Public Housing Rent Calculation Worksheet

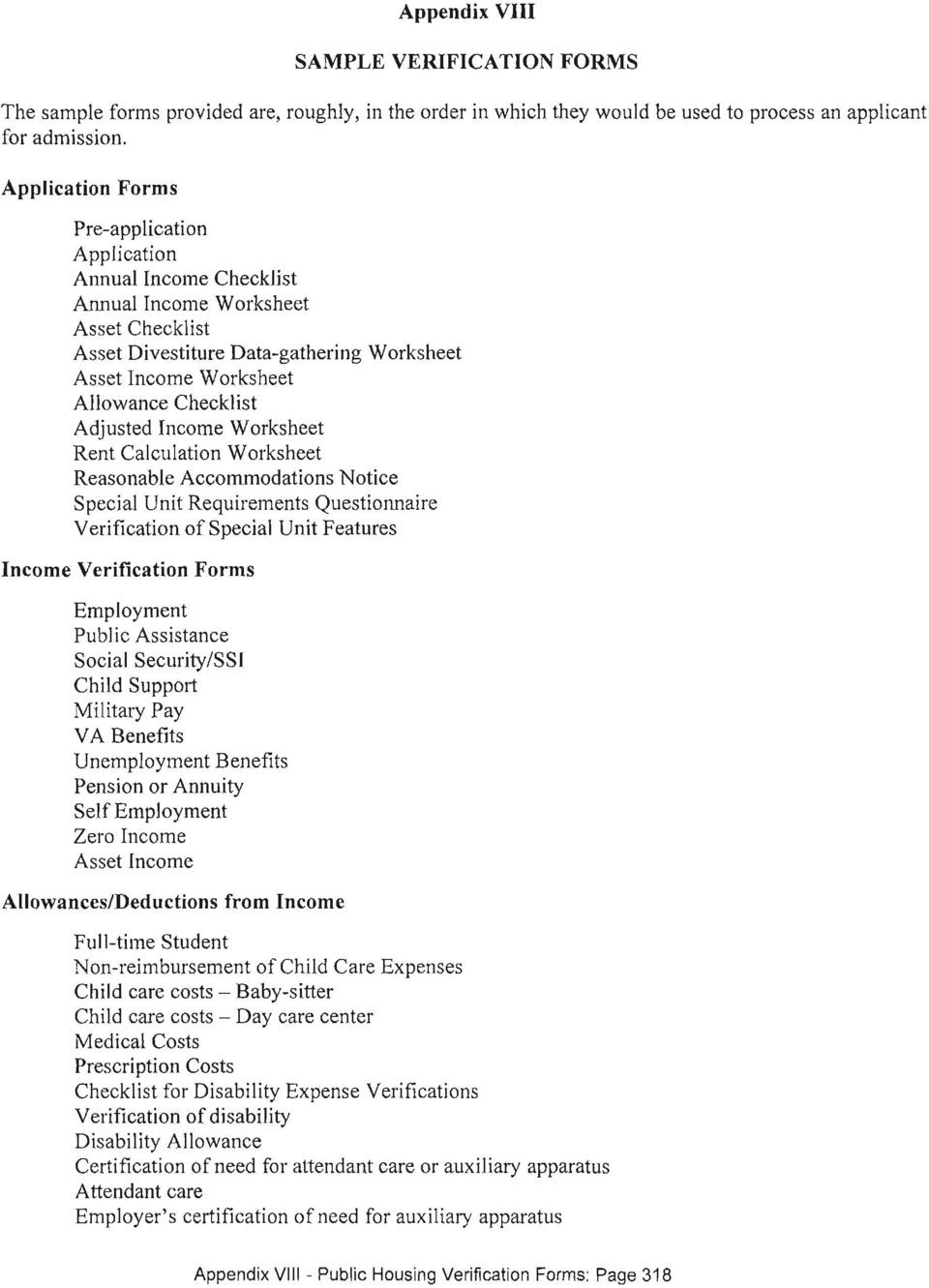

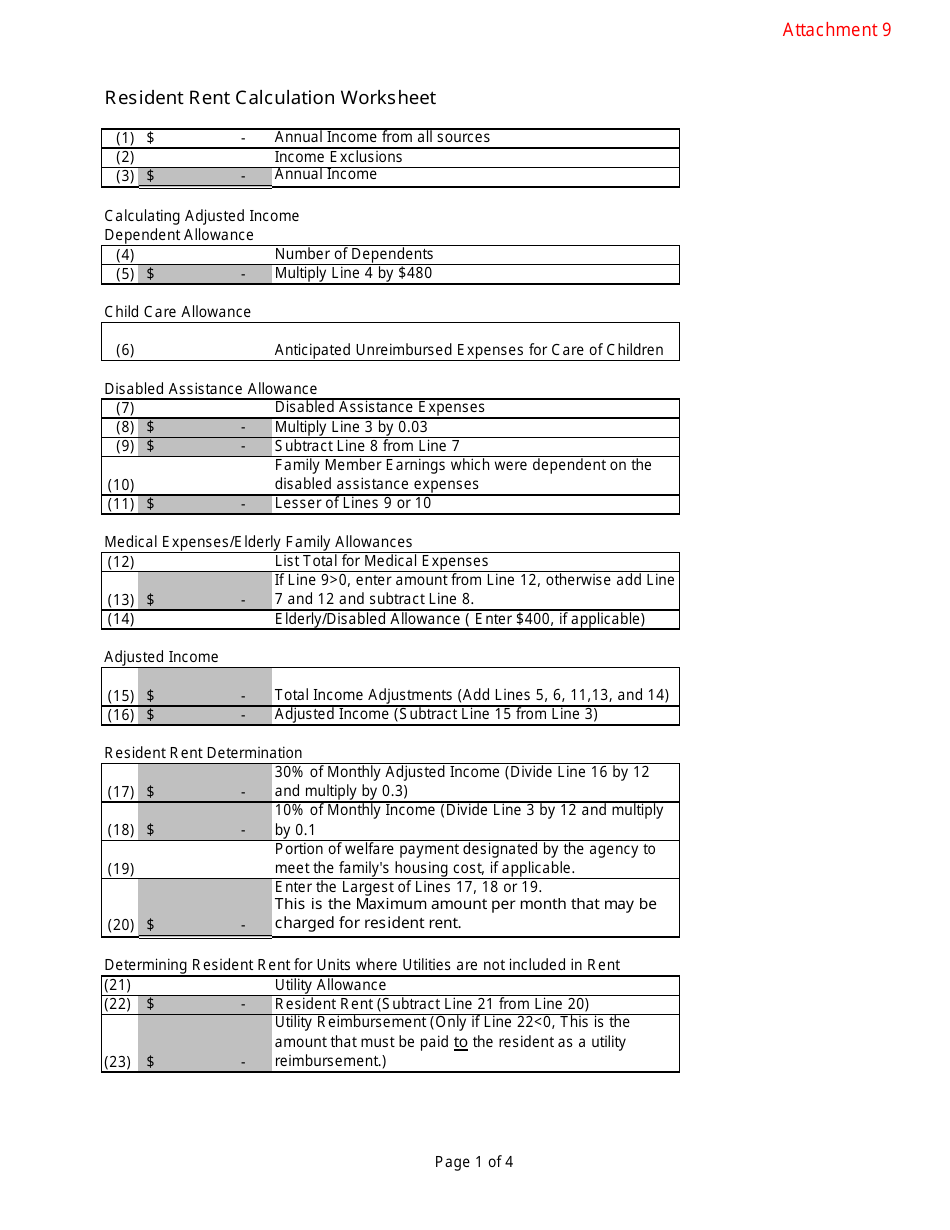

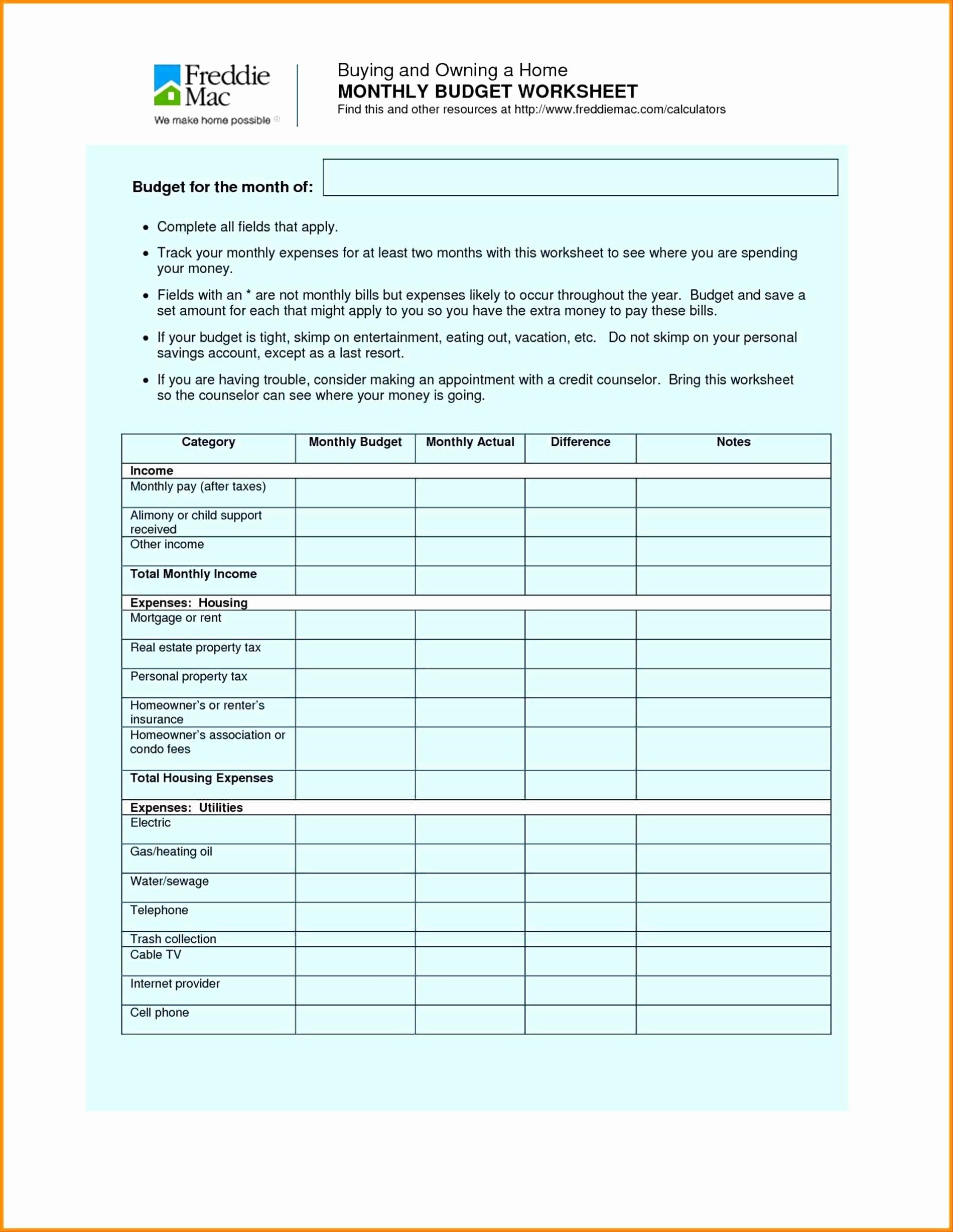

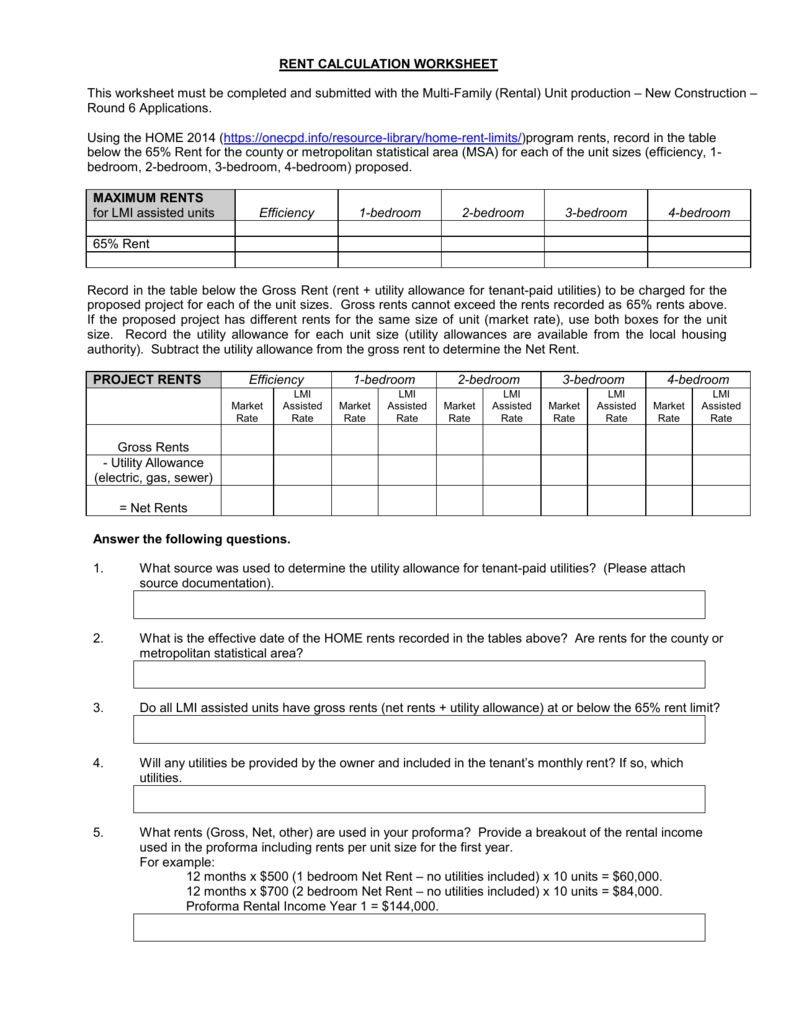

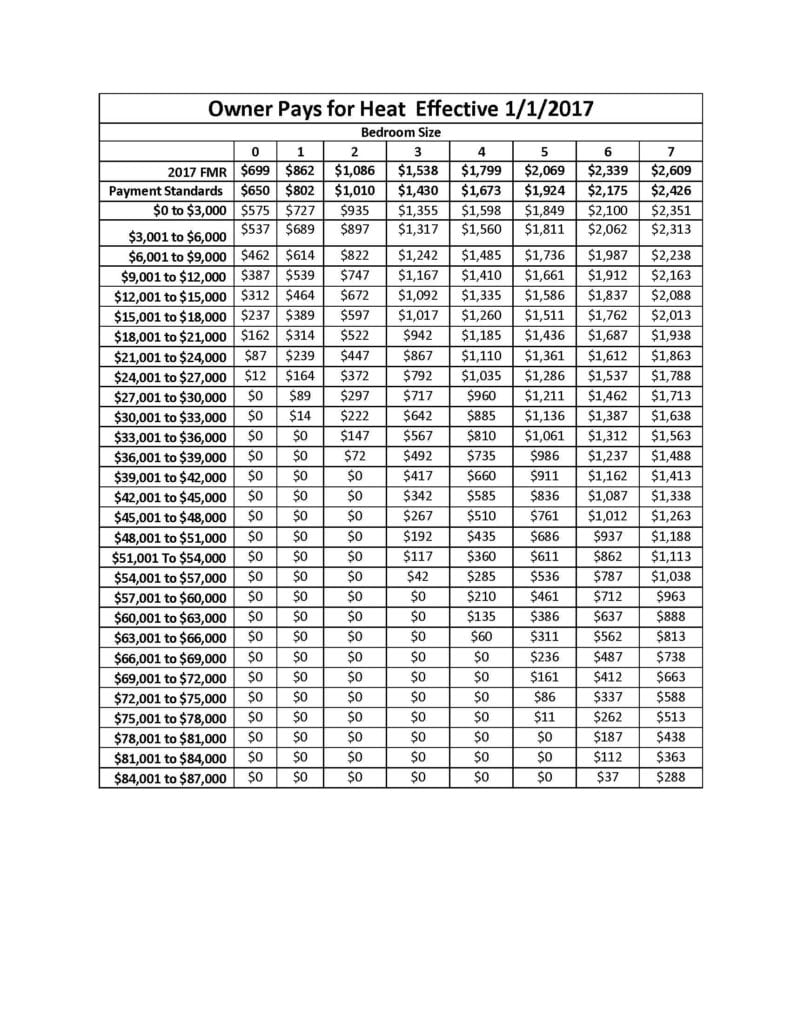

Public Housing Rent Calculation Worksheet - Determine the childcare deduction step 4: $15,600 ($1,300 x 12 months). Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. Determine the annual income step 2: The gross rent is the sum of the rent to owner plus an. Enter gross rent (rent to owner plus utilities) $_____. Web calculate annual income based on current income: If you live in minneapolis public housing, the mpha self. Figure out your annual income: The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. Web how are tenant rent charges calculated? Determine the annual income step 2: Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. Figure. Web to correctly calculate the housing assistance payment (hap), the pha first calculates the gross rent for the family’s unit. Figure out your annual income: The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. If maximum family rent is over 40% monthly adjusted income,. The gross rent is. The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. Determine the dependent deduction step 3: Determine the disability assistance deduction. Determine the annual income step 2: Maximum family rent is 40% monthly adjusted income. Add up the following sources of income for everyone in your household: Web calculate annual income based on current income: Web rent calculation quick guide & calculator the new york city housing authority and new york city department housing preservation and development the following guide. If you live in minneapolis public housing, the mpha self. Web worksheet for prorated rent. The owner would then conduct an interim recertification at the end of the school year to. The landlord will start the. Determine the disability assistance deduction. Determine the annual income step 2: Web worksheet for prorated rent for citizen/noncitizen mixed families (housing choice voucher) 1. Add up the following sources of income for everyone in your household: Determine the disability assistance deduction. Web worksheet for prorated rent for citizen/noncitizen mixed families (housing choice voucher) 1. The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. Web rent calculation quick guide & calculator the new. Web worksheet for prorated rent for citizen/noncitizen mixed families (housing choice voucher) 1. Maximum family rent is 40% monthly adjusted income. Web calculate annual income based on current income: Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. If maximum. Determine the dependent deduction step 3: Enter gross rent (rent to owner plus utilities) $_____. Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. Add up the following sources of income for everyone in your household: Web to correctly calculate the housing assistance payment. Web 10 percent of monthly gross income (divide the total annual income by 12 and multiply by 0.1) the portion of the family’s welfare assistance, if any, that is designated for housing. Determine the annual income step 2: Determine the childcare deduction step 4: To determine the annual income: The gross rent is the sum of the rent to owner. Web rent calculation quick guide & calculator the new york city housing authority and new york city department housing preservation and development the following guide. Web 10 percent of monthly gross income (divide the total annual income by 12 and multiply by 0.1) the portion of the family’s welfare assistance, if any, that is designated for housing. If you live. Web worksheet for prorated rent for citizen/noncitizen mixed families (housing choice voucher) 1. Web calculate annual income based on current income: Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income. The amount of rent or occupancy charges owed by the program participant is calculated using the family’s annual income less allowable. Maximum family rent is 40% monthly adjusted income. If you live in minneapolis public housing, the mpha self. The gross rent is the sum of the rent to owner plus an. The owner would then conduct an interim recertification at the end of the school year to. The landlord will start the. Web 10 percent of monthly gross income (divide the total annual income by 12 and multiply by 0.1) the portion of the family’s welfare assistance, if any, that is designated for housing. Add up the following sources of income for everyone in your household: Determine the disability assistance deduction. To determine the annual income: Determine the dependent deduction step 3: Web how are tenant rent charges calculated? Web to correctly calculate the housing assistance payment (hap), the pha first calculates the gross rent for the family’s unit. Enter gross rent (rent to owner plus utilities) $_____. $15,600 ($1,300 x 12 months). Web this worksheet calculates the gross household income as well as providing for eligible adjustments to determine the amount of rent that the recipient will pay to the landlord,. Determine the annual income step 2: Determine the disability assistance deduction. Web 10 percent of monthly gross income (divide the total annual income by 12 and multiply by 0.1) the portion of the family’s welfare assistance, if any, that is designated for housing. Web rent calculation quick guide & calculator the new york city housing authority and new york city department housing preservation and development the following guide. Web to correctly calculate the housing assistance payment (hap), the pha first calculates the gross rent for the family’s unit. The landlord will start the. Maximum family rent is 40% monthly adjusted income. To determine the annual income: Determine the annual income step 2: Add up the following sources of income for everyone in your household: Figure out your annual income: The owner would then conduct an interim recertification at the end of the school year to. Web worksheet for prorated rent for citizen/noncitizen mixed families (housing choice voucher) 1. The gross rent is the sum of the rent to owner plus an. If you live in minneapolis public housing, the mpha self. If maximum family rent is over 40% monthly adjusted income,. Web this worksheet will determine the household rent payment based on the greatest of 10% of monthly gross income or 30% of monthly adjusted income.Public Housing Rent Calculation Worksheet —

Public Housing Rent Calculation Worksheet —

(PDF) Public Housing Rent Calculation Changes...Public Housing Rent

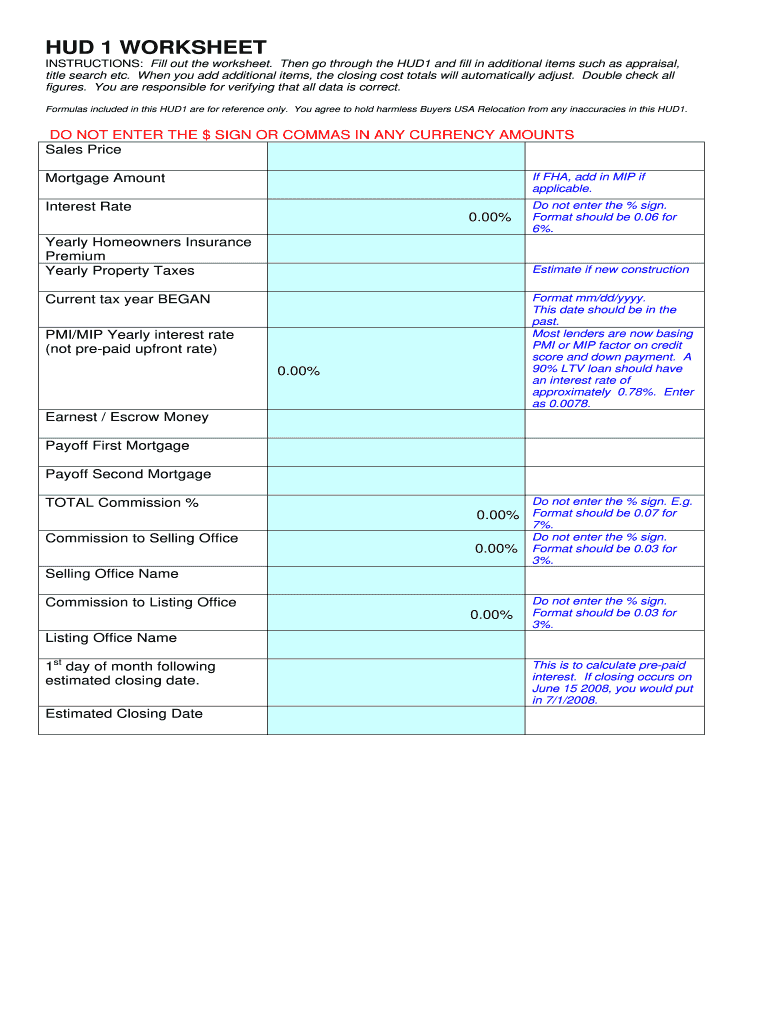

Hud Calculation Worksheet Studying Worksheets

Attachment 9 Download Printable PDF or Fill Online Resident Rent

Public Housing Rent Calculation Worksheet —

Public Housing Rent Calculation Worksheet —

Rental Calculation Worksheet Master of Documents

Public Housing Rent Calculation Worksheet —

15 Beautiful Hud Rent Calculation Worksheet

Web This Worksheet Calculates The Gross Household Income As Well As Providing For Eligible Adjustments To Determine The Amount Of Rent That The Recipient Will Pay To The Landlord,.

Determine The Childcare Deduction Step 4:

Web Calculate Annual Income Based On Current Income:

Enter Gross Rent (Rent To Owner Plus Utilities) $_____.

Related Post: