Nol Calculation Worksheet

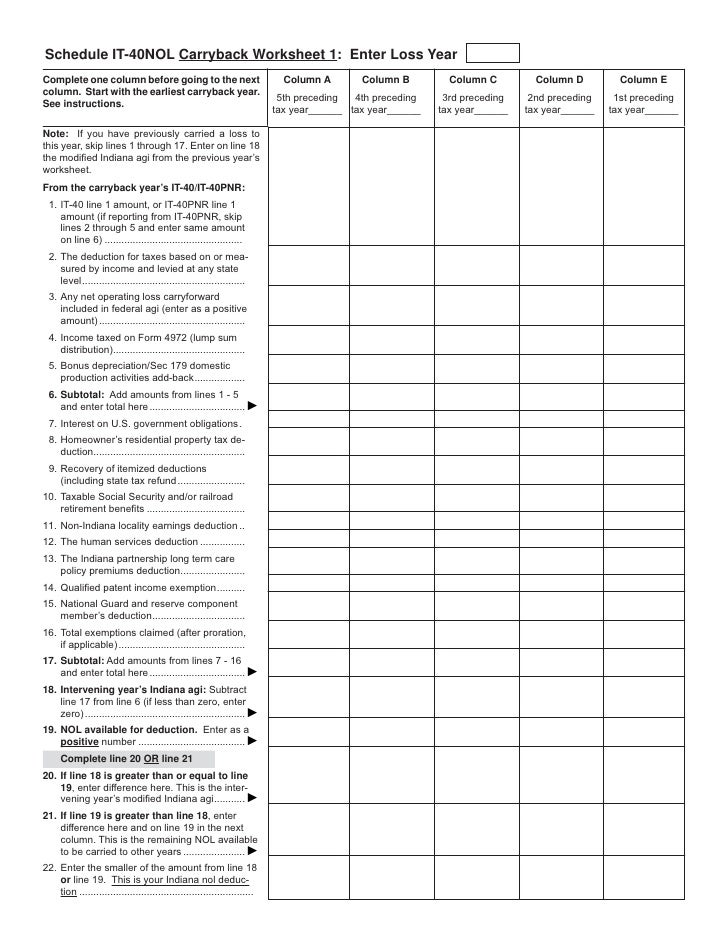

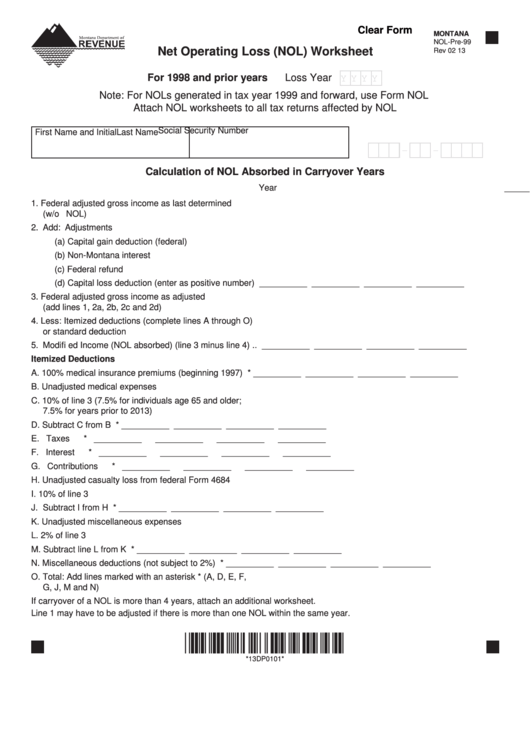

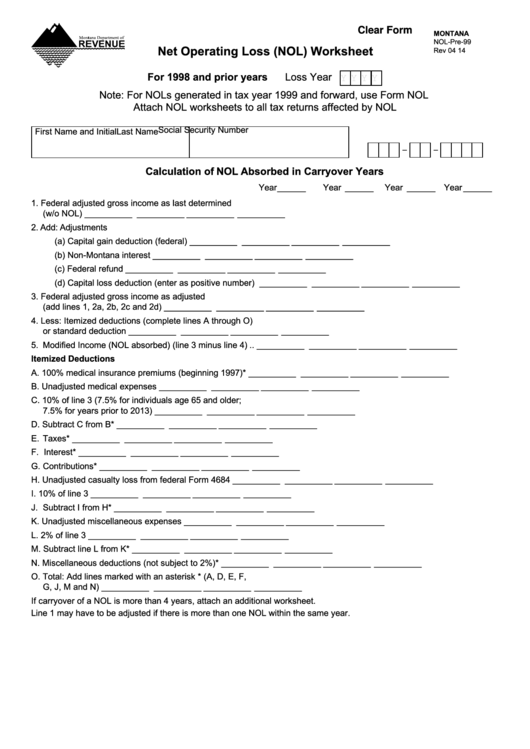

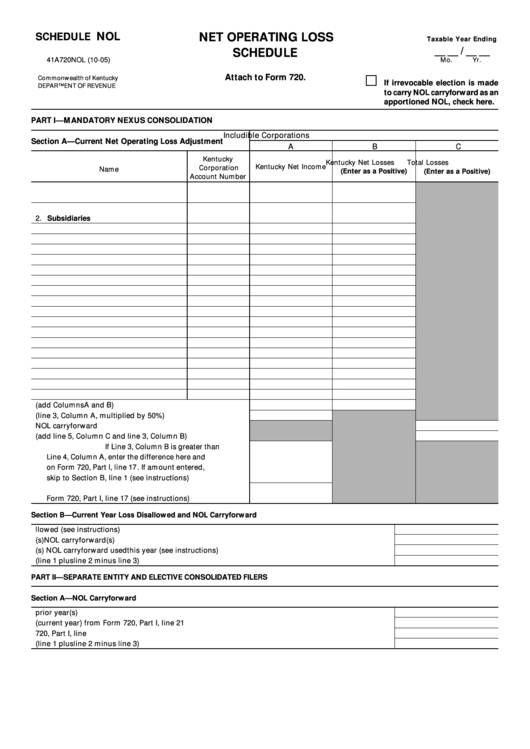

Nol Calculation Worksheet - The amount is calculated as follows: Of a human (70 kg)) / 2000. Web in the nol carryback section, enter the amount of the current year net operating loss that was calculated on the net operating loss worksheet 1 (or portion of the loss applicable. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). When to use an nol. Where ld50 = amount of drug required to kill half of the population. Web alternative minimum tax (amt) nol computation worksheet this tax worksheet calculates alternative minimum tax’s net operating loss deduction. Net operating losses (nols) are the tax benefits provided to a company operating at a loss under u.s. The word unscrambler shows exact matches of n o l and also words that can be made by adding one or more letters. Form 1040, line 10 (taxable income) + nol deduction = nol worksheet 2, line 2. Web what are net operating losses (nols)? Web alternative minimum tax (amt) nol computation worksheet this tax worksheet calculates alternative minimum tax’s net operating loss deduction. Web nol steps.2 how to figure an nol.2 worksheet 1. Irs publication 536, net operating losses (nols) for individuals, estates, and trusts. Nol worksheet 1 computes the nonbusiness and business capital losses that are. How to carry an nol back or forward. Web unscrambling nol resulted in a list of 27 words found. Entering a net operating loss (nol) carryback by. Generally, if a taxpayer has an nol for a tax year ending in the current year, the. How to figure an nol. The nol deduction can be found on nol. Of a human (70 kg)) / 2000. How to carry an nol back or forward. When to use an nol. Entering a net operating loss (nol) carryback by. Figuring your nol.3 when to use an nol.4 waiving the carryback period.5 how to carry an nol back or. Web what are net operating losses (nols)? Of a human (70 kg)) / 2000. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Web this tax worksheet is completed for each year in. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Form 1040, line 10 (taxable income) + nol deduction = nol worksheet 2, line 2. Figuring your nol.3 when to use an nol.4 waiving the carryback period.5 how to carry an nol back or. Web noel (no observed effect level) = (ld50 *. Irs publication 536, net operating losses (nols) for individuals, estates, and trusts. Form 1040, line 11b (taxable income) + nol deduction = nol carryover calculation worksheet 1, line 2. Web what are net operating losses (nols)? Where ld50 = amount of drug required to kill half of the population. Generally, if a taxpayer has an nol for a tax year. Web a net operating loss (nol) is a situation in which the annual tax deductions of a business or other entity are worth more than the owner's adjusted gross income. Of a human (70 kg)) / 2000. Web to view the worksheet: How to figure an nol. Figuring your nol.3 when to use an nol.4 waiving the carryback period.5 how. Web nol steps.2 how to figure an nol.2 worksheet 1. Web a net operating loss (nol) is a situation in which the annual tax deductions of a business or other entity are worth more than the owner's adjusted gross income. The word unscrambler shows exact matches of n o l and also words that can be made by adding one. When to use an nol. When to use an nol. Web this tax worksheet is completed for each year in which an nol is carried back or carried forward. How to figure an nol. An individual, estate, or trust files form 1045 to apply for a quick tax refund resulting from: Web this tax worksheet is completed for each year in which an nol is carried back or carried forward. Web what are net operating losses (nols)? How to figure an nol. Entering a net operating loss (nol) carryback by. Web unscrambling nol resulted in a list of 27 words found. Web noel (no observed effect level) = (ld50 * avg wt. How to figure an nol. Entering a net operating loss (nol) carryback by. How to carry an nol back or forward. The nol deduction can be found on nol. Web nol steps.2 how to figure an nol.2 worksheet 1. Generally, if a taxpayer has an nol for a tax year ending in the current year, the. Web a net operating loss (nol) is a situation in which the annual tax deductions of a business or other entity are worth more than the owner's adjusted gross income. Nol worksheet 1 computes the nonbusiness and business capital losses that are entered on lines 2 and 11 of schedule a (form 1045) respectively. Irs publication 536, net operating losses (nols) for individuals, estates, and trusts. How to figure an nol. Where ld50 = amount of drug required to kill half of the population. How to carry an nol back or forward. The word unscrambler shows exact matches of n o l and also words that can be made by adding one or more letters. Of a human (70 kg)) / 2000. Web unscrambling nol resulted in a list of 27 words found. Web to view the worksheet: When to use an nol. Web if your deductions for the year are more than your income for the year, you may have a net operating loss (nol). Gaap — i.e., if the company’s. How to carry an nol back or forward. The amount is calculated as follows: Web alternative minimum tax (amt) nol computation worksheet this tax worksheet calculates alternative minimum tax’s net operating loss deduction. Web to view the worksheet: Web in the nol carryback section, enter the amount of the current year net operating loss that was calculated on the net operating loss worksheet 1 (or portion of the loss applicable. Web this tax worksheet is completed for each year in which an nol is carried back or carried forward. Exception to the no carryback rule. Entering a net operating loss (nol) carryback by. How to figure an nol. The nol deduction can be found on nol. How to carry an nol back or forward. Web noel (no observed effect level) = (ld50 * avg wt. How to figure an nol. When to use an nol. Form 1040, line 10 (taxable income) + nol deduction = nol worksheet 2, line 2. Generally, if a taxpayer has an nol for a tax year ending in the current year, the.AMT NOL Calculation Worksheet Alternative Minimum Tax Tax Deduction

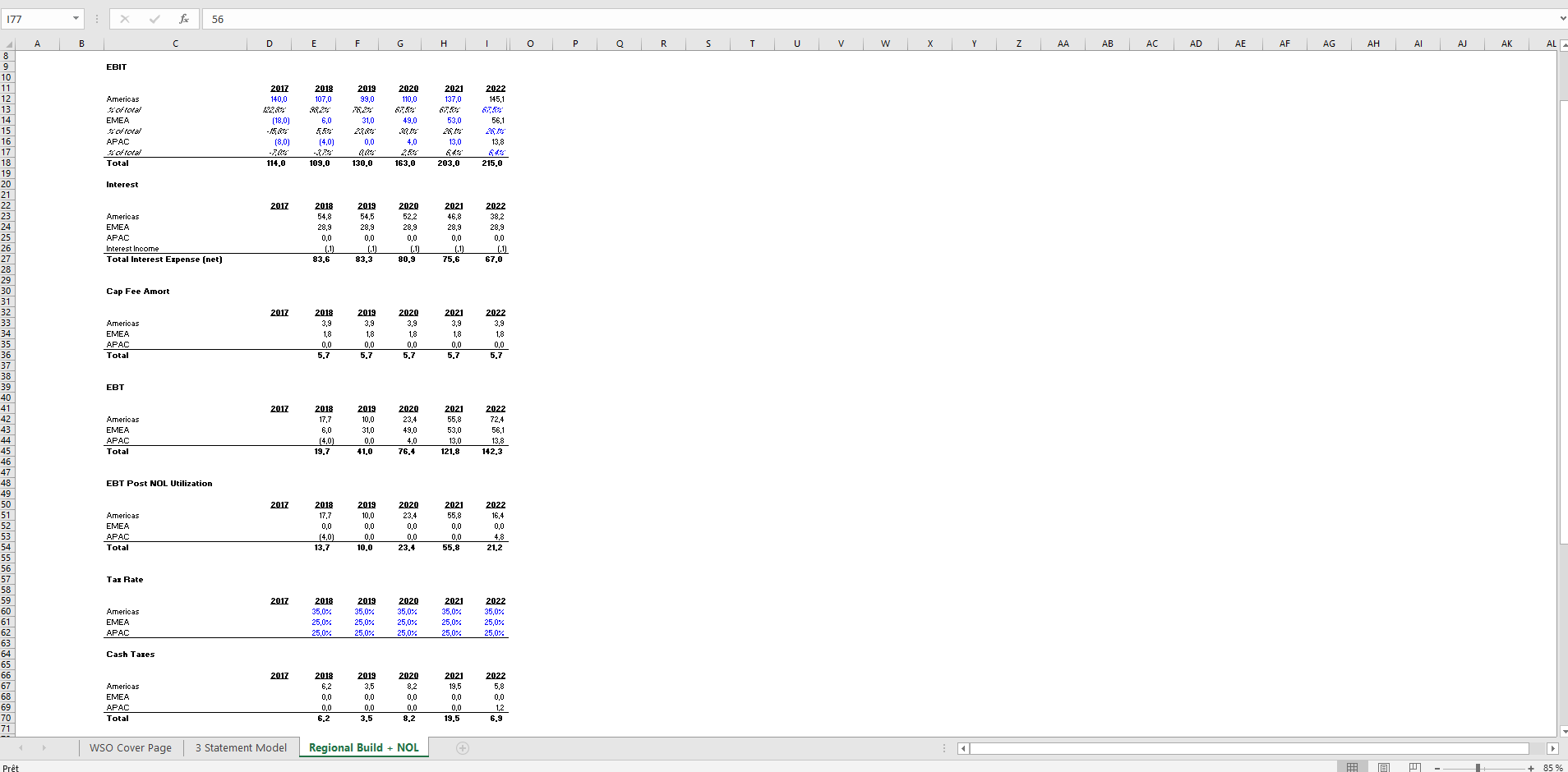

Nol Calculation Worksheet Excel Ivuyteq

Net Operating Loss Computation for Individuals

41 nol calculation worksheet excel Worksheet Works

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet (For 1998

Fillable Form NolPre99 Net Operating Loss (Nol) Worksheet 2014

nol calculation worksheet

Nol Calculation Worksheet Excel Ivuyteq

nol calculation worksheet

Nol Calculation Worksheet Excel Ivuyteq

Gaap — I.e., If The Company’s.

Web A Net Operating Loss (Nol) Is A Situation In Which The Annual Tax Deductions Of A Business Or Other Entity Are Worth More Than The Owner's Adjusted Gross Income.

An Individual, Estate, Or Trust Files Form 1045 To Apply For A Quick Tax Refund Resulting From:

Web What Are Net Operating Losses (Nols)?

Related Post: