Mcc Calculation Worksheet

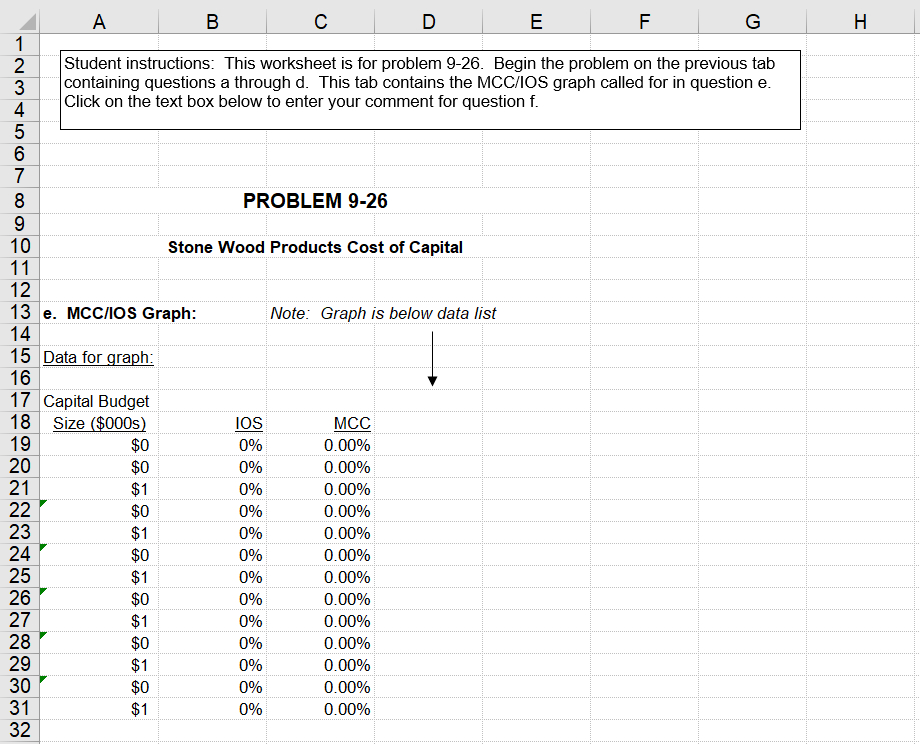

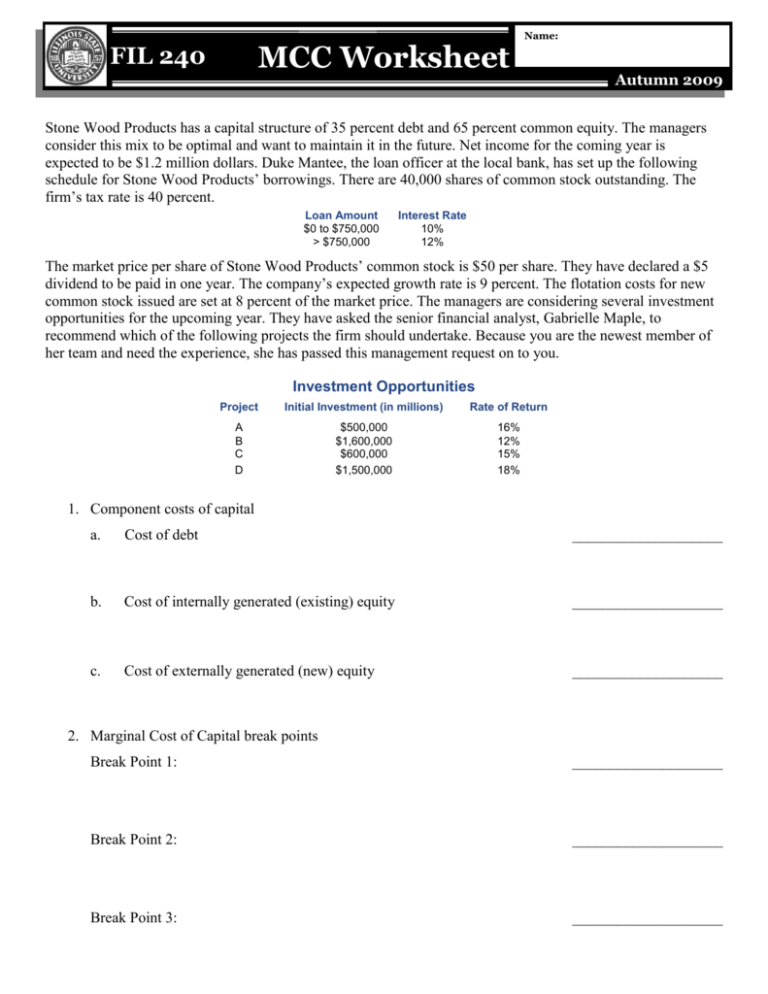

Mcc Calculation Worksheet - Web available to first time homebuyers, veterans, or a homebuyer who has not owned a home in the past three years. Web mortgage credit certificate (mcc) programs can help first time homebuyers save money each year they live in their newly purchased home. Conveys mcc processing fees : Training presentations and tip sheets. With the mcc program, homeowners may claim between 10% to 50% of their mortgage interest as a federal tax credit on. Web how to calculate the mcc. Web the ohio housing finance agency's mortgage tax credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid, which could provide up to a $2,000 tax savings per year. Texas mortgage credit certificates (“mccs”) provide eligible first time homebuyers the opportunity to receive a federal tax credit to. Web if you were issued a qualified mortgage credit certificate (mcc) by a state or local governmental unit or agency under a qualified mortgage credit certificate program, use form 8396 to figure: Define, calculate, and apply the concepts of vectors, dot, and cross products. Autumn 2009 stone wood products has a capital structure of 35 percent debt and 65 percent common equity. If you take this credit, you must reduce your mortgage interest deduction. Training presentations and tip sheets. (to be completed at time of mcc application) loan officer completes this section to determine mcc applicant’s 20% tax credit. Calculate arc length, unit tangent. Net income for the coming year is expected. Web when calculating the borrower’s dti ratio, treat the maximum possible mcc income as an addition to the borrower’s income, rather than as a reduction to the amount of the borrower’s mortgage payment. The dollar for dollar reduction. Web homebuyers home | homebuyers | programs available | mortgage credit certificates what are. Texas mortgage credit certificates (“mccs”) provide eligible first time homebuyers the opportunity to receive a federal tax credit to. 9/15 exhibit 2 schedule of fees : Web how to calculate the mcc. Enter the mortgage loan amount. Web homebuyers home | homebuyers | programs available | mortgage credit certificates what are mccs? May be provided to the applicant to demonstrate the benefit of the mcc : The dollar for dollar reduction. Web how to calculate the mcc. Texas mortgage credit certificates (“mccs”) provide eligible first time homebuyers the opportunity to receive a federal tax credit to. Use the following calculation when determining the. Your mortgage interest credit for the current year. Use the following calculation when determining the. Calculate arc length, unit tangent and normal vectors, curvature, and surface area. Web mortgage credit certificate (mcc) programs can help first time homebuyers save money each year they live in their newly purchased home. Enter the mortgage loan amount. State and local governments operate mcc programs to provide incentive for residents to own homes. The lender must obtain a copy of the mcc and the lender’s documented. Web if you were issued a qualified mortgage credit certificate (mcc) by a state or local governmental unit or agency under a qualified mortgage credit certificate program, use form 8396 to figure:. Define, calculate, and apply the concepts of vectors, dot, and cross products. Web homebuyers home | homebuyers | programs available | mortgage credit certificates what are mccs? Establish the first year’s interest by. Your mortgage interest credit for the current year. Example of how to calculate the monthly benefit to the borrower for qualifying income purposes : Homebuyers must have a tax liability in order to use this. Figure the credit on form 8396, mortgage interest credit. Web mcc worksheet fil 240 name: Web when calculating the borrower’s dti ratio, treat the maximum possible mcc income as an addition to the borrower’s income, rather than as a reduction to the amount of the borrower’s mortgage payment. Web. Web texas mortgage credit certificate fact sheet type of. With the mcc program, homeowners may claim between 10% to 50% of their mortgage interest as a federal tax credit on. Establish the first year’s interest by. (to be completed at time of mcc application) loan officer completes this section to determine mcc applicant’s 20% tax credit. Enter the mortgage loan. 202 calculation of business use worksheet * 204 tax credit worksheet * forms followed by an asterisk “*” may not be required, depending on the circumstances. Figure the credit on form 8396, mortgage interest credit. Maximize your benefit by combining an mcc with my first. Enter the mortgage loan amount. The dollar for dollar reduction. Your mortgage interest credit for the current year. State and local governments operate mcc programs to provide incentive for residents to own homes. The mortgage credit certificate (mcc) program gives homebuyers another savings option. Autumn 2009 stone wood products has a capital structure of 35 percent debt and 65 percent common equity. Example of how to calculate the monthly benefit to the borrower for qualifying income purposes : Conveys mcc processing fees : Net income for the coming year is expected. To learn what the potential benefit might be, please enter the information requested below and select the calculate button to obtain. Web mortgage credit certificate (mcc) programs can help first time homebuyers save money each year they live in their newly purchased home. 202 calculation of business use worksheet * 204 tax credit worksheet * forms followed by an asterisk “*” may not be required, depending on the circumstances. Web tax credit worksheet : The lender must obtain a copy of the mcc and the lender’s documented. Figure the credit on form 8396, mortgage interest credit. Web use the following calculation when determining the available income: Web this calculator provides an example of the potential financial impact of having an mcc from the pennsylvania housing finance agency. Web how to calculate the mcc. May be provided to the applicant to demonstrate the benefit of the mcc : Calculate the amount or remittance you can expect to receive as your annual mortgage credit certificate, or mcc. If you take this credit, you must reduce your mortgage interest deduction. Web if you were issued a qualified mortgage credit certificate (mcc) by a state or local governmental unit or agency under a qualified mortgage credit certificate program, use form 8396 to figure: Define, calculate, and apply the concepts of vectors, dot, and cross products. (to be completed at time of mcc application) loan officer completes this section to determine mcc applicant’s 20% tax credit. Web use the following calculation when determining the available income: Homebuyers must have a tax liability in order to use this. Web mcc worksheet fil 240 name: If you take this credit, you must reduce your mortgage interest deduction. Web texas mortgage credit certificate fact sheet type of. Enter the mortgage loan amount. Web mortgage credit certificate (mcc) programs can help first time homebuyers save money each year they live in their newly purchased home. Web the ohio housing finance agency's mortgage tax credit provides homebuyers with a direct federal tax credit on a portion of mortgage interest paid, which could provide up to a $2,000 tax savings per year. Autumn 2009 stone wood products has a capital structure of 35 percent debt and 65 percent common equity. Calculate arc length, unit tangent and normal vectors, curvature, and surface area. Web you may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate (mcc) by a state or local government. Calculate the amount or remittance you can expect to receive as your annual mortgage credit certificate, or mcc. Texas mortgage credit certificates (“mccs”) provide eligible first time homebuyers the opportunity to receive a federal tax credit to. Web mcc tax credit worksheet.Short Circuit Current Calculation

31 Electrical Service Load Calculation Worksheet support worksheet

Moore Marsden Calculation Worksheet

Mcc Sizing

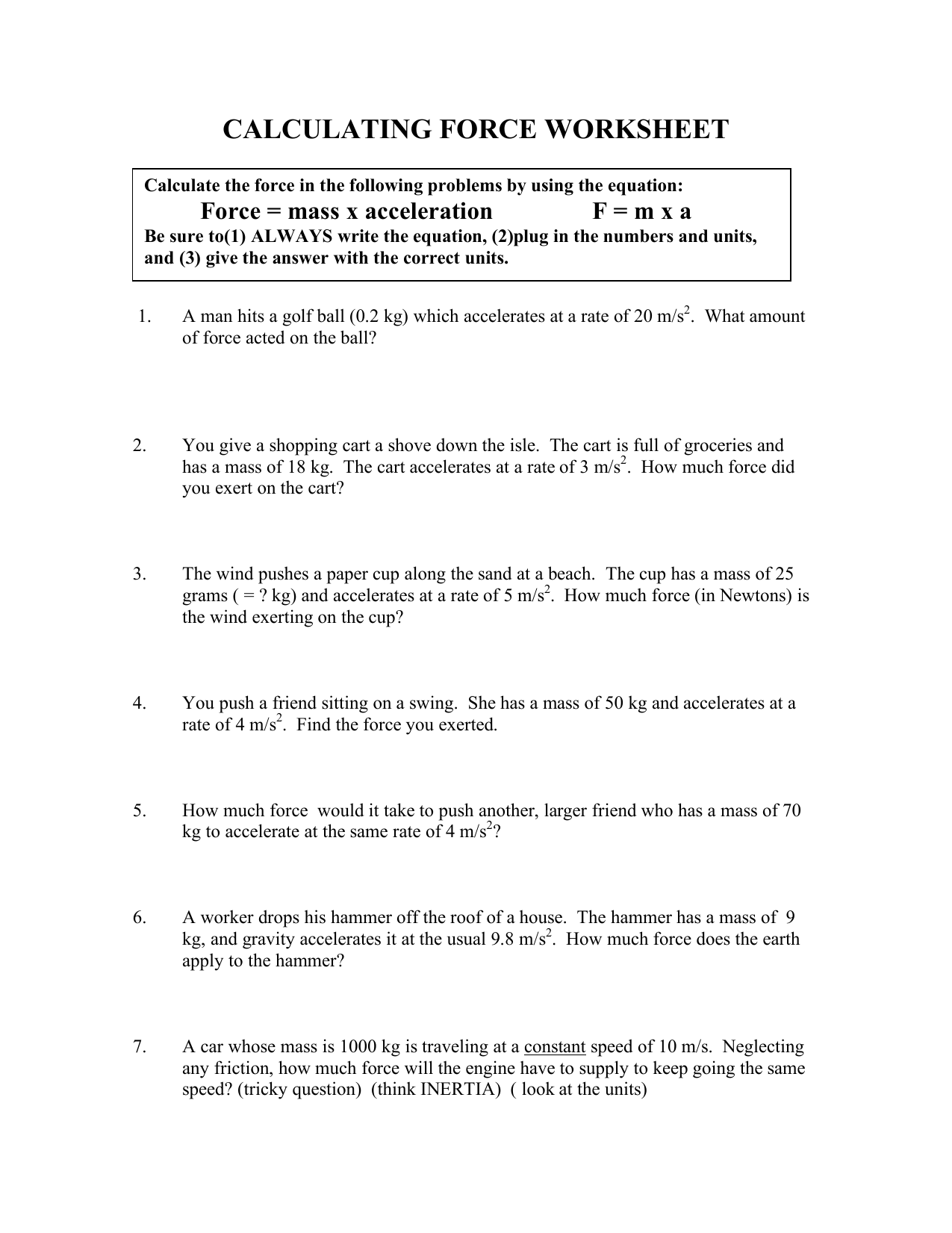

Calculating Force Worksheet Answers Ivuyteq

Mcc Calculation Worksheet Master of Documents

Calculation procedure of the PICMCC method and DSMC method. Download

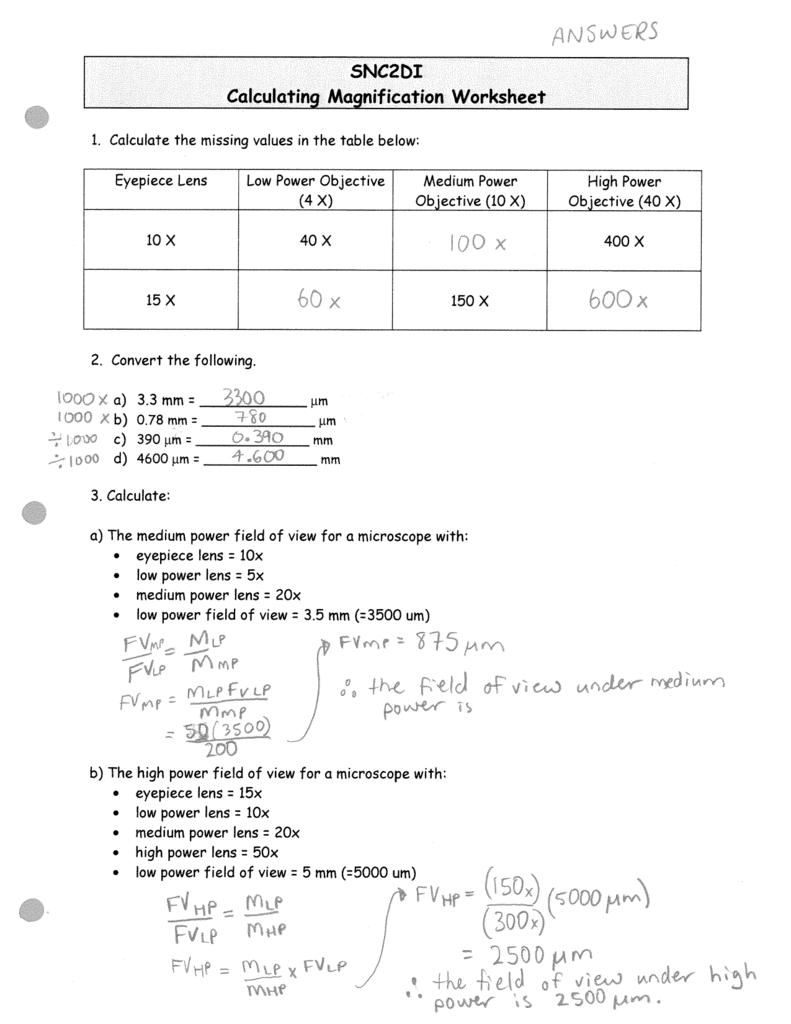

SNC2bI Calculating Magnification Worksheet

Drugs calculation worksheets

MCC Worksheet

Web This Calculator Provides An Example Of The Potential Financial Impact Of Having An Mcc From The Pennsylvania Housing Finance Agency.

Web Tax Credit Worksheet :

Lock Process And Policy For Mcc.

Figure The Credit On Form 8396, Mortgage Interest Credit.

Related Post: