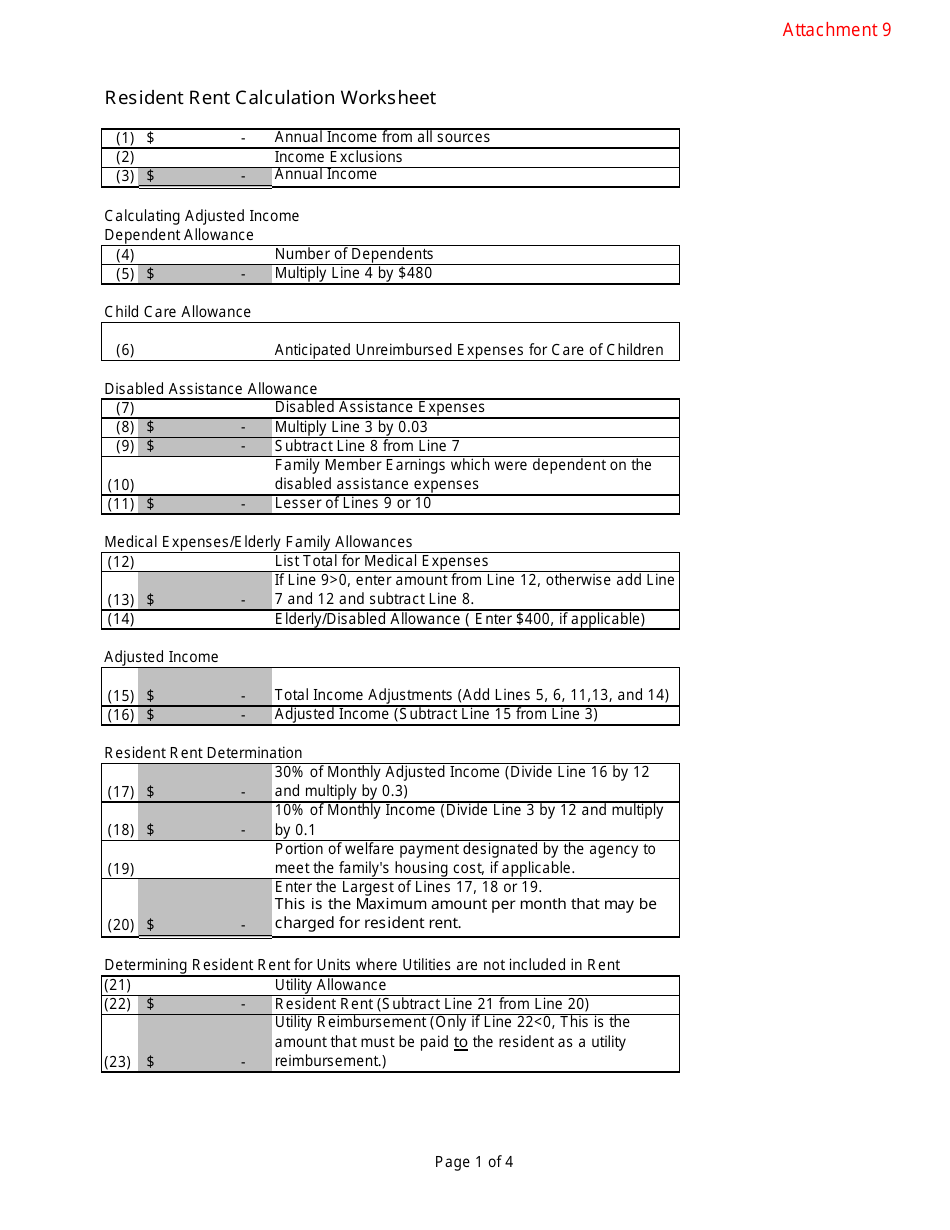

Partnership Basis Calculation Worksheet

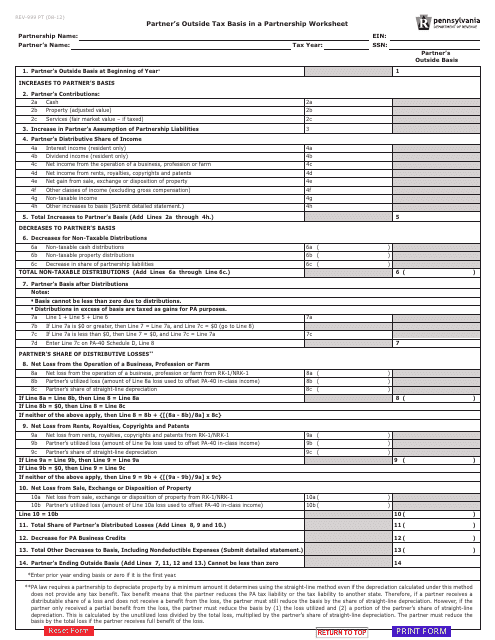

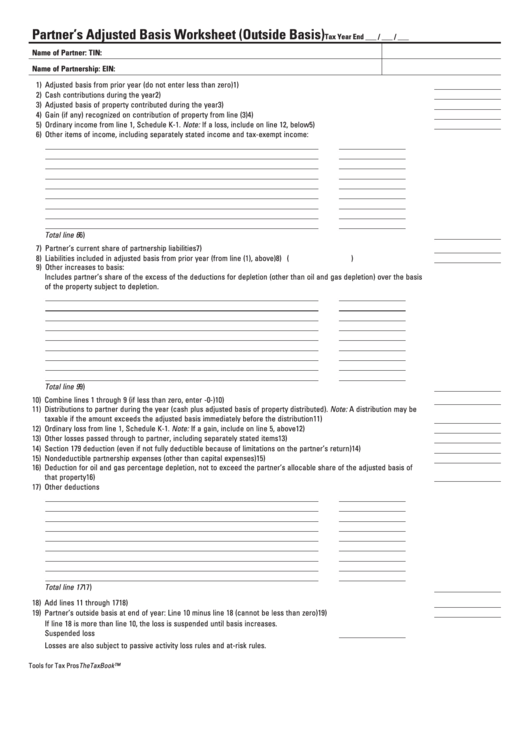

Partnership Basis Calculation Worksheet - Remember that the tax basis is equal to the purchase price of an asset minus. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web worksheet for tracking the basis of a partner’s interest in the partnership. Select the partnership passthrough worksheets. Web the following tips can help you fill out partnership basis calculation worksheet excel easily and quickly: Web process overview partner’s outside basis background partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Press the green arrow with the. Web calculating adjusted tax basis in a partnership or llc: Web do i use the shareholder basis worksheet information to calculate? Sign it in a few clicks draw your signature,. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web process overview partner’s outside basis background partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Web up to 24% cash back a partnership worksheet can give. Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Web to enter partnership basis limitation: Remember that the tax basis is equal to the purchase price of an asset minus. A partner’s adjusted (outside) basis refers to the partner’s investment in a partnership. @cur1ous yes, in practical terms your. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? A version of this worksheet can be generated. Outside basis calculating adjusted tax basis in a partnership or. Web do i use the shareholder basis worksheet information to calculate? Answer a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction. Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Web up to 24% cash back a partnership. Web the following tips can help you fill out partnership basis calculation worksheet excel easily and quickly: Sign it in a few clicks draw your signature,. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web up to 24% cash back a partnership worksheet can give you a. Web to enter partnership basis limitation: The adjusted basis of any property contributed; Answer a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction. Each partner has a basis in his partnership interest. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Web a version of this worksheet can be generated in keystone tax solutions pro and is accessed in the business program from the main menu of a partnership tax return (form 1065) by selecting: Web worksheet for tracking the basis. Web worksheet for tracking the basis of a partner’s interest in the partnership. The partner’s basis in his. Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Fill in the necessary fields that are marked in yellow. The adjusted partnership basis will be used to figure your gain or. Web how does the partner's basis worksheet calculate the basis limitation on the deductibility of a partner's share of partnership losses? Web do i use the shareholder basis worksheet information to calculate? Sign it in a few clicks draw your signature,. Plus the amount, if any, of gain. The calculated basis determines the tax impact of certain transactions (e.g., if. The adjusted basis of any property contributed; Web do i use the shareholder basis worksheet information to calculate? Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Each partner has a basis in his partnership interest. Fill in the necessary fields that are marked in yellow. Web to enter partnership basis limitation: Basis is the amount of your investment in property for tax purposes. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Answer a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction. Press the green arrow with the. A partner’s adjusted (outside) basis refers to the partner’s investment in a partnership. Outside basis refers to basis each partner contributes (cash and adjusted basis in property contributed) into their partnership. The calculated basis determines the tax impact of certain transactions (e.g., if a partner receives a distribution in excess of. Web process overview partner’s outside basis background partnership is a relationship between two or more persons who join together to carry on a trade, business, or investment activity. Remember that the tax basis is equal to the purchase price of an asset minus. A version of this worksheet can be generated. Each partner has a basis in his partnership interest. Select the partnership passthrough worksheets. Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Web worksheet for tracking the basis of a partner’s interest in the partnership. Fill in the necessary fields that are marked in yellow. The partner’s basis in his. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Web calculating adjusted tax basis in a partnership or llc: @cur1ous yes, in practical terms your ownership percentage is used only by the partnership to figure your value and costs as. In this worksheet, you'll provide information about each owner, including whether each party will. @cur1ous yes, in practical terms your ownership percentage is used only by the partnership to figure your value and costs as. Fill in the necessary fields that are marked in yellow. A version of this worksheet can be generated. Web calculating adjusted tax basis in a partnership or llc: The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Outside basis refers to basis each partner contributes (cash and adjusted basis in property contributed) into their partnership. Web do i use the shareholder basis worksheet information to calculate? Web the following tips can help you fill out partnership basis calculation worksheet excel easily and quickly: Web up to 24% cash back a partnership worksheet can give you a little direction, and streamline the process if you decide to go forward and hire an attorney to prepare the official agreement. Web this tax worksheet calculates, for carryforward purposes, a partner’s “outside” basis in a partnership interest. Sign it in a few clicks draw your signature,. Answer a partner's distributive share of partnership loss will be allowed only to the extent of the adjusted basis, before reduction. The adjusted basis of any property contributed; Outside basis calculating adjusted tax basis in a partnership or llc takes us into a complex area of tax law. Web to enter partnership basis limitation:Partnership Basis Calculation Worksheet Studying Worksheets

Solved The following balance sheet is for a local

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

PDF le progrès ain bugey PDF Télécharger Download

Access Free partnership basis calculation worksheet ? vcon.duhs.edu.pk

Partnership Basis Calculation Worksheet Studying Worksheets

Partner Basis Worksheet Instructions

Form REV999 Download Fillable PDF or Fill Online Partner's Outside Tax

Solved Assessment 4 Partnerships 2 Exercise 1 Worksheet

Fillable Partner'S Adjusted Basis Worksheet (Outside Basis) Template

Web How Does The Partner's Basis Worksheet Calculate The Basis Limitation On The Deductibility Of A Partner's Share Of Partnership Losses?

Plus The Amount, If Any, Of Gain.

Web Worksheet For Tracking The Basis Of A Partner’s Interest In The Partnership.

The Calculated Basis Determines The Tax Impact Of Certain Transactions (E.g., If A Partner Receives A Distribution In Excess Of.

Related Post: