Qualified Business Income Deduction Worksheet

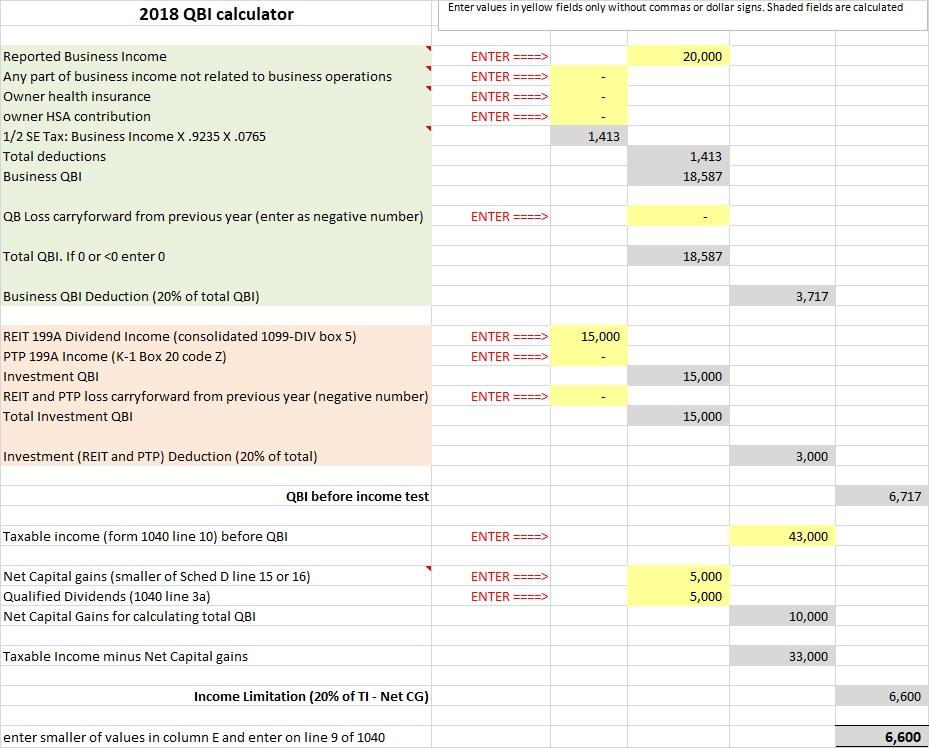

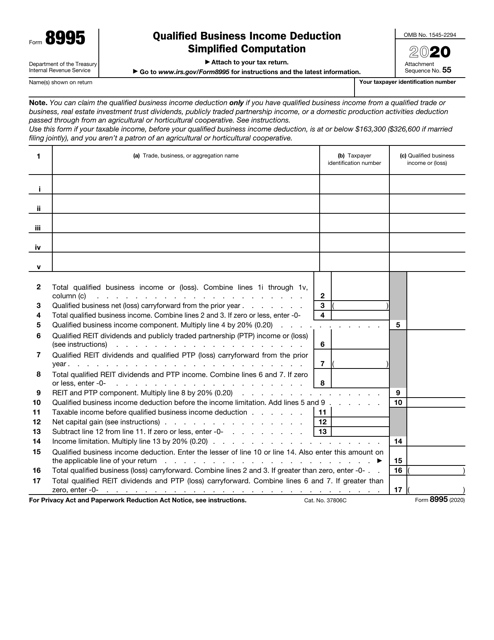

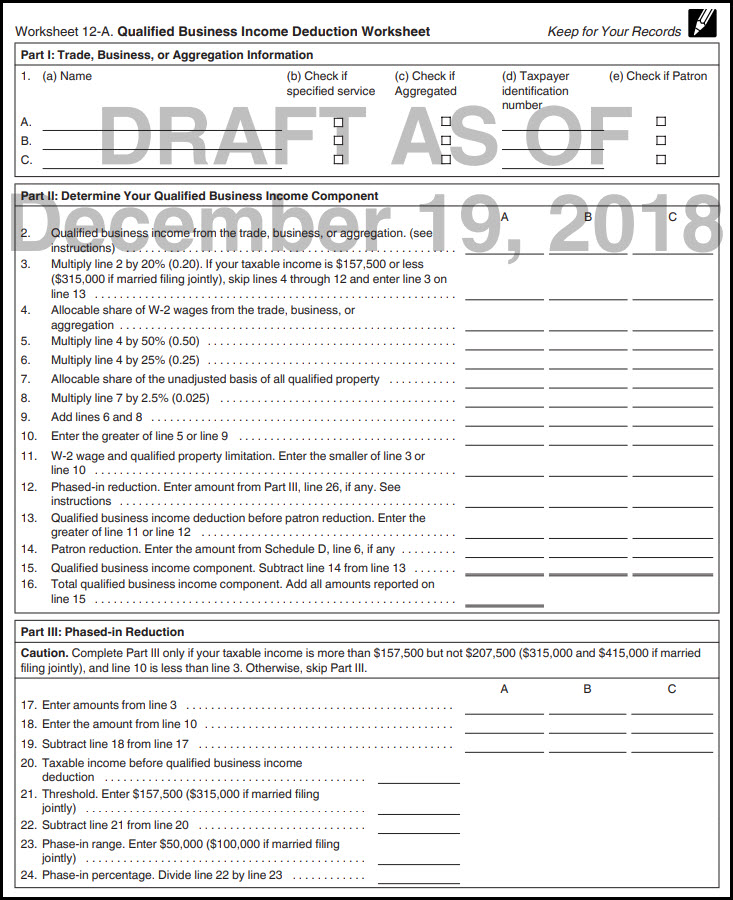

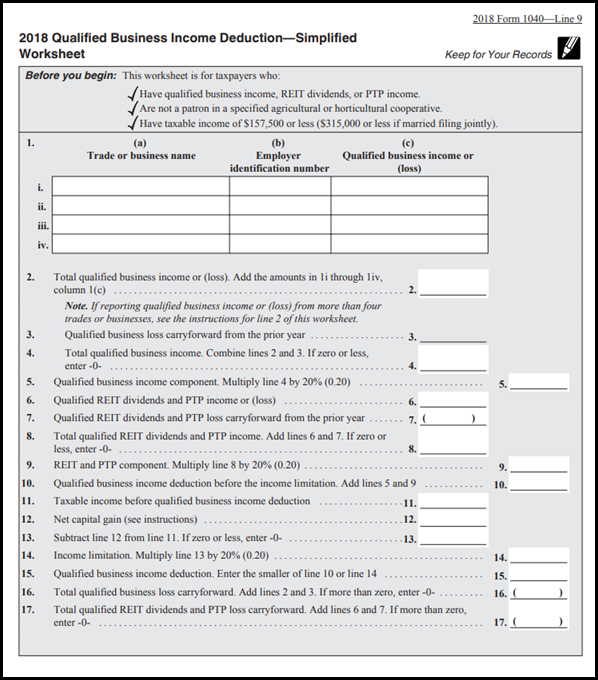

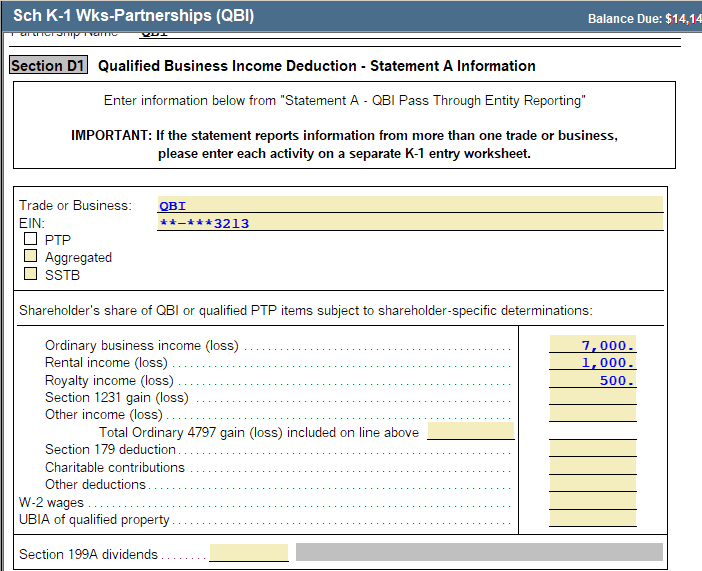

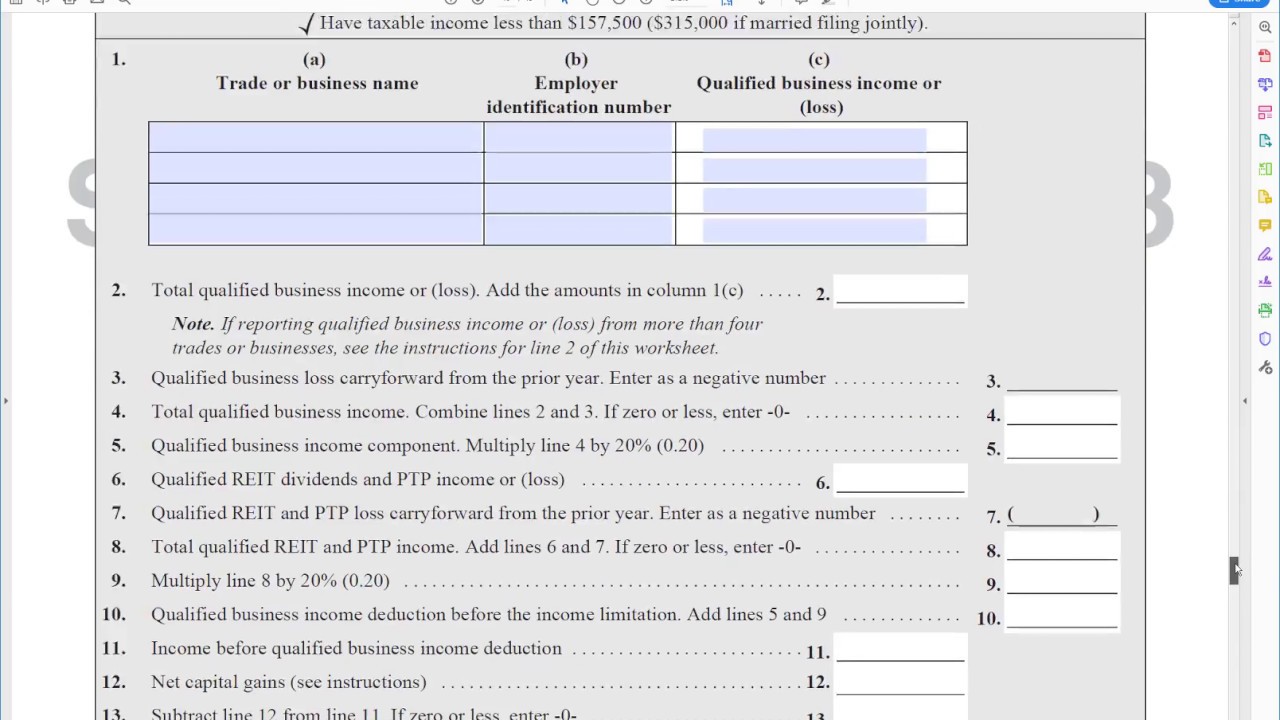

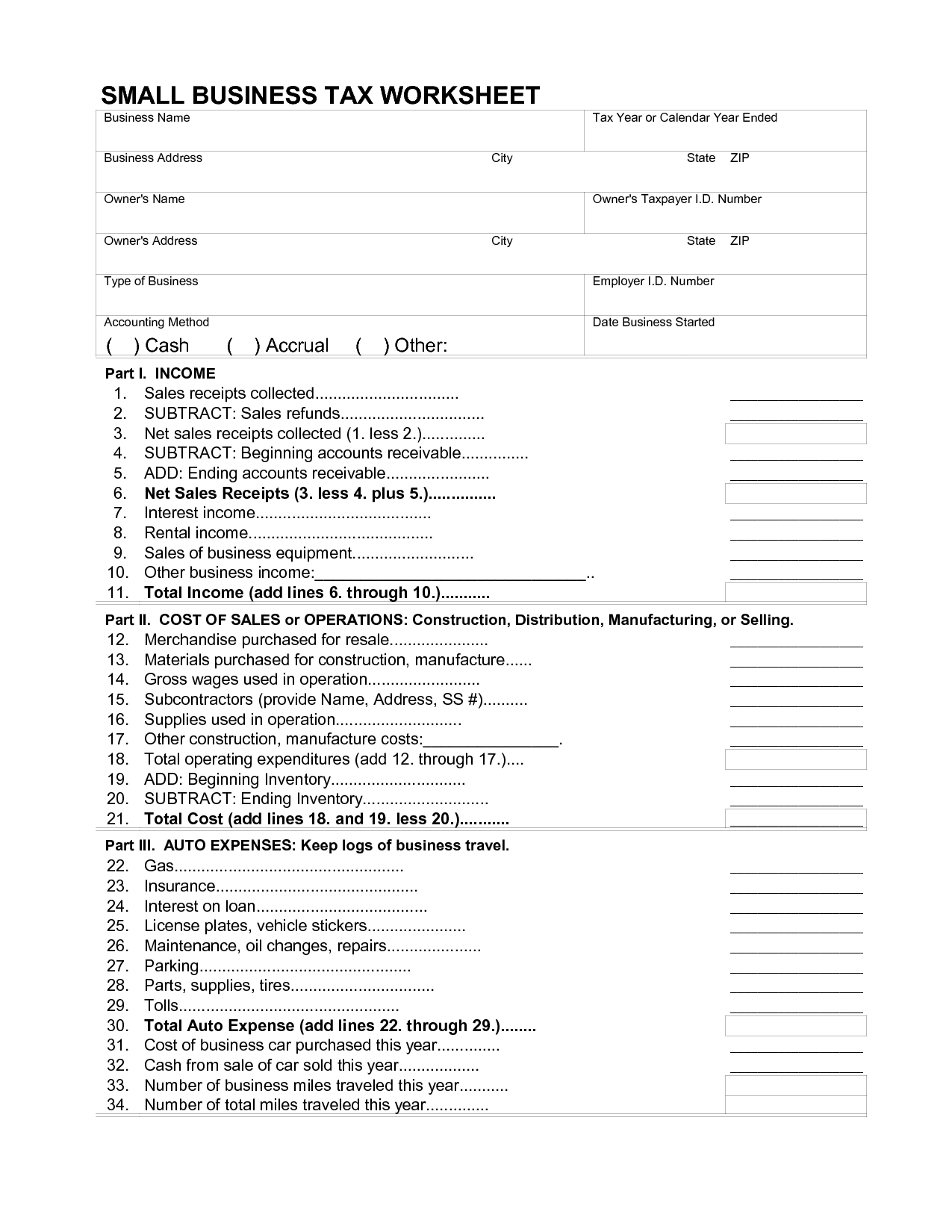

Qualified Business Income Deduction Worksheet - Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Web qualified business income deduction. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business. Business owners can deduct up. Trade, business, or aggregation information 1. Calculating the qualified business income deduction, section. Use this form to figure your qualified business income deduction. Explore updated credits, deductions, and exemptions, including the standard. (a) name (b)check if specified service (c)check. Web qualified business income dedution smart worksheet i'm doing the smart worksheet for the qualified business income deduction. If you are in a specified trade or business and. Web qualified business income dedution smart worksheet i'm doing the smart worksheet for the qualified business income deduction. Explore updated credits, deductions, and exemptions, including the standard. The images included below and in the expandable sections are draft copies of the qualified business income deduction worksheet. Specified business income/loss from. If you are in a specified trade or business and. (a) name (b)check if specified service (c)check. Web qualified business income dedution smart worksheet i'm doing the smart worksheet for the qualified business income deduction. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Trade, business, or aggregation information 1. Use this form to figure your qualified business income deduction. Business owners can deduct up. Use separate schedules a, b, c, and/or d, as. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Web qualified business income deduction. Use separate schedules a, b, c, and/or d, as. Specified business income/loss from sch/form. Web how does the qualified business income deduction work? If you are in a specified trade or business and. The images included below and in the expandable sections are draft copies of the qualified business income deduction worksheet. Business owners can deduct up. Web his qualified business income for 2021 was $180,000 and his taxable income is $225,000. (a) name (b)check if specified service (c)check. Web how does the qualified business income deduction work? Calculating the qualified business income deduction, section. Web his qualified business income for 2021 was $180,000 and his taxable income is $225,000. This is the main worksheet for computing qbi in the tax return that flows to the main return form. Web how to enter and calculate the qualified business income. (a) name (b)check if specified service (c)check. Web comprehensive qualified business income deduction worksheet. Web his qualified business income for 2021 was $180,000 and his taxable income is $225,000. Here’s how the new qualified business income deduction works. Use separate schedules a, b, c, and/or d, as. Specified business income/loss from sch/form. Have taxable income of $157,500 or less ($315,000 or less if married. This is the main worksheet for computing qbi in the tax return that flows to the main return form. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings.. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. Specified business income/loss from sch/form. Calculating the. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business. Use separate schedules a, b, c, and/or d, as. Here’s how the new qualified business income deduction works. This is the main worksheet for computing qbi in the tax return that flows. Business owners can deduct up. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income. Use separate schedules a, b, c, and/or d, as. Web qualified business income deduction. This is the main worksheet for computing qbi in the tax return that flows to the main return form. Specified business income/loss from sch/form. Web how does the qualified business income deduction work? Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. (a) name (b)check if specified service (c)check. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. The images included below and in the expandable sections are draft copies of the qualified business income deduction worksheet. If you are in a specified trade or business and. Have taxable income of $157,500 or less ($315,000 or less if married. On line e1 it shows my rental. Web how to enter and calculate the qualified business income deduction, section 199a, in lacerte. Calculating the qualified business income deduction, section. Web qualified business income dedution smart worksheet i'm doing the smart worksheet for the qualified business income deduction. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Web 78 rows this worksheet is designed for tax professionals to evaluate the type of legal entity a business should consider, including the application of the qualified business. Trade, business, or aggregation information 1. Web his qualified business income for 2021 was $180,000 and his taxable income is $225,000. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income. Web comprehensive qualified business income deduction worksheet. This worksheet is for taxpayers who: Web qualified business income deduction. Web how does the qualified business income deduction work? Web qualified business income dedution smart worksheet i'm doing the smart worksheet for the qualified business income deduction. Use this form to figure your qualified business income deduction. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. The images included below and in the expandable sections are draft copies of the qualified business income deduction worksheet. Use separate schedules a, b, c, and/or d, as. On line e1 it shows my rental. Web one can add to the deduction qualified reit dividends and qualified ptp (publicly traded partnership) income. This is the main worksheet for computing qbi in the tax return that flows to the main return form. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. Have taxable income of $157,500 or less ($315,000 or less if married.Update On The Qualified Business Deduction For Individuals

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Qualified Business Deduction Worksheet dialasopa

Qualified Business Deduction Worksheet teacherfasr

Qualified Business Deduction Worksheets

How to enter and calculate the qualified business deduction

How to use the new Qualified Business Deduction Worksheet for

8 Tax Itemized Deduction Worksheet /

Irs Qualified Business Deduction

How The Qualified Business Deduction Worksheet Can Help You Save

Here’s How The New Qualified Business Income Deduction Works.

Business Owners Can Deduct Up.

Trade, Business, Or Aggregation Information 1.

(A) Name (B)Check If Specified Service (C)Check.

Related Post: