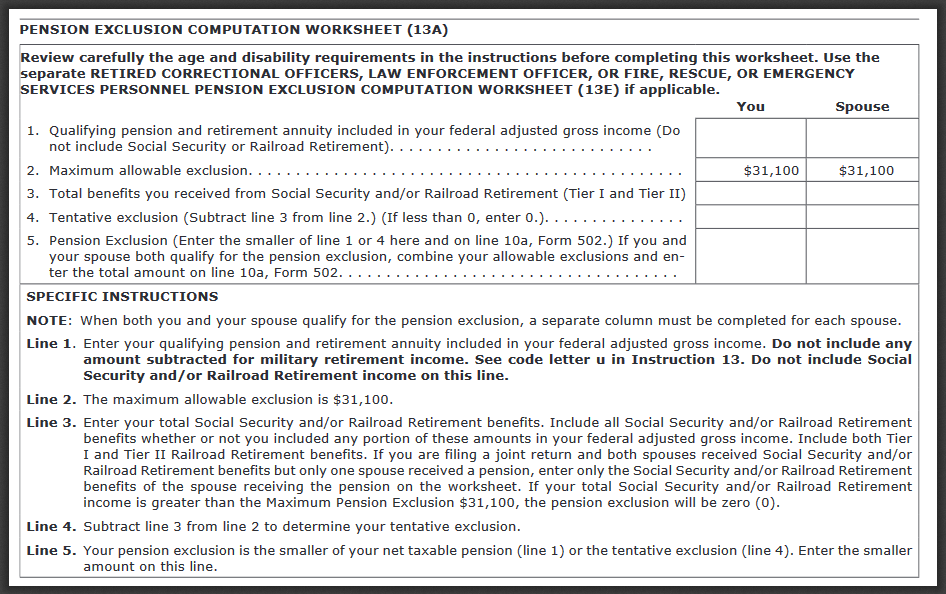

Maryland Pension Exclusion Worksheet

Maryland Pension Exclusion Worksheet - Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension exclusion of $34,300 for tax year. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. I was able to fix the pension exclusion problem and the related two earner subtraction problem. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web claimed a pension exclusion on line 10a of form 502; Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Complete, fill out, and authorize your irs reporting online or print out. Web 1 best answer billjh level 2 good news! Web state pension exclusion maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who are totally. Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who. Web state pension exclusion maryland law provides a pension exclusion (in the form of. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check with your employer or contact a retirement benefits. Web state pension exclusion maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who are totally. Web personnel pension. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Complete part 5 if you or your spouse received social security or railroad retirement benefits (tier i or tier ii). Web 1 best answer billjh level 2 good news! Web state pension exclusion maryland law provides a pension. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who. Web the maximum admissible amount of the exclusion is $34,300. Web complete the 502r after adding your 1099r in the w2 and 1099 information section and after completing the pension. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Web state pension exclusion maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who are totally. Web 1 best answer billjh level 2 good. Complete part 5 if you or your spouse received social security or railroad retirement benefits (tier i or tier ii). Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. I was able to fix the pension exclusion problem and the related two earner subtraction problem. Web state pension exclusion maryland law provides a pension exclusion (in. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from : Web claimed a pension exclusion on line 10a of form 502; Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Complete, fill out, and authorize your irs reporting online or print. Complete part 5 if you or your spouse received social security or railroad retirement benefits (tier i or tier ii). Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have received qualified pension income, you should. Web 1 best answer billjh level. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check with your employer or contact a retirement benefits. Web claimed a pension exclusion on line 10a of form 502; Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who. Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally disabled may subtract certain taxable pension and. Web 1 best answer billjh level 2 good news! Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your. Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Web claimed a pension exclusion on line 10a of form 502; Web the maximum admissible amount of the exclusion is $34,300. Complete part 5 if you or your spouse received social security or railroad retirement benefits (tier i or tier ii). Web state pension exclusion maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who are totally. Web if you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension exclusion of $34,300 for tax year. I was able to fix the pension exclusion problem and the related two earner subtraction problem. Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have received qualified pension income, you should. Web complete the 502r after adding your 1099r in the w2 and 1099 information section and after completing the pension exclusion worksheet (s) in the subtractions section. If you file a joint return and both spouses have income subject to maryland tax, you may. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check with your employer or contact a retirement benefits. Web 1 best answer billjh level 2 good news! Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. You can edit these pdf forms online and download them on your computer for free. Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who. Web my suggestion would be to carefully complete md's own pension exclusion worksheet manually, and see if your results jibe with the turbotax calculation. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Worksheet 13e of the maryland resident. Complete, fill out, and authorize your irs reporting online or print out. Complete, fill out, and authorize your irs reporting online or print out. Worksheet 13e of the maryland resident. Web personnel pension exclusion computation worksheet (13e) review carefully the age and prior employment requirements in the instructions before completing this worksheet. Web easily navigate maryland pension exclusion worksheet library and use online editing tools on the spot. Web cocodoc collected lots of free maryland pension exclusion worksheet for our users. Web to confirm your system and plan refer to your yearly personal statement of benefits issued in september, check with your employer or contact a retirement benefits. Web under the maryland pension exclusion, an individual who is at least age 65, who is totally disabled, or whose spouse is totally disabled may subtract certain taxable pension and. Web state pension exclusion maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who are totally. Web the maximum admissible amount of the exclusion is $34,300. Web my suggestion would be to carefully complete md's own pension exclusion worksheet manually, and see if your results jibe with the turbotax calculation. Web claimed a pension exclusion on line 10a of form 502; Web if you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have received qualified pension income, you should. Web fire, rescue, or emergency services personnel pension exclusion (from line 10b on form 502), complete part 7 using information from : Web state pension exclusion current law maryland law provides a pension exclusion (in the form of a subtraction modification) for individuals who are at least 65 years old or who. Web complete the 502r after adding your 1099r in the w2 and 1099 information section and after completing the pension exclusion worksheet (s) in the subtractions section. Complete part 5 if you or your spouse received social security or railroad retirement benefits (tier i or tier ii).Retirement Exclusion Worksheet

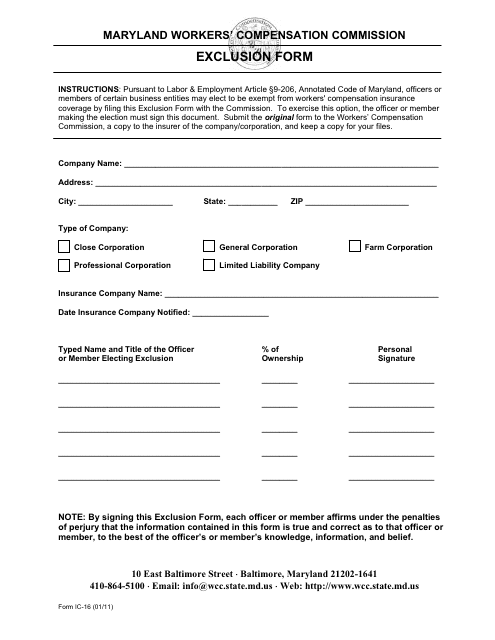

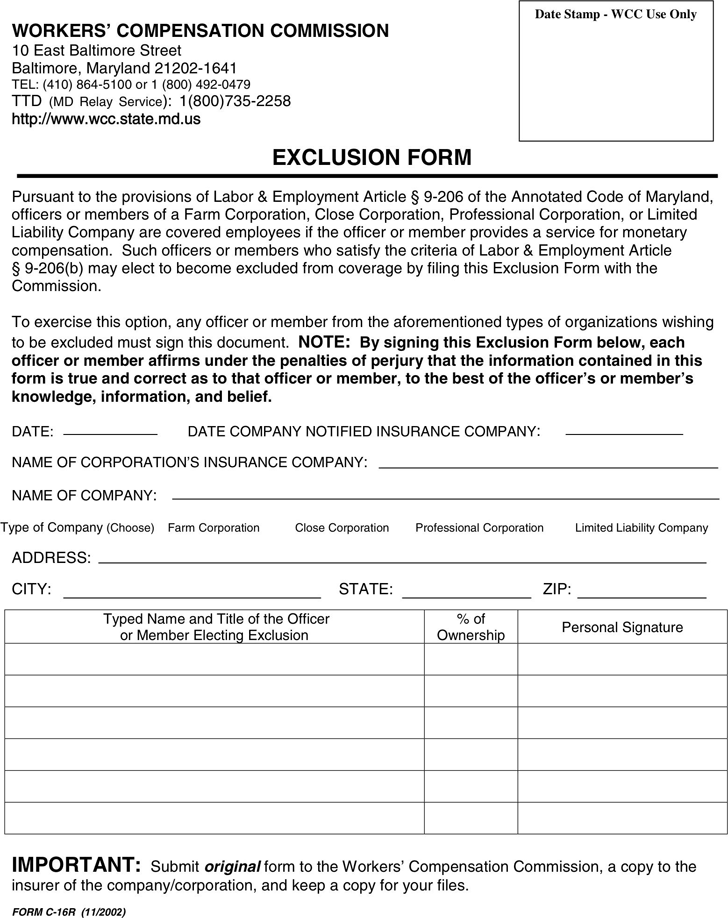

WCC Form IC16 Download Printable PDF or Fill Online Officer Exclusion

Maryland Pension Exclusion 2017

Free Arkansas Single Member Llc Operating Agreement Form Pdf Word

Maryland pension exclusion may include a state tax deduction

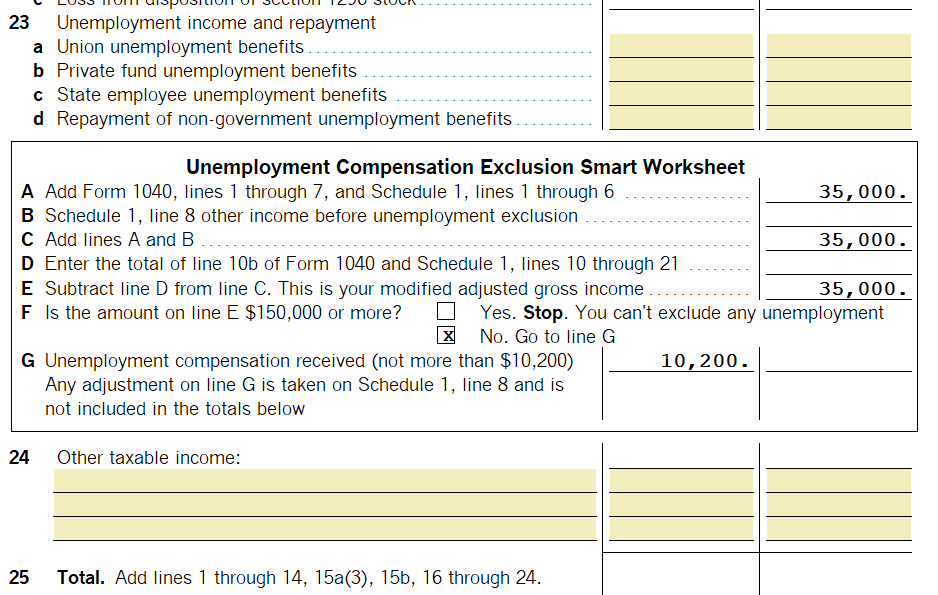

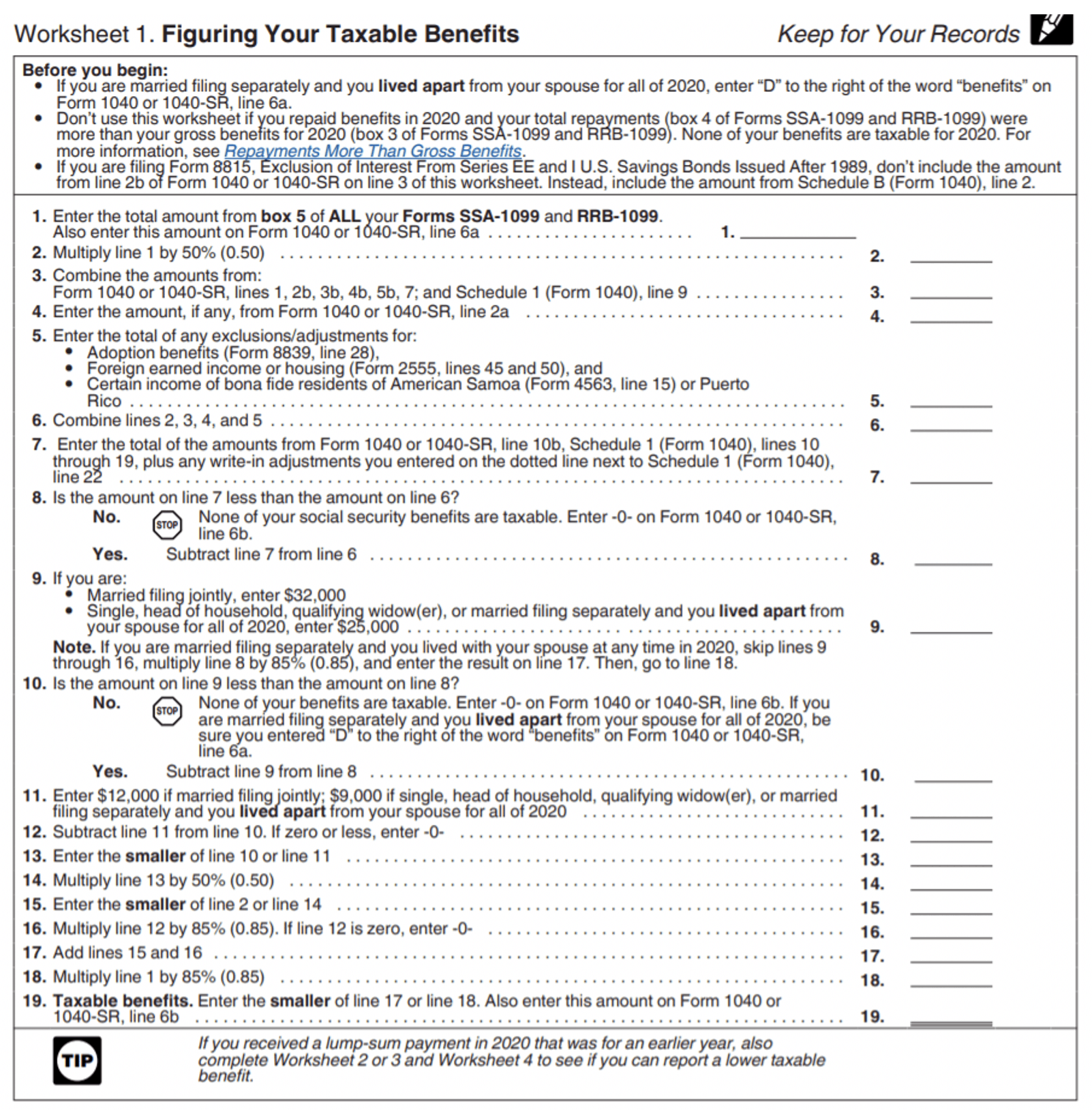

Unemployment Compensation Exclusion Worksheet T Updated 2021

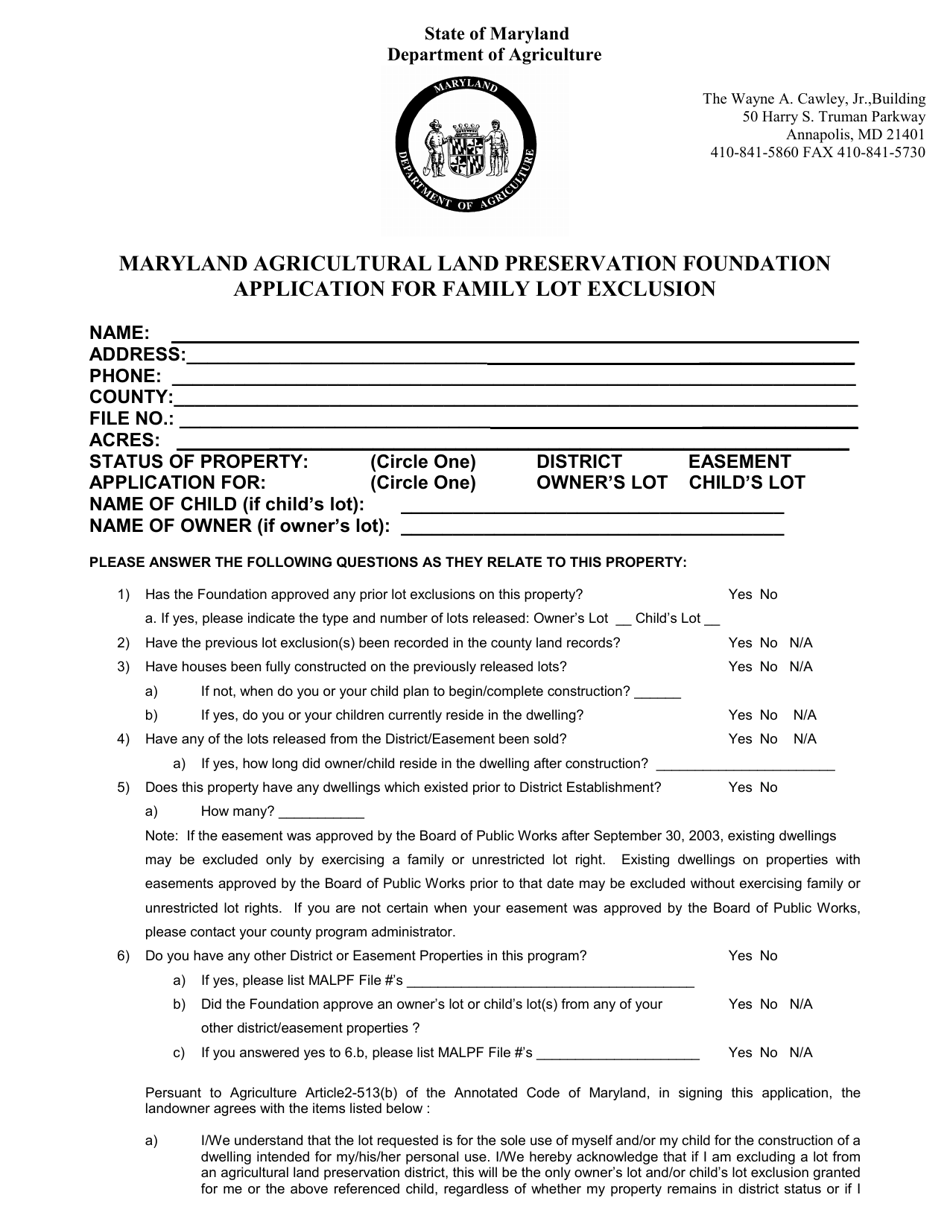

Maryland Application for Family Lot Exclusion Download Printable PDF

Worker's Compensation Template Free Template Download,Customize and Print

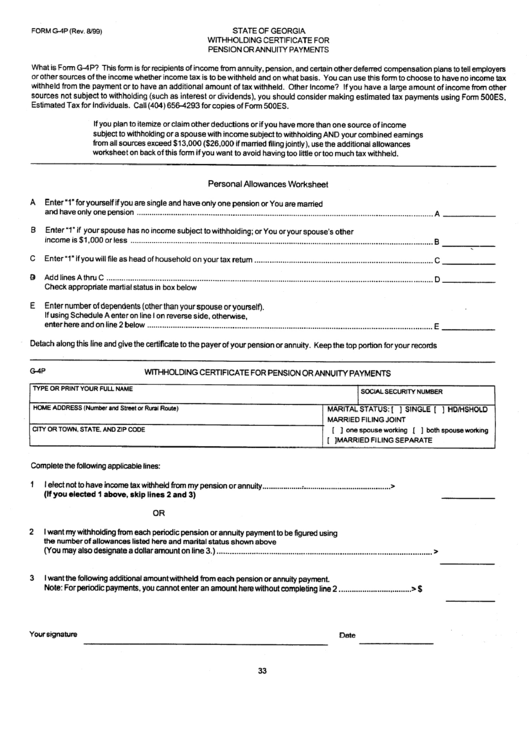

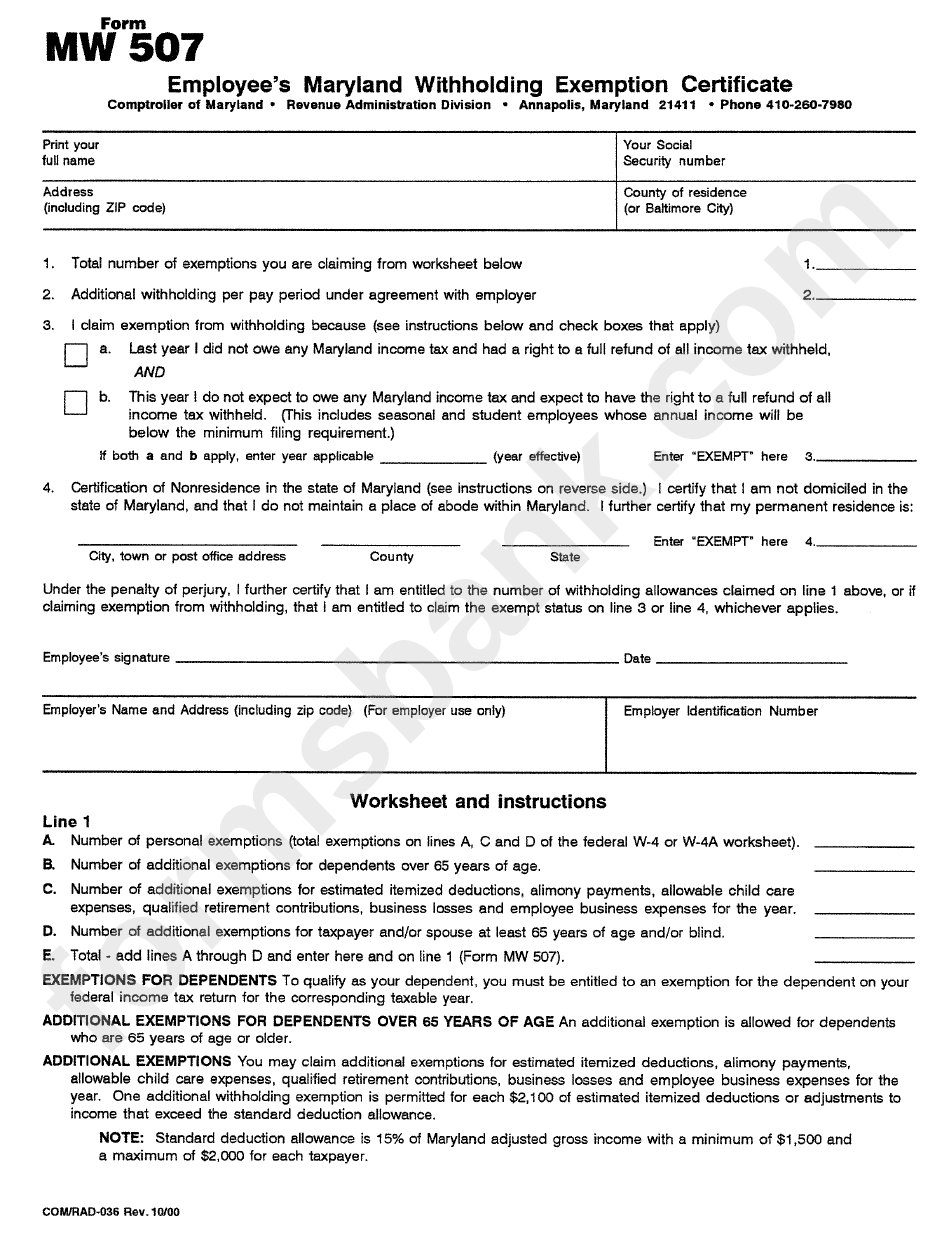

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

Does The State Of Kansas Tax Social Security Benefits

Web 1 Best Answer Billjh Level 2 Good News!

I Was Able To Fix The Pension Exclusion Problem And The Related Two Earner Subtraction Problem.

You Can Edit These Pdf Forms Online And Download Them On Your Computer For Free.

Web Personnel Pension Exclusion Computation Worksheet (13E) Review Carefully The Age And Prior Employment Requirements In The Instructions Before Completing This Worksheet.

Related Post: