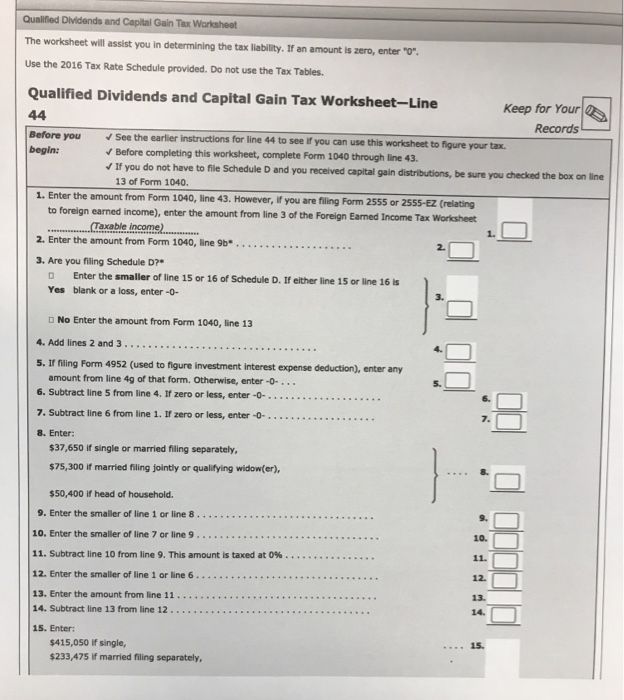

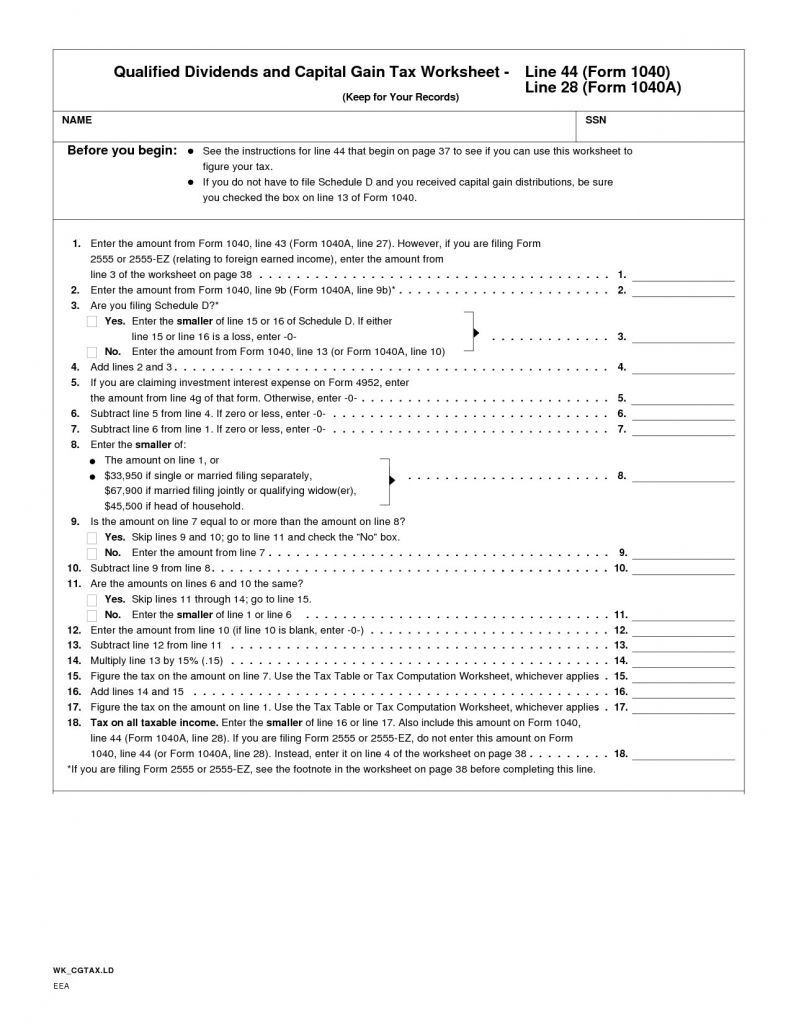

Qualified Dividends And Capital Gains Tax Worksheet

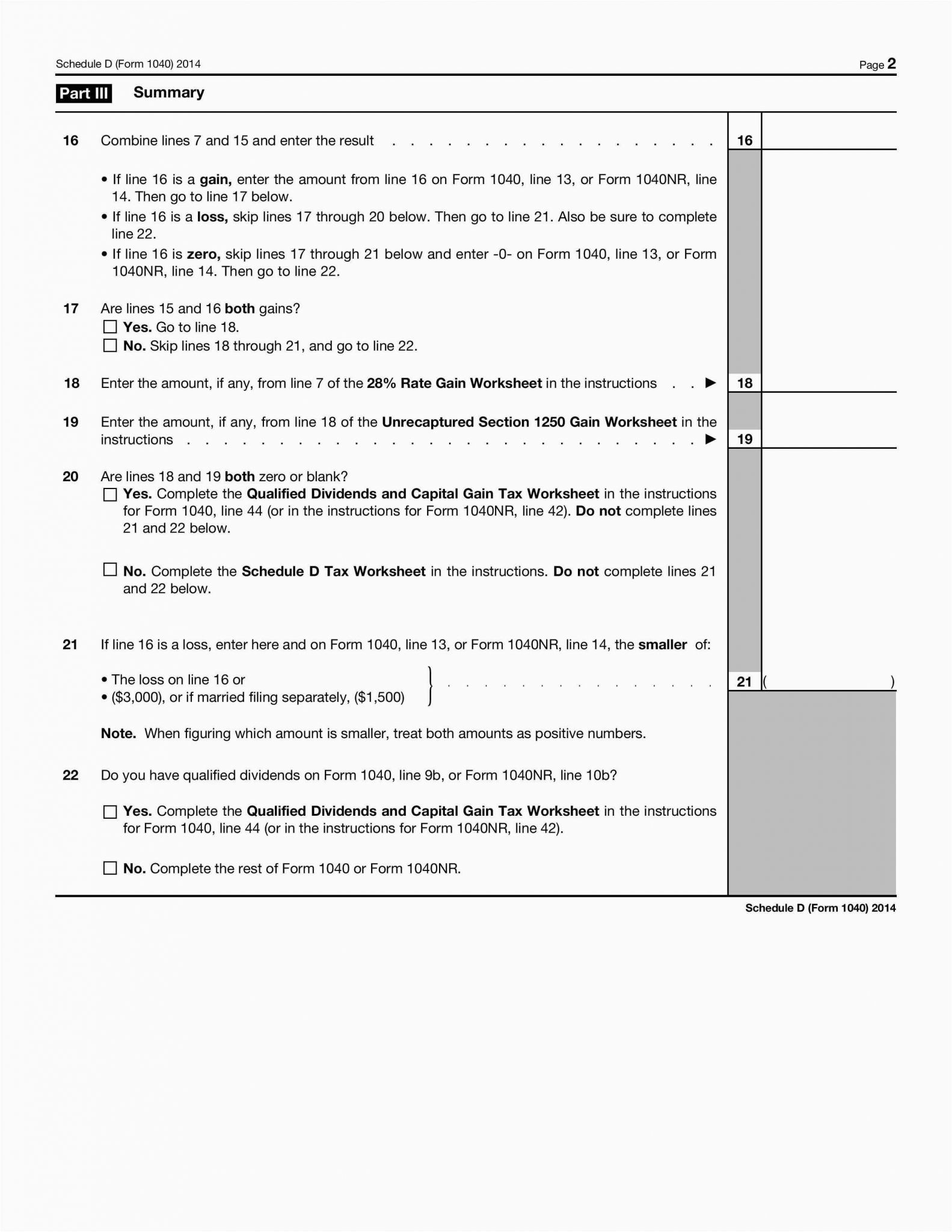

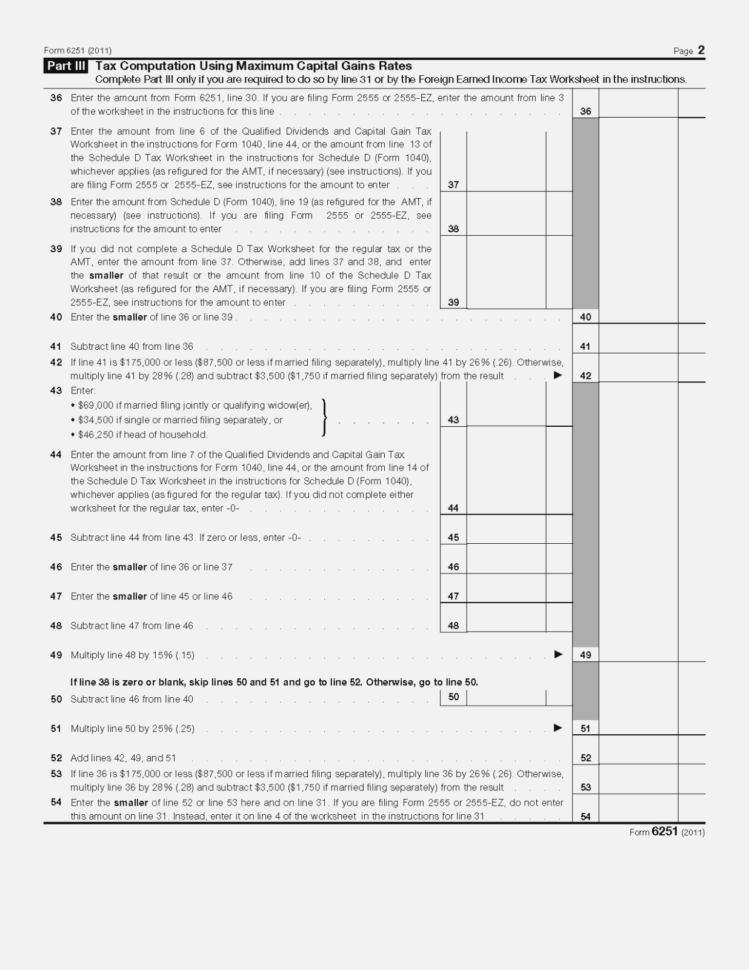

Qualified Dividends And Capital Gains Tax Worksheet - Use fill to complete blank online h&rblock pdf forms for free. The tax rates on ordinary dividends are the same as the tax rates on. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. If the amount on line 1 is. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. If you have never come across a qualified dividend worksheet, irs shows how one looks like; Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. Before completing this worksheet, complete form 1040 through line 15. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the worksheet to see it. For details, see the instructions for form 8615, line 9. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Web fill online, printable,. Before completing this worksheet, complete form 1040 through line 15. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. But, please check my math on the excel. Once completed you can sign your fillable form or send. Web all about the qualified dividend worksheet. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. The tax computation is on the tax smart. Before completing this worksheet, complete form 1040 through line 15. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. Web a qualified. If you received more than $1,500 in interest income and/or ordinary dividends in a year, you. Before completing this worksheet, complete form 1040 through line 15. If you have never come across a qualified dividend worksheet, irs shows how one looks like; Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to. Web the qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Ordinary income is then everything leftover, which is taxable income minus qualified. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, alternative minimum tax (amt), earned income tax. It is used to calculate the tax liability associated with these earnings, which can vary depending on one’s filing status. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode and open the. Before completing this worksheet, complete form 1040 through line 15. Once completed you can sign your fillable form or send. If you have never come across a qualified dividend worksheet, irs shows how one looks like; However, if the child, the parent, or any other child has 28% rate gain. Web the irs recently released the new inflation adjusted 2022. Lower capital gains tax rates (0% to 20%) reporting interest and dividend income. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms mode. The tax rates on ordinary dividends are the same as the tax rates on. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Web 1 best answer tomk expert alumni for the desktop version you can switch to forms. If the amount on line 1 is less than $100,000, use the tax table to figure the tax. I had looked around for a spreadsheet like this. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web 1 best. Before completing this worksheet, complete form 1040 through line 15. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. If the amount on line 1 is less than $100,000, use the tax table to figure the tax. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. The tax computation is on the tax smart. Web all about the qualified dividend worksheet. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. For details, see the instructions for form 8615, line 9. Web turbotax may be using the qualified dividends and capital gains worksheet to calculate your tax liability. If the amount on line 5 is $100,000 or more, use the tax computation worksheet add lines 18, 21, and 22 figure the tax on the amount on line 1. Use fill to complete blank online h&rblock pdf forms for free. The tax rates on ordinary dividends are the same as the tax rates on. Web if you had a capital gain excess, complete a second 2019 qualified dividends and capital gain tax worksheet or 2019 schedule d tax worksheet (whichever applies) as instructed above but in its entirety and with the following additional modifications. But, please check my math on the excel. It is used to calculate the tax liability associated with these earnings, which can vary depending on one’s filing status. If you received more than $1,500 in interest income and/or ordinary dividends in a year, you. Ordinary income is then everything leftover, which is taxable income minus qualified. I had looked around for a spreadsheet like this. However, if the child, the parent, or any other child has 28% rate gain. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Web this year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. Web if line 8 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. But, please check my math on the excel. For details, see the instructions for form 8615, line 9. If you received more than $1,500 in interest income and/or ordinary dividends in a year, you. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. It is used to calculate the tax liability associated with these earnings, which can vary depending on one’s filing status. Once completed you can sign your fillable form or send. Click forms in the upper right (upper left for mac) and look through the forms in my return list and open the qualified dividends. To be sure of what worksheet you need to check, look at your form 1040/1040sr wks. If the amount on line 1 is less than $100,000, use the tax table to figure the tax. It is very, very basic. Before completing this worksheet, complete form 1040 through line 15.Irs Qualified Dividends And Capital Gain Tax Worksheet 2019

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

2017 Qualified Dividends and Capital Gain Tax Worksheet

Capital Gains Worksheets

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

Qualified Dividends and Capital Gain Tax Worksheet

41 1040 qualified dividends worksheet Worksheet Live

Web The Qualified Dividends And Capital Gain Tax Worksheet Can Be Separated Into Different Lines In Order To Make It Easier For You.

Web Qualified Dividends And Capital Gain Tax Worksheet (2022) See Form 1040 Instructions For Line 16 To See If The Taxpayer Can Use This Worksheet To Compute The Taxpayer’s Tax.

Lower Capital Gains Tax Rates (0% To 20%) Reporting Interest And Dividend Income.

Web 1 Best Answer Tomk Expert Alumni For The Desktop Version You Can Switch To Forms Mode And Open The Worksheet To See It.

Related Post: