Partner's Outside Basis Worksheet

Partner's Outside Basis Worksheet - If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease because the partnership assumes their. Web adhere to the instructions below to fill out partner's outside basis worksheet online easily and quickly: Web worksheet for adjusting the basis of a partner's interest in the partnership. Each partner “owns” a share of the partnership’s inside basis for. Web get partners adjusted basis worksheet outside basis tax year. Web partner’s outside tax basis in a partnership worksheet. Sign up with your email and password or create a. Open form follow the instructions. Generally, the application limits the amount of available basis before losses and decreases in liabilities. Web up to $40 cash back the outside basis is the amount of money a partner has invested (including any loans) in the partnership. Generally, the application limits the amount of available basis before losses and decreases in liabilities. Web what is a partners basis worksheet? Web partner’s outside tax basis in a partnership worksheet. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or without being. Open form follow the. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the partnership, any of the above. Sign up with your email and password or create a. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or without being.. Web get partners adjusted basis worksheet outside basis tax year. Outside basis refers to basis each partner. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web up to $40 cash back the outside basis is the amount of money a partner has invested (including any loans) in the partnership. At the adjusted. What is included in partner basis? Outside basis refers to basis each partner. Web adhere to the instructions below to fill out partner's outside basis worksheet online easily and quickly: Web up to $40 cash back the outside basis is the amount of money a partner has invested (including any loans) in the partnership. Web partner’s outside tax basis in. Web partner's adjusted basis worksheet. Web in addition to the capital account, partners are also required to maintain a balance called “outside basis.” similar to an adjusted basis of a capital asset, the outside basis tracks. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or without. Outside basis refers to basis each partner. Web modified outside basis method if a partnership elects to use the modified outside basis method, a partner’s beginning capital account will equal the partner’s outside basis, as. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. Web. Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or without being. Generally, the application limits the amount of available basis before losses and decreases in liabilities. Web in addition to the capital account, partners are also required to maintain a balance called “outside basis.” similar to. Outside basis refers to basis each partner. For example, if a partner’s. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease because the partnership assumes their. Web up to $40 cash. Web worksheet for adjusting the basis of a partner's interest in the partnership. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. When distributions or changes in liabilities would decrease the. At the adjusted basis worksheet menu, the user will be able to enter, based. Web what is a partners basis worksheet? Web get partners adjusted basis worksheet outside basis tax year. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. Outside basis refers to basis each partner. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis. Log in to your account. What is the basis in a partnership? For example, if a partner’s. Outside basis represents each partner’s basis in the partnership interest. Web what is a partners basis worksheet? Web outside basis determines how much a partner may withdraw or deduct from a partnership for tax purposes without recognizing additional gain or without being. Sign up with your email and password or create a. Web up to $40 cash back the outside basis is the amount of money a partner has invested (including any loans) in the partnership. Generally, the application limits the amount of available basis before losses and decreases in liabilities. Web in addition to the capital account, partners are also required to maintain a balance called “outside basis.” similar to an adjusted basis of a capital asset, the outside basis tracks. Web the irs initially intended for tax basis capital account reporting to begin in 2019, but that was deferred until 2020 due to concerns about whether partnerships. At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the partnership, any of the above. Easily sign the form with your finger. Each partner “owns” a share of the partnership’s inside basis for. Web modified outside basis method if a partnership elects to use the modified outside basis method, a partner’s beginning capital account will equal the partner’s outside basis, as. If a partner's share of partnership liabilities decreases, or a partner's individual liabilities decrease because the partnership assumes their. What is included in partner basis? Web use the basis wks screen, partner’s adjusted basis worksheet, to calculate a partner’s new basis after increases and/or decreases are made to basis during the current year. Web partner’s outside tax basis in a partnership worksheet. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. Outside basis represents each partner’s basis in the partnership interest. How do i calculate my basis in a partnership? At the adjusted basis worksheet menu, the user will be able to enter, based on the accounting records of the partnership, any of the above. Log in to your account. Web in addition to the capital account, partners are also required to maintain a balance called “outside basis.” similar to an adjusted basis of a capital asset, the outside basis tracks. Each partner “owns” a share of the partnership’s inside basis for. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web the partner reduced outside basis in the partnership by the partner’s share of the adjusted basis of contributed property, but not below zero. Web adhere to the instructions below to fill out partner's outside basis worksheet online easily and quickly: When distributions or changes in liabilities would decrease the. Outside basis refers to basis each partner. Generally, the application limits the amount of available basis before losses and decreases in liabilities. Web worksheet for adjusting the basis of a partner's interest in the partnership. Sign up with your email and password or create a. Web partner's adjusted basis worksheet. Web partner’s outside tax basis in a partnership worksheet.Partnership Basis Worksheets Excel

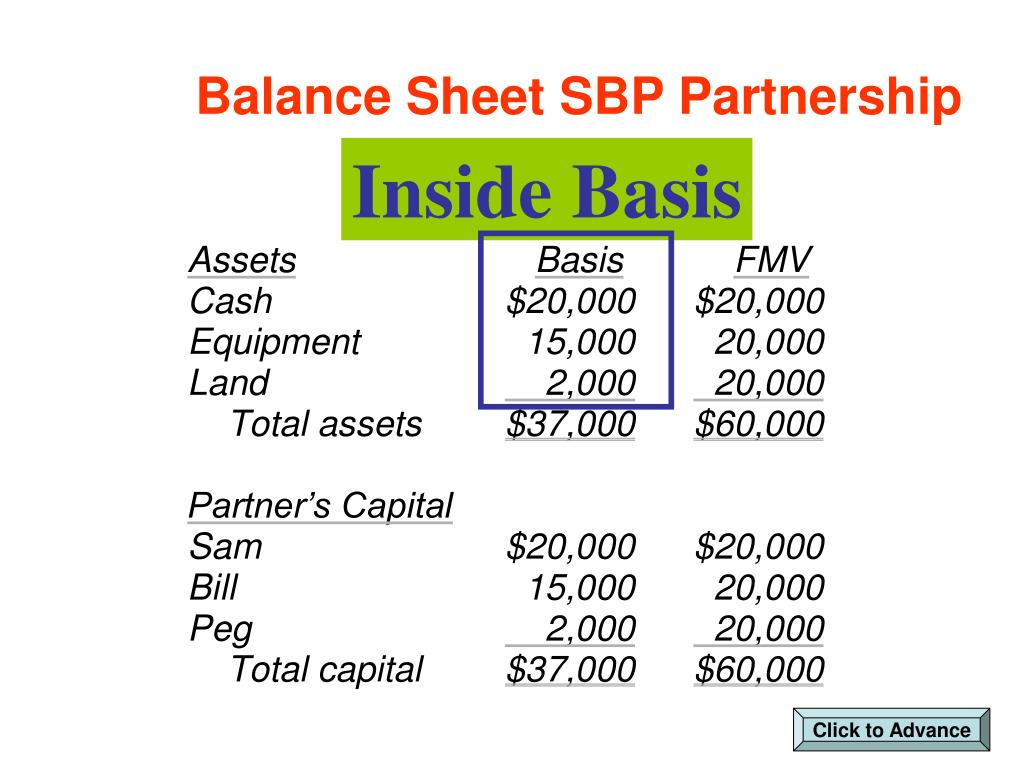

PPT Outside Basis §722 Example PowerPoint Presentation, free

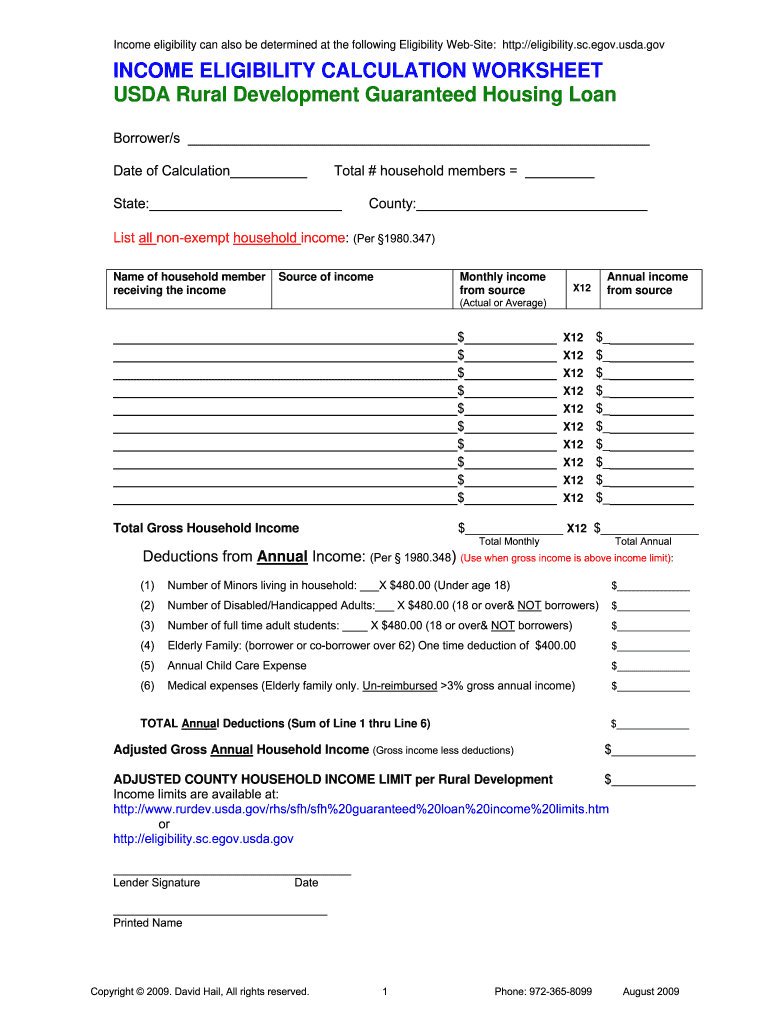

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

Partnership Tax Basis Worksheet Worksheet Resume Examples

find your partner ESL worksheet by mioesmio

Partnership Basis Calculation Worksheet Studying Worksheets

Free Partnership Worksheet Free to Print, Save & Download

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Partner Basis Worksheets Instructions

Web Outside Basis Determines How Much A Partner May Withdraw Or Deduct From A Partnership For Tax Purposes Without Recognizing Additional Gain Or Without Being.

Web Modified Outside Basis Method If A Partnership Elects To Use The Modified Outside Basis Method, A Partner’s Beginning Capital Account Will Equal The Partner’s Outside Basis, As.

The Worksheet Tracks The Contributions The Partner.

Open Form Follow The Instructions.

Related Post: