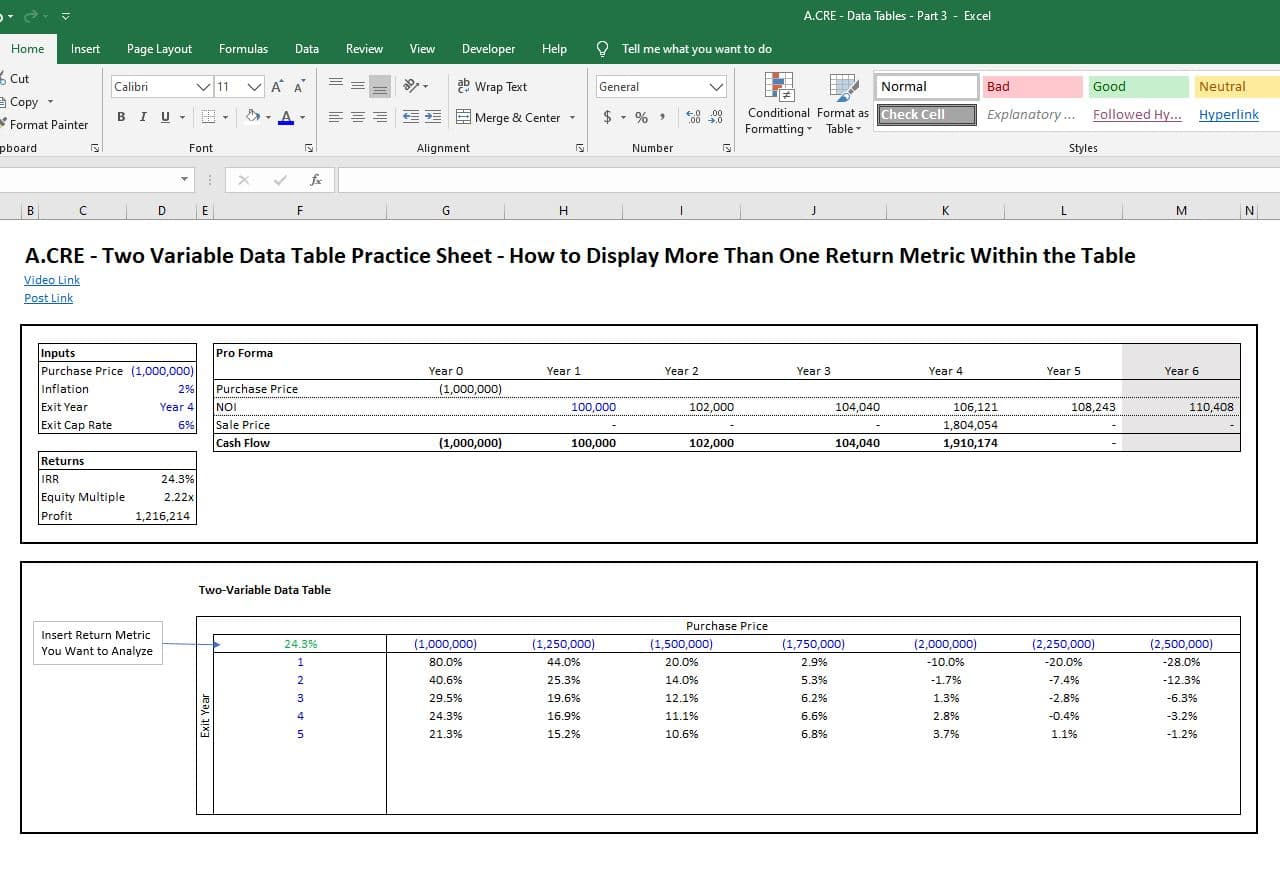

LIHTC Calculator Adventures in CRE

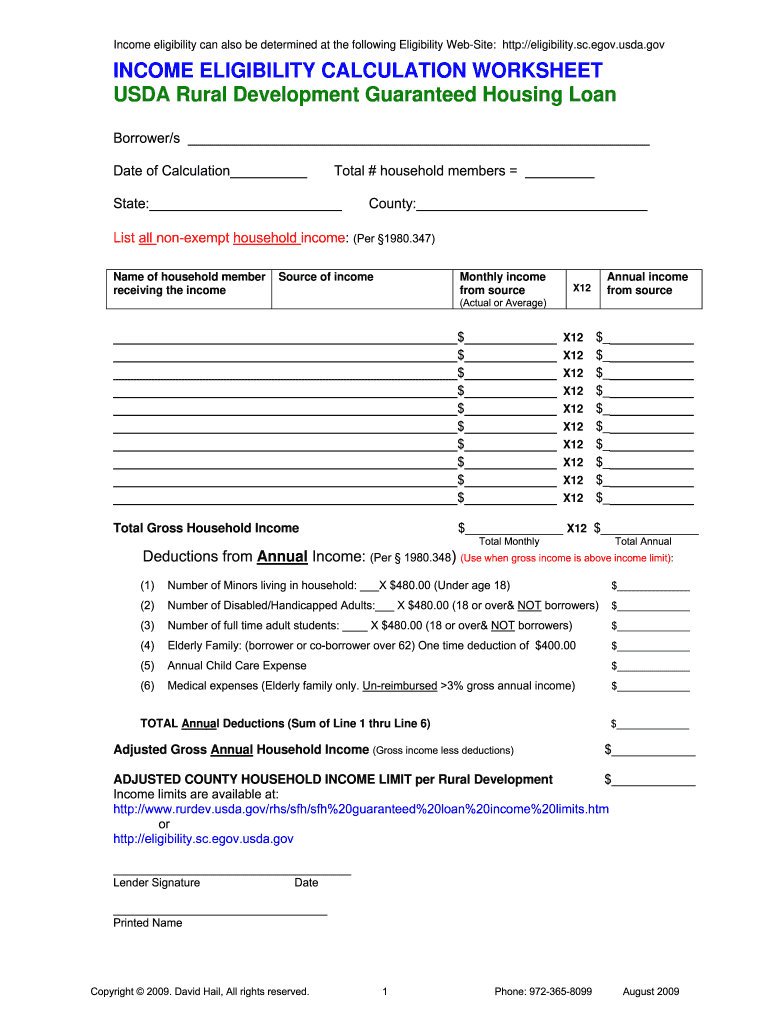

Usda calculation worksheet Fill out & sign online DocHub

Business Calculation Worksheet

Web 14K Views 10 Years Ago.

Web This Video, Excerpted From The Lihtc Property Compliance Webinar Series, Discusses How To Account For An Anticipated Raise When Calculating Employment Income.

Income And Adjustments To Income.

Below Is An Overview Of How Lihtc (Low Income Housing Tax Credits) Are Calculated And Applied.

Related Post: