Partner's Adjusted Basis Worksheet

Partner's Adjusted Basis Worksheet - Web toos for tax proseoo. Web withholding on foreign partner or firm. Basis is the amount of your investment in property for tax purposes. This worksheet reflects the partner’s. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the. Can i enter and track basis for partners or shareholders in the individual return? Web worksheet for tracking the basis of a partner’s interest in the partnership. Partnership basis schedule template excel. Web a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest in. A partnership that has foreign partners or engages in certain transactions with foreign persons may have one (or more) of the following. Web toos for tax proseoo. Can i enter and track basis for partners or shareholders in the individual return? Partner’s adjusted basis worksheettax year end ___ / ___ / ___ name of partner: Web a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately after deducting distributions and before other. 1) adjusted basis from prior year.. Web toos for tax proseoo. 1) adjusted basis from prior year. Yes, basis worksheet calculations are available in the 1040 package. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the. Web partner’s adjusted basis worksheet. This worksheet reflects the partner’s. Yes, basis worksheet calculations are available in the 1040 package. Name ___________________________ id# ______________________ year _______. Web a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest in. Web you can figure the adjusted basis of your. Web a version of this worksheet can be generated in taxslayer pro and is accessed in the business program from the main menu of a partnership tax return (form 1065) by. Web how do i calculate my basis in a partnership? Here is the worksheet for adjusting the basis of a. What is included in partner basis? Partner’s adjusted basis. Name ___________________________ id# ______________________ year _______. Web how do i calculate my basis in a partnership? Web as previously stated, outside basis is a partner’s basis in his partnership interest. Can i enter and track basis for partners or shareholders in the individual return? Basis is the amount of your investment in property for tax purposes. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the. Web a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction by current year's losses, of such partner's interest in. A partnership that has foreign partners or engages in certain. Here is the worksheet for adjusting the basis of a. Web toos for tax proseoo. Web how do i calculate my basis in a partnership? Inside basis is the partnership’s basis in its assets. Web ultratax cs calculates this adjusted basis all the way through to expenditures of the partnership not deductible in calculating its taxable income and not properly. Name ___________________________ id# ______________________ year _______. Yes, basis worksheet calculations are available in the 1040 package. Can i enter and track basis for partners or shareholders in the individual return? Web use the worksheet for adjusting the basis of a partner's interest in the partnership, later, to figure the basis of your interest in the partnership. Web as previously stated,. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately after deducting distributions and before other. Name ___________________________ id# ______________________ year _______. Basis is the amount of your investment in property for tax purposes. Web a partner’s distributive share of the adjusted basis of a partnership’s property donation to charity.. Inside basis is the partnership’s basis in its assets. Web worksheet for tracking the basis of a partner’s interest in the partnership. Web withholding on foreign partner or firm. Basis is the amount of your investment in property for tax purposes. Web the partner’s outside basis is used to determine gain or loss on the disposition of the partnership interest and may limit the current deductibility of partnership losses and. Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web a version of this worksheet can be generated in taxslayer pro and is accessed in the business program from the main menu of a partnership tax return (form 1065) by. Web a partner’s distributive share of the adjusted basis of a partnership’s property donation to charity. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program from the main menu of a partnership tax. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the. Typically, at the start of the partnership,. Basis is the amount of your investment in property for tax purposes. Web partner’s adjusted basis worksheet. A partnership that has foreign partners or engages in certain transactions with foreign persons may have one (or more) of the following. 2010 excel functions macros and data. What is included in partner basis? Web worksheet for tracking the basis of a partner’s interest in the partnership. Yes, basis worksheet calculations are available in the 1040 package. Partnership basis schedule template excel. Can i enter and track basis for partners or shareholders in the individual return? Basis is the amount of your investment in property for tax purposes. Partnership basis schedule template excel. What is included in partner basis? Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web as previously stated, outside basis is a partner’s basis in his partnership interest. A partnership that has foreign partners or engages in certain transactions with foreign persons may have one (or more) of the following. Typically, at the start of the partnership,. Web jerry and george, 50/50 partners in j&g, each have an adjusted basis in their partnership interest of $20 immediately after deducting distributions and before other. Here is the worksheet for adjusting the basis of a. Name ___________________________ id# ______________________ year _______. Web partner’s adjusted basis worksheet. Web how do i use the shareholder's adjusted basis worksheet (basis wks)? Web toos for tax proseoo. 1) adjusted basis from prior year. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the. Inside basis is the partnership’s basis in its assets.Partner Basis Worksheet Instructions

Partners Adjusted Basis Worksheet Public Finance Economy Of The

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Solved Assessment 4 Partnerships 2 Exercise 2 Worksheet

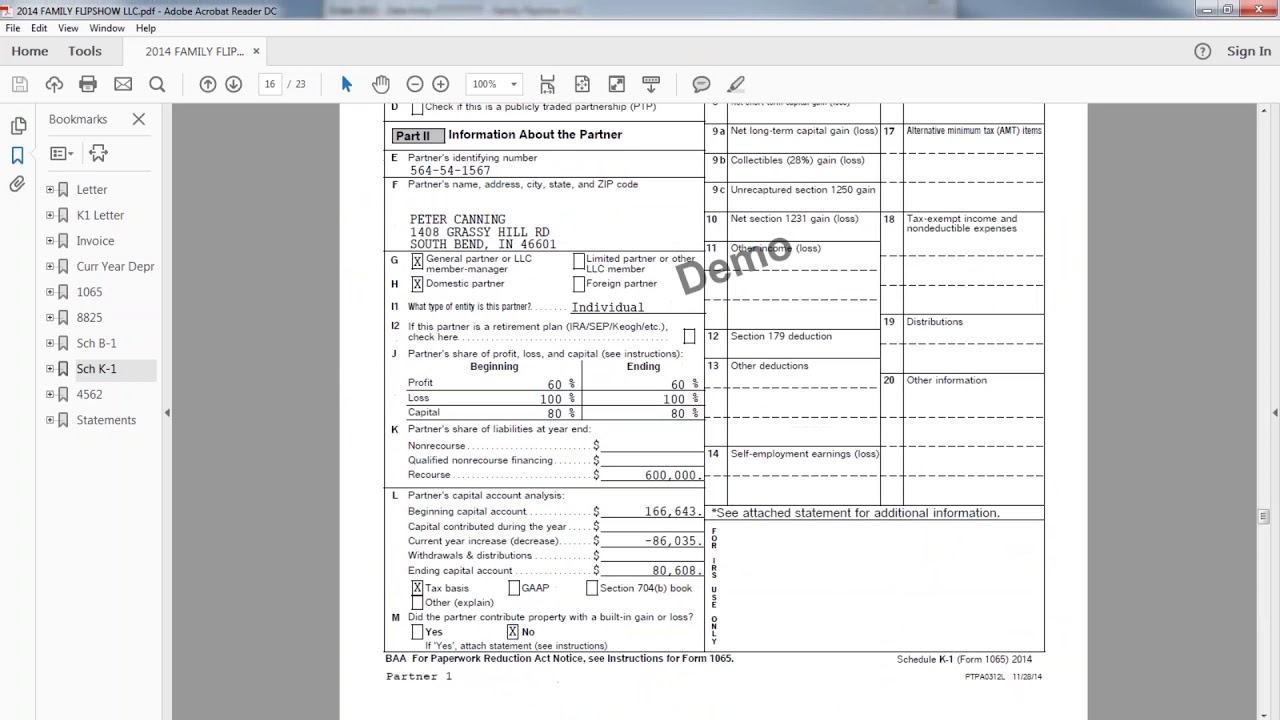

Business & Partnership(1120S & 1065)

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Partner Basis Worksheets Instructions

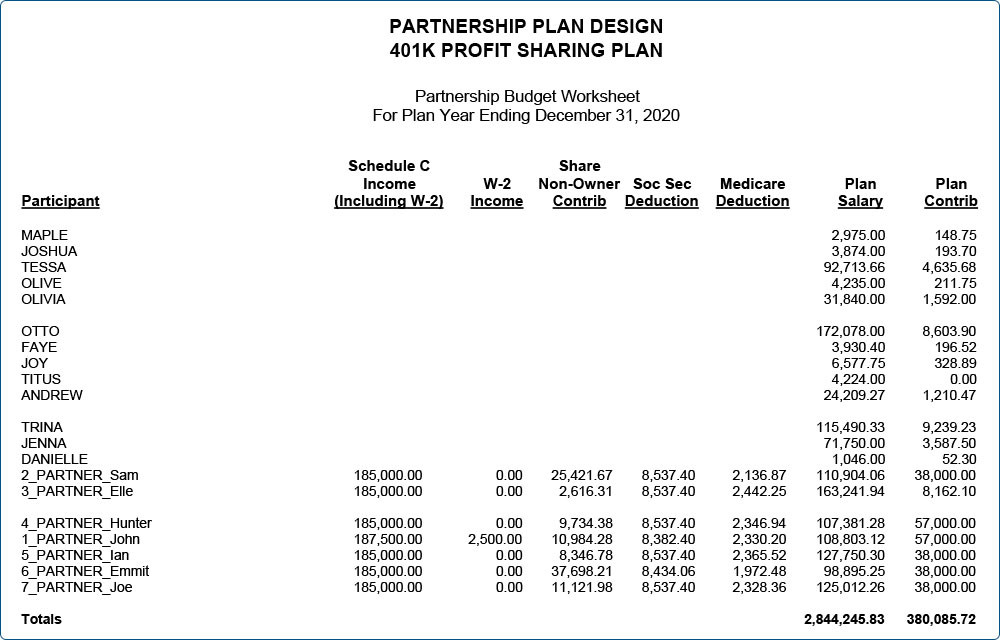

Budget Module 401a4

How do you use the Partner's Adjusted Basis Worksheet when preparing

Web A Partner's Distributive Share Of Partnership Loss Will Be Allowed Only To The Extent Of The Adjusted Basis, Before Reduction By Current Year's Losses, Of Such Partner's Interest In.

Web Ultratax Cs Calculates This Adjusted Basis All The Way Through To Expenditures Of The Partnership Not Deductible In Calculating Its Taxable Income And Not Properly Chargeable.

This Worksheet Reflects The Partner’s.

2010 Excel Functions Macros And Data.

Related Post: