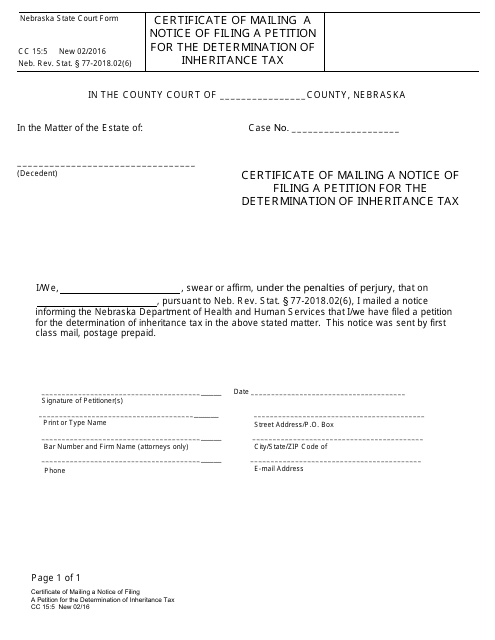

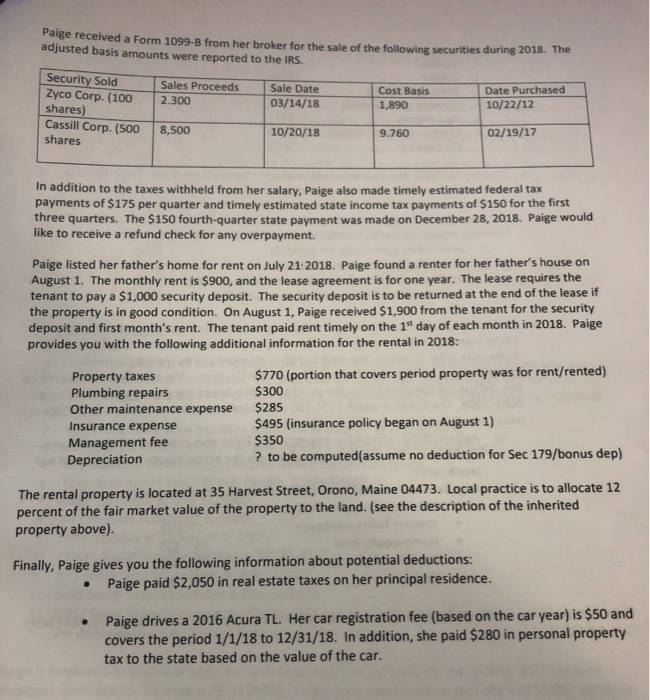

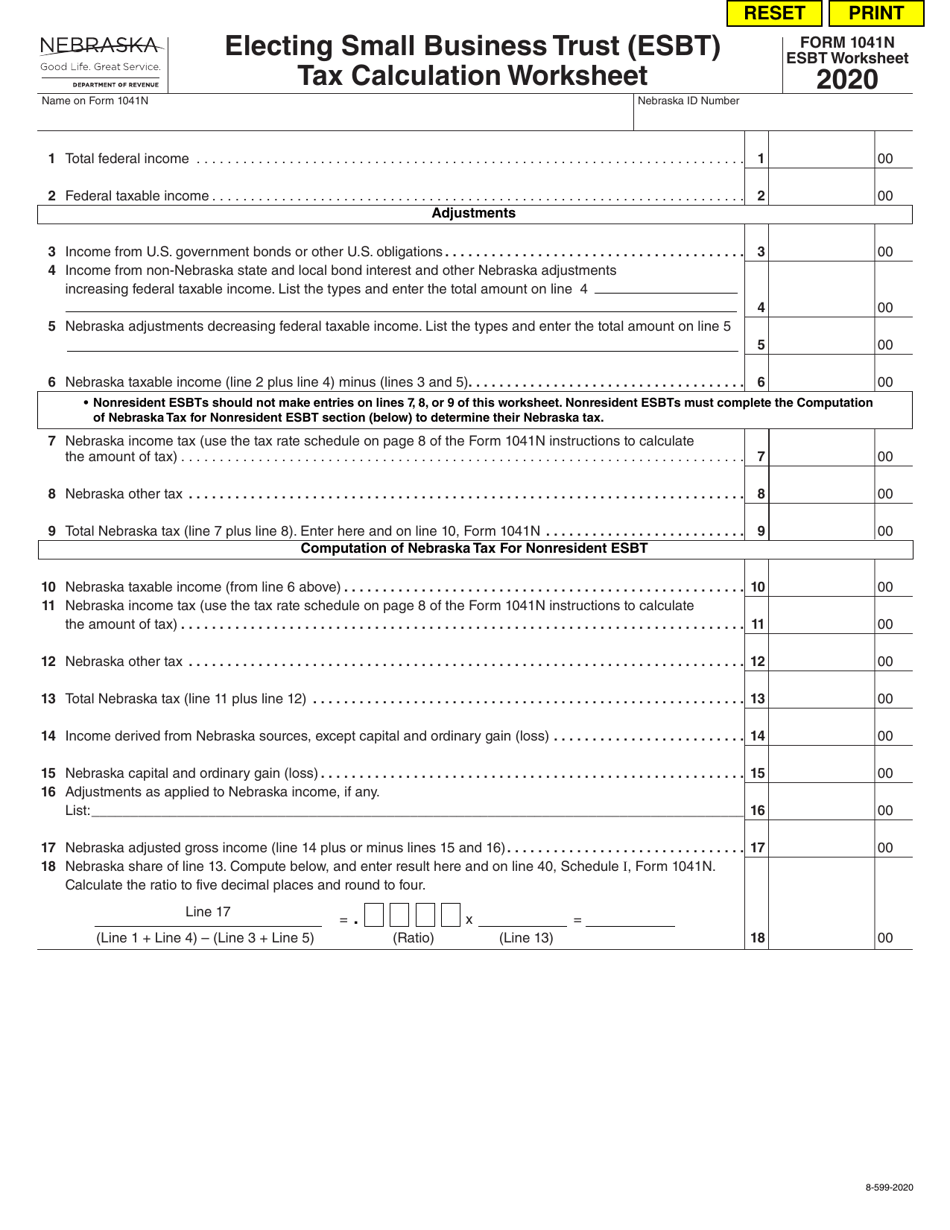

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500 - The tax rate and applicable exemption amount varies based on. Enjoy smart fillable fields and interactivity. Tax paid to all counties (residents and nonresidents) 1. Rev.probate@nebraska.gov, or mail to nebraska department of revenue, legal/compliance, attn: Children inheriting $1 million from their parents would pay $9,900 state. Tax incentive purchasing agent appointment and certification (10/2015) 312c. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as. This notice was sent by first class mail, postage prepaid to: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The inheritance tax is repealed as of january 1, 2025. Web the inheritance tax is due and payable within twelve (12) months of the decedent’s date of death, and failure to timely file and pay the requisite tax may result in interest and penalties. Complete, edit or print tax forms instantly. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments, highlights and more.. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back fill nebraska inheritance tax worksheet form 500, edit online. Web the following tips will allow you to fill out nebraska inheritance tax worksheet form easily and quickly: When and where to file. Web nebraska inheritance. Web the following tips will allow you to fill out nebraska inheritance tax worksheet form easily and quickly: Maintain readily available web templates and enjoy our best instructions. File the form ecit with the county treasurer of the county in which the estate was administered. Enjoy smart fillable fields and interactivity. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. File the form ecit with the county treasurer of the county in which the estate was administered. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. The form ecit is due when distributions have been made. Web inheritance tax rates by twenty percent each year beginning january 1, 2021. Web video instructions and help with filling out and completing nebraska form 500 inheritance worksheet. The tax rate and applicable exemption amount varies based on. When and where to file. Web to the county of the decedent's residence within one year of death. The fair market value is the present value as determined under the provisions of the internal revenue. Nebraska advantage act election of contactor's computation. Tax incentive purchasing agent appointment and certification (10/2015) 312c. Nebraska inheritance tax may also apply to tangible personal property located in nebraska even. Web the nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. Fill in the required boxes that are. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web the nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. 4 $ $ $ $ $ $ $ authorized by neb. The form ecit is due when distributions have been made. The inheritance tax. Web video instructions and help with filling out and completing nebraska form 500 inheritance worksheet. Web incentive withholding worksheet (to be submitted with nebraska withholding return, form 941n) worksheet. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Get your online template and fill it in. Nebraska inheritance tax may also apply to tangible personal property located in nebraska even. Rev.probate@nebraska.gov, or mail to nebraska department of revenue, legal/compliance, attn: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Follow the simple instructions below: Tax incentive purchasing agent appointment and certification (10/2015). Click the arrow with the inscription. Nebraska advantage act election of contactor's computation. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments, highlights and more. Tax paid to all counties. The inheritance tax is credited to the county's general fund or to any other fund of the county selected by the county board. Web incentive withholding worksheet (to be submitted with nebraska withholding return, form 941n) worksheet. Nebraska advantage act election of contactor's computation. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Download or email ne form 500 & more fillable forms, register and subscribe now! Web the nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. 4 $ $ $ $ $ $ $ authorized by neb. Click the arrow with the inscription. Web nebraska inheritance tax is computed on the fair market value of annuities, life estates, terms for years, remainders, and reversionary interests. Fill in the required boxes that are marked in yellow. This excel file assists lawyers with calculating inheritance tax. Follow the simple instructions below: Web how to fill out and sign nebraska inheritance tax worksheet 2022 online? The tax rate and applicable exemption amount varies based on. This notice was sent by first class mail, postage prepaid to: Get your online template and fill it in using progressive features. Web up to $40 cash back fill nebraska inheritance tax worksheet form 500, edit online. Tax paid to all counties. Rev.probate@nebraska.gov, or mail to nebraska department of revenue, legal/compliance, attn: Fill & download for free get form download the form how to edit and fill out nebraska inheritance tax worksheet online to start with, look for the “get form” button and tap it. Edit your nebraksa probate form 500 online type text, add images, blackout confidential details, add comments, highlights and more. Once the amount of the inheritance tax is determined, an inheritance tax worksheet must be completed and. 4 $ $ $ $ $ $ $ authorized by neb. Complete, edit or print tax forms instantly. This excel file assists lawyers with calculating inheritance tax. Nebraska advantage act election of contactor's computation. Rev.probate@nebraska.gov, or mail to nebraska department of revenue, legal/compliance, attn: Web the following tips will allow you to fill out nebraska inheritance tax worksheet form easily and quickly: Web up to $40 cash back fill nebraska inheritance tax worksheet form 500, edit online. Click the arrow with the inscription. The fair market value is the present value as determined under the provisions of the internal revenue code of 1986, as. Web incentive withholding worksheet (to be submitted with nebraska withholding return, form 941n) worksheet. Tax paid to all counties. Web video instructions and help with filling out and completing nebraska form 500 inheritance worksheet. The tax rate and applicable exemption amount varies based on. Web the inheritance tax is due and payable within twelve (12) months of the decedent’s date of death, and failure to timely file and pay the requisite tax may result in interest and penalties.Nebraska Inheritance Tax Worksheet Form 500 Worksheet Resume

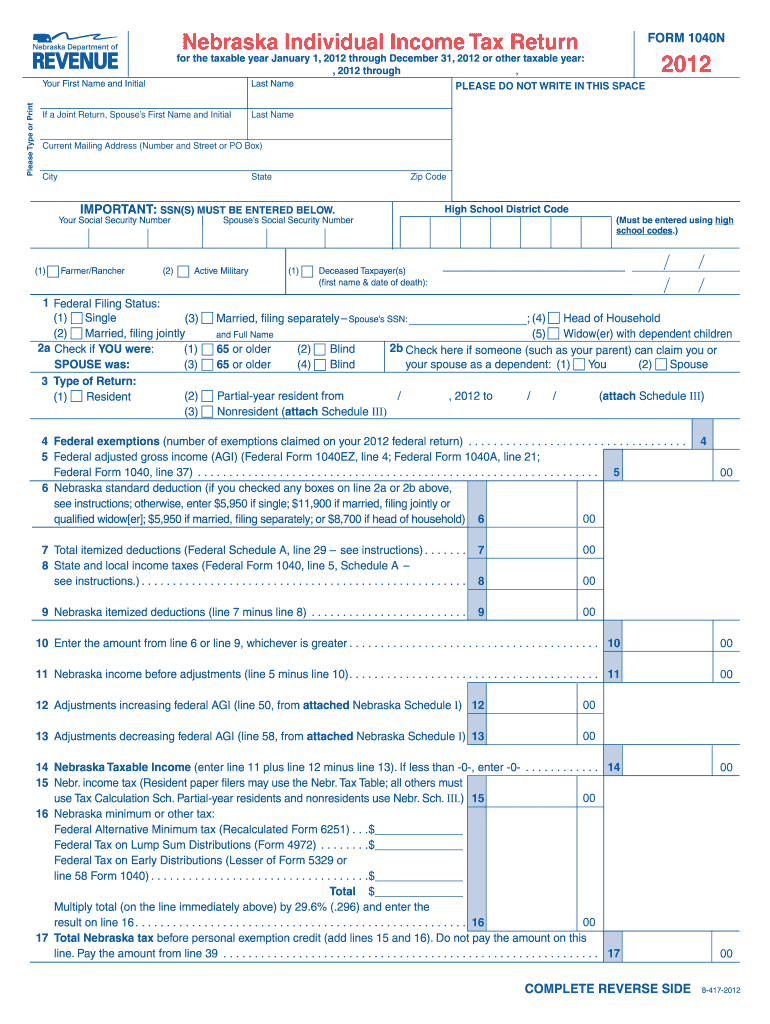

Nebraska Individual Tax Return, Form 1040 N Fill Out and Sign

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500

Nebraska inheritance tax worksheet form 500 Fill out & sign online

Nebraska Probate Form 500 Inheritance Tax Worksheet Worksheet

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

43 nebraska inheritance tax worksheet Worksheet Live

Nebraska Inheritance Tax Worksheet Master of Documents

Sign, Fax And Printable From Pc, Ipad, Tablet Or Mobile With Pdffiller Instantly.

Download Or Email Ne Form 500 & More Fillable Forms, Register And Subscribe Now!

Tax Paid To All Counties (Residents And Nonresidents) 1.

Sign It In A Few Clicks Draw Your Signature, Type It, Upload Its Image, Or Use Your Mobile Device As.

Related Post: