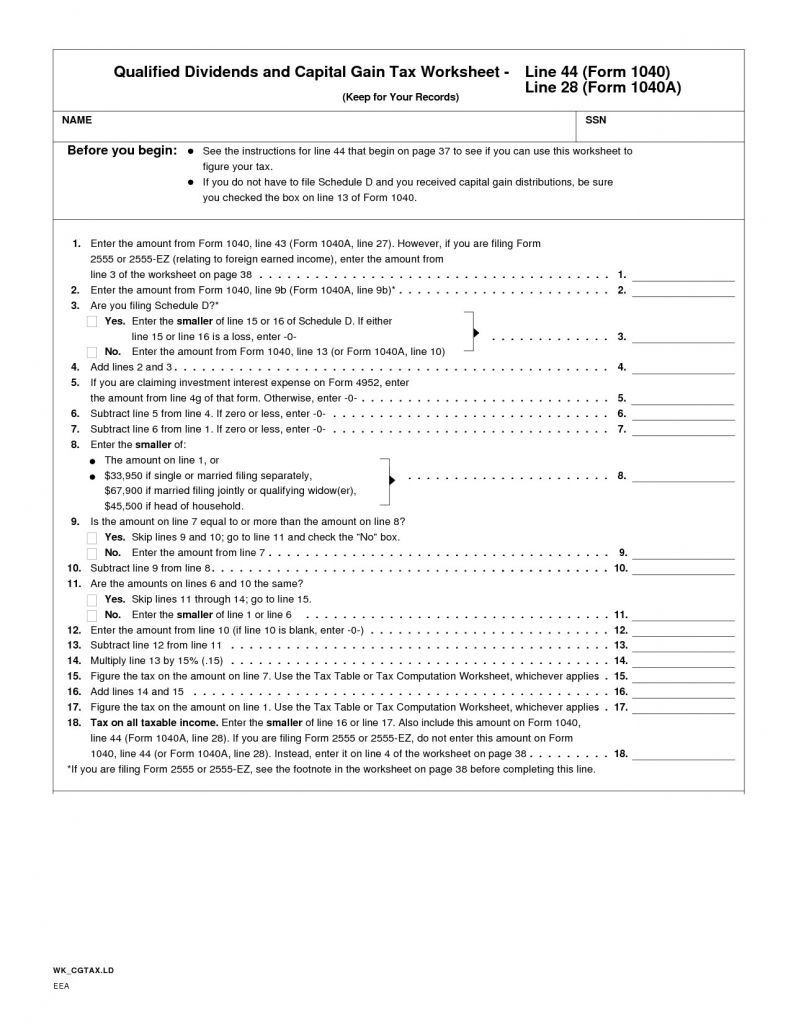

Qualified Dividend Worksheet

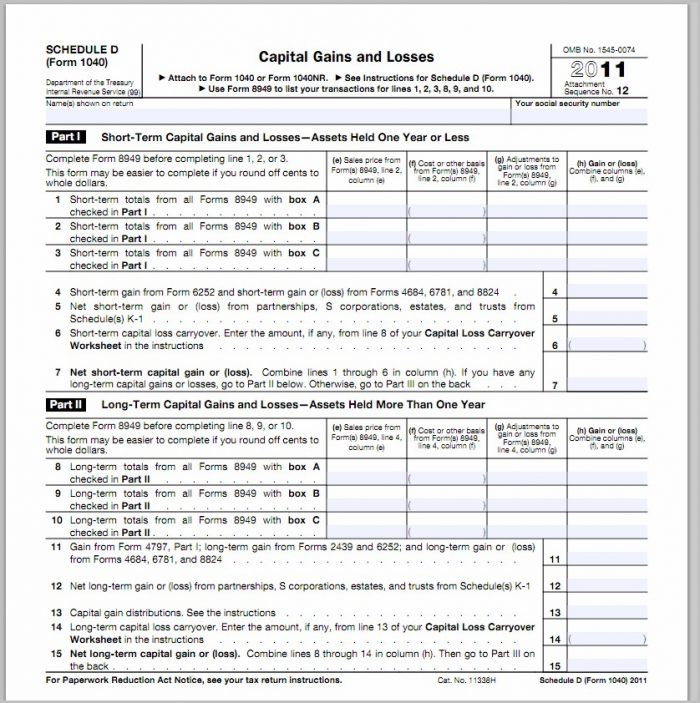

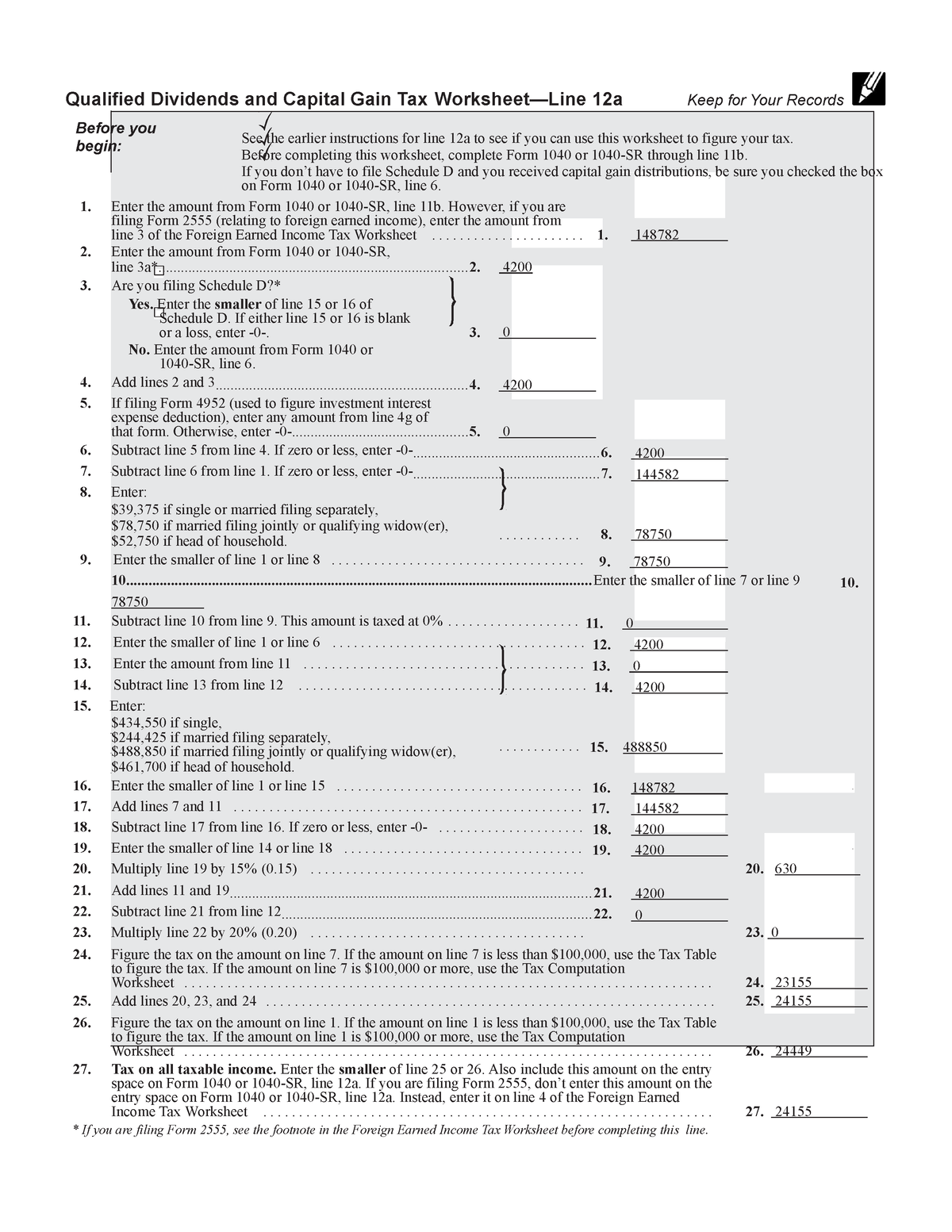

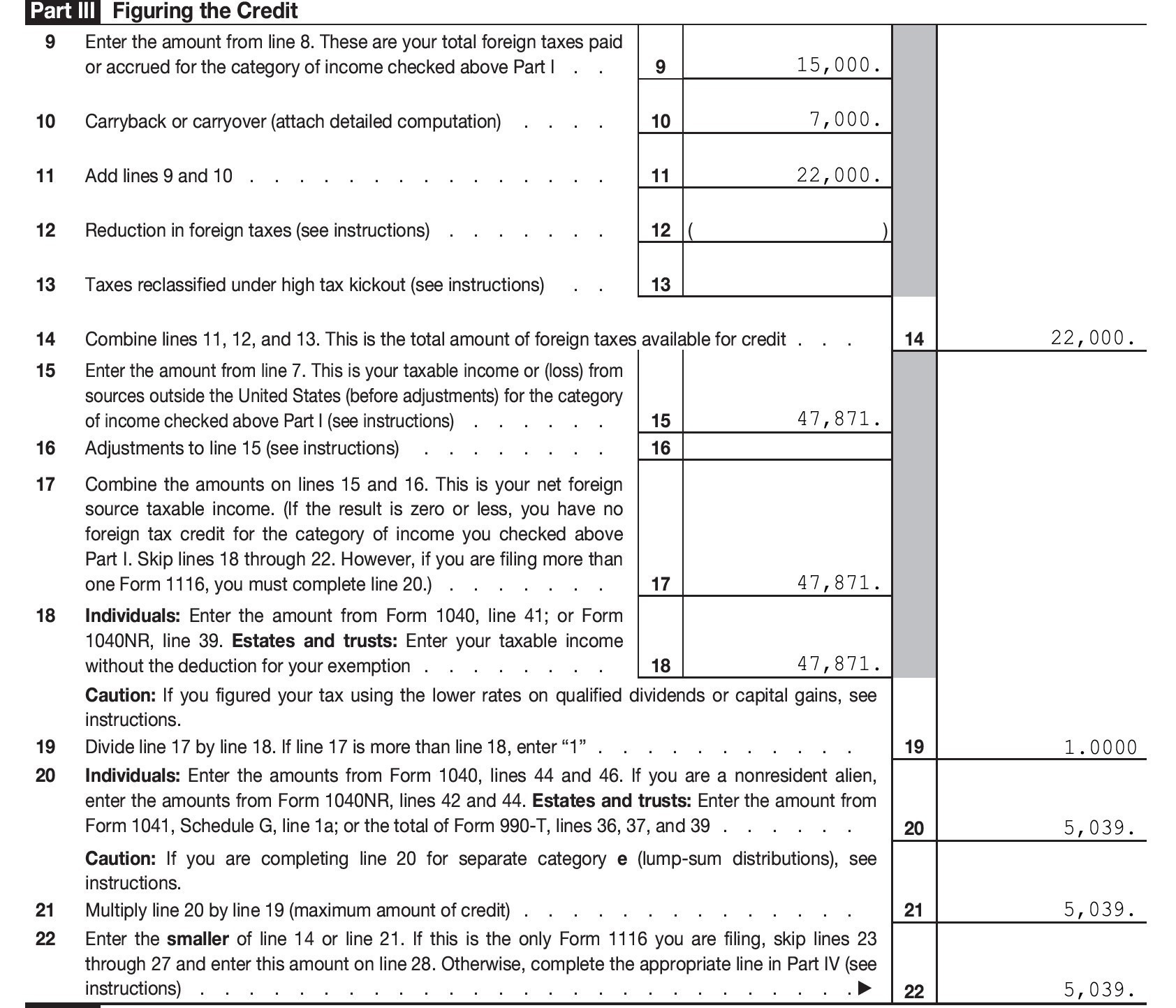

Qualified Dividend Worksheet - Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. Web what is the qualified dividend and capital gain tax worksheet? Complete lines 21 and 22 below. Web qualified dividends and capital gain tax worksheet: In the instructions for form 1040, line 16. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web how does a qualified dividend work? Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: You can find them in the form 1040 instructions. Web qualified dividends and capital gain tax worksheet: Web all about the qualified dividend worksheet. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines. Web qualified dividends or a net capital gain for 2023. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. In the instructions for form 1040, line 16. Use the qualified dividends and capital gain tax worksheet. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Complete lines 21 and 22 below. Web how does a. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Web qualified dividends and capital gain tax worksheet: Web qualified dividends or a net capital gain for 2023. For example, let's assume that john owns 10,000 shares of. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Use fill to complete blank online. Web if the estate or trust received qualified dividends or capital gains as income. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Web all about the qualified dividend worksheet. Use fill to complete blank online. Web what is the qualified dividend and capital gain tax worksheet? Income tax return for. Web qualified dividends and capital gain tax worksheet: Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Web what is the qualified dividend and capital gain tax worksheet? Figuring. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: This is advantageous to the investor as capital gains are usually taxed at a lower rate than. You can find them in the form 1040 instructions.. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Income tax return for electing alaska native settlement trusts, as a. This is advantageous to the investor as capital gains are usually taxed at a lower rate. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. If you have never come across a qualified dividend worksheet, irs shows how one looks like; Income tax return for electing alaska native settlement trusts, as a. Web complete this worksheet only if line 18 or line 19 of schedule d is more. Web what is the qualified dividend and capital gain tax worksheet? If you have never come across a qualified dividend worksheet, irs shows how one looks like; Web report your qualified dividends on line 9b of form 1040 or 1040a. Web qualified dividends or a net capital gain for 2023. For example, let's assume that john owns 10,000 shares of company xyz stock x capital gains tax (say, 15%) on the. Complete lines 21 and 22 below. Web all about the qualified dividend worksheet. Web qualified dividends and capital gain tax worksheet: In the instructions for form 1040, line 16. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web how does a qualified dividend work? Web in the united states, a dividend eligible for capital gains tax rather than income tax. Use fill to complete blank online. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Income tax return for electing alaska native settlement trusts, as a. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. You can find them in the form 1040 instructions. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web what is the qualified dividend and capital gain tax worksheet? Web qualified dividends or a net capital gain for 2023. Web qualified dividends and capital gain tax worksheet: This is advantageous to the investor as capital gains are usually taxed at a lower rate than. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: For example, let's assume that john owns 10,000 shares of company xyz stock x capital gains tax (say, 15%) on the. If you have never come across a qualified dividend worksheet, irs shows how one looks like; Complete lines 21 and 22 below. Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web all about the qualified dividend worksheet. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Web in the united states, a dividend eligible for capital gains tax rather than income tax. You can find them in the form 1040 instructions.Understanding The Qualified Dividends And Capital Gains Worksheet 2020

41 1040 qualified dividends worksheet Worksheet Live

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

41 1040 qualified dividends worksheet Worksheet Live

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

41 1040 qualified dividends worksheet Worksheet Live

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

Qualified Dividends and Capital Gain Tax Worksheet 2016

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Web How Does A Qualified Dividend Work?

Use Fill To Complete Blank Online.

Web Report Your Qualified Dividends On Line 9B Of Form 1040 Or 1040A.

Figuring Out The Tax On Your Qualified Dividends Can Be Difficult For Even The Most Experienced.

Related Post: