Owner Operator Truck Driver Tax Deductions Worksheet

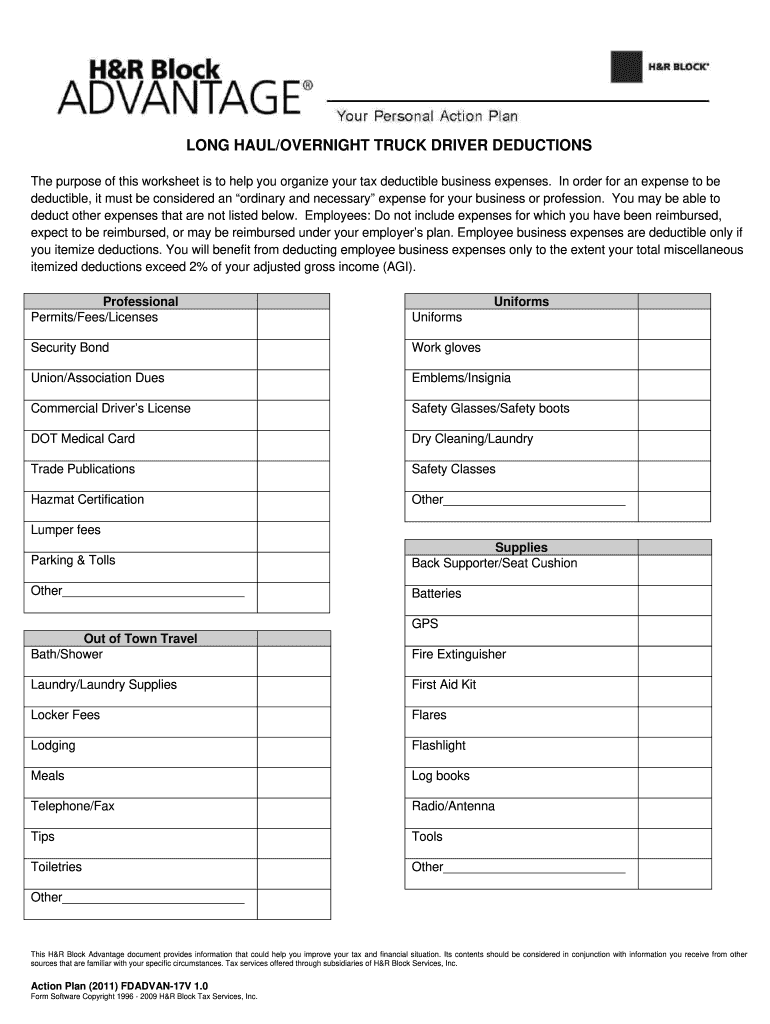

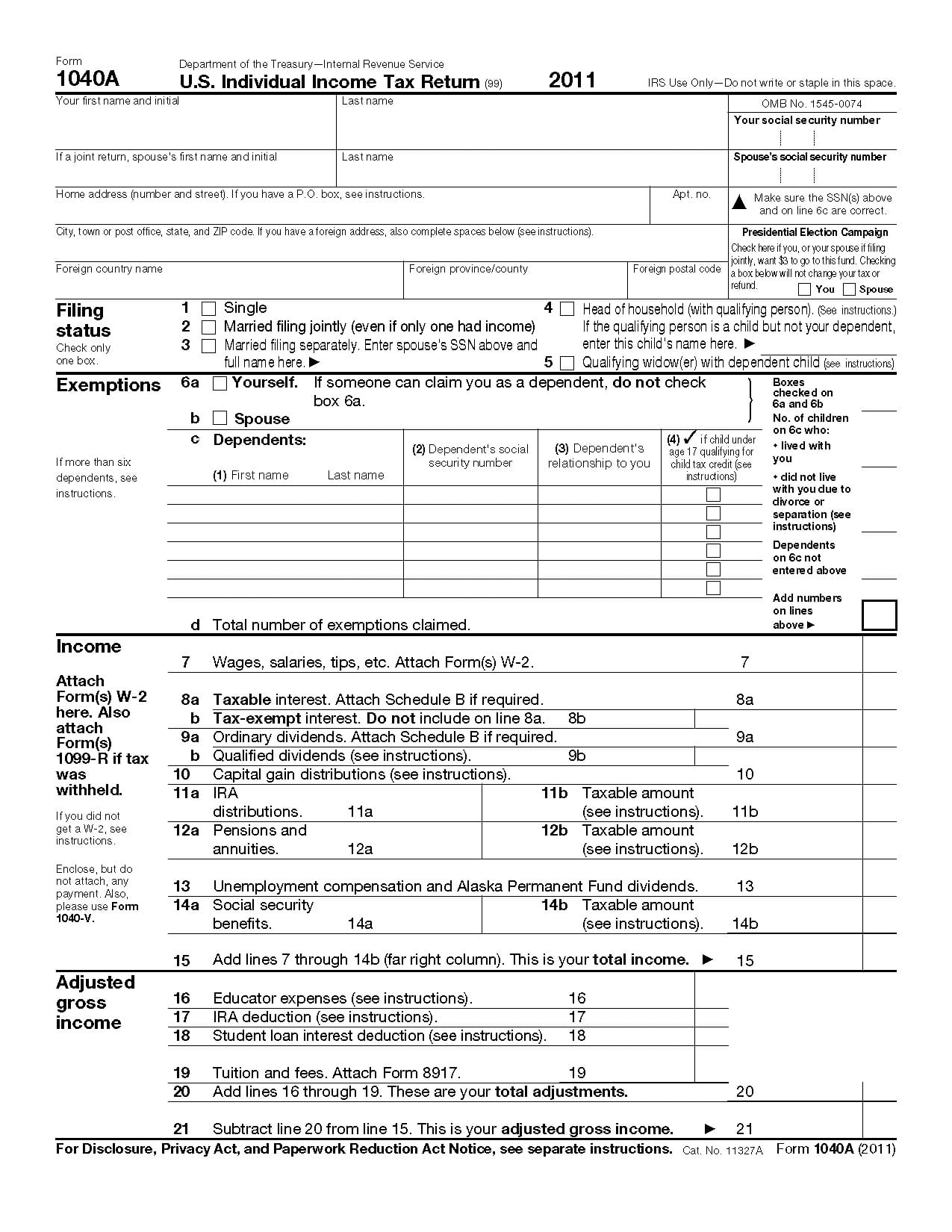

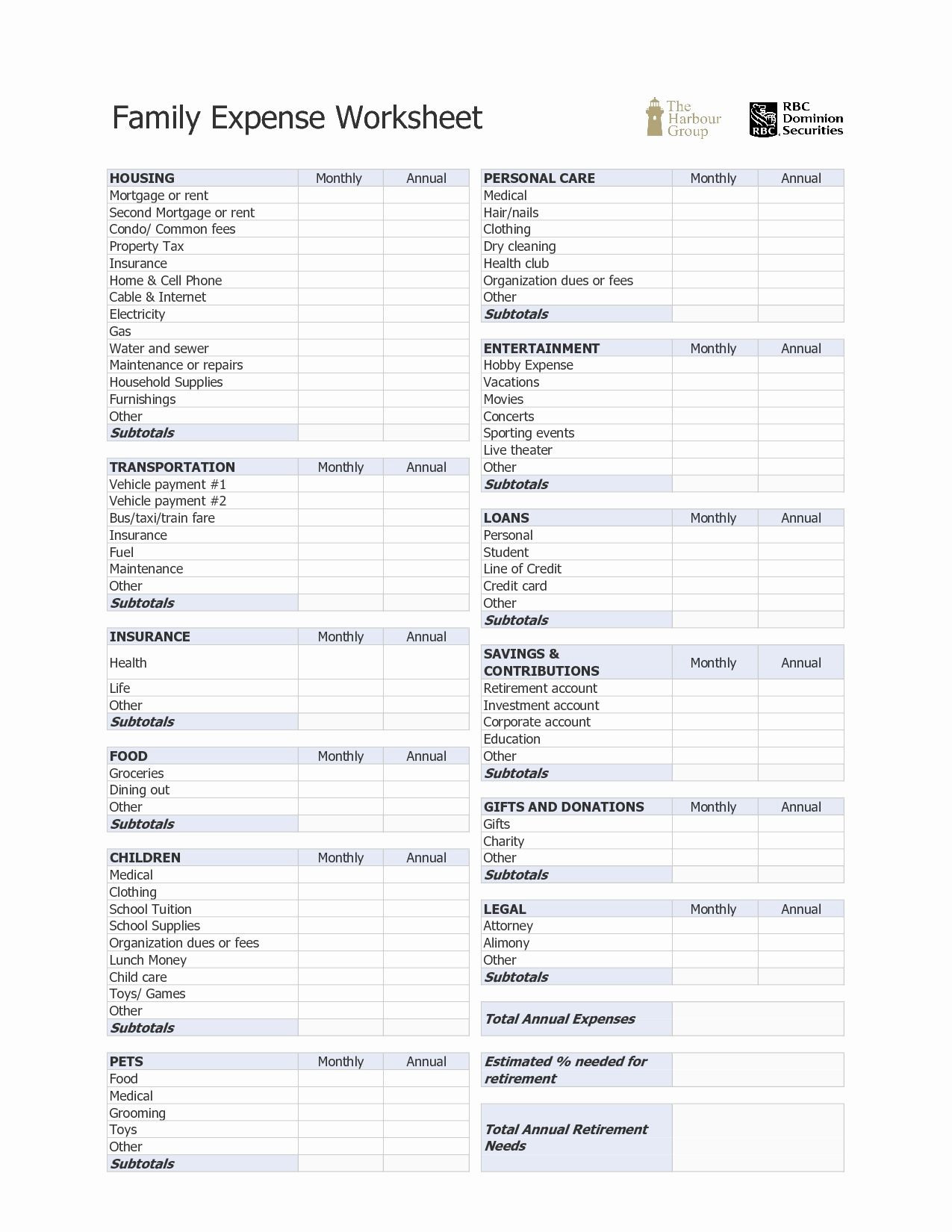

Owner Operator Truck Driver Tax Deductions Worksheet - Keep in mind that the per diem rate for january 1, 2021, to september 30, 2021, was $66 per day. Web trucker’s expenses (continued) advertising/promotion: And, you might not even know if there are any tax deductions that you. You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Ads, business cards, greeting cards, etc. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You can tell whether you qualify by looking at what type of tax documents you get at the end of the year. Interest paid on business loans; Web the purpose of this worksheet is to help you organize your tax deductible business expenses. These deductions can help truck drivers save money on taxes and keep more of their earnings. Web owner operator tax deductions list pdf. Keep track of what deductions you are taking advantage of. The daily rate changes over time. Keep in mind that the per diem rate for january 1, 2021, to september 30, 2021, was $66 per day. These deductions can help truck drivers save money on taxes and keep more of their earnings. Web august 12, 2021 tax season can always be a stressful time of year. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. Web trucker’s expenses (continued) advertising/promotion: Download 2023 per diem tracker Ads, business cards, greeting cards, etc. You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. As of now, the irs allows $69 per day in. In this article, we provide certain helpful general for semi driver taxes, deductions, truck disparagement, and tips for minimizing taxes. Web trucker’s expenses (continued) advertising/promotion: In order for. As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. And, you might not even know if there are any tax deductions that you. They should also include taxes because none will be subtracted from the paycheck. Web so the big question that you as an owner op might. You cannot legitimately deduct for downtime (with some minor exceptions…ask your tax pro). Lumper/helper expenses (away from home overnight): In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession. Keep track of what deductions you are taking advantage of. Web trucker tax deduction worksheet our list of the. You might not have all your documentation prepared or even know where it is. Knowing which expenses can be deducted (and which can’t) helps to ensure that you are not overpaying on taxes. Keep track of what deductions you are taking advantage of. You cannot legitimately deduct for downtime (with some minor exceptions…ask your tax pro). The daily rate changes. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Get everything done in minutes. Interest paid on business loans; Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Decide on what kind of. Web owner operator tax deductions list pdf. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that they pay to irs. Decide on what kind of signature to create. What the job is and what the expenses are for. Lumper/helper expenses (away from home overnight): Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Taxes and deductions that may be considered “ordinary and necessary” depends upon: Web most truck driver pay about $550 dollar for heavy highway use tax. Sign it in a few clicks draw your signature, type it, upload its image, or use. As of now, the irs allows $69 per day in. Lodging meals & tips (keep total separate from other costs) insurance: Web august 12, 2021 tax season can always be a stressful time of year. Interest paid on business loans; Decide on what kind of signature to create. You might not have all your documentation prepared or even know where it is. Ads, business cards, greeting cards, etc. Worker’s comp, business liability, truck insurance, etc. You may be able to deduct other expenses that are not listed below. Web when they are setting the price for their service, owner operator truck drivers should consider expenses that might arise later: Get everything done in minutes. Web owner operator tax deductions list pdf. Web so the big question that you as an owner op might have now is just what exactly can you deduct from your tax bill. Web mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You'll use those 1099s, plus your own records of income and expenses, to report your trucking income and expenses on schedule c. Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web trucker’s expenses (continued) advertising/promotion: Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Knowing which expenses can be deducted (and which can’t) helps to ensure that you are not overpaying on taxes. And, you might not even know if there are any tax deductions that you. Ads, business cards, greeting cards, etc. Decide on what kind of signature to create. Knowing which expenses can be deducted (and which can’t) helps to ensure that you are not overpaying on taxes. Get everything done in minutes. Web trucker tax deduction worksheet our list of the most common truck driver tax deductions will help you find out how you can save money on your taxes! The daily rate changes over time. What the job is and what the expenses are for. Web when they are setting the price for their service, owner operator truck drivers should consider expenses that might arise later: Taxes and deductions that may be considered “ordinary and necessary” depends upon: As of october 1, 2021, the per diem tax deduction rate is $69 per full day and $51.75 per partial day. You cannot legitimately deduct for downtime (with some minor exceptions…ask your tax pro). However, the deductible cannot be more than $7,150, up $50 from the limit for tax year 2020. These deductions can help truck drivers save money on taxes and keep more of their earnings. Select the document you want to sign and click upload. Form 2290 is used by truck driver and owner operator truck drivers to calculate their heavy highway use tax. In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession.Owner Operator Tax Deductions Worksheet Form Fill Out and Sign

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Free Owner Operator Expense Spreadsheet in Truck Driver Expenset

Truck Driver Tax Deductions Worksheet —

20 Unique Truck Driver Tax Deductions Worksheet

10 Business Tax Deductions Worksheet /

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

32+ Truck paper financial calculator CarrickSavva

Owner Operator Tax Deductions Worksheet Preschool Worksheets

Web Most Truck Driver Pay About $550 Dollar For Heavy Highway Use Tax.

Web Truck Driver Tax Deductions May Include Any Expenses That Are Ordinary And Necessary To The Business Of Being A Truck Driver.

Web So The Big Question That You As An Owner Op Might Have Now Is Just What Exactly Can You Deduct From Your Tax Bill.

Lodging Meals & Tips (Keep Total Separate From Other Costs) Insurance:

Related Post: