Living Trust Worksheet

Living Trust Worksheet - Asset inventory and personal information. Web published december 23, 2021 | written by emily crowley. This set of slides and cut and paste worksheets are a great way to introduce and practice identifying living and nonliving things! And maria garcia living trust. The slides include a definition slide, slides to identify if a cat, plant, and rock are living or nonliving things, and a thumbs up/thumbs down activity. Web the ihss program will help pay for services provided to you so that you can remain safely in your own home. Web revocable living trust, to be known as “the _____ [grantor] revocable living trust” (this “trust”). Web revocable living trust forms. Because of that, you will need to choose the assigned person very carefully. A living trust is a document that allows an individual, or grantor, to place their assets to the benefit of someone else at their death or incapacitation. Change an existing living trust To be eligible, you must be 65 year of age and over, or disabled, or blind. Part iii purpose of trust. Decide if you’re the sole grantor 2. Decide whether you will be the sole grantor 4. Web 3 beneficiary information (continued) information for 4th beneficiary. Decide whether you will be the sole grantor 4. We manage the largest public pension fund in the us. Web paulla is a certified specialist in estate planning trust and probate law. Be sure to include both names. Plan and organize your individual living trust. Unlike a will, a trust does not go through the probate process with the court. For example, a children's trust for minor children or a bypass trust for the benefit of a spouse may cause the living trust to continue for a period of time. Our online living trust funding worksheet helps you. Asset inventory and personal information. To be eligible, you must be 65 year of age and over, or disabled, or blind. She also assists clients with formation of business entities, general business matters. Web living trust forms. _____ if you are doing a joint trust i.e.: If you are married or in a domestic partnership and you and your spouse or partner own most of your property together, a shared trust may be the right way to go. Nmy spouse does not have a revocable living trust. A living trust form is a document that creates a legal entity (called a trust) to hold assets like. Therefore, the person who is selected as the successor trustee will. Living trust, pour over will, advance health care directive, living will, general durable powers of attorney, and trust transfer deeds usually takes a couple of weeks to prepare. Choose a successor trustee 6. Be sure to include both names. Getting your finances in check with an individual living trust. Your other choice is two individual trusts. Unlike a will, a trust does not go through the probate process with the court. The purpose of this trust is. List your assets and decide which you’ll include in the trust 2. There is a flat fee for living trust packages: Identify your assets and find the paperwork 3. _____ if you are doing a joint trust i.e.: Maybe you want to figure out which assets to move, or maybe you just want to work out how to do it. A revocable living trust is created by an individual (the grantor) for the purpose of holding their assets and property and. Web revocable living trust, to be known as “the _____ [grantor] revocable living trust” (this “trust”). Set up a living trust with your spouse. Web trust are private, wills are public. Your other choice is two individual trusts. Transfer property to yourself as trustee 10. You can also put it as: Because of that, you will need to choose the assigned person very carefully. Maybe you want to figure out which assets to move, or maybe you just want to work out how to do it. Decide whether you will be the sole grantor 4. If you are married or in a domestic partnership and. Decide whether you will be the sole grantor 4. The grantor maintains ownership over their assets and they can make alterations to the. Maybe you want to figure out which assets to move, or maybe you just want to work out how to do it. This set of slides and cut and paste worksheets are a great way to introduce and practice identifying living and nonliving things! A living trust is a document that allows an individual, or grantor, to place their assets to the benefit of someone else at their death or incapacitation. The slides include a definition slide, slides to identify if a cat, plant, and rock are living or nonliving things, and a thumbs up/thumbs down activity. Change an existing living trust Set up a living trust with your spouse. Decide if you’re the sole grantor 2. A revocable living trust is created by an individual (the grantor) for the purpose of holding their assets and property and dictating how said assets and property will be distributed upon their death. And maria garcia living trust. The grantor has, or upon the execution of this trust immediately will, transfer the assets listed in schedule a hereto as a gift and without consideration. For the former, this will be the one in charge of distributing your assets to your beneficiaries. You can also put it as: Transfer property to yourself as trustee 10. A joint living trust funding worksheet can give you a solid foundation to get started. Our online living trust funding worksheet helps you organize all that information. Web calpers builds retirement and health security for california state, school, and public agency members. Nmy spouse does not have a revocable living trust. Decide whether you need a shared trust or an individual trust. Her practice is focused on representation of individuals in estate planning matters, including preparation of revocable and irrevocable trusts and administration of trusts and estates. Web 3 beneficiary information (continued) information for 4th beneficiary. A living trust is a document that allows an individual, or grantor, to place their assets to the benefit of someone else at their death or incapacitation. Be sure to include both names. Decide whether you need a shared trust or an individual trust. Identify your assets and find the paperwork 3. Choose your beneficiaries table of contents a living trust, also called an inter vivos trust, is created during your lifetime. $1,500 for a single person and $2,000 for a married couple. A trust is a useful estate planning document that works alongside your last will and testament to manage your assets and distribute them to beneficiaries privately after your death. We manage the largest public pension fund in the us. And maria garcia living trust. Web paulla is a certified specialist in estate planning trust and probate law. If you are married or in a domestic partnership and you and your spouse or partner own most of your property together, a shared trust may be the right way to go. Set up a living trust with your spouse. Choose a successor trustee 6. _____ if you are doing a joint trust i.e.:30 Free Living Trust Forms & Templates [Word] TemplateArchive

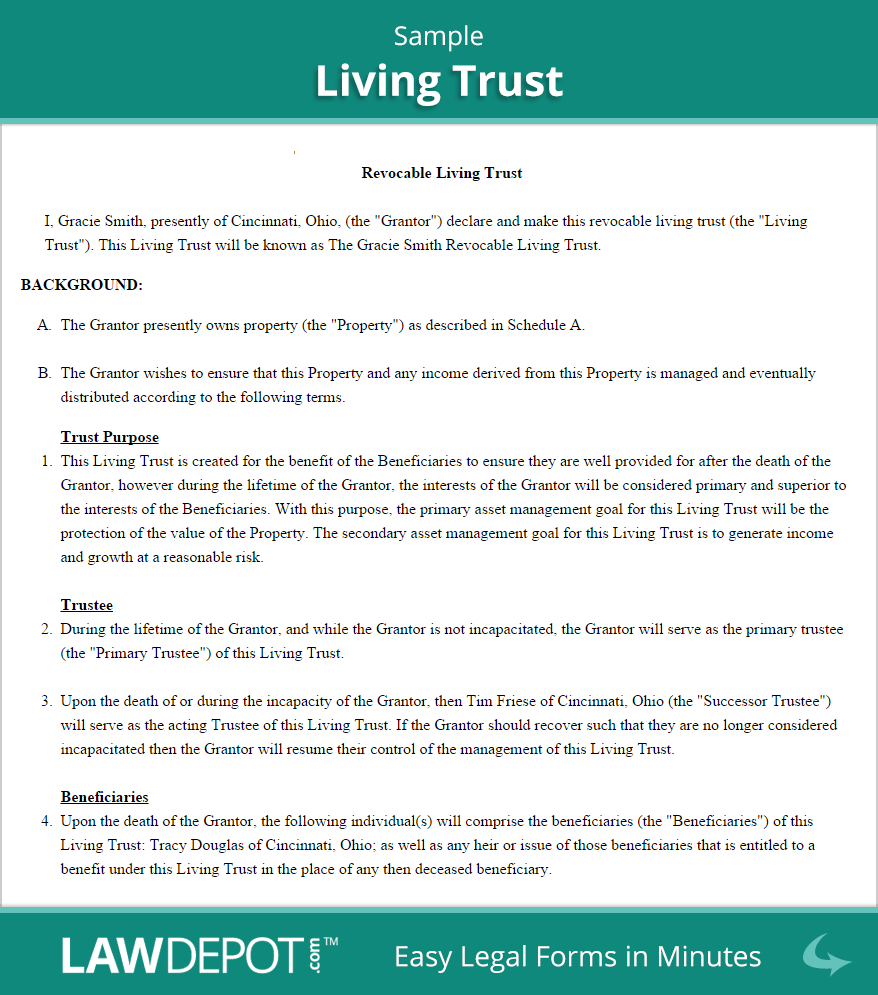

Revocable Living Trust Forms Free Download amulette

10++ Living Trust Worksheet

living trust worksheet

Glendale Living Trust Attorney Free Living Trust Evaluation and

30 Free Living Trust Forms & Templates [Word] TemplateArchive

Living Trust Worksheet —

10++ Living Trust Worksheet

30 Free Living Trust Forms & Templates [Word] TemplateArchive

️Identifying Parenting Styles Worksheet Free Download Gambr.co

Web Living Trust Forms.

This Set Of Slides And Cut And Paste Worksheets Are A Great Way To Introduce And Practice Identifying Living And Nonliving Things!

Because Of That, You Will Need To Choose The Assigned Person Very Carefully.

Choose Someone To Manage Property For Minor Children 7.

Related Post:

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-09.jpg)

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-22.jpg)

![30 Free Living Trust Forms & Templates [Word] TemplateArchive](https://templatearchive.com/wp-content/uploads/2020/12/living-trust-form-17.jpg)