Owner Operator Tax Deductions Worksheet

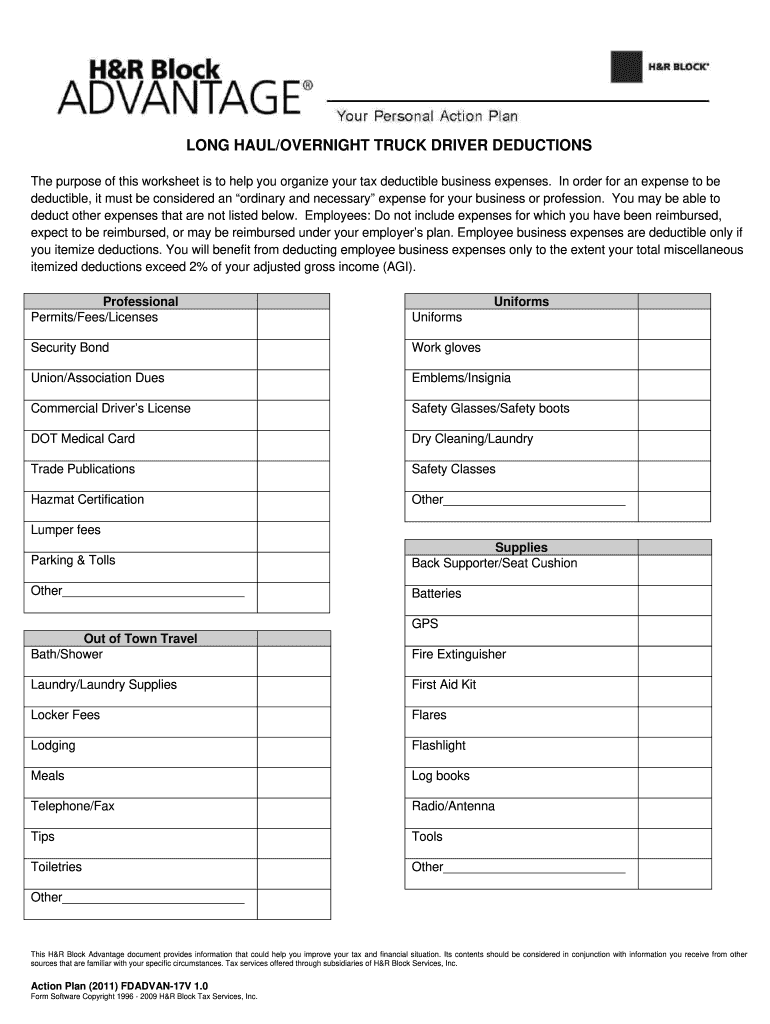

Owner Operator Tax Deductions Worksheet - Without documentation, you can’t take the deductions,. Find or create a system for tracking expenses. Checkout these “31 tax deductions for. Web tax deductions for owner operator truck drivers. Web an owner operator is subjected to a different set of tax deductions than, say, the average company employee or company driver; Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to account for these deductions. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. In this edition of our. Web forms that you should file as a truck driver depends on your type of employment: Truck lease, repairs, depreciation and accessories. Keep in mind that the per. Automatically track all your income and expenses. Web 303 100,000+ users here's how it works 02. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. In this edition of our. Keep in mind that the per. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! In this edition of our. Web forms that you should file as a truck driver depends on your type of employment: Without documentation, you can’t take. Web many ordinary and necessary business expenses can be deducted from your overall tax liability, as long as you have a record of them. You'll use those 1099s, plus. This includes both itemized deductions and other deductions such as for student loan interest and iras. Web forms that you should file as a truck driver depends on your type of. Navigating danger, compliance, and regulations watch now × find active charge by location and equipment type. Truck lease, repairs, depreciation and accessories. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. This includes both itemized deductions and other deductions such as for student loan interest and iras. Automatically. Web read this quick guide to save money and accept advantage of owner operator tax rebates. Web many ordinary and necessary business expenses can be deducted from your overall tax liability, as long as you have a record of them. Truck lease, repairs, depreciation and accessories. Keep in mind that the per. Web owner operators may also deduct expenses for: Which is the first thing an owner operator needs. Web 303 100,000+ users here's how it works 02. Find or create a system for tracking expenses. Checkout these “31 tax deductions for. Ad manage all your business expenses in one place with quickbooks®. Web check out these five tax tips for owner operators. Get a free guided quickbooks® setup. Ad manage all your business expenses in one place with quickbooks®. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. Keep in mind that the per. Web forms that you should file as a truck driver depends on your type of employment: This includes both itemized deductions and other deductions such as for student loan interest and iras. Automatically track all your income and expenses. Web read this quick guide to save money and accept advantage of owner operator tax rebates. Navigating danger, compliance, and regulations. Automatically track all your income and expenses. Truck lease, repairs, depreciation and accessories. Navigating danger, compliance, and regulations watch now × find active charge by location and equipment type. Get a free guided quickbooks® setup. Keep in mind that the per. Ad manage all your business expenses in one place with quickbooks®. Navigating danger, compliance, and regulations watch now × find active charge by location and equipment type. Find or create a system for tracking expenses. Keep in mind that the per. Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower. This includes both itemized deductions and other deductions such as for student loan interest and iras. Navigating danger, compliance, and regulations watch now × find active charge by location and equipment type. Web check out these five tax tips for owner operators. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Web an owner operator is subjected to a different set of tax deductions than, say, the average company employee or company driver; Web forms that you should file as a truck driver depends on your type of employment: Without documentation, you can’t take the deductions,. Checkout these “31 tax deductions for. Web tax deductions for owner operator truck drivers. Web owner operators may also deduct expenses for: Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower your taxes? In this edition of our. Truck lease, repairs, depreciation and accessories. Web 303 100,000+ users here's how it works 02. Find or create a system for tracking expenses. Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to account for these deductions. Ad manage all your business expenses in one place with quickbooks®. Get a free guided quickbooks® setup. Web [ ] laptop computer & accessories [ ] portable radio [ ] portable television devices [ ] other: Web many ordinary and necessary business expenses can be deducted from your overall tax liability, as long as you have a record of them. Keep in mind that the per. Which is the first thing an owner operator needs. Find or create a system for tracking expenses. Without documentation, you can’t take the deductions,. Web an owner operator is subjected to a different set of tax deductions than, say, the average company employee or company driver; Ad manage all your business expenses in one place with quickbooks®. Web check out these five tax tips for owner operators. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. You'll use those 1099s, plus. Did you know that the trucking profession offers tax deductions for common business expenses? Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web 31 best tax deductions for truckers, truck drivers & owner operators are you a trucker looking to lower your taxes? Web [ ] laptop computer & accessories [ ] portable radio [ ] portable television devices [ ] other: Web tax deductions for owner operator truck drivers. Web forms that you should file as a truck driver depends on your type of employment:Tax De Trucker Tax Deduction Worksheet Great Linear —

10 Business Tax Deductions Worksheet /

Owner Operator Expense Spreadsheet with regard to Owner Operator

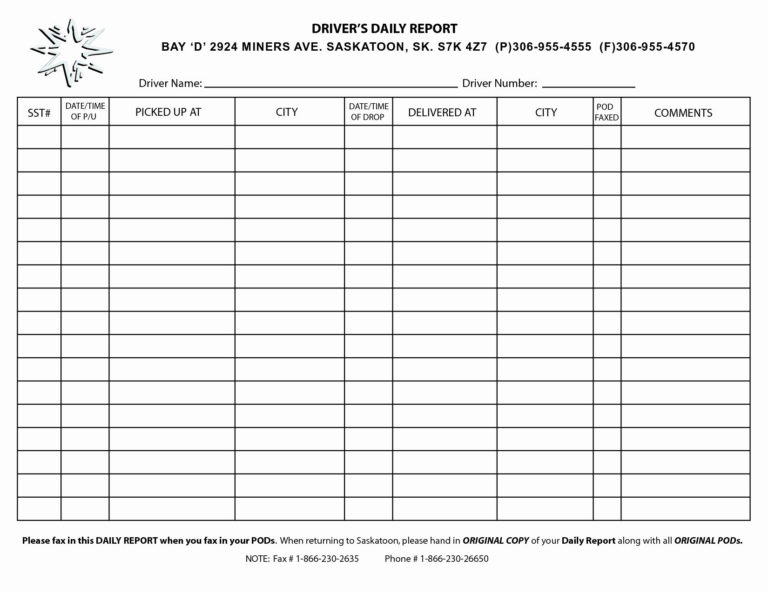

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Pin on Worksheet

20 Unique Truck Driver Tax Deductions Worksheet

Tax Deduction Worksheet Business tax deductions, Small business tax

Real Estate Agent Tax Deductions Worksheet 2021 Fill Online

Owner Operator Tax Deductions Worksheet Form Fill Out and Sign

Web 303 100,000+ Users Here's How It Works 02.

Web Owner Operators May Also Deduct Expenses For:

Web Deductions Worksheet, Line 5, If You Expect To Claim Deductions Other Than The Basic Standard Deduction On Your 2023 Tax Return And Want To Reduce Your Withholding To Account For These Deductions.

Checkout These “31 Tax Deductions For.

Related Post: