Pvw-Payment Voucher Worksheet

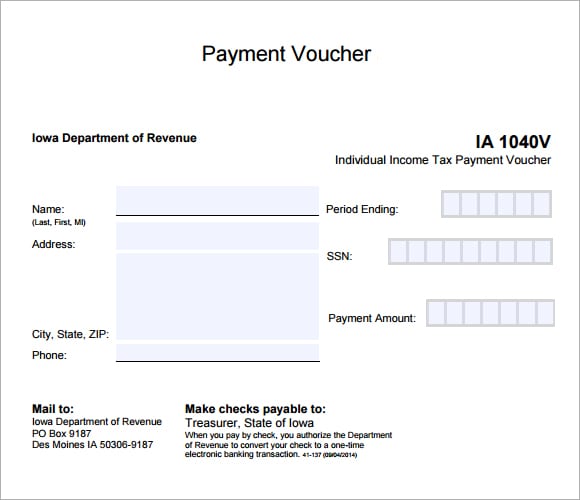

Pvw-Payment Voucher Worksheet - Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. Open the maryland form 505 and follow the. • if you are not. Web time making an estimated payment or if filing status has changed. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. If you are filing on a fiscal year basis, each payment is due by the 15th day of the 4th, 6th, 9th and 13th months following the beginning of the fiscal year. It appears you don't have a pdf plugin for this. Web please refer to payment voucher worksheet (pvw) for estimated tax and extension payments instructions. • enter the exact amount of your payment in dollars and cents. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. • enter the exact amount of your payment in dollars and cents. • enter the exact amount of your payment in dollars and cents. Web you can use this calculator to compute the amount of tax due, but this system does not allow you to file or pay the amount online. Web time making an estimated payment or if filing. • enter the exact amount of your payment in dollars and cents. Web 36 rows showing 1 to 25 of 35 entries. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web the new maryland payment voucher worksheet (pvw) must be used to determine the amount of the estimated payment or extension payment required.. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. • enter the exact amount of your payment in dollars and cents. Web payment voucher worksheet for estimated tax and. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web 36 rows showing 1 to 25 of 35 entries. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. Web time making an estimated payment or if filing status has changed. Web. • if you are not. • enter the exact amount of your payment in dollars and cents. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. Web time making an estimated payment. Web • enter tax year of payment. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. • enter the exact amount of your payment in dollars and cents. Web 36 rows showing 1 to 25 of 35 entries. Web use a pvw payment voucher worksheet template to. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. Once you have submitted the information, this. Web time making an estimated payment or if filing status has changed. Web. Web please refer to payment voucher worksheet (pvw) for estimated tax and extension payments instructions. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web 36 rows showing 1 to 25 of 35 entries. • enter the exact amount of your payment in dollars and cents. • enter the exact amount of your payment. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. • enter the exact amount of your payment in dollars and cents. Web payment voucher worksheet for estimated tax and. • enter the exact amount of your payment in dollars and cents. Web please refer to payment voucher worksheet (pvw) for estimated tax and extension payments instructions. Once you have submitted the information, this. Web time making an estimated payment or if filing status has changed. • enter tax year of payment. • enter the exact amount of your payment in dollars and cents. • enter tax year of payment. It appears you don't have a pdf plugin for this. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. • enter the exact amount of your payment in dollars and cents. • enter the exact amount of your payment in dollars and cents. Web time making an estimated payment or if filing status has changed. Head over to the federal income tax forms page to get any forms you. Web • enter tax year of payment. Web time making an estimated payment or if filing status has changed. Open the maryland form 505 and follow the. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. • if you are not. If you owe additional maryland tax and are seeking an automatic. • if you are not sure of the amount due for estimated tax or an extension use the pvw. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web please refer to payment voucher worksheet (pvw) for estimated tax and extension payments instructions. Printed all of your maryland income tax forms? If you are filing on a fiscal year basis, each payment is due by the 15th day of the 4th, 6th, 9th and 13th months following the beginning of the fiscal year. Web we last updated the payment voucher worksheet & instructions in february 2023, so this is the latest version of form pv worksheet, fully updated for tax year 2022. Web if line 6 of the worksheet shows you owe tax, you must file form pv and pay the full amount due by april 15, 2022, (or the 15th day of the fourth month following the close of the tax. Web use a pvw payment voucher worksheet template to make your document workflow more streamlined. Web maryland — payment voucher worksheet for estimated tax and extension payments. Web 36 rows showing 1 to 25 of 35 entries. Web you may use the worksheet provided with the payment voucher worksheet (pvw) as a guide in estimating your income tax liability. • enter the exact amount of your payment in dollars and cents. Web payment voucher worksheet for estimated tax and extension payments (pvw) for taxpayers filing joint returns, head of household, or for. Web please refer to payment voucher worksheet (pvw) for estimated tax and extension payments instructions. If you are filing on a fiscal year basis, each payment is due by the 15th day of the 4th, 6th, 9th and 13th months following the beginning of the fiscal year. • enter the exact amount of your payment in dollars and cents. • if you are not sure of the amount due for estimated tax or an extension use the pvw. Printed all of your maryland income tax forms? Head over to the federal income tax forms page to get any forms you. It appears you don't have a pdf plugin for this browser. Web • enter tax year of payment.Payment Voucher

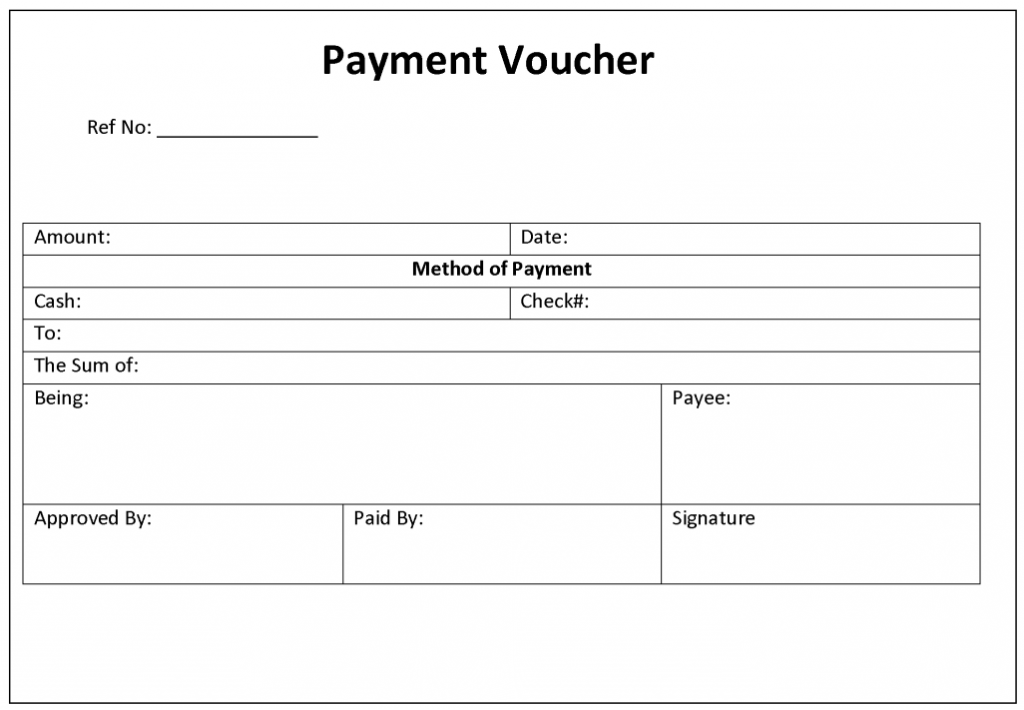

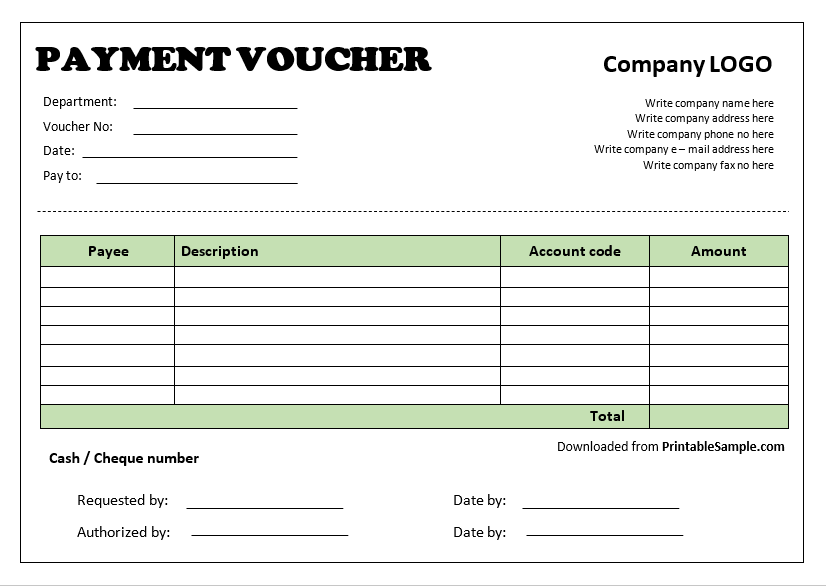

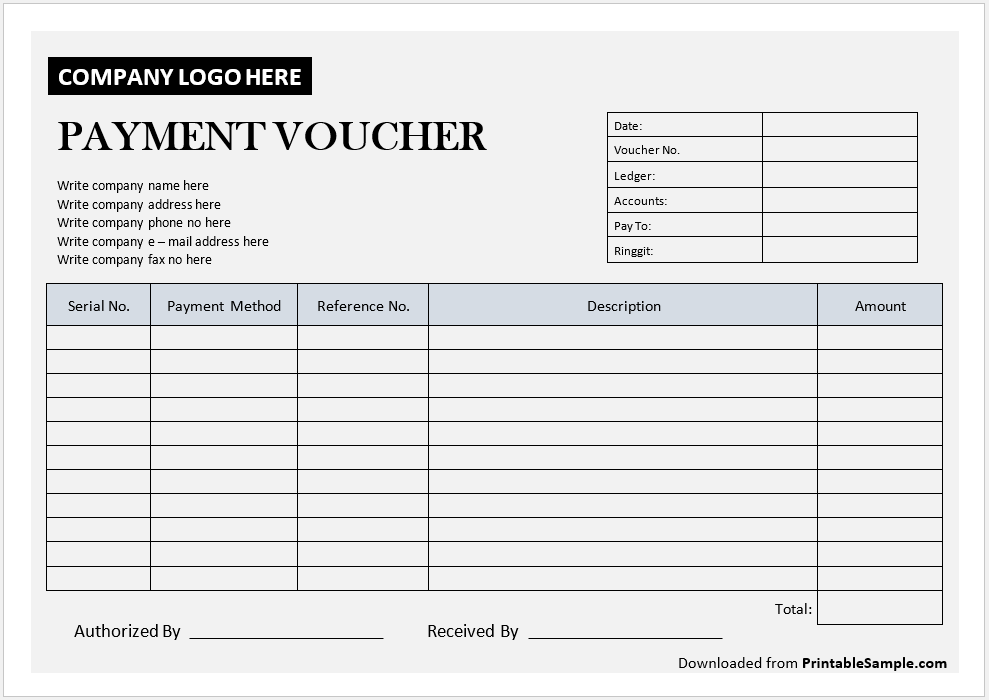

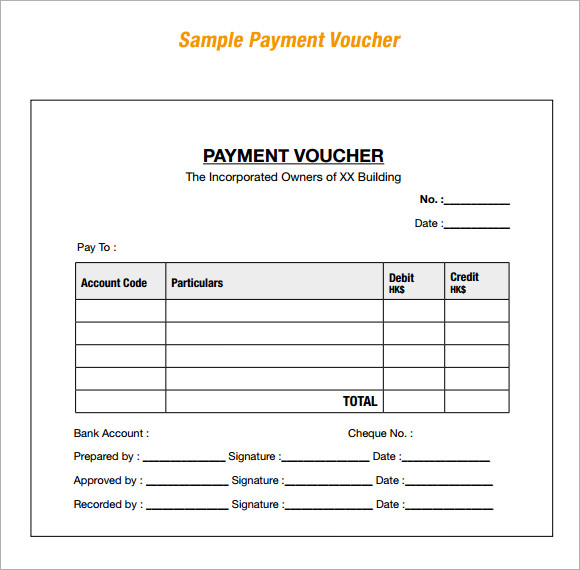

20 Free Sample Payment Voucher Templates Printable Samples

Voucher sample / ruimtewandeleninhetpark.nl

20 Free Sample Payment Voucher Templates Printable Samples

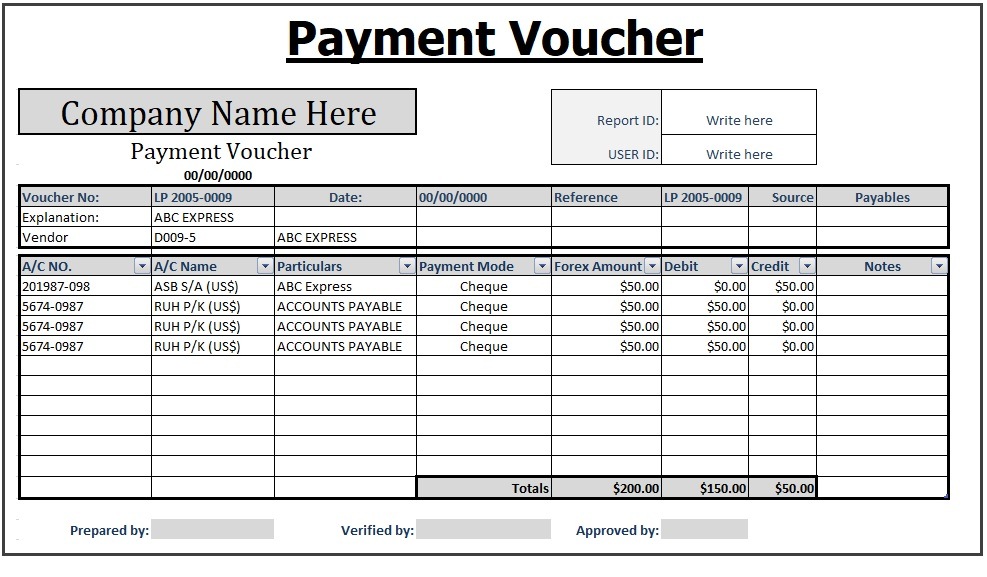

7 Free Payment Voucher Templates Excel PDF Formats

Payment Voucher Made in Excel Sample Word & Excel Templates

Payment Voucher Template 20 Printable Samples

payment voucher Google 搜尋 Payment voucher, Vouchers template

Payment Voucher Template Excel Free

Fillable Form Vp1w Withholding Tax Payment Voucher printable pdf

Web The New Maryland Payment Voucher Worksheet (Pvw) Must Be Used To Determine The Amount Of The Estimated Payment Or Extension Payment Required.

• If You Are Not.

If You Owe Additional Maryland Tax And Are Seeking An Automatic.

Web You Can Use This Calculator To Compute The Amount Of Tax Due, But This System Does Not Allow You To File Or Pay The Amount Online.

Related Post: