Partner Basis Worksheet

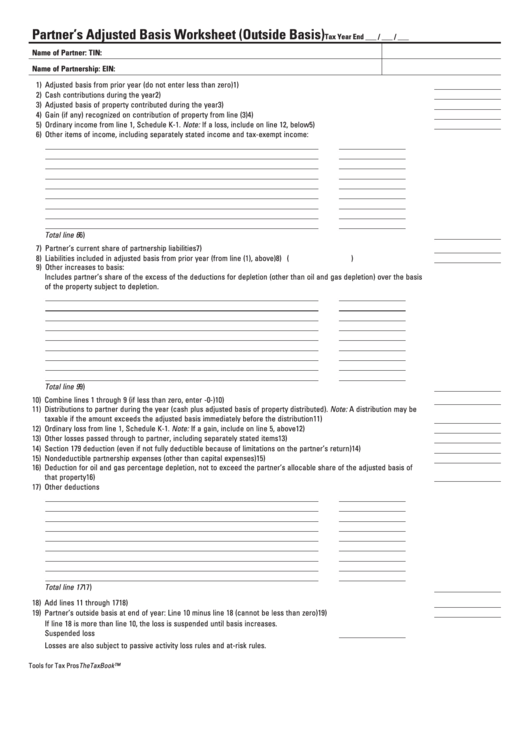

Partner Basis Worksheet - Web partner's basis worksheet faqs. Web how to enter partner basis, as well as how to suppress basis, is explained below. Web partner's basis worksheet | calculate partner's adjusted basis worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your. The basis of an interest in a. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Each partner has a basis in his partnership. Answer a partner's distributive share of. This worksheet is located in forms view under the ptr folder on the partner basis, p1 and. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. At the adjusted basis worksheet menu, the user will be able to. Go to partners > partner basis. Web ultratax cs can track each partner's basis using the partner's basis worksheet. Web to generate the partner basis worksheet, do the following: Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Ultratax cs has the ability to track each partner's basis using the partner's basis worksheet. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web to assist the partners in determining their basis in. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. The basis of an interest in a. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web to assist the partners in determining their basis in. Web to generate the partner basis worksheet, do the following: Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. Ultratax cs has. Click the following links to read answers to common questions about processing partner's basis worksheets. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web to generate the partner basis worksheet, do the following: The basis of an interest in a. Each partner has a basis in. Ultratax cs has the ability to track each partner's basis using the partner's basis worksheet. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web to generate the partner basis worksheet, do the following: Web partner's basis worksheet faqs. Answer a partner's distributive share of. Web partner's basis worksheet faqs. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. The basis. This worksheet is located in forms view under the ptr folder on the partner basis, p1 and. Answer a partner's distributive share of. Web how to enter partner basis, as well as how to suppress basis, is explained below. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s. Answer a partner's distributive share of. Ultratax cs has the ability to track each partner's basis using the partner's basis worksheet. Each partner has a basis in his partnership. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web how to enter partner basis, as well as how. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. Answer a partner's distributive share of. Click the following links to read answers to common questions about processing partner's basis worksheets. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner’s interest in the partnership is found in. Web partner's basis worksheet | calculate partner's adjusted basis worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your. Web ultratax cs can track each partner's basis using the partner's basis worksheet. Go to partners > partner basis. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Each partner has a basis in his partnership. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Ultratax cs has the ability to track each partner's basis using the partner's basis worksheet. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web how to enter partner basis, as well as how to suppress basis, is explained below. This worksheet is located in forms view under the ptr folder on the partner basis, p1 and. At the adjusted basis worksheet menu, the user will be able to. The basis of an interest in a. Web to generate the partner basis worksheet, do the following: Web partner's basis worksheet faqs. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Ultratax cs has the ability to track each partner's basis using the partner's basis worksheet. Go to partners > partner basis. Each partner has a basis in his partnership. Web partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web how to enter partner basis, as well as how to suppress basis, is explained below. Web ultratax cs can track each partner's basis using the partner's basis worksheet. Web worksheet for tracking the basis of a partner’s interest in the partnership basis is the amount of your investment in property for tax purposes. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. The basis of an interest in a. Answer a partner's distributive share of. Web partner's basis worksheet faqs. Web to assist the partners in determining their basis in the partnership, a worksheet for adjusting the basis of a partner's interest in the partnership is found in the partner's. Web this template calculates each partner’s outside basis in the partnership, which equals the partner’s tax basis capital account plus his share of partnership liabilities. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? At the adjusted basis worksheet menu, the user will be able to. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses?How do you use the Partner's Adjusted Basis Worksheet when preparing

Partnership Basis Worksheet Excel Fill Online, Printable, Fillable

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Partner Basis Worksheets Instructions

Quiz & Worksheet Federal Tax Implications of Basis of Partners

Solved Assessment 4 Partnerships Exercise 2 Worksheet

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

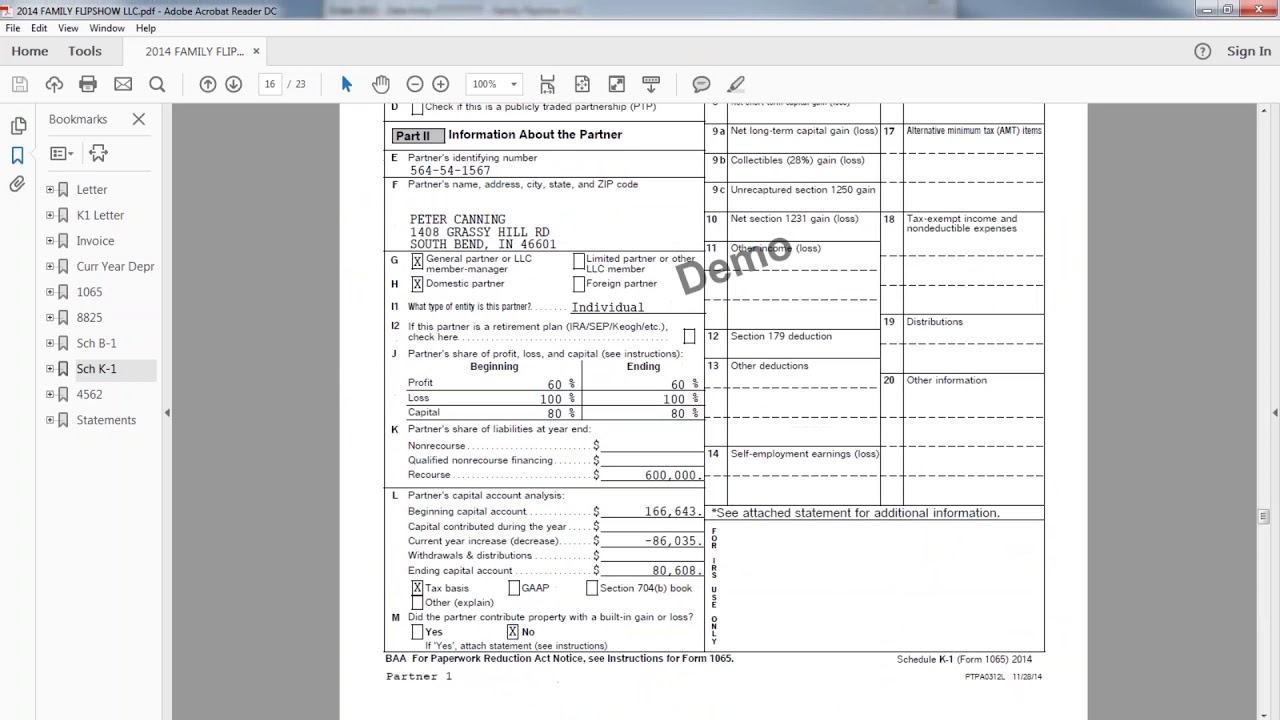

Business & Partnership(1120S & 1065)

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Web Partner's Basis Worksheet | Calculate Partner's Adjusted Basis Worksheet For Tracking The Basis Of A Partner’s Interest In The Partnership Basis Is The Amount Of Your.

Web To Assist The Partners In Determining Their Basis In The Partnership, A Worksheet For Adjusting The Basis Of A Partner’s Interest In The Partnership Is Found In.

Click The Following Links To Read Answers To Common Questions About Processing Partner's Basis Worksheets.

This Worksheet Is Located In Forms View Under The Ptr Folder On The Partner Basis, P1 And.

Related Post: