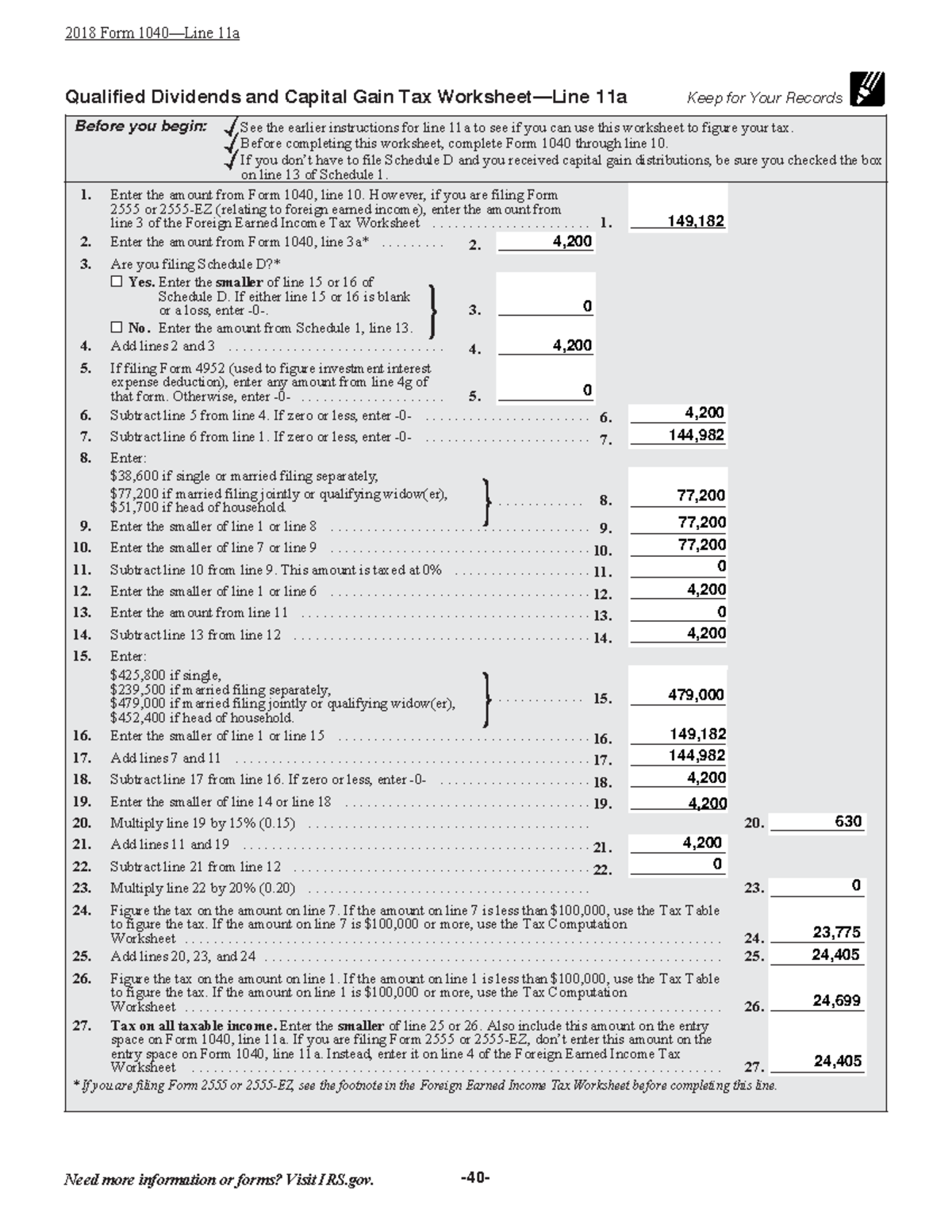

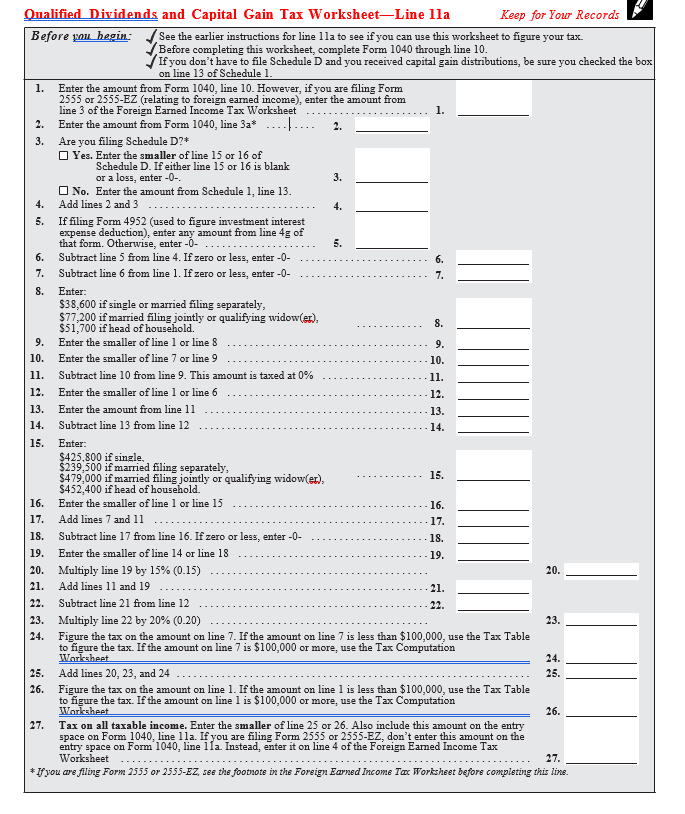

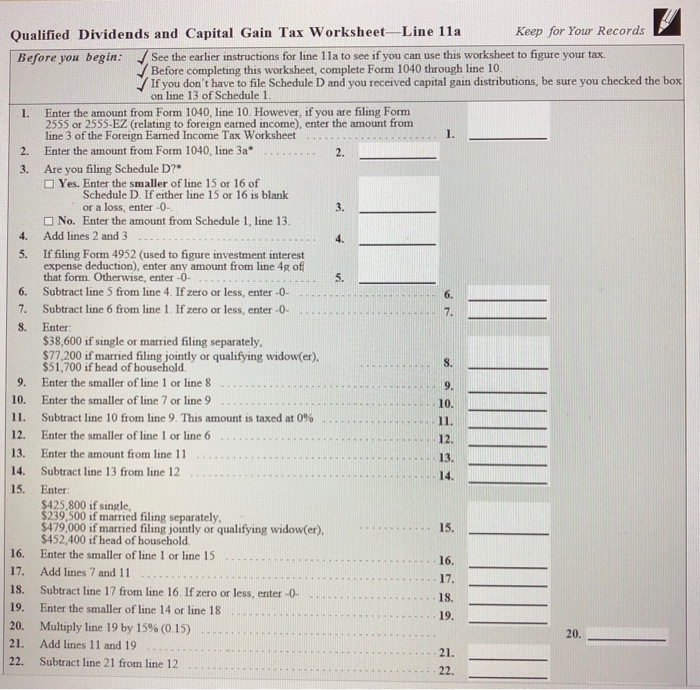

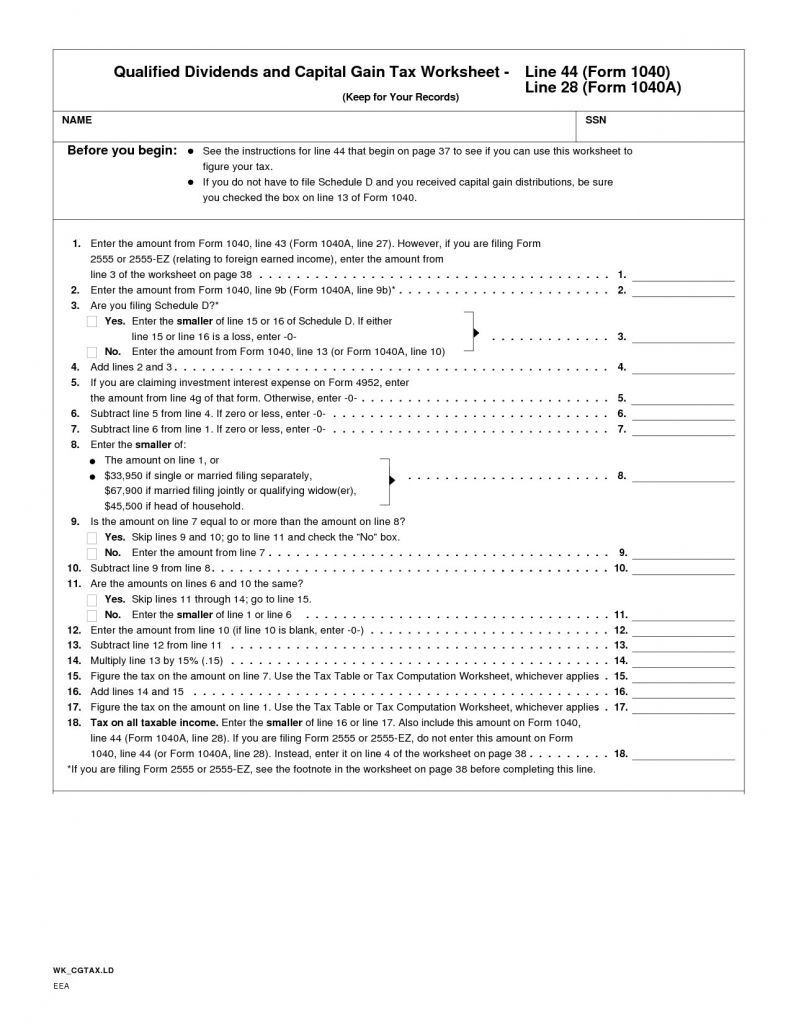

Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet - These tax rates are lower than the income tax rate on. Lower capital gains tax rates (0% to 20%) reporting interest and dividend income. Before completing this worksheet, complete form 1040 through line 43. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web qualified dividends and capital gain tax worksheet 2022. Complete and sign it in. Web figure the tax on the amount on line 5. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Complete lines 21 and 22 below. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. If you received more than $1,500 in interest income and/or. Web how is the qualified dividends and capital gain tax worksheet used? Web qualified dividends. Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘.. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web qualified dividends and capital gain tax worksheet 2022. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web qualified dividends. But, please check my math. Before completing this worksheet, complete form 1040 through line 43. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web how is the qualified dividends and capital gain tax worksheet used? Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure. Web. But, please check my math. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Complete and sign it in. These tax rates are lower than the income tax rate on. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to. Enter the smaller of line 45 or line 46. In order to use the qualified dividends and capital gain tax worksheet, you will need. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Lower capital gains tax rates (0% to 20%) reporting interest and dividend income. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the.. Web qualified dividends and capital gain tax worksheet: Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Web click forms in the upper right (upper left for mac). Web how is the qualified dividends and capital gain tax worksheet used? Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web this year i dashed off. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. These tax rates are lower than the income tax rate on. Before completing this worksheet, complete form 1040 through line 43. If the amount on line 5 is $100,000 or more, use the tax. If you received more than $1,500 in interest income and/or. Get a fillable qualified dividends and capital gains worksheet 2022 template online. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Web tax on all taxable income (including capital gains and qualified dividends). Lower capital gains tax rates (0% to 20%) reporting interest and dividend income. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Web figure the tax on the amount on line 5. Our publications provide fast answers to tax questions for tax practitioners! Enter the smaller of line 45 or line 46. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Explore updated credits, deductions, and exemptions, including the standard. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Before completing this worksheet, complete form 1040 through line 43. Web click forms in the upper right (upper left for mac) and look through the forms in my return list and open the qualified dividends and capital gain tax worksheet. If the amount on line 5 is $100,000 or more, use the tax. Explore updated credits, deductions, and exemptions, including the standard. If the amount on line 5 is less than $100,000, use the tax table to figure the tax. Enter the smaller of line 45 or line 46. Web qualified dividends and capital gain tax worksheet 2022. Our publications provide fast answers to tax questions for tax practitioners! Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. For details, see the instructions for form. Web tax on all taxable income (including capital gains and qualified dividends). See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. These tax rates are lower than the income tax rate on.Qualified Dividends And Capital Gain Tax Worksheet 1040A —

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

IN C++ PLEASW Create A Function For Calculating Th...

Solved Create Function Calculating Tax Due Qualified Divi

Qualified Dividends And Capital Gain Worksheet

Qualified Dividends and Capital Gain Tax Worksheet 2016

" Qualified Dividends and Capital Gain Tax Worksheet." not showing

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Complete And Sign It In.

Web Qualified Dividends And Capital Gain Tax Worksheet—Line 12A Keep For Your Records See The Earlier Instructions For Line 12A To See If You Can Use This Worksheet To Figure.

Web The Irs Recently Released The New Inflation Adjusted 2022 Tax Brackets And Rates.

Complete Lines 21 And 22 Below.

Related Post: