Nebraska Inheritance Tax Worksheet

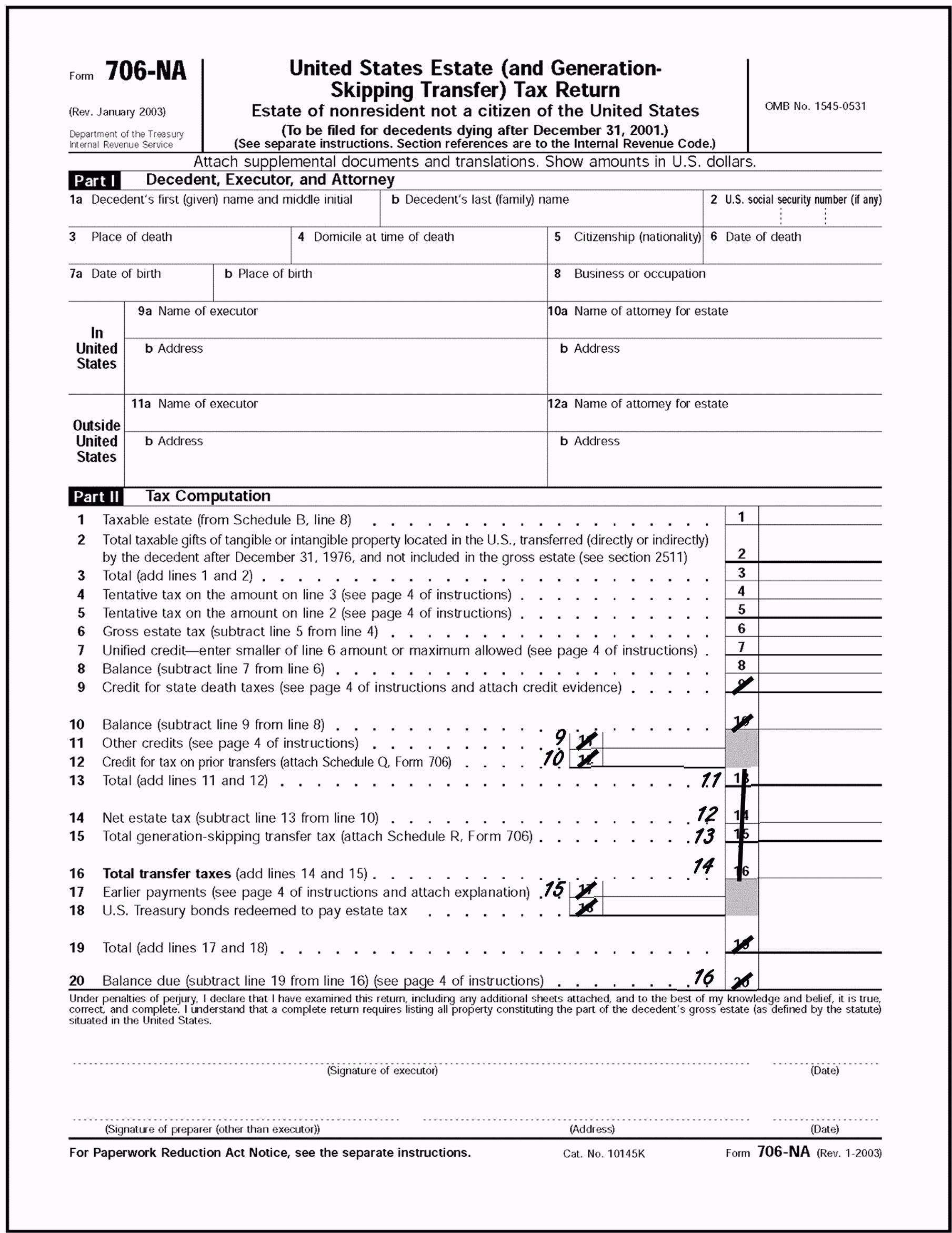

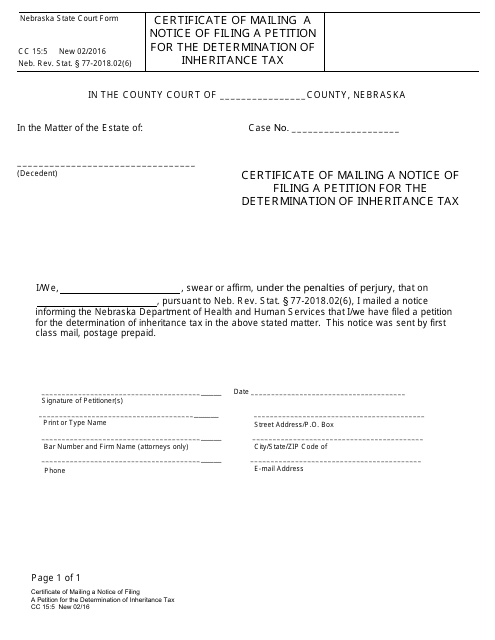

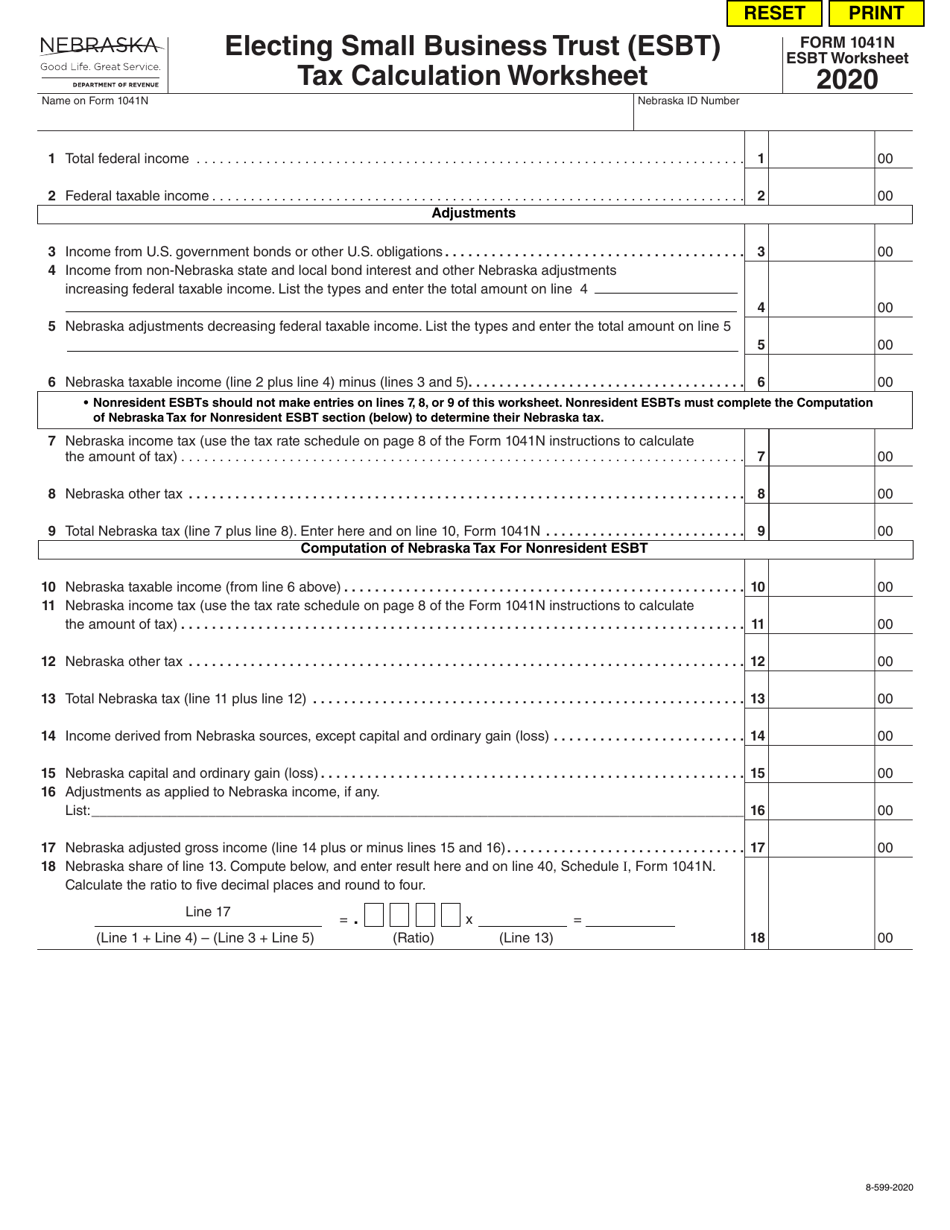

Nebraska Inheritance Tax Worksheet - The changes essentially increase the exemption. Web the total tax paid amount in column d and total of column. The dor created form ecit to assist estate administrators in reporting this information. Web up to 25% cash back close relatives pay 1% tax after $40,000. This excel file assists lawyers with calculating inheritance tax. Close relatives of the deceased person are given a $40,000 exemption from the state inheritance tax. Online tax forms have been made to help. A plus b should match the tax due amount and total number of beneficiaries listed on the inheritance. Are you still looking for a fast and efficient tool to fill out nebraska probate form 500 inheritance tax at an affordable price? When and where to file. Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be received by a. When and where to file. Numeric listing of all current nebraska tax forms. Easily fill out pdf blank, edit, and sign them. These changes are discussed as an update to this article. Are you still looking for a fast and efficient tool to fill out nebraska probate form 500 inheritance tax at an affordable price? For residents of the state of nebraska, most of what you own at the time of death is going to be. Web what is the nebraska inheritance tax and how does it work? Online tax forms have. Web 001.01 nebraska inheritance tax applies to bequests, devises, or transfers of property or any other interest in trust or otherwise having characteristics of annuities, life estates,. The changes essentially increase the exemption. Web 03/30/2022 nebraska inheritance tax: Web in all proceedings for the determination of inheritance tax, the following deductions from the value of the property subject to nebraska. These changes are discussed as an update to this article. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign nebraska inheritance tax form 500 online?. Web up to 25% cash back close relatives pay 1% tax after $40,000. A plus b. Web 03/30/2022 nebraska inheritance tax: Online tax forms have been made to help. Are you still looking for a fast and efficient tool to fill out nebraska probate form 500 inheritance tax at an affordable price? Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the. Ad download or email ne form 500 & more fillable forms, register and subscribe now! Web in 2022, nebraska, through lb 310, changed its inheritance tax law. When and where to file. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign. These changes are discussed as an update to this article. The form ecit and the inheritance tax worksheets filed with. This excel file assists lawyers with calculating inheritance tax. Online tax forms have been made to help. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how. Numeric listing of all current nebraska tax forms. These changes are discussed as an update to this article. The amount exceeding the exemption counts against your $12.92 million lifetime gift tax exemption. Online tax forms have been made to help. Web the total tax paid amount in column d and total of column. Web certificate of mailing a notice of filing a petition for the determination of inheritance tax: Certificate of mailing, annual budget reporting forms : Web in 2022, nebraska, through lb 310, changed its inheritance tax law. Close relatives of the deceased person are given a $40,000 exemption from the state inheritance tax. The amount exceeding the exemption counts against your. The changes essentially increase the exemption. The form ecit is due when distributions have been made. Web up to 25% cash back close relatives pay 1% tax after $40,000. If you gift one person more than $17,000 in a single year, you must report that gift to the irs. Web the total tax paid amount in column d and total. Web the nebraska inheritance tax form template is a form with fillable fields where one can insert information, i.e., fill it out on the web. Web 03/30/2022 nebraska inheritance tax: Are you still looking for a fast and efficient tool to fill out nebraska probate form 500 inheritance tax at an affordable price? This excel file assists lawyers with calculating inheritance tax. Web the federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. Numeric listing of all current nebraska tax forms. Ad download or email ne form 500 & more fillable forms, register and subscribe now! Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be received by a. Web in 2022, nebraska, through lb 310, changed its inheritance tax law. Easily fill out pdf blank, edit, and sign them. Web that exemption amount, and the underlying inheritance tax rate, varies based on the inheritance category the beneficiary falls into: The form ecit is due when distributions have been made. Web the total tax paid amount in column d and total of column. A plus b should match the tax due amount and total number of beneficiaries listed on the inheritance. Web march 8, 2022 pexels. Online tax forms have been made to help. Nebraska farmcast when nebraskans inherit land or other property, they must pay inheritance taxes to the county where the property. Previous years' income tax forms. For residents of the state of nebraska, most of what you own at the time of death is going to be. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign nebraska inheritance tax form 500 online?. Are you still looking for a fast and efficient tool to fill out nebraska probate form 500 inheritance tax at an affordable price? Certificate of mailing, annual budget reporting forms : Web up to 25% cash back close relatives pay 1% tax after $40,000. Unlike a typical estate tax, nebraska inheritance tax is measured by the value of the portion of a decedent’s estate that will be received by a. Web nebraska law requires the petitioner in a proceeding to determine inheritance tax to submit a report to the county treasurer of the county in which the order. These changes are discussed as an update to this article. Web complete nebraska inheritance tax worksheet form online with us legal forms. Web nebraska inheritance tax worksheet form 500 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 3.97 satisfied 36 votes how to fill out and sign nebraska inheritance tax form 500 online?. Web the federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. Save or instantly send your ready documents. When and where to file. Ad download or email ne form 500 & more fillable forms, register and subscribe now! The dor created form ecit to assist estate administrators in reporting this information. For residents of the state of nebraska, most of what you own at the time of death is going to be. A plus b should match the tax due amount and total number of beneficiaries listed on the inheritance. Easily fill out pdf blank, edit, and sign them.Estate Executor Spreadsheet For Nebraska Inheritance Tax Worksheet

Irs Form 433 A Worksheet Universal Network

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Nebraska Inheritance Tax Worksheet Form 500

Nebraska inheritance tax worksheet form 500 Fill out & sign online

Nebraska Inheritance Tax Worksheet Printable qualified dividends and

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Resume Examples

Nebraska Inheritance Tax Worksheet Form 500

Nebraska Inheritance Tax Worksheet Form 500

Web In 2022, Nebraska, Through Lb 310, Changed Its Inheritance Tax Law.

Web 001.01 Nebraska Inheritance Tax Applies To Bequests, Devises, Or Transfers Of Property Or Any Other Interest In Trust Or Otherwise Having Characteristics Of Annuities, Life Estates,.

The Amount Exceeding The Exemption Counts Against Your $12.92 Million Lifetime Gift Tax Exemption.

File The Form Ecit With The County Treasurer Of The.

Related Post: