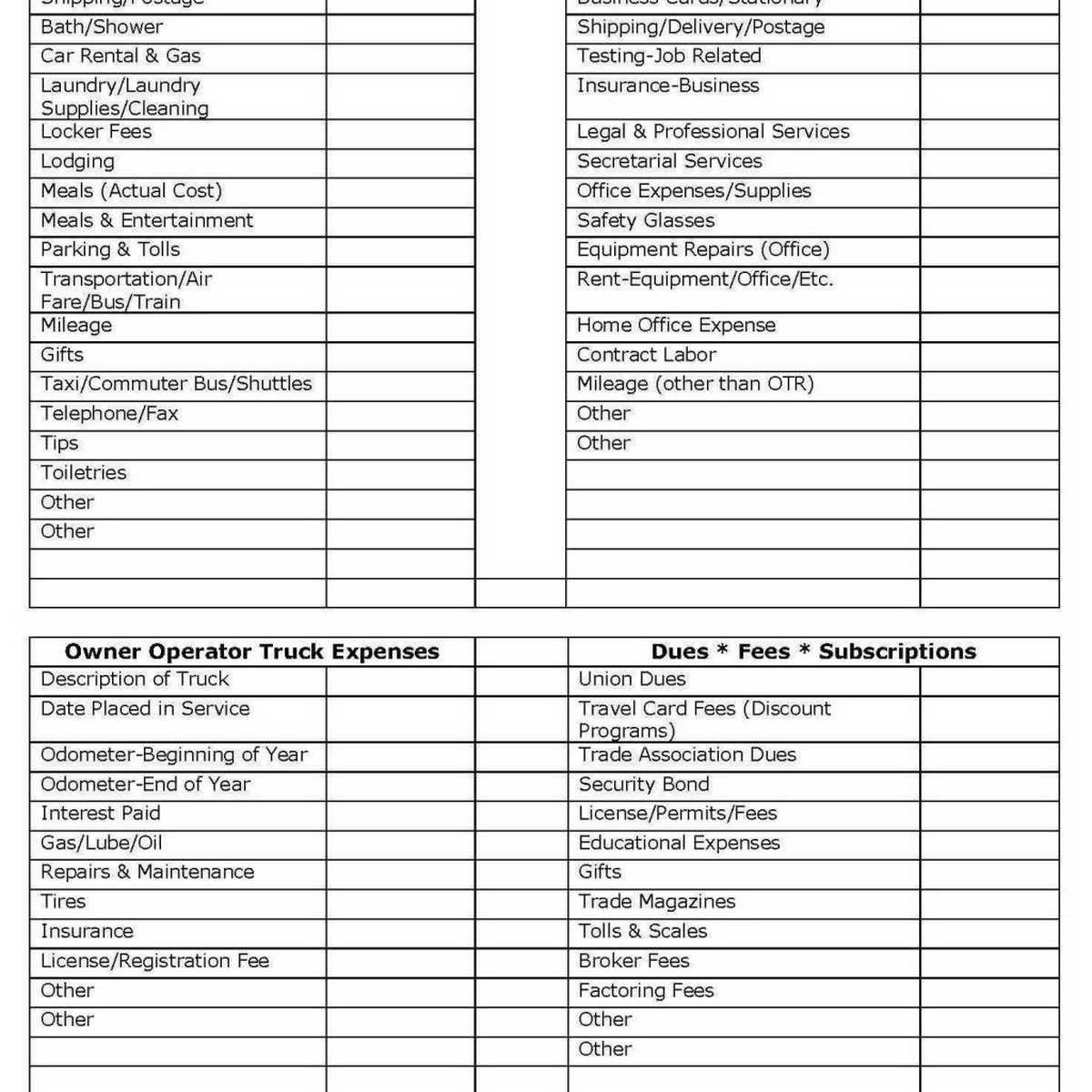

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

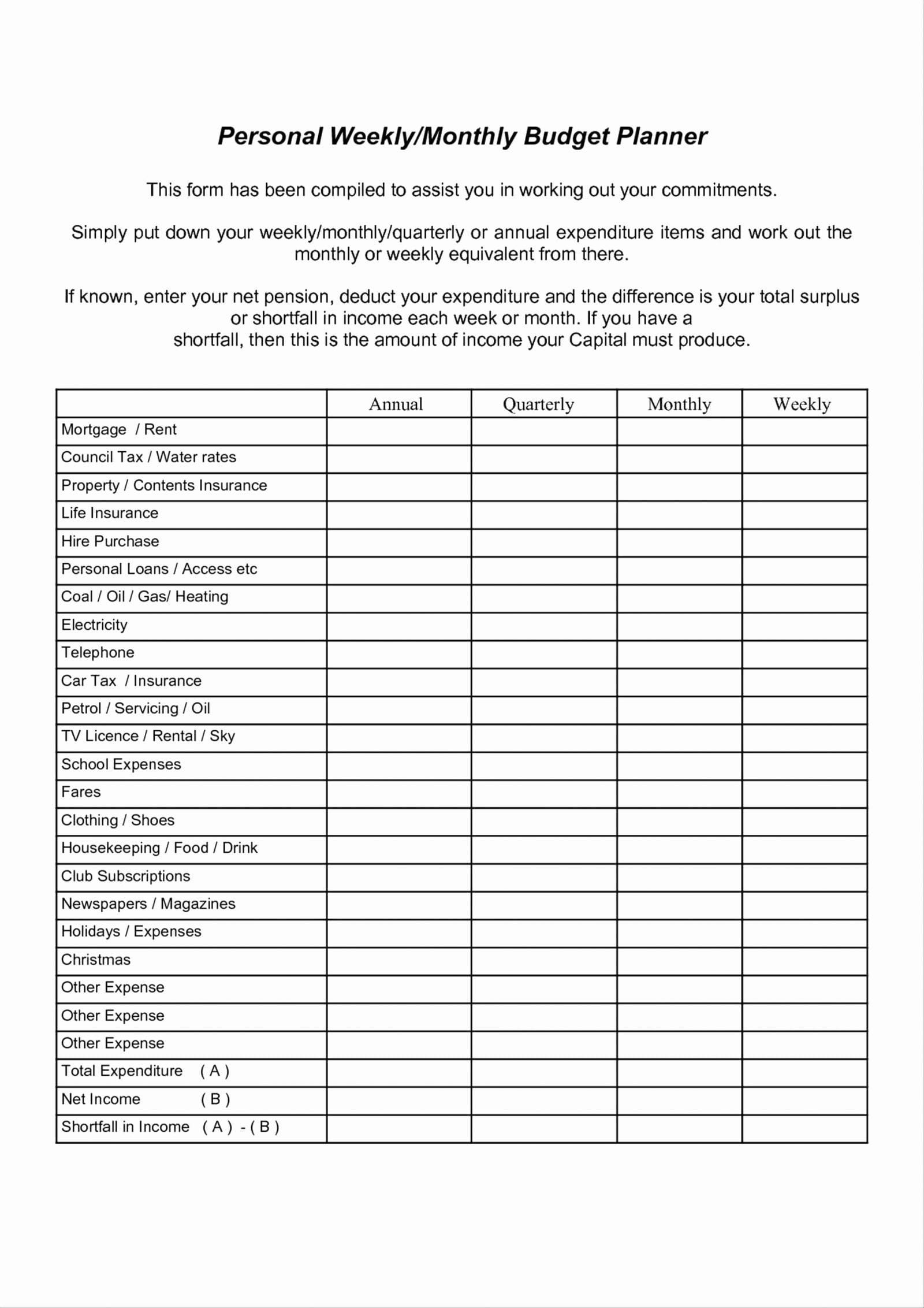

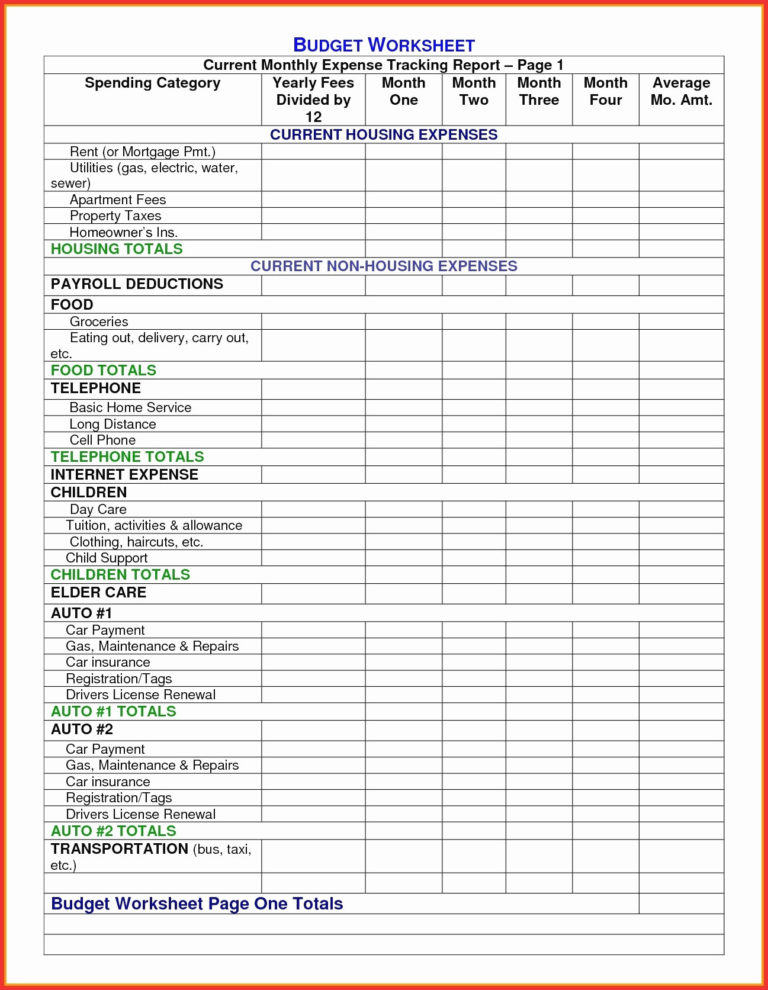

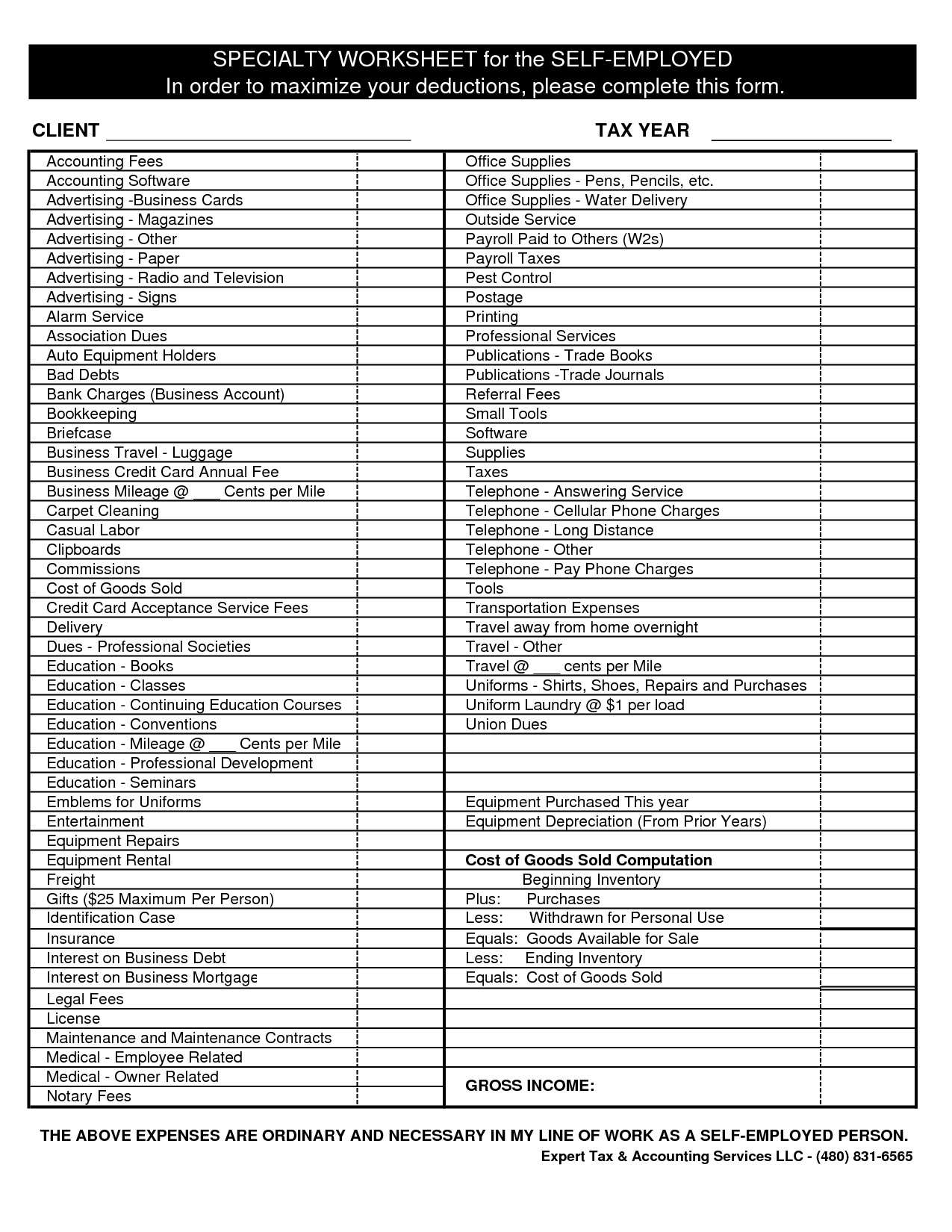

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Web forms that you should file as a truck driver depends on your type of employment: Sales of equipment, machinery, land, buildings held for. You can also download it, export it or print it out. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. Since they aren't an employee they won't receive a form. Web tax deductions for owner operators reduce the amount of self. Web up to $40 cash back truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability. With this form, you can track your mileage, fuel costs, and other expenses. Use get form or simply click on the template preview to open it in the editor. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Web who can claim truck driver tax deductions? Web tax deductions for owner operators reduce the amount of self. Web send 2020 truck driver tax deductions worksheet via email, link, or fax. Web forms that you should file as a truck driver depends on your type of employment: Web truck driver tax deductions may include any expenses that are ordinary. Web tax deductions for owner operators reduce the amount of self. Web web 19 truck driver tax deductions that will save you money. Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Taxes and deductions that may be considered. Use get form or simply click on the template preview to open it in the. Web this truck driver expenses worksheet form can help make the process a little easier. Web who can claim truck driver tax deductions? Use get form or simply click on the template preview to open it in the editor. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household,. Web web 19 truck driver tax deductions that will save you money. With this form, you can track your mileage, fuel costs, and other expenses. Web most truck driver pay about $550 dollar for heavy highway use tax. Select the document you want to sign and. Use get form or simply click on the template preview to open it in. With this form, you can track your mileage, fuel costs, and other expenses. Web this truck driver expenses worksheet form can help make the process a little easier. Web up to $40 cash back truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability. Use get form or simply. Taxes and deductions that may be considered. Web tax deductions for owner operators reduce the amount of self. You can also download it, export it or print it out. Use get form or simply click on the template preview to open it in the editor. Web truck driver tax deductions may include any expenses that are ordinary and necessary to. Web this truck driver expenses worksheet form can help make the process a little easier. You can also download it, export it or print it out. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. This is 100% tax deductible and truck driver can. Select the document you want to sign and. Since they aren't an employee they won't receive a form. Web web 19 truck driver tax deductions that will save you money. Web send 2020 truck driver tax deductions worksheet via email, link, or fax. Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? You can also download it, export it or print it out. Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Edit your tax deduction worksheet for truck. Select the document you want to sign and. Web truck rental fees individual at any one time—or in accumulated amounts—during. Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Web this truck driver expenses worksheet form can help make the process a little easier. Since they aren't an employee they won't receive a form. Taxes and deductions that may be considered. Use get form or simply click on the template preview to open it. Web most truck driver pay about $550 dollar for heavy highway use tax. With this form, you can track your mileage, fuel costs, and other expenses. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Web this truck driver expenses worksheet form can help make the process a little easier. Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. Web truck driver tax deductions may include any expenses that are ordinary and necessary to the business of being a truck driver. Web web 19 truck driver tax deductions that will save you money. Edit your tax deduction worksheet for truck. Web who can claim truck driver tax deductions? Web send 2020 truck driver tax deductions worksheet via email, link, or fax. You can also download it, export it or print it out. Since they aren't an employee they won't receive a form. Sales of equipment, machinery, land, buildings held for. Web forms that you should file as a truck driver depends on your type of employment: Web up to $40 cash back truck driver tax deductions are expenses that truck drivers can subtract from their taxable income to reduce their overall tax liability. Select the document you want to sign and. Web tax deductions for owner operators reduce the amount of self. Taxes and deductions that may be considered. Use get form or simply click on the template preview to open it in the editor. Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Web truck rental fees individual at any one time—or in accumulated amounts—during this tax year? Web who can claim truck driver tax deductions? Web the standard tax deduction stands at $12,550 for single people or married couples filing separately, $18,800 for head of household, and $25,100 for married. Web web 19 truck driver tax deductions that will save you money. Since they aren't an employee they won't receive a form. You can also download it, export it or print it out. Web forms that you should file as a truck driver depends on your type of employment: Taxes and deductions that may be considered. Web this truck driver expenses worksheet form can help make the process a little easier. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Edit your tax deduction worksheet for truck. Web most truck driver pay about $550 dollar for heavy highway use tax. Use get form or simply click on the template preview to open it in the editor. Sales of equipment, machinery, land, buildings held for. Select the document you want to sign and. Web send 2020 truck driver tax deductions worksheet via email, link, or fax.Truck Driver Tax Deductions Worksheet —

Tax worksheet realtors Fill out & sign online DocHub

Truck Driver Expense Spreadsheet Then Owner Operator —

Truck Driver Expenses Worksheet ≡ Fill Out Printable PDF Forms Online

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

Truck Expenses Worksheet Spreadsheet template, Printable worksheets

Self Employed Tax Deductions Worksheet 2016 —

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

20 Unique Truck Driver Tax Deductions Worksheet

Owner Operator Expense Spreadsheet Google Spreadshee owner operator

Web Up To $40 Cash Back Truck Driver Tax Deductions Are Expenses That Truck Drivers Can Subtract From Their Taxable Income To Reduce Their Overall Tax Liability.

Web Tax Deductions For Owner Operators Reduce The Amount Of Self.

With This Form, You Can Track Your Mileage, Fuel Costs, And Other Expenses.

Web Truck Driver Tax Deductions May Include Any Expenses That Are Ordinary And Necessary To The Business Of Being A Truck Driver.

Related Post: