Nurse Tax Deduction Worksheet

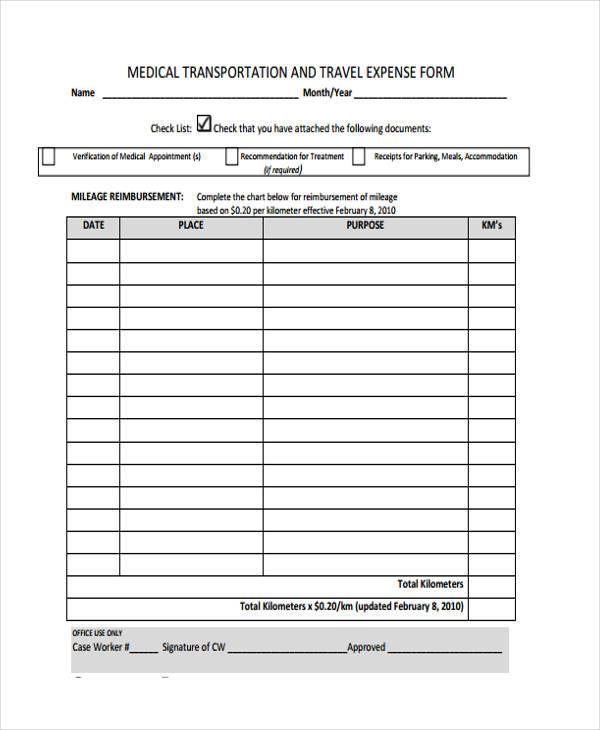

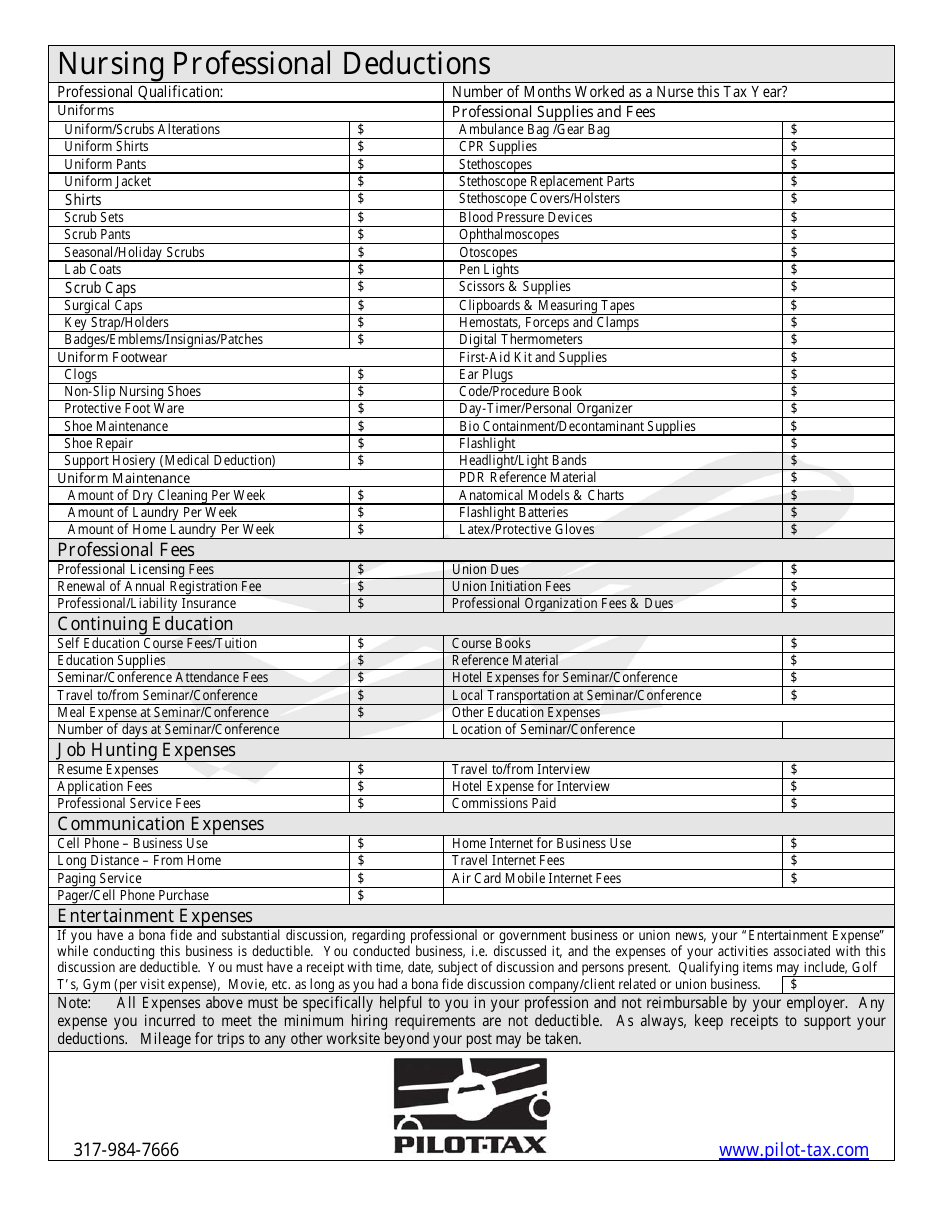

Nurse Tax Deduction Worksheet - If you, your spouse, or your dependent is in a nursing home primarily for. Itemizing your tax deductions can potentially reduce your tax burden compared to taking the standard deduction,. $450 age 41 to 50: $1,690 age 61 to 70: With everlance, you can effortlessly and automatically track mileage and expenses, and scan your purchase history to find eligible. Web video instructions and help with filling out and completing nurse tax deduction worksheet form. Web age 40 or under: $5,640 the limit on premiums is for each person. If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to. $850 age 51 to 60: Start by gathering all of your records that document. $1,690 age 61 to 70: Web read on for one list of the top duty deductions for nursing real healthcare professionals so you cannot file taxes in a snap—and storage some money. Renter homeowner nursing home or adult foster care resident mobile home owner 2023 form m1pr, homestead credit refund (for. Start by gathering all of your records that document. If you, your spouse, or your dependent is in a nursing home primarily for. Web video instructions and help with filling out and completing nurse tax deduction worksheet form. For tax year 2022, a married couple ages 65 and 66 (with no children). Web up to $40 cash back comments and. Web age 40 or under: For tax year 2022, a married couple ages 65 and 66 (with no children). $1,690 age 61 to 70: Yes, in certain instances nursing home expenses are deductible medical expenses. Start by gathering all of your records that document. Sign it in a few clicks draw. $450 age 41 to 50: Itemizing your tax deductions can potentially reduce your tax burden compared to taking the standard deduction,. $1,690 age 61 to 70: Web travel nurse taxes: Itemizing your tax deductions can potentially reduce your tax burden compared to taking the standard deduction,. Find a suitable template on the internet. Start by gathering all of your records that document. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding. Web read on for one list of the top duty deductions for nursing real healthcare professionals so you cannot file taxes in a snap—and storage some money. Renter homeowner nursing home or adult foster care resident mobile home owner 2023 form m1pr, homestead credit refund (for homeowners). $4,520 age 71 and over: Web age 40 or under: $450 age 41. Itemizing your tax deductions can potentially reduce your tax burden compared to taking the standard deduction,. $5,640 the limit on premiums is for each person. Web read on for one list of the top duty deductions for nursing real healthcare professionals so you cannot file taxes in a snap—and storage some money. Start by gathering all of your records that. Web video instructions and help with filling out and completing nurse tax deduction worksheet form. Web up to $40 cash back comments and help with printable tax deduction worksheet how to fill out nurse tax deduction worksheet? $4,520 age 71 and over: Renter homeowner nursing home or adult foster care resident mobile home owner 2023 form m1pr, homestead credit refund. For tax year 2022, a married couple ages 65 and 66 (with no children). Sign it in a few clicks draw. Web video instructions and help with filling out and completing nurse tax deduction worksheet form. $4,520 age 71 and over: $850 age 51 to 60: 502 medical and dental expenses. $450 age 41 to 50: Sign it in a few clicks draw. If you, your spouse, or your dependent is in a nursing home primarily for. Read all the field labels. $1,690 age 61 to 70: Web travel nurse taxes: For tax year 2022, a married couple ages 65 and 66 (with no children). Web check all that apply: Yes, in certain instances nursing home expenses are deductible medical expenses. Web read on for one list of the top duty deductions for nursing real healthcare professionals so you cannot file taxes in a snap—and storage some money. $450 age 41 to 50: $850 age 51 to 60: Itemizing your tax deductions can potentially reduce your tax burden compared to taking the standard deduction,. Web want to make tax season easier as a nurse? $5,640 the limit on premiums is for each person. Start by gathering all of your records that document. $4,520 age 71 and over: 502 medical and dental expenses. Sign it in a few clicks draw. Find a suitable template on the internet. Renter homeowner nursing home or adult foster care resident mobile home owner 2023 form m1pr, homestead credit refund (for homeowners). Web video instructions and help with filling out and completing nurse tax deduction worksheet form. If you itemize your deductions for a taxable year on schedule a (form 1040), itemized deductions, you may be able to. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Renter homeowner nursing home or adult foster care resident mobile home owner 2023 form m1pr, homestead credit refund (for homeowners). Sign it in a few clicks draw. $5,640 the limit on premiums is for each person. Read all the field labels. If you, your spouse, or your dependent is in a nursing home primarily for. Web read on for one list of the top duty deductions for nursing real healthcare professionals so you cannot file taxes in a snap—and storage some money. Use get form or simply click on the template preview to open it in the editor. $850 age 51 to 60: Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to. Yes, in certain instances nursing home expenses are deductible medical expenses. Find a suitable template on the internet. Web want to make tax season easier as a nurse? Web travel nurse taxes: Edit your printable tax deduction worksheet online type text, add images, blackout confidential details, add comments, highlights and more. $450 age 41 to 50: Web up to $40 cash back comments and help with printable tax deduction worksheet how to fill out nurse tax deduction worksheet?Can I Claim Medical Expenses Without Receipts

10 Business Tax Deductions Worksheet /

30 Home Daycare Tax Worksheet Education Template

40 airline pilot tax deduction worksheet Worksheet For Fun

Printable Itemized Deductions Worksheet

Overlooked Tax Deductions for Healthcare Workers Nursing jobs, Nurse

Printable yearly itemized tax deduction worksheet Fill out & sign

Nurse Tax Deduction Worksheets

Anchor Tax Service Nurses & medical professionals

Tax Deductions For Nurses What you can claim... Tax deductions

Itemizing Your Tax Deductions Can Potentially Reduce Your Tax Burden Compared To Taking The Standard Deduction,.

If You Itemize Your Deductions For A Taxable Year On Schedule A (Form 1040), Itemized Deductions, You May Be Able To.

$4,520 Age 71 And Over:

For Tax Year 2022, A Married Couple Ages 65 And 66 (With No Children).

Related Post: