Publication 523 Worksheet

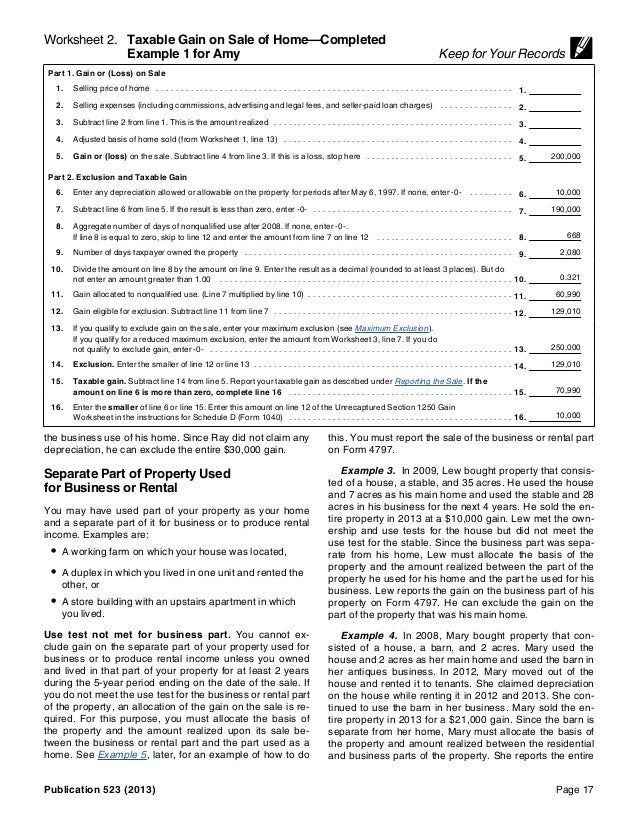

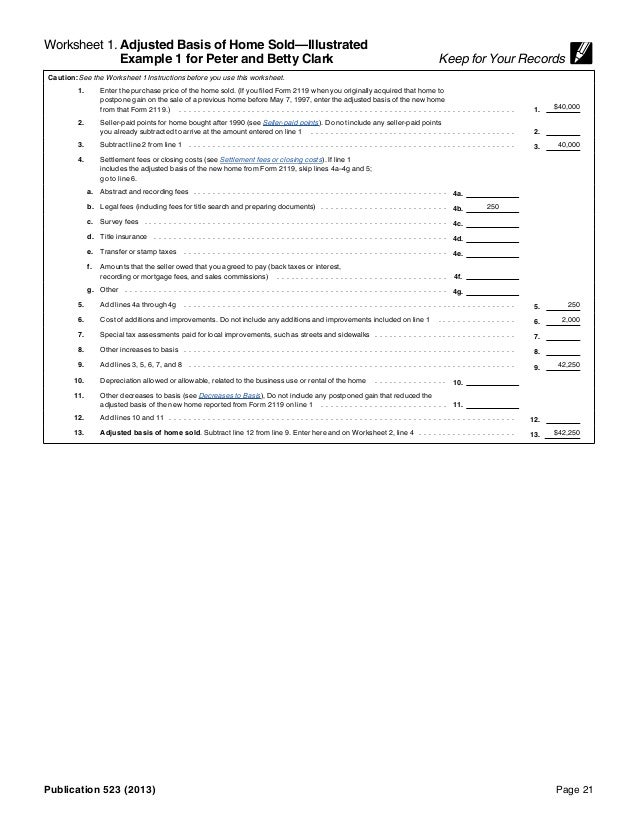

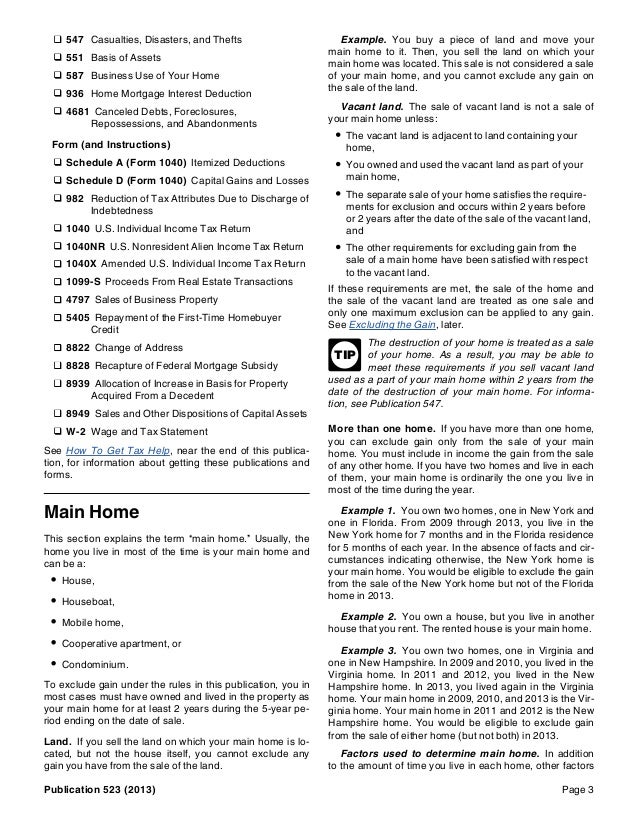

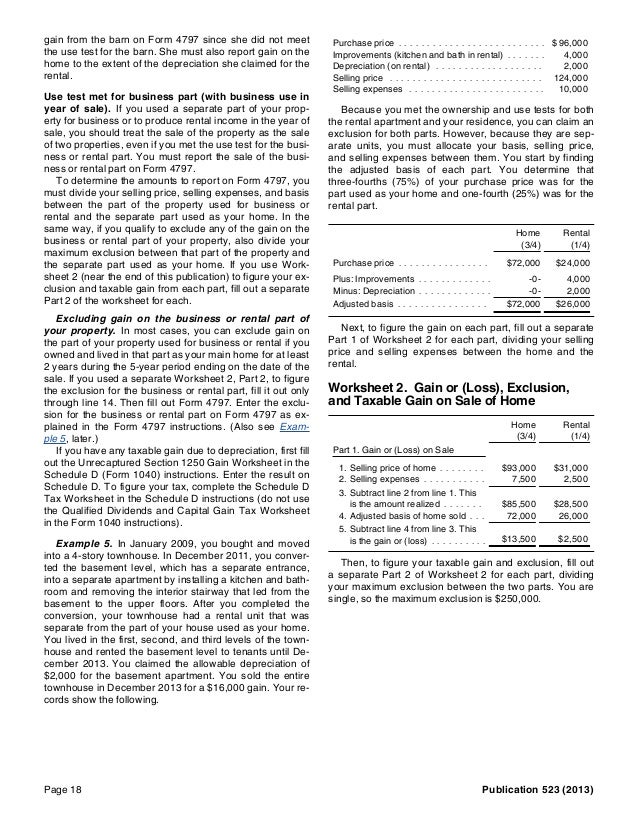

Publication 523 Worksheet - Web you owned your home jointly with your spouse who died. Factors used to determine main home. Web complete your “total” worksheet using the figures for your property as a whole. Web once you've determined the gain or loss on the sale of the taxpayer's home, then figure the exclusion of any taxable gain from the sale. Get tax help with tax on property sales. Selling your home at www.irs.gov. Get your online template and fill it in using progressive features. Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. 523, such as legislation enacted after it was published, go to irs.gov/pub523. You can access the worksheet for how to figure your gain or loss on the sale of a home at. Must be removed before printing. If you meet certain conditions, you may exclude the first $250,000. You don’t have to navigate your taxes solo… h&r. The exclusion is increased to. It will show you how to: Get tax help with tax on property sales. It will show you how to: If you meet certain conditions, you may exclude the first $250,000. You can access the worksheet for how to figure your gain or loss on the sale of a home at. Factors used to determine main home. Web to learn more, see publication 523: Determine if you have a gain or loss on the sale of your home, 2. You can access the worksheet for how to figure your gain or loss on the sale of a home at. Enjoy smart fillable fields and interactivity. It will show you how to: Web complete your “total” worksheet using the figures for your property as a whole. It also contains worksheets to help you prepare your tax return and calculate your exclusion. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. Must be. Per irs publication 523 selling your home, within the worksheet on page 12: Must be removed before printing. It also contains worksheets to help you prepare your tax return and calculate your exclusion. If you meet certain conditions, you may exclude the first $250,000. Selling your home at www.irs.gov. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Selling your home at www.irs.gov. The exclusion is increased to. Get your online template and fill it in using progressive features. The requirements of ownership and use for periods. Web complete your “total” worksheet using the figures for your property as a whole. Web you owned your home jointly with your spouse who died. Web the amount realized on the sale of your home is the selling price minus selling expenses. Enjoy smart fillable fields and interactivity. What's new extension of the exclusion of canceled or forgiven mortgage debt. If you meet certain conditions, you may exclude the first $250,000. Get your online template and fill it in using progressive features. It also contains worksheets to help you prepare your tax return and calculate your exclusion. You don’t have to navigate your taxes solo… h&r. Use the how to figure the taxable gain or. Determine if you have a gain or loss on the sale of your home, 2. The exclusion is increased to. Web this publication also has worksheets for calculations relating to the sale of your home. Must be removed before printing. Use the how to figure the taxable gain or. If you meet certain conditions, you may exclude the first $250,000. Must be removed before printing. You don’t have to navigate your taxes solo… h&r. Web the amount realized on the sale of your home is the selling price minus selling expenses. Get tax help with tax on property sales. You can access the worksheet for how to figure your gain or loss on the sale of a home at. Web the amount realized on the sale of your home is the selling price minus selling expenses. Per irs publication 523 selling your home, within the worksheet on page 12: Web you owned your home jointly with your spouse who died. Must be removed before printing. Web pub 523 is an irs publication that explains the rules for claiming a home exclusion. Web how to fill out and sign publication 523 online? Get tax help with tax on property sales. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. What's new extension of the exclusion of canceled or forgiven mortgage debt from income. Web to learn more, see publication 523: 523, such as legislation enacted after it was published, go to irs.gov/pub523. Web once you've determined the gain or loss on the sale of the taxpayer's home, then figure the exclusion of any taxable gain from the sale. Factors used to determine main home. Get your online template and fill it in using progressive features. The requirements of ownership and use for periods. Use the how to figure the taxable gain or. Web this publication explains the tax rules that apply when you sell or otherwise give up ownership of a home. Web complete your “total” worksheet using the figures for your property as a whole. Must be removed before printing. Must be removed before printing. You can access the worksheet for how to figure your gain or loss on the sale of a home at. Web complete your “total” worksheet using the figures for your property as a whole. What's new extension of the exclusion of canceled or forgiven mortgage debt from income. The requirements of ownership and use for periods. Web how to fill out and sign publication 523 online? Enjoy smart fillable fields and interactivity. Web the amount realized on the sale of your home is the selling price minus selling expenses. Web once you've determined the gain or loss on the sale of the taxpayer's home, then figure the exclusion of any taxable gain from the sale. It also contains worksheets to help you prepare your tax return and calculate your exclusion. Selling your home at www.irs.gov. Web you owned your home jointly with your spouse who died. Web if you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. Get tax help with tax on property sales. If you meet certain conditions, you may exclude the first $250,000. Determine if you have a gain or loss on the sale of your home, 2.Publication 523 Worksheet / Capital Gains Tax Worksheet Irs Jobs

IRS Pub 523

IRS Pub 523

Publication 523 Selling Your Home; Excluding the Gain

IRS Pub 523

IRS Pub 523

IRS Pub 523

Publication 523 Selling Your Home 2003 printable pdf download

IRS Pub 523

F 1120x Instructions

Factors Used To Determine Main Home.

It Will Show You How To:

The Exclusion Is Increased To.

523, Such As Legislation Enacted After It Was Published, Go To Irs.gov/Pub523.

Related Post: