Publication 575 Worksheet A Simplified Method

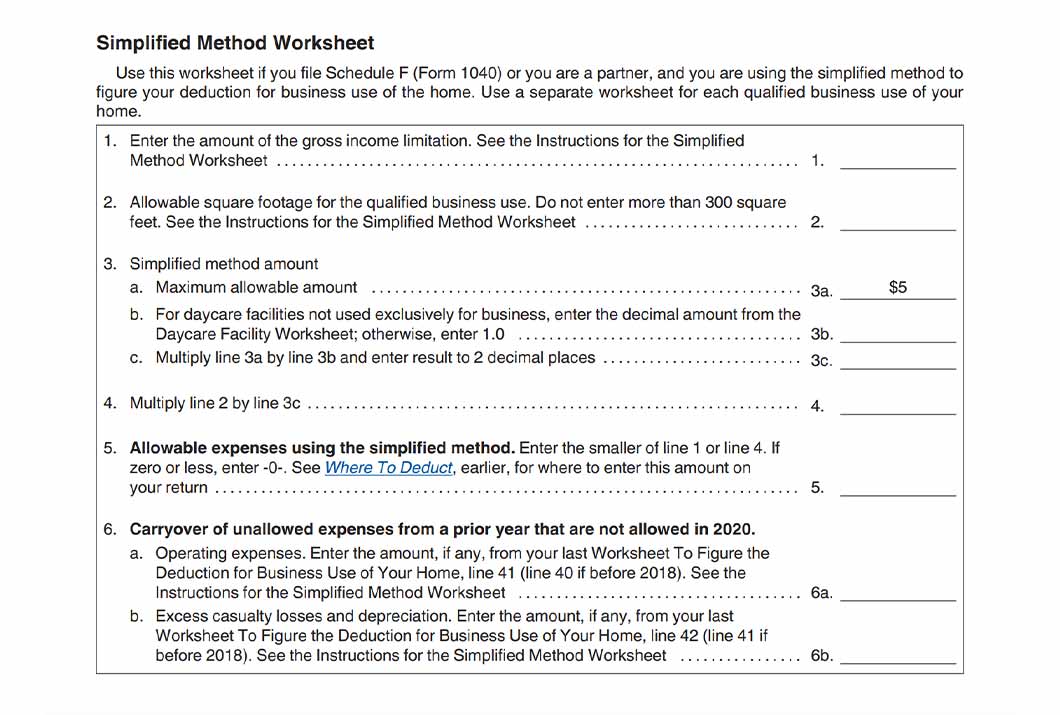

Publication 575 Worksheet A Simplified Method - Web what is covered in this publication? Web publication 575, pension and annuity income describes the simplified method and includes the worksheet at the end of the publication. Find the gcd (or hcf) of numerator and denominator gcd of 575 and 100 is 25; Web what is covered in this publication? Web see irs publication 575 pension and annuity income for the definition of guaranteed payments. Web simplified method worksheet—lines 4a and 4b. How to report pension and annuity income. * a death benefit exclusion (up to $5,000) applied to certain benefits received by employees who died before august 21, 1996. Web who cannot use the simplified method. Web the simplified general rule worksheet. Web you must use the simplified method if your annuity starting date was after november 18, 1996, you meet condition 1, and you meet one of the conditions in condition 2. This publication discusses the tax treatment of distributions you receive from. Enter the total pension or annuity. Web what is covered in this publication? * a death benefit exclusion. Web publication 575, pension and annuity income describes the simplified method and includes the worksheet at the end of the publication. If you begin receiving annuity payments from a qualified retirement plan after. Web publication 4012 publication 575. Find the gcd (or hcf) of numerator and denominator gcd of 575 and 100 is 25; Web see irs publication 575 pension. Web simplified method worksheet—lines 4a and 4b. Find the gcd (or hcf) of numerator and denominator gcd of 575 and 100 is 25; This publication discusses the tax treatment of distributions you receive from. Web publication 4012 publication 575. Web the simplified general rule worksheet. How to report pension and annuity income. Web what is covered in this publication? Web you must use the simplified method if your annuity starting date was after november 18, 1996, you meet condition 1, and you meet one of the conditions in condition 2. Web publication 575, pension and annuity income describes the simplified method and includes the worksheet. How to report pension and annuity income. If you begin receiving annuity payments from a qualified retirement plan after. Web the irs provides a simplified method worksheet to help you along. Web publication 4012 publication 575. Enter the total pension or annuity payments received this year. Web publication 575, pension and annuity income describes the simplified method and includes the worksheet at the end of the publication. If you had more than one partially taxable pension or annuity,. This publication discusses the tax treatment of distributions you receive from. Web what is covered in this publication? You cannot use the simplified method if you receive your. How to report pension and annuity income. Web what is covered in this publication? Web what is covered in this publication? Web for the beneficiary of an employee who died, see publication 575, pensions and annuities. Web publication 575 is an irs guide that specifies how taxpayers are to report distributions received from pensions and annuities on their annual tax. Web what is covered in this publication? Web simplified method worksheet—lines 4a and 4b. Web information about publication 575, pension and annuity income, including recent updates. Web the simplest form of 575 / 100 is 23 / 4. This publication discusses the tax treatment of distributions you receive from. Web who cannot use the simplified method. Enter the total pension or annuity. If you had more than one partially taxable pension or annuity,. Web this letter provides a summary of the information found in irs publication 575, “pension and annuity income.” it shows how imrf determines what portion of your. Web the irs provides a simplified method worksheet to. Web choosing the simplified method worksheet. How to report pension and annuity income. Web see irs publication 575 pension and annuity income for the definition of guaranteed payments. Web publication 575 is an irs guide that specifies how taxpayers are to report distributions received from pensions and annuities on their annual tax returns. Web this letter provides a summary of. Web who cannot use the simplified method. Enter the total pension or annuity. * a death benefit exclusion (up to $5,000) applied to certain benefits received by employees who died before august 21, 1996. Web you must use the simplified method if your annuity starting date was after november 18, 1996, you meet condition 1, and you meet one of the conditions in condition 2. Web see irs publication 575 pension and annuity income for the definition of guaranteed payments. Web what is covered in this publication? If you begin receiving annuity payments from a qualified retirement plan after. Web information about publication 575, pension and annuity income, including recent updates. You cannot use the simplified method if you receive your pension or annuity from a nonqualified plan or otherwise do not meet the. This publication discusses the tax treatment of distributions you receive from. Web see irs publication 575 pension and annuity income for the definition of guaranteed payments. Web publication 575, pension and annuity income describes the simplified method and includes the worksheet at the end of the publication. Web for the beneficiary of an employee who died, see publication 575, pensions and annuities. Web the simplest form of 575 / 100 is 23 / 4. If you had more than one partially taxable pension or annuity,. Web simplified method worksheet—lines 4a and 4b. How to report pension and annuity income. If you are the bene ciary of a deceased employee or former employee who died. Web publication 575 is an irs guide that specifies how taxpayers are to report distributions received from pensions and annuities on their annual tax returns. Find the gcd (or hcf) of numerator and denominator gcd of 575 and 100 is 25; Web choosing the simplified method worksheet. Web the simplest form of 575 / 100 is 23 / 4. Enter the total pension or annuity payments received this year. Web the irs provides a simplified method worksheet to help you along. Web what is covered in this publication? Web for the beneficiary of an employee who died, see publication 575, pensions and annuities. If you begin receiving annuity payments from a qualified retirement plan after. This publication discusses the tax treatment of distributions you receive from. Web you must use the simplified method if your annuity starting date was after november 18, 1996, you meet condition 1, and you meet one of the conditions in condition 2. If you had more than one partially taxable pension or annuity,. * a death benefit exclusion (up to $5,000) applied to certain benefits received by employees who died before august 21, 1996. Find the gcd (or hcf) of numerator and denominator gcd of 575 and 100 is 25; Web the simplified general rule worksheet. Enter the total pension or annuity. Web who cannot use the simplified method. Web what is covered in this publication?Simplified Method Worksheet 2020 Home Office Irs Jay Sheets

Home Office Tax Deduction What to Know Fast Capital 360®

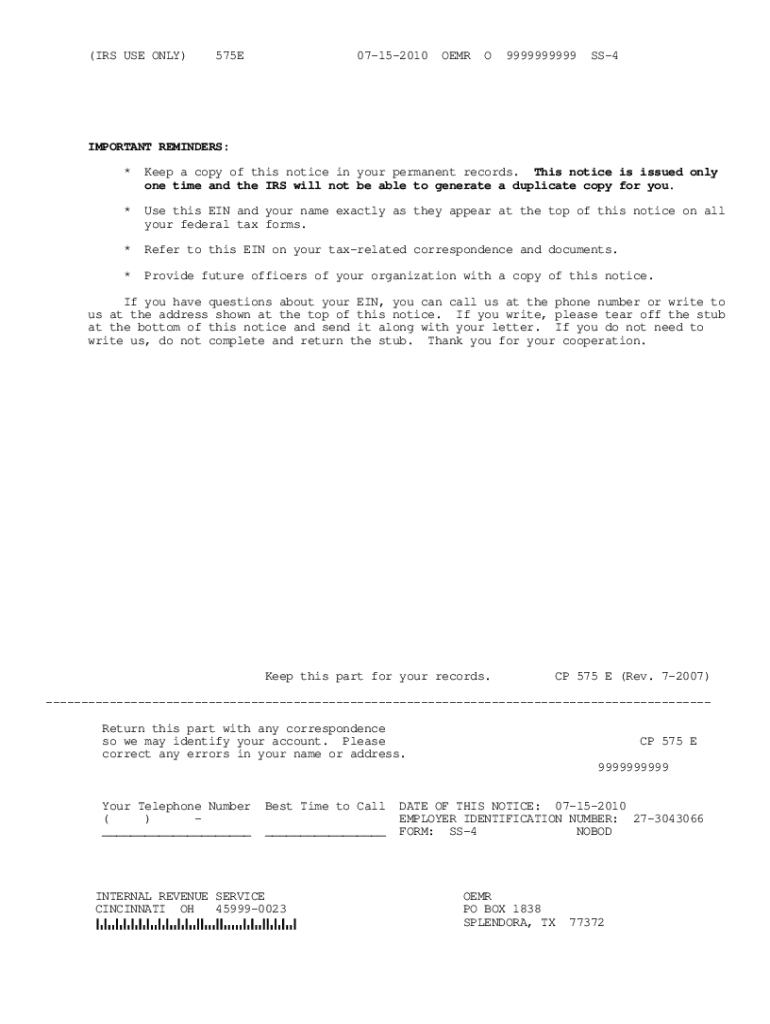

IRS 575E Fill out Tax Template Online US Legal Forms

Simplified Method Worksheet 2021 Home Office Simplified Method

Publication 575 Worksheet A Simplified Method Is Tripmart

Publication 575 Worksheet A Simplified Methodology Gettrip24

Simplified Worksheet 2022 North Carolina Worksheet The Art of Images

Publication 575 Pension And Annuity 2004 printable pdf download

Publication 575 Pension and Annuity Pension & Annuity

Publication 721 Uncle Fed's Tax*Board

Web Simplified Method Worksheet—Lines 4A And 4B.

Web See Irs Publication 575 Pension And Annuity Income For The Definition Of Guaranteed Payments.

How To Report Pension And Annuity Income.

Web This Letter Provides A Summary Of The Information Found In Irs Publication 575, “Pension And Annuity Income.” It Shows How Imrf Determines What Portion Of Your.

Related Post: