Non Cash Charitable Contributions Worksheet

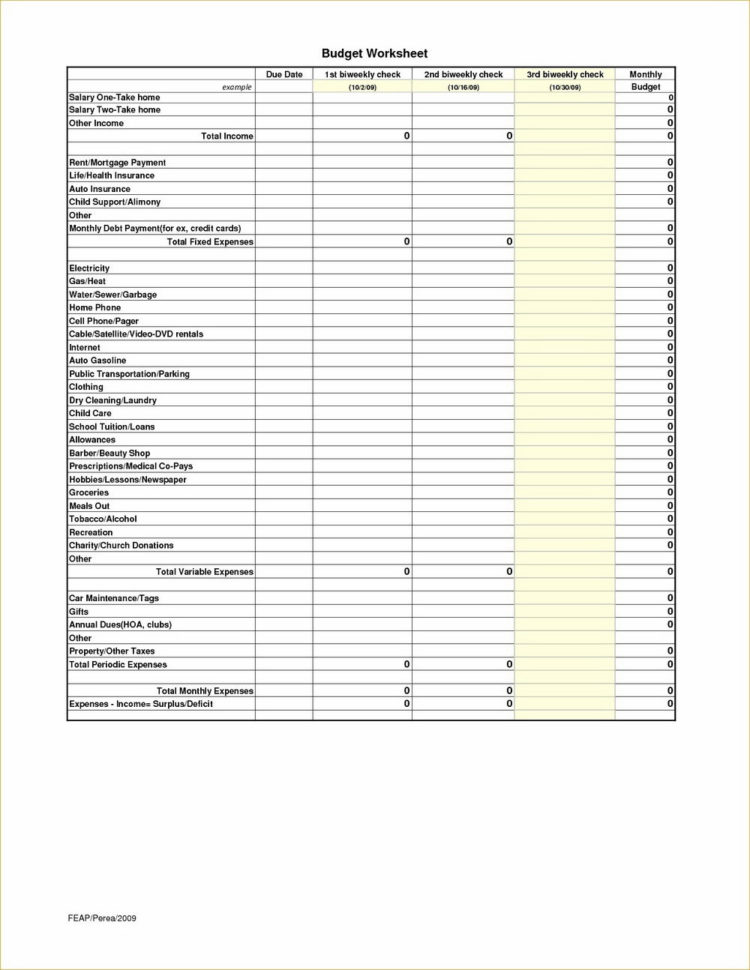

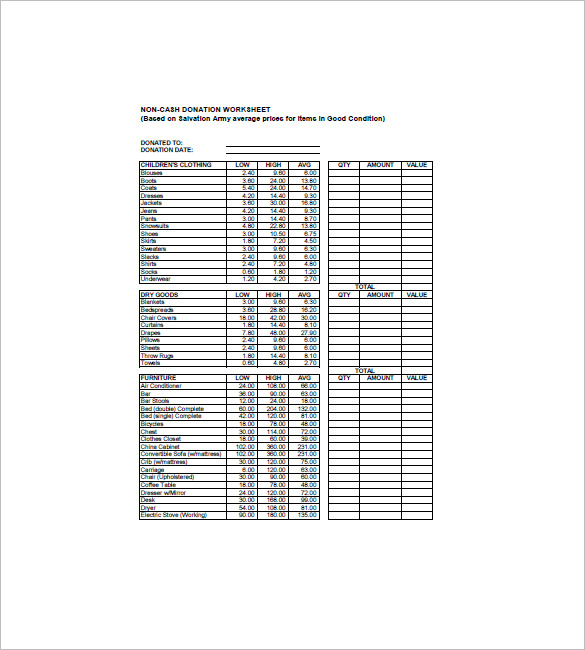

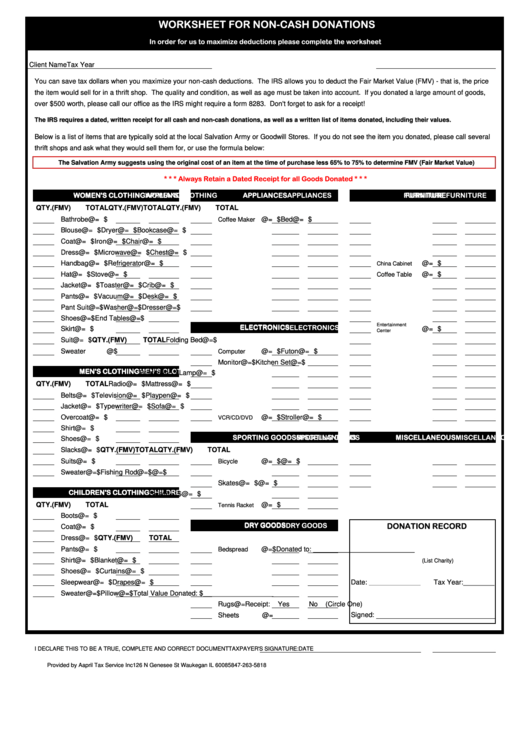

Non Cash Charitable Contributions Worksheet - Attach one or more forms 8283 to your tax return if. Web cash contributions subject to the limit based on 60% of agi. Insert tax year ===> insert date given ===> enter items not provided for in the. Web charitable contributions noncash fmv guide let’s start a conversation we’d love to meet you, talk about your financial goals, and see if we’re the right fit to help you. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. Ad understand the basics of charitable funds with fidelity charitable. Web form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. The donee must sign part iv of section b,. Web stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: The internal revenue service (irs) allows you to. Web how to fill out non cash charitable contribution worksheet with pdfsimpli in five steps? Web non cash charitable contributions / donations worksheet. Attach one or more forms 8283 to your tax return if. The first step in filling out or editing non cash. Discover what a charitable fund is and how it can amplify your giving. November 2022) department of the treasury internal revenue service. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. Web form 8283 is used to claim a deduction for. Web stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: November 2022) department of the treasury internal revenue service. Web how to fill out non cash charitable contribution worksheet with pdfsimpli in five steps? Ad download, fill, sign or email the file & more fillable forms, register and subscribe now! The following is a. Web form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Insert tax year ===> insert date given ===> enter items not provided for in the. Web charitable contributions noncash fmv guide let’s start a conversation we’d love to meet you, talk about your. Discover what a charitable fund is and how it can amplify your giving. Web stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Web h&r block you can deduct donations you make to qualified charities. November 2022) department of the treasury internal revenue service. In order to claim a tax deduction for noncash contributions. Deduct the contributions that don't exceed 60% of your agi. Web form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. The first step in filling out or editing non cash. Web non cash charitable contributions / donations worksheet. The temporary deduction for charitable. In order to claim a tax deduction for noncash contributions totaling over $500, certain information is required to be. The temporary deduction for charitable cash contributions for taxpayers who do not itemize their tax returns has expired and is no. Web charitable contributions noncash fmv guide let’s start a conversation we’d love to meet you, talk about your financial goals,. Insert tax year ===> insert date given ===> enter items not provided for in the. Web charitable contributions noncash fmv guide let’s start a conversation we’d love to meet you, talk about your financial goals, and see if we’re the right fit to help you. Discover what a charitable fund is and how it can amplify your giving. The internal. This can reduce your taxable income, but to claim the donations, you have to itemize your. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. Web h&r block you can deduct donations you make to qualified charities. Web for noncash donations over $5,000, the donor must attach form 8283. Web for noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. This can reduce your taxable income, but to claim the donations, you have to itemize your. Web charitable contributions noncash fmv guide let’s start a conversation we’d love to meet you, talk about your financial goals, and see if. Web you must fill out one or more forms 8283, noncash charitable contributions and attach them to your return, if your deduction for each noncash contribution is more. Deduct the contributions that don't exceed 60% of your agi. Web for noncash donations over $5,000, the donor must attach form 8283 to the tax return to support the charitable deduction. Discover what a charitable fund is and how it can amplify your giving. Pdffiller allows users to edit, sign, fill and share their all type of documents online Noncash contributions (other than qualified. Web non cash charitable contributions / donations worksheet. Attach one or more forms 8283 to your tax return if. The first step in filling out or editing non cash. Web form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Get the document you require in the collection of legal. Web h&r block you can deduct donations you make to qualified charities. This can reduce your taxable income, but to claim the donations, you have to itemize your. Insert tax year ===> insert date given ===> enter items not provided for in the. Ad understand the basics of charitable funds with fidelity charitable. Web stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: The internal revenue service (irs) allows you to. The following is a guideline for. November 2022) department of the treasury internal revenue service. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. Web h&r block you can deduct donations you make to qualified charities. Deduct the contributions that don't exceed 60% of your agi. Insert tax year ===> insert date given ===> enter items not provided for in the. November 2022) department of the treasury internal revenue service. Web for the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. Pdffiller allows users to edit, sign, fill and share their all type of documents online The first step in filling out or editing non cash. This can reduce your taxable income, but to claim the donations, you have to itemize your. Web stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: In order to claim a tax deduction for noncash contributions totaling over $500, certain information is required to be. End tables (2) 12.00 60.00 36.00. Web non cash charitable contributions / donations worksheet. Discover what a charitable fund is and how it can amplify your giving. The internal revenue service (irs) allows you to. Web form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Get the document you require in the collection of legal.Non Cash Charitable Contributions Worksheet 2016 —

non cash contribution worksheet

Non Cash Charitable Contributions Donations Worksheet

40 non cash charitable donations worksheet Worksheet Master

35 Non Cash Charitable Contributions Worksheet Notutahituq Worksheet

40 non cash charitable donations worksheet Worksheet Master

Non Cash Charitable Contributions Excel Worksheet Generator Jay Sheets

Download Non Cash Charitable Contribution Worksheet for Free Page 13

Donation Sheet Template 9+Free PDF Documents Download

Original Noncash Donation Receipt Template Superb Receipt Templates

Web How To Fill Out Non Cash Charitable Contribution Worksheet With Pdfsimpli In Five Steps?

The Temporary Deduction For Charitable Cash Contributions For Taxpayers Who Do Not Itemize Their Tax Returns Has Expired And Is No.

Ad Understand The Basics Of Charitable Funds With Fidelity Charitable.

Web For Noncash Donations Over $5,000, The Donor Must Attach Form 8283 To The Tax Return To Support The Charitable Deduction.

Related Post: