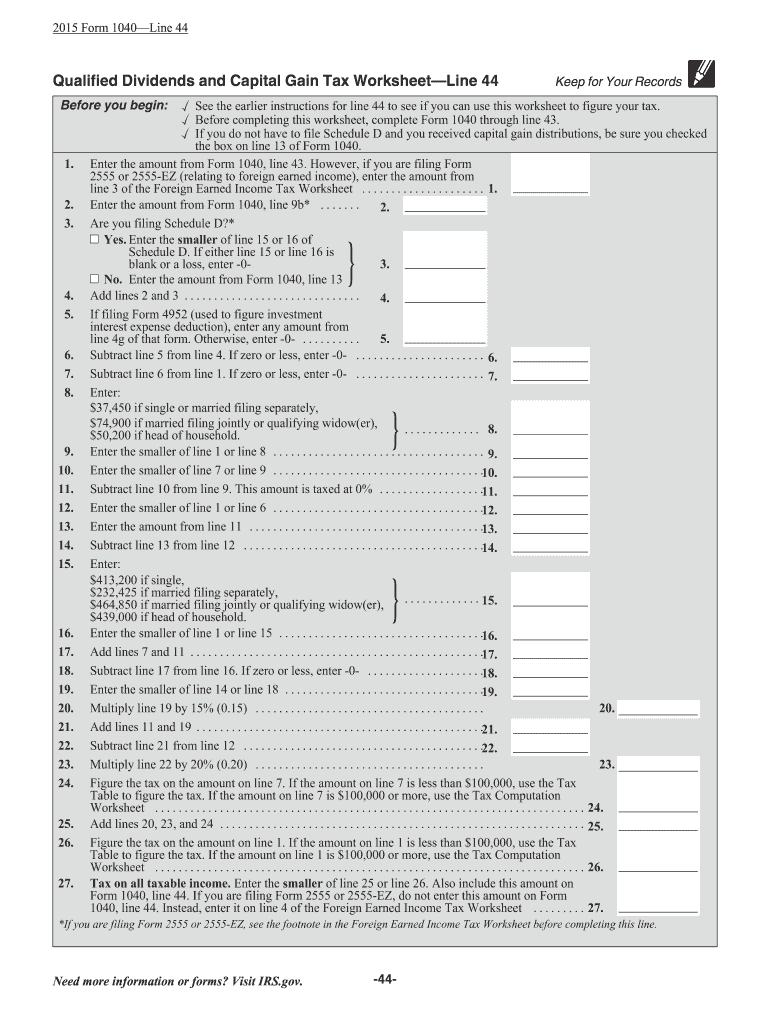

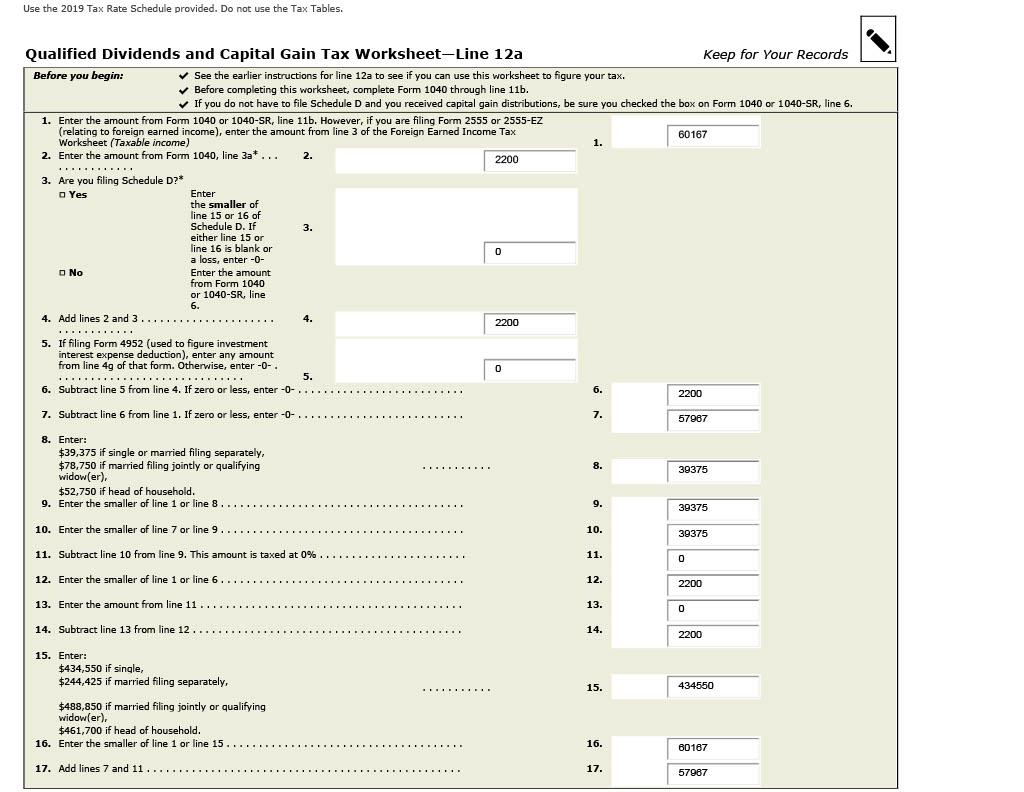

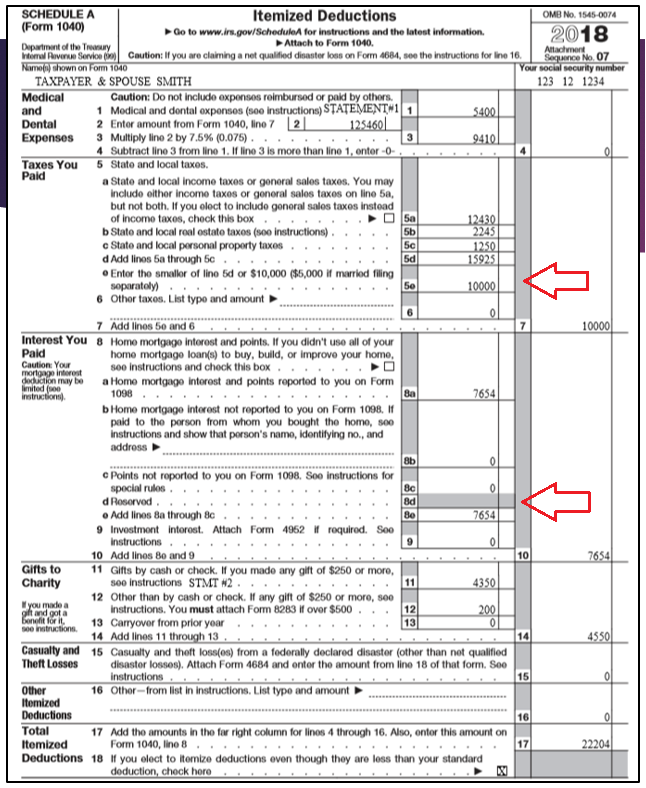

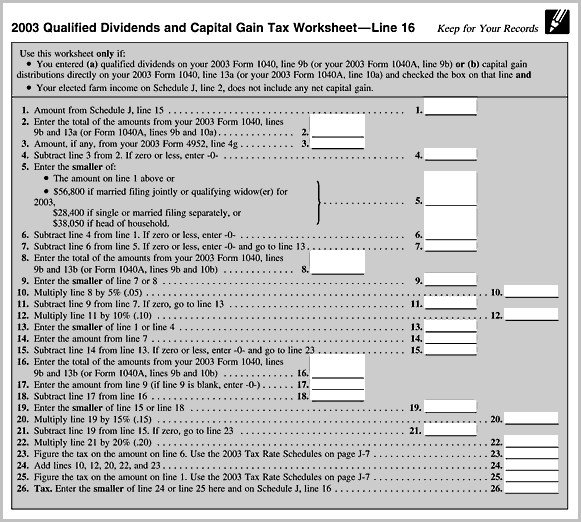

Qualified Dividends And Capital Gains Worksheet Line 16

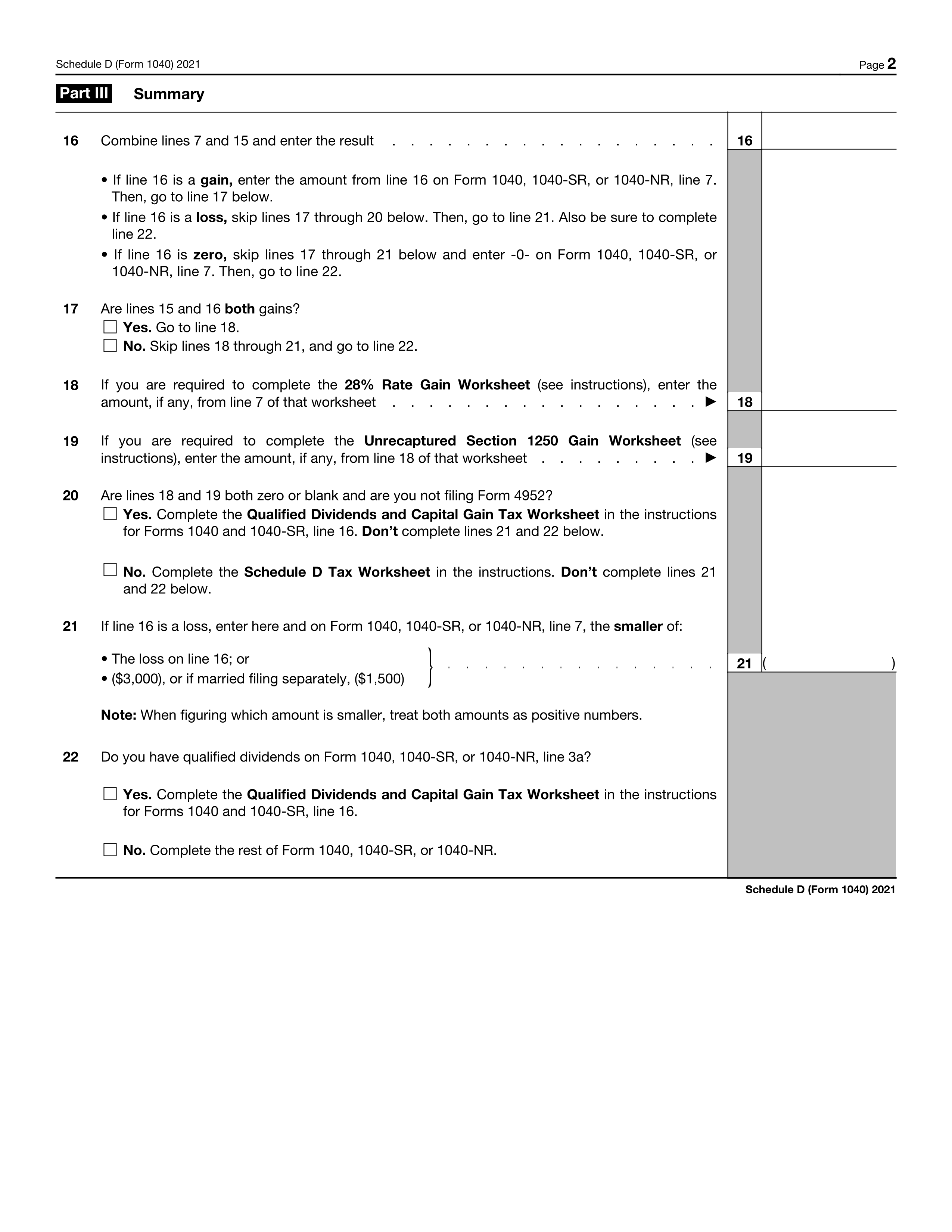

Qualified Dividends And Capital Gains Worksheet Line 16 - If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the qualified dividends and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Web enter the smaller of line 15 or 16 of schedule d. Suppose you sell an asset for $5,000. Qualified dividend and capital gain tax worksheet. If i have reached line 22 on schedule d, because line 16 was either a gain or a loss, is form 1040, line 13 supposed to be filled from line 16, or from the result of the qualified dividends and capital. This year i dashed off this quick excel to check my math on the ‘qualified dividends and capital gain tax worksheet‘. It is very, very basic. Looking for more tax information and tips? J if you do not have to file schedule d. Enter the smaller of line 15 or 16 of schedule d. Web enter the smaller of line 15 or 16 of schedule d. Qualified dividends and capital gain tax worksheet—line 16; Looking for more tax information and tips? You can find them in the form 1040 instructions. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. In most cases if you have qualified dividends or capital gains reported the taxes are calculated using the qualified dividends and. Web schedule d tax worksheet. Qualified dividends and capital gain tax worksheet—line 16; • before completing this worksheet, complete form 1040 through. Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. • before completing this worksheet, complete form 1040 through line 15. Qualified dividends. • before completing this worksheet, complete form 1040 through line 15. Enter the amount from form 1040, line 10. Web enter the smaller of line 15 or 16 of schedule d. Looking for more tax information and tips? If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as. • before completing this worksheet, complete form 1040 through line 15. You can find them in the form 1040 instructions. If either line 15 or 16 is blank or a. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Suppose you sell an asset for $5,000. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the qualified dividends and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned. Qualified dividends and capital gain tax worksheet—line 16; Looking for more tax information and tips? Web •. J see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. When the tax on line 12 does not match the tax in the tax table:. Web on schedule d, line 22, it says to complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44. It is very, very basic. • before completing this worksheet, complete form 1040 through line 15. Should i write it next to 1040 line 16? Form 8862, who must file. Ordinary income is then everything leftover, which is taxable income minus qualified income. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. Should i write it next to 1040 line 16? Enter the smaller of line 15 or 16 of schedule d. Web on schedule d, line 22, it says to complete. There may be a typo on. Looking for more tax information and tips? It is very, very basic. J see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. If either line 15 or 16 is blank or a. J see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. No need to install software, just go to dochub, and sign up instantly and for free. You can find them in the form 1040 instructions. • if the taxpayer does not have to file schedule d (form 1040) and received capital gain distributions, be sure the box on line 7, form 1040, is. Web on schedule d, line 22, it says to complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line 44. Web schedule d tax worksheet. • before completing this worksheet, complete form 1040 through line 15. Enter the amount from form 1040, line 10. Web enter the smaller of line 15 or 16 of schedule d. Qualified dividend and capital gain tax worksheet. Web see the instructions for line 16 to see if you must use the worksheet below to figure your tax. When the tax on line 12 does not match the tax in the tax table: • before completing this worksheet, complete form 1040 through line 15. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. But, please check my math on the excel. If you are required to use this worksheet to figure the tax on an amount from another form or worksheet, such as the qualified dividends and capital gain tax worksheet, the schedule d tax worksheet, schedule j, form 8615, or the foreign earned. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Qualified dividends and capital gain tax worksheet. Before completing this worksheet, complete form 1040 through line 10. Add lines 2 and 3. No need to install software, just go to dochub, and sign up instantly and for free. Web returns containing certain forms or taxable income amounts may need to calculate the tax on the return using a different method or worksheet as outlined in the 1040 instructions. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. J see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Looking for more tax information and tips? Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Enter the smaller of line 15 or 16 of schedule d. Web enter the smaller of line 15 or 16 of schedule d. Web to the left of line 16 there should be an indication of what was used to calculate the taxes. Should i write it next to 1040 line 16? • if the taxpayer does not have to file schedule d (form 1040) and received capital gain distributions, be sure the box on line 7, form 1040, is. But, please check my math on the excel. Qualified dividends and capital gain tax worksheet—line 16; Web • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Child tax credit and credit for other dependents.Capital gaines work sheet Fill out & sign online DocHub

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Amt Qualified Dividends And Capital Gains Worksheet Ivuyteq

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2022

Qualified Dividend and Capital Gains Tax Worksheet? YouTube

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Qualified Dividends and Capital Gain Tax Worksheet

2022 Qualified Dividends And Capital Gain Tax Worksheet Line 16

Capital Gains Tax

If I Have Reached Line 22 On Schedule D, Because Line 16 Was Either A Gain Or A Loss, Is Form 1040, Line 13 Supposed To Be Filled From Line 16, Or From The Result Of The Qualified Dividends And Capital.

Web See The Instructions For Line 16 To See If You Must Use The Worksheet Below To Figure Your Tax.

Qualified Dividend And Capital Gain Tax Worksheet.

Before Completing This Worksheet, Complete Form 1040 Through Line 10.

Related Post: