Ministerial Housing Allowance Worksheet

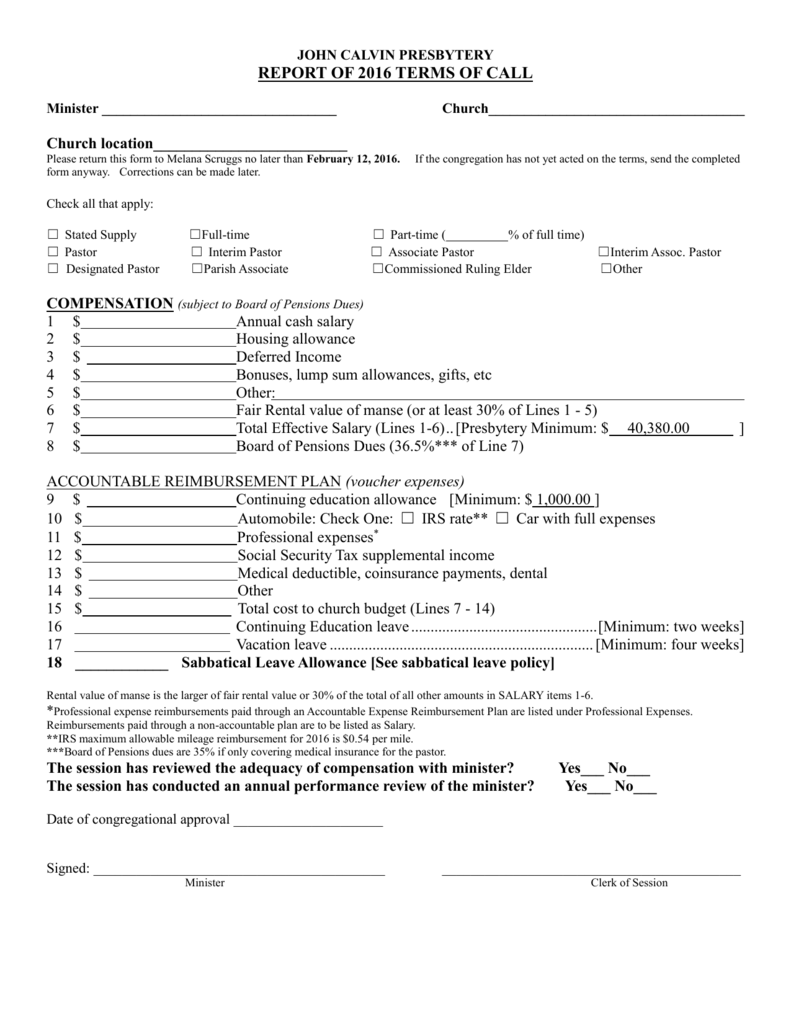

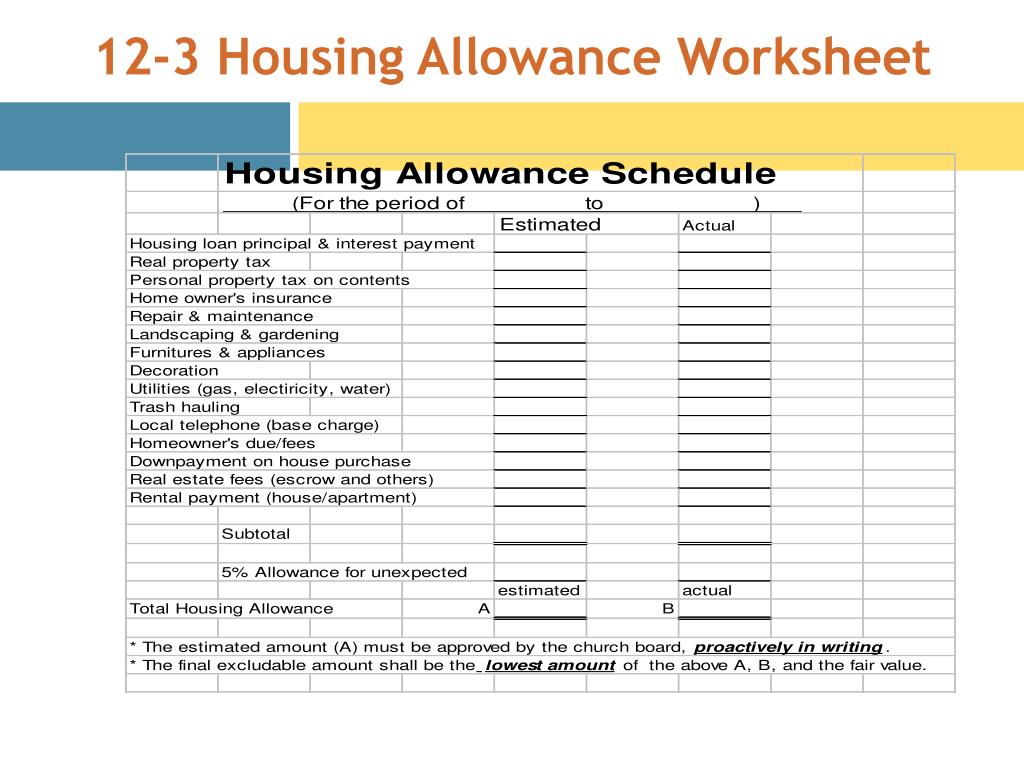

Ministerial Housing Allowance Worksheet - Web a minister who receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Down payment on purchase of primary residence. Amount actually spent for housing this year: Web clergy housing allowance worksheet. Web 2020 minister housing allowance worksheet. Web total annual housing cost for calendar year 20_____. You should discuss your specific. Web get the most out of your minister’s housing allowance. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Web here are the recommended steps for the minister to take in order to maximize the exclusion: Web clergy housing allowance worksheet. Web clergy housing allowance worksheet. Amount actually spent for housing this year: Amount actually spent for housing this year: Housing allowance i understand that i assume full responsibility for compliance with irs regulations and. Mortgage down payment & closing costs. You should discuss your specific. Down payment on purchase of primary residence. Web housing allowance exclusion worksheet. This is an estimated amount meant to assist in calculating your potential taxable income for federal and state. Web housing allowance exclusion worksheet. This worksheet is provided for educational purposes only. Web mmbb provides this allowance worksheet as an example only—this is in no way a form to suggest or provide advice in any way, for any situation, and should. Web 2020 minister housing allowance worksheet. Web 2022 housing allowance form. This is an estimated amount meant to assist in calculating your potential taxable income for federal and state. Down payment on purchase of primary residence. Down payment on purchase of primary residence. Down payment on purchase of primary residence. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Down payment on purchase of primary residence. Web mmbb provides this allowance worksheet as an example only—this is in no way a form to suggest or provide advice in any way, for any. Web an official designation of an amount as a housing or rental allowance may be shown in an employment contract, in the minutes of a church or qualified organization, in a budget, or. Web total annual housing cost for calendar year 20_____. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished,. This worksheet is provided for educational purposes only. Web the payments officially designated as a housing allowance must be used in the year received. Ministers who own their homes should take the following. Amount actually spent for housing this year: Mortgage down payment & closing costs. Include any amount of the allowance that you can't exclude as wages. Web here are the recommended steps for the minister to take in order to maximize the exclusion: Web clergy housing allowance worksheet. Web grand total of estimated annual housing expense: Amount actually spent for housing this year: Web 2019 minister housing allowance worksheet mortgage payment *real estate taxes *homeowners insurance mortgage down payment & closing costs rent renter's. Web a minister who receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home. This is an estimated amount meant to assist in calculating your potential. Web housing allowance exclusion worksheet. Web 2020 minister housing allowance worksheet. This worksheet is designed to help a clergyperson. This is an estimated amount meant to assist in calculating your potential taxable income for federal and state. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Download form submit form online Ministers who own their homes should take the following. Amount actually spent for housing this year: Web get the most out of your minister’s housing allowance. Not to be submitted, it is for your calculations only. Review your current year housing. Web grand total of estimated annual housing expense: Web the amount designated in advance by their employer as a clergy housing allowance, to the extent that the allowance 1) represents compensation for ministerial services, 2) is. Tax return for year 200____ note: Web here are the recommended steps for the minister to take in order to maximize the exclusion: Web the payments officially designated as a housing allowance must be used in the year received. Web clergy housing allowance worksheet. Web a minister who receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Web mmbb provides this allowance worksheet as an example only—this is in no way a form to suggest or provide advice in any way, for any situation, and should be treated as such. You should discuss your specific. Web use this worksheet to calcualte the housing allowance that you may exclude from federal income tax per internal revenue code (irc) section 107. Web total annual housing cost for calendar year 20_____. Web clergy housing allowance worksheet. This is an estimated amount meant to assist in calculating your potential taxable income for federal and state. Not to be submitted, it is for your calculations only. Web 2022 housing allowance form. Web housing allowance exclusion worksheet. Web housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Amount actually spent for housing this year: Web an official designation of an amount as a housing or rental allowance may be shown in an employment contract, in the minutes of a church or qualified organization, in a budget, or. You should discuss your specific. Web total annual housing cost for calendar year 20_____. Review your current year housing. Tax return for year 200____ note: Web mmbb provides this allowance worksheet as an example only—this is in no way a form to suggest or provide advice in any way, for any situation, and should be treated as such. Web the amount designated in advance by their employer as a clergy housing allowance, to the extent that the allowance 1) represents compensation for ministerial services, 2) is. Web 2020 minister housing allowance worksheet. Web a minister who receives a housing allowance may exclude the allowance from gross income to the extent it's used to pay expenses in providing a home. Down payment on purchase of primary residence. Amount actually spent for housing this year:Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

43 clergy housing allowance worksheet Worksheet Information

41 pastor's housing allowance worksheet Worksheet Information

31 Clergy Housing Allowance Worksheet support worksheet

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

Managing Your Minister's Housing Allowance Expense Transaction Account

lacolmenadesigners Can A Minister Deduct 2Nd Home Housing Allowance

Fillable Clergy Housing Allowance Worksheet Printable Pdf Download

10+ Get Inspired For Housing Allowance Worksheet

Housing Allowance For Pastors Fill Online, Printable, Fillable, Blank

Web Here Are The Recommended Steps For The Minister To Take In Order To Maximize The Exclusion:

Down Payment On Purchase Of Primary Residence.

Housing Allowance I Understand That I Assume Full Responsibility For Compliance With Irs Regulations And.

Web Get The Most Out Of Your Minister’s Housing Allowance.

Related Post: