Monetary Policy Worksheet Answers

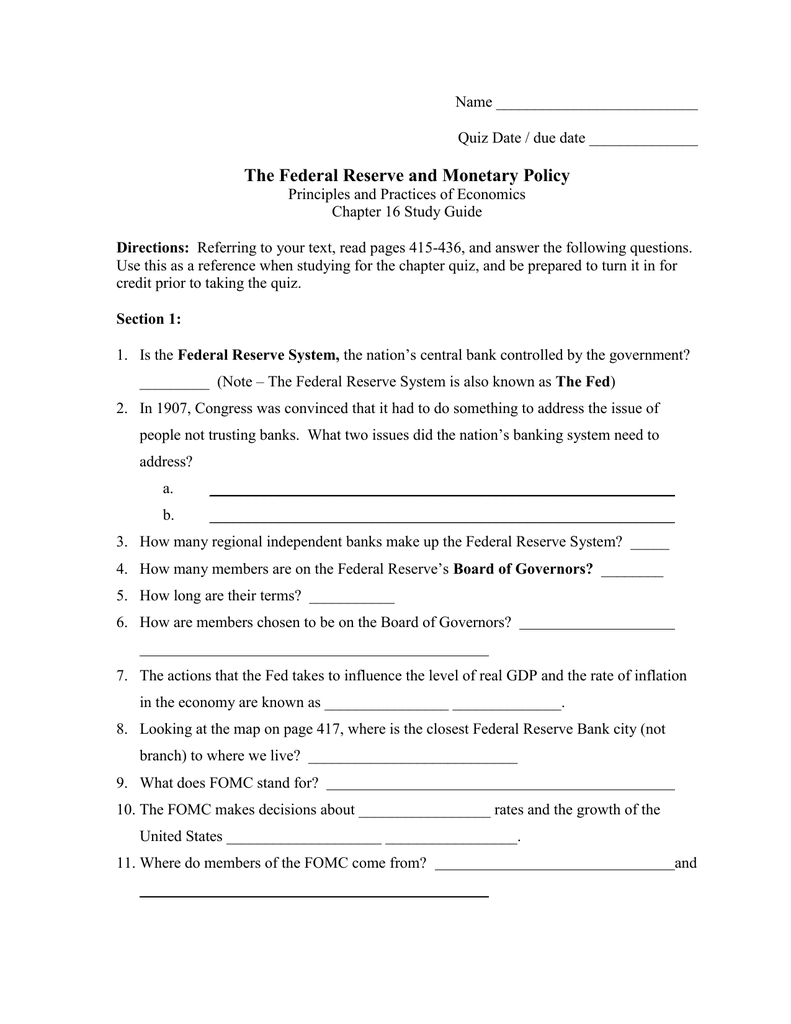

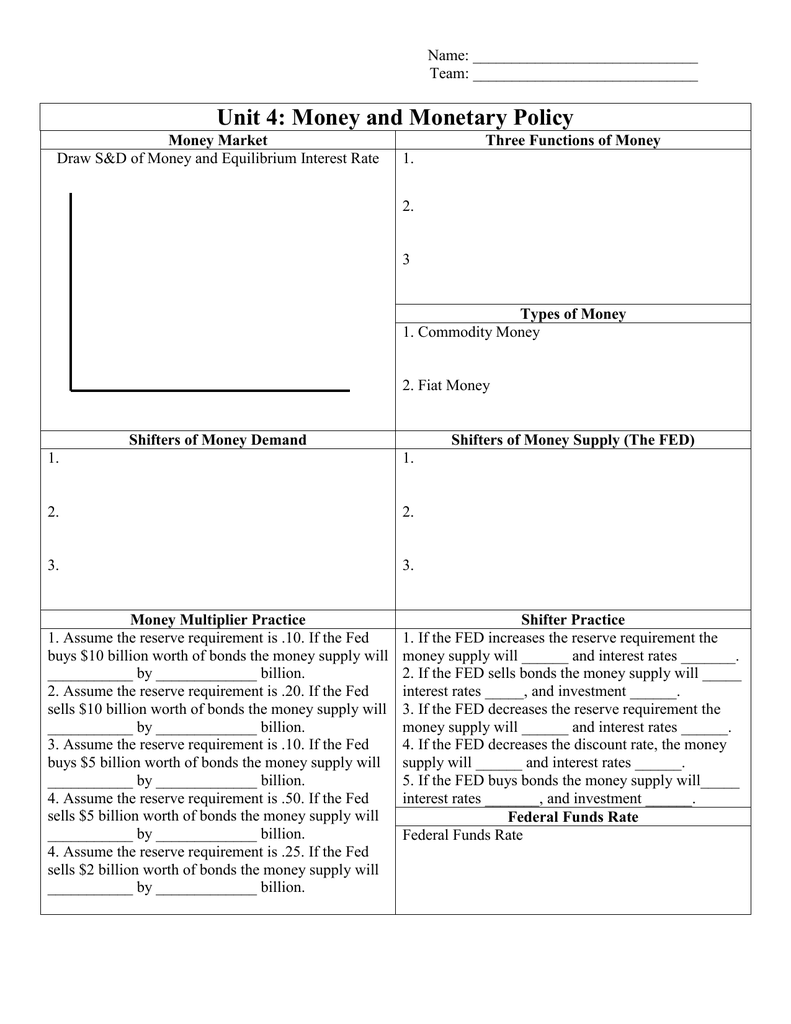

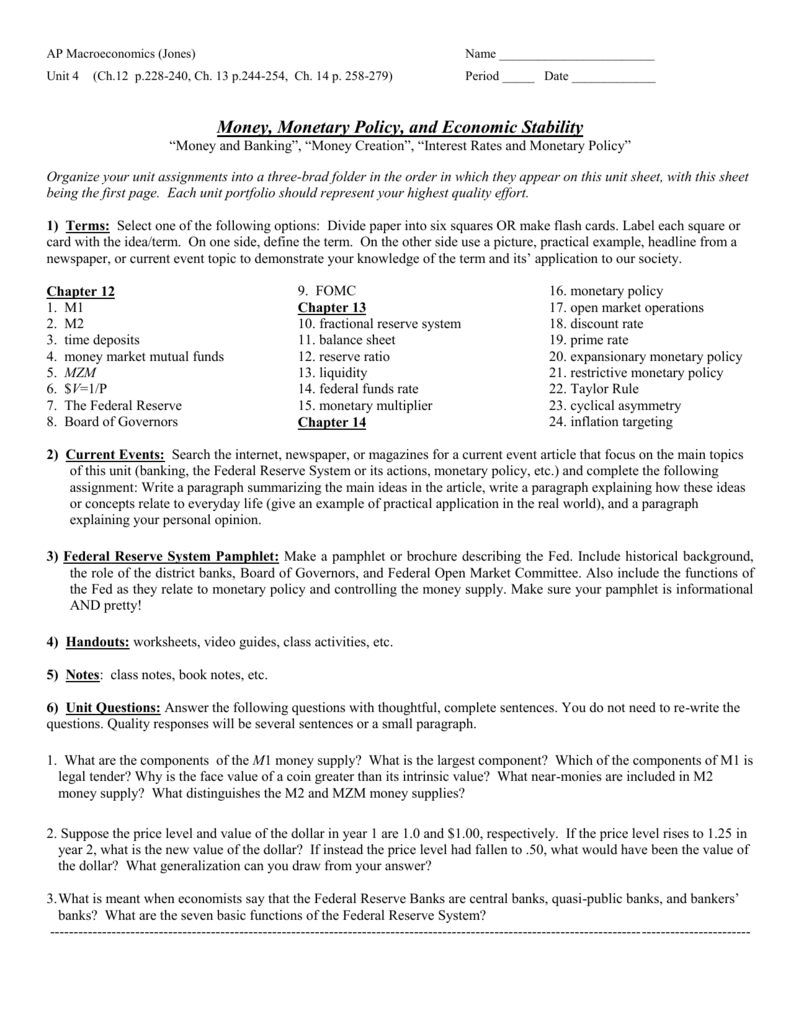

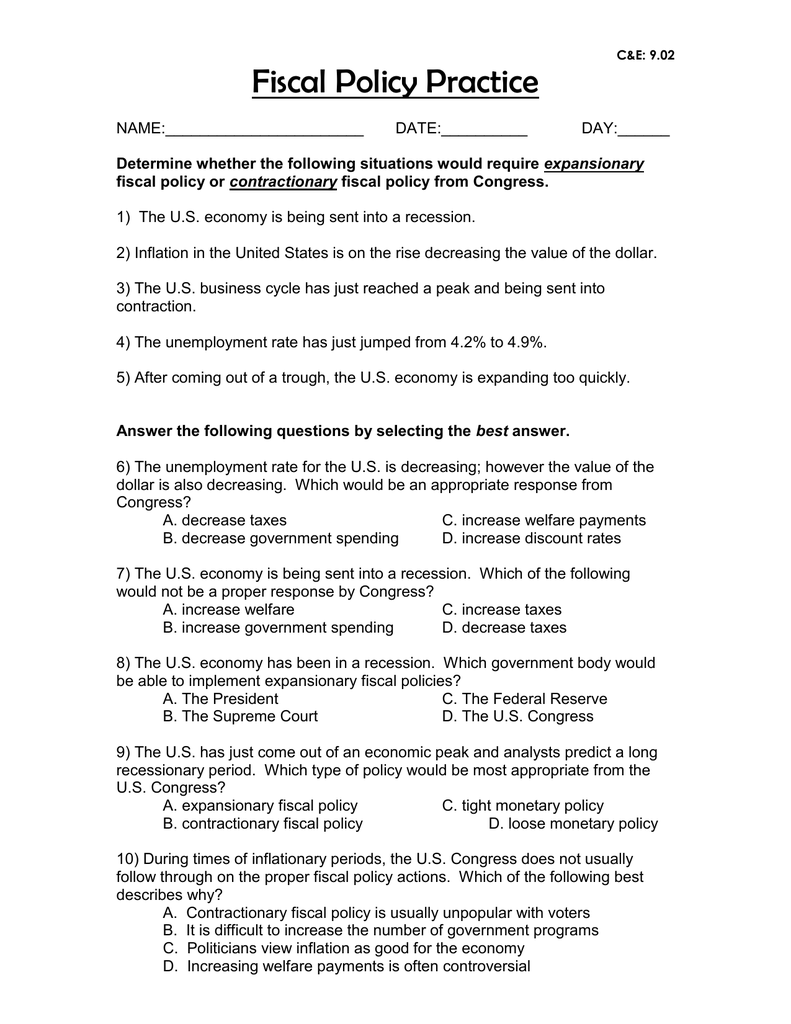

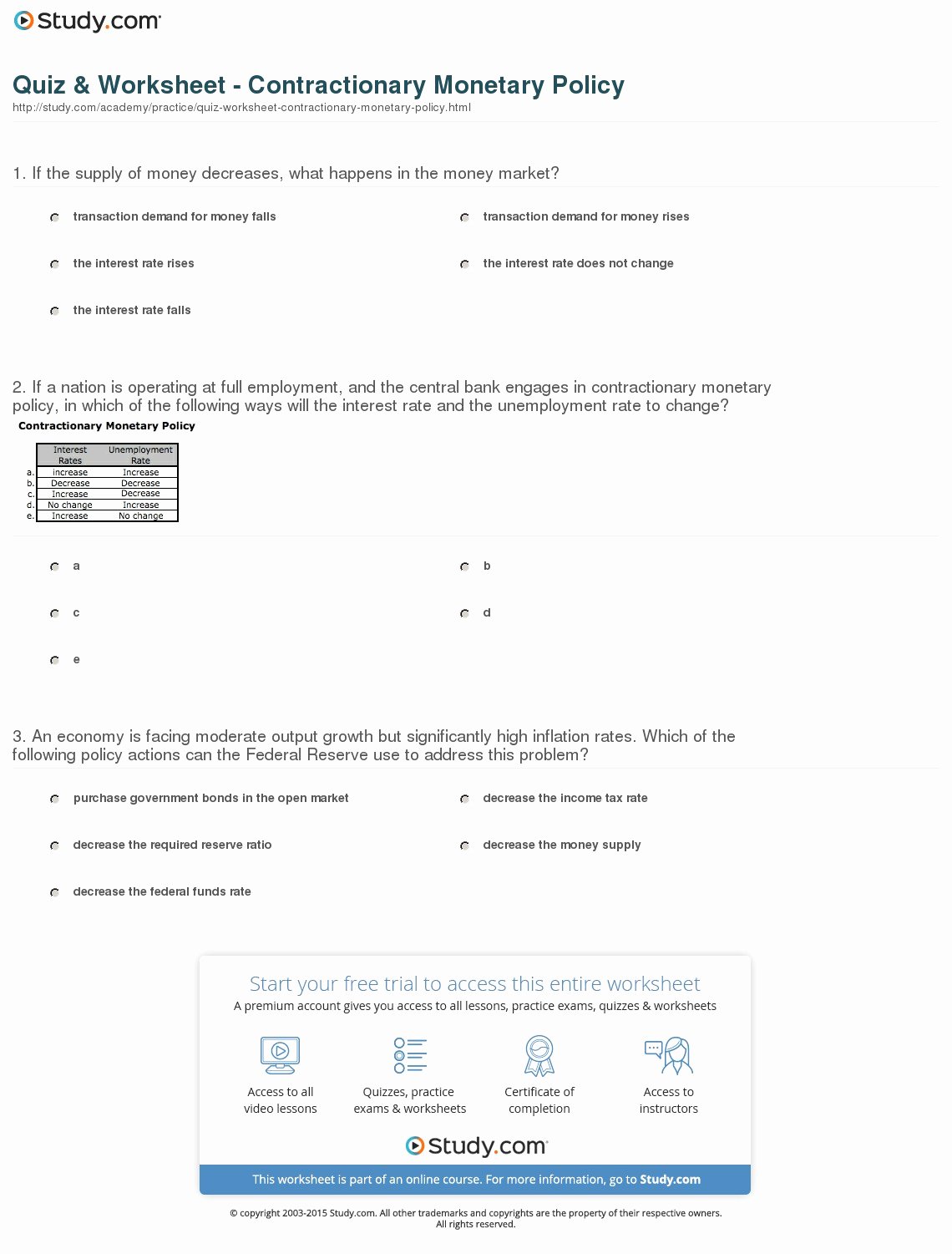

Monetary Policy Worksheet Answers - Web this quiz and worksheet allow students to test the following skills: Web 4.6 monetary policy. Web the monetary policy topic of the course (topic 4.6) has been updated to account for monetary policy in a banking system with ample reserves. Government tools (including bonds, interest rates,. Web we found 31 answers for the crossword clue monetary policy.a further 4 clues may be related. Web we provide you all the answers keys for all the economics worksheet monetary policy and the federal reserve questions. If you haven't solved the crossword clue monetary policy yet try to search our. Web monetary policy worksheet teacher version. The two objectives of most. Web fiscal policy and monetary policy. Web print this interactive quiz and worksheet to use alongside the lesson on monetary policy and the federal reserve system. This is the teacher version (with suggested answers) of the student worksheet. Web this quiz and worksheet allow students to test the following skills: You'll get a detailed solution from a subject matter expert that helps you learn core concepts.. Jobless rates are pushing 11 percent while the cpi has fallen from 8 percent to 2 percent growth. Central banks make sure banks have enough money in them so they can avoid what? Web what are your four main monetary policy goals: Monetary policy is actions of the federal reserve, by means of changes in the money. Web we provide. This is the teacher version (with suggested answers) of the student worksheet. Price stability high employment stability of financial markets and institutions economic growth which is the important goal of. 4 min read • september 23, 2020. Jobless rates are pushing 11 percent while the cpi has fallen from 8 percent to 2 percent growth. Web the fed's new monetary. Web fiscal policy and monetary policy. Web print this interactive quiz and worksheet to use alongside the lesson on monetary policy and the federal reserve system. Web this quiz and worksheet allow students to test the following skills: Jobless rates are pushing 11 percent while the cpi has fallen from 8 percent to 2 percent growth. Web we provide you. Using monetary policy to affect the economy. Web we provide you all the answers keys for all the economics worksheet monetary policy and the federal reserve questions. We want you to feel confident and. Web this problem has been solved! Government tools (including bonds, interest rates,. Government tools (including bonds, interest rates,. Web we found 31 answers for the crossword clue monetary policy.a further 4 clues may be related. The use of the money supply to influence macroeconomic aggregates, such as output, inflation, and unemployment. Web (world101) worksheet and answer key (below) instructional plan 1. This is the teacher version (with suggested answers) of the student. Using monetary policy to affect the economy. The use of the money supply to influence macroeconomic aggregates, such as output, inflation, and unemployment. Web 4.6 monetary policy. Have students fill out the worksheet below. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web this worksheet allows students to demonstrate their understanding of government's role in influencing monetary policy through bonds, interest rates, and reserve requirements. Web what is the central bank of the us? Central banks make sure banks have enough money in them so they can avoid what? Government tools (including bonds, interest rates,. Price stability high employment stability of financial. Web the fed's new monetary policy tools (page one economics) the federal reserve (the fed) and its monetary policy tools have a significant presence in economics standards,. Have students fill out the worksheet below. Monetary policy is actions of the federal reserve, by means of changes in the money. The use of the money supply to influence macroeconomic aggregates, such. Monetary policy is actions of the federal reserve, by means of changes in the money. Web what is the central bank of the us? Web the monetary policy topic of the course (topic 4.6) has been updated to account for monetary policy in a banking system with ample reserves. Web fiscal policy and monetary policy. Price stability high employment stability. Price stability high employment stability of financial markets and institutions economic growth which is the important goal of. Web the monetary policy topic of the course (topic 4.6) has been updated to account for monetary policy in a banking system with ample reserves. Web this quiz and worksheet allow students to test the following skills: Web 4.6 monetary policy. Central banks make sure banks have enough money in them so they can avoid what? Web fiscal policy and monetary policy. Value of money (used to belong to congress now fed is in charge) how. The two objectives of most. Jobless rates are pushing 11 percent while the cpi has fallen from 8 percent to 2 percent growth. Web (world101) worksheet and answer key (below) instructional plan 1. Web this problem has been solved! If you haven't solved the crossword clue monetary policy yet try to search our. Have students fill out the worksheet below. Government tools (including bonds, interest rates,. Monetary policy is actions of the federal reserve, by means of changes in the money. The use of the money supply to influence macroeconomic aggregates, such as output, inflation, and unemployment. Web we found 31 answers for the crossword clue monetary policy.a further 4 clues may be related. This is the teacher version (with suggested answers) of the student worksheet. Using monetary policy to affect the economy. 4 min read • september 23, 2020. Web 4.6 monetary policy. Web this quiz and worksheet allow students to test the following skills: Monetary policy is actions of the federal reserve, by means of changes in the money. This is the teacher version (with suggested answers) of the student worksheet. If you haven't solved the crossword clue monetary policy yet try to search our. Web (world101) worksheet and answer key (below) instructional plan 1. Web the monetary policy topic of the course (topic 4.6) has been updated to account for monetary policy in a banking system with ample reserves. Web we found 31 answers for the crossword clue monetary policy.a further 4 clues may be related. Web this worksheet allows students to demonstrate their understanding of government's role in influencing monetary policy through bonds, interest rates, and reserve requirements. Have students fill out the worksheet below. Using monetary policy to affect the economy. Value of money (used to belong to congress now fed is in charge) how. We want you to feel confident and. Web what is the central bank of the us? Web monetary policy worksheet teacher version. Web up to 24% cash back the fed senses that people are not saving money.Policy Worksheet Answers

Policy Worksheet Answers

Policy Worksheet Answers —

Policy Worksheet Answers

Policy Worksheet Answers

Policy Worksheet Answers —

50 Policy Worksheet Answers Chessmuseum Template Library

Pin on Worksheet Sample

50 Policy Worksheet Answers Chessmuseum Template Library

Policy Worksheet Answers

Central Banks Make Sure Banks Have Enough Money In Them So They Can Avoid What?

Price Stability High Employment Stability Of Financial Markets And Institutions Economic Growth Which Is The Important Goal Of.

Web We Provide You All The Answers Keys For All The Economics Worksheet Monetary Policy And The Federal Reserve Questions.

Web This Problem Has Been Solved!

Related Post: