Printable Small Business Tax Deductions Worksheet

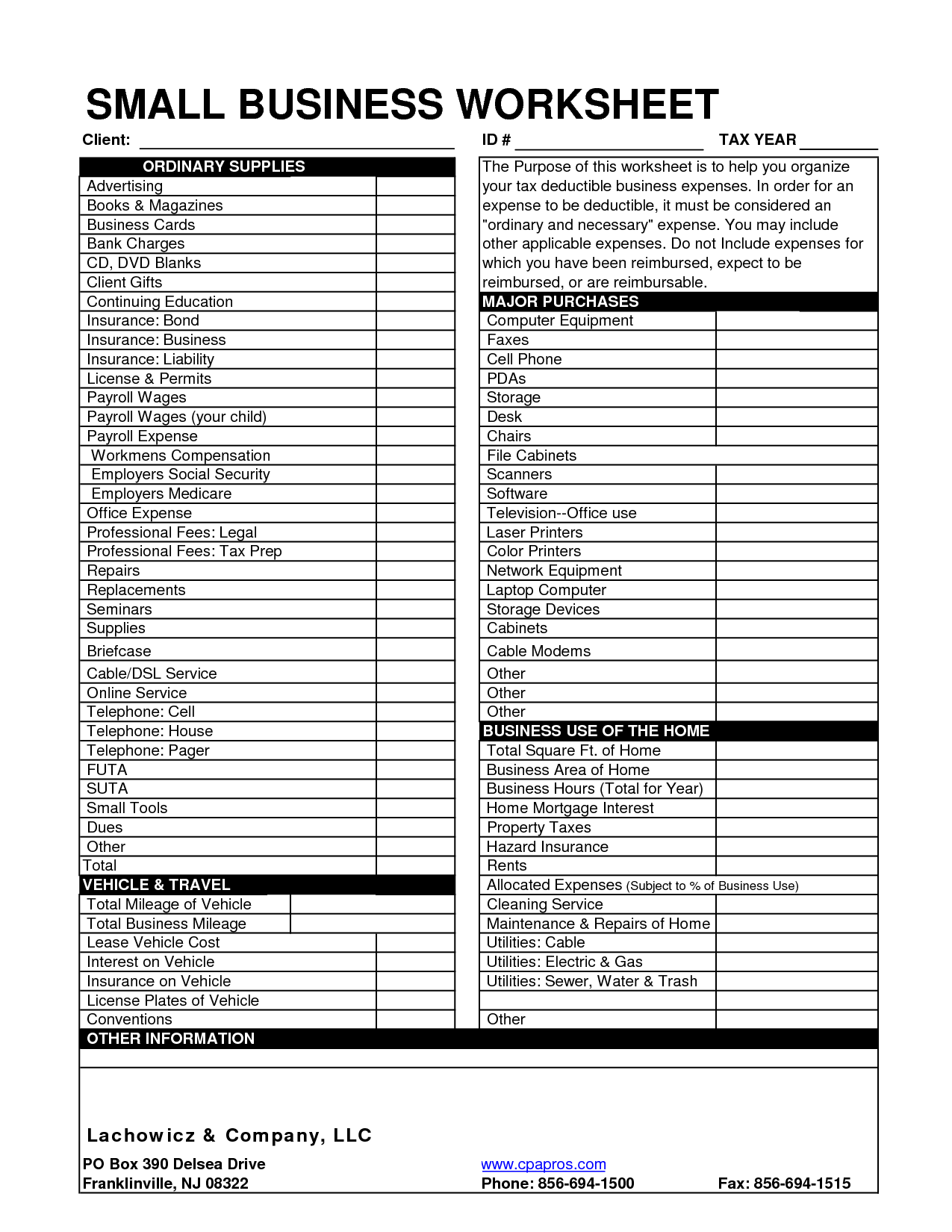

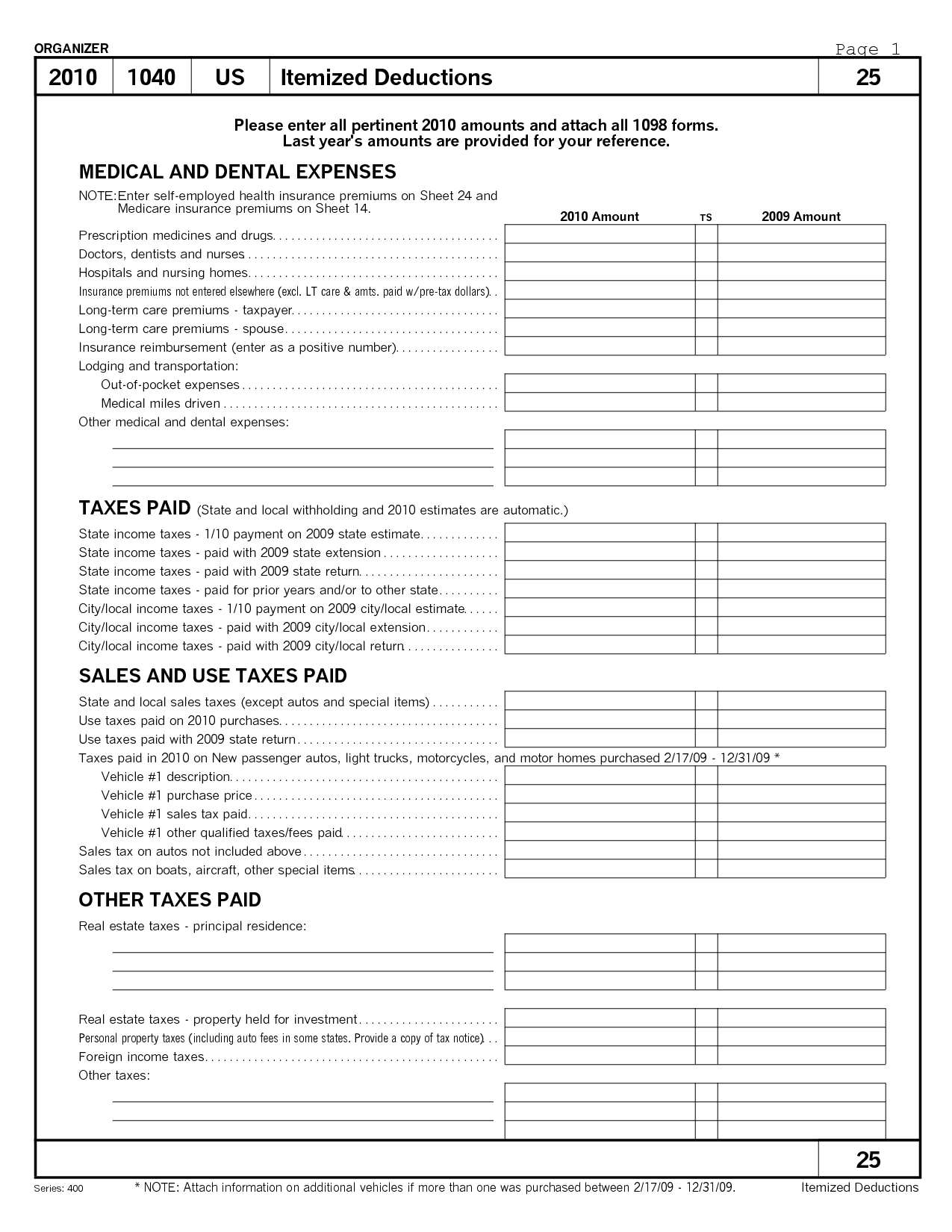

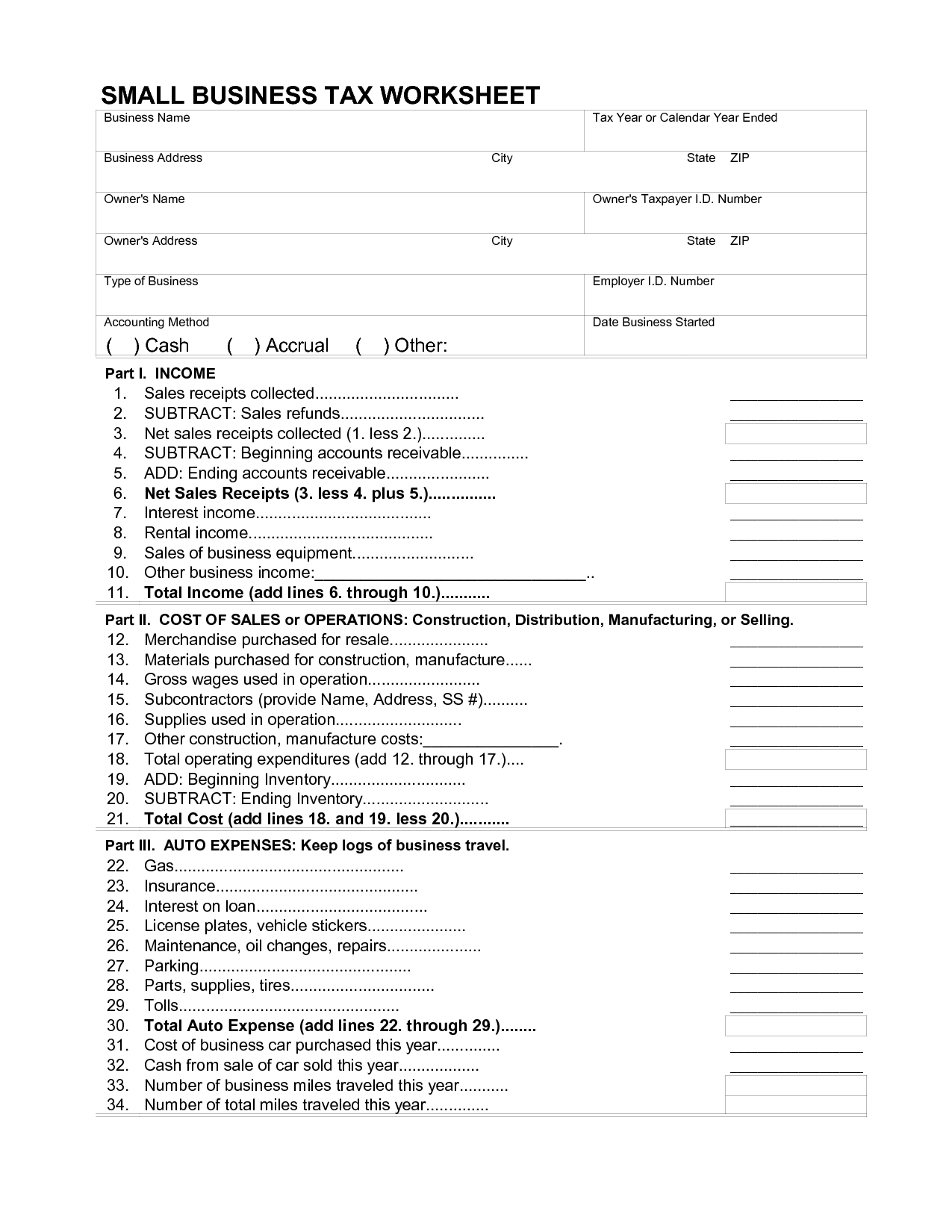

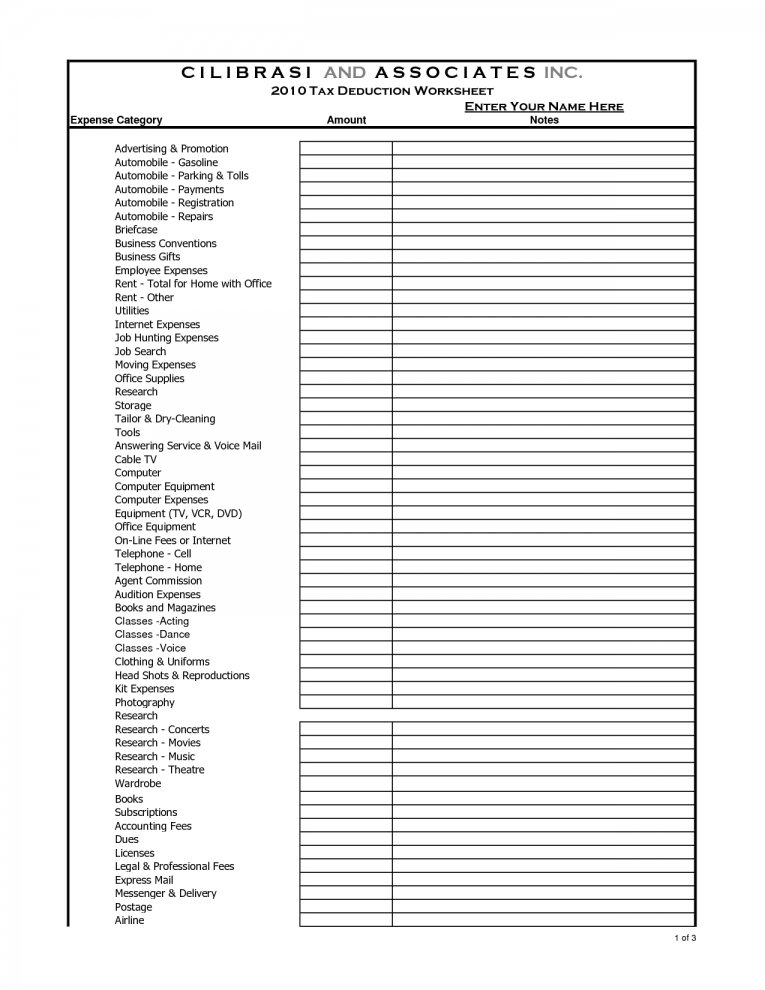

Printable Small Business Tax Deductions Worksheet - Publication 334, tax guide for small business (for individuals who use schedule c) publication 463, travel, gift, and car expenses. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the aggregate amount of qualified real estate investment trust (reit) and qualified publicly traded partnership income. The qbi was introduced under the tax cuts and jobs act of 2017, which sought. Web employee salary deductions: Free to download and print. This includes both itemized deductions and other deductions such as for student loan interest and iras. Know which business tax forms to file. Web small business worksheet client: Check out this comprehensive list of small business tax deductions for 2022 von kassey mossy tax & accounting. Web make your free small business tax worksheet make document create your document in just 3 easy steps: Within the first year, you can deduct up to $5,000 for startup costs and $5,000 for organizational costs. Web don’t get stuck with a huge tax bill next year! Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Check out this comprehensive list of. Web business startup costs and organizational costs: Web deductions worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2023 tax return and want to reduce your withholding to account for these deductions. Know which business tax forms to file. Web for tax years beginning after 2017, you may be entitled to take. Web make your free small business tax worksheet make document create your document in just 3 easy steps: Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________ $___________$___________$___________ $___________accountantadministrativeagent/manager expensescontractedother. The dollar limitation for employee salary deductions for contributions to health flexible spending arrangements increased from $2,750 to $2,850, and the maximum carryover amount for cafeteria plans will. Simply follow the instructions on this sheet and start lowering your social security and medicare taxes. Know which business tax forms to file. With an easy internet search, you can easily search for a large option of free, printable worksheets for a variety of subjects as well as grade levels such as printable small business tax. When we’re done, you’ll. Web tax deduction worksheet this worksheet allows you to itemize your tax deductions for a given year. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. This deduction applies to sole proprietorships, partnerships, s corporations, certain trusts, and estates. Costs incurred to get your business up and. Web employee salary deductions: Know which business tax forms to file. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the aggregate amount of qualified real estate investment trust (reit) and qualified publicly traded partnership income.. Id # tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. In order for an books & magazines expense to be deductible, it must be. Publication 505, tax withholding and estimated tax. Tax day 2017 is tuesday april 18. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the aggregate amount of qualified real estate investment trust (reit) and qualified publicly. Web small business worksheet client: Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the aggregate amount of qualified real estate investment trust (reit) and qualified publicly traded partnership income. Web don’t get stuck with a. This printable business form template is available to download for free, or you can download the entire collection for only $199. This deduction applies to sole proprietorships, partnerships, s corporations, certain trusts, and estates. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize. Web use this form to figure your qualified business income deduction. Build your document answer a few simple questions to make your document in minutes save now, finish later start now and save your progress, finish on any device download, print & share store securely, share online and make copies Web make your free small business tax worksheet make document create your document in just 3 easy steps: 334, such as legislation enacted after it was published, go to irs.gov/pub334. With an easy internet search, you can easily search for a large option of free, printable worksheets for a variety of subjects as well as grade levels such as printable small business tax. Federal section>deductions>itemized deductions>medical and dental expenses if mfs and spouse itemizes, taxpayer must also itemize. Web get our free printable small business tax deduction worksheet at casey moss tax, we have a free spreadsheet template that you can use to organize all of your expenses by transaction and even generate a profit. Publication 334, tax guide for small business (for individuals who use schedule c) publication 463, travel, gift, and car expenses. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. To help you minimize your tax liability, here is a list of 20+ small business tax deductions. Eligible small business owners who file form 1040 can take this one, though it phases out once you reach an income level of $160,700 for single filers and married filers filing separately, or $321,400 for married taxpayers filing jointly. In order for an books & magazines expense to be deductible, it must be considered an business cards ordinary and necessary expense. Standard deduction can’t be used. This includes both itemized deductions and other deductions such as for student loan interest and iras. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. Web employee salary deductions: The qbi was introduced under the tax cuts and jobs act of 2017, which sought. Web don’t get stuck with a huge tax bill next year! This deduction applies to sole proprietorships, partnerships, s corporations, certain trusts, and estates. Web don’t get stuck with a huge tax bill next year! Federal section>deductions>itemized deductions>medical and dental expenses if mfs and spouse itemizes, taxpayer must also itemize. The dollar limitation for employee salary deductions for contributions to health flexible spending arrangements increased from $2,750 to $2,850, and the maximum carryover amount for cafeteria plans will be $570 for the 2022 tax year, a $20 increase from the previous year. Web for tax years beginning after 2017, you may be entitled to take a deduction of up to 20% of your qualified business income from your qualified trade or business, plus 20% of the aggregate amount of qualified real estate investment trust (reit) and qualified publicly traded partnership income. The qbi was introduced under the tax cuts and jobs act of 2017, which sought. When we’re done, you’ll know exactly how to reduce your income tax bill by making sure you’re claiming all the tax deductions available to your small business. Build your document answer a few simple questions to make your document in minutes save now, finish later start now and save your progress, finish on any device download, print & share store securely, share online and make copies Web employee salary deductions: Web the most relevant part of this tax category for small businesses is a provision that allows deductions for business startup and organizational costs—typically capital expenditures. Web 24 small business tax deductions: Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Eligible small business owners who file form 1040 can take this one, though it phases out once you reach an income level of $160,700 for single filers and married filers filing separately, or $321,400 for married taxpayers filing jointly. Tax deductions for calendar year 2 0 ___ ___ hired$___________help $___________$___________ $___________$___________$___________ $___________accountantadministrativeagent/manager expensescontractedother. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right now in this blog post. This includes both itemized deductions and other deductions such as for student loan interest and iras. Publication 334, tax guide for small business (for individuals who use schedule c) publication 463, travel, gift, and car expenses.Self Employment Printable Small Business Tax Deductions Worksheet

8 Best Images of Tax Preparation Organizer Worksheet Individual

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

Small Business Tax Deduction Worksheets

8 Tax Itemized Deduction Worksheet /

Self Employment Printable Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheets

10++ Small Business Tax Deductions Worksheet

Small Business Tax Deductions Worksheet

Tax Deduction Worksheet Small business tax deductions, Small business

Id # Tax Year Ordinary Supplies The Purpose Of This Worksheet Is To Help You Organize Advertising Your Tax Deductible Business Expenses.

Simply Follow The Instructions On This Sheet And Start Lowering Your Social Security And Medicare Taxes.

Web Business Startup Costs And Organizational Costs:

December 16Th, 2021 Everyone’s Favorite Day Of The Year Is Right Around The Corner:

Related Post: