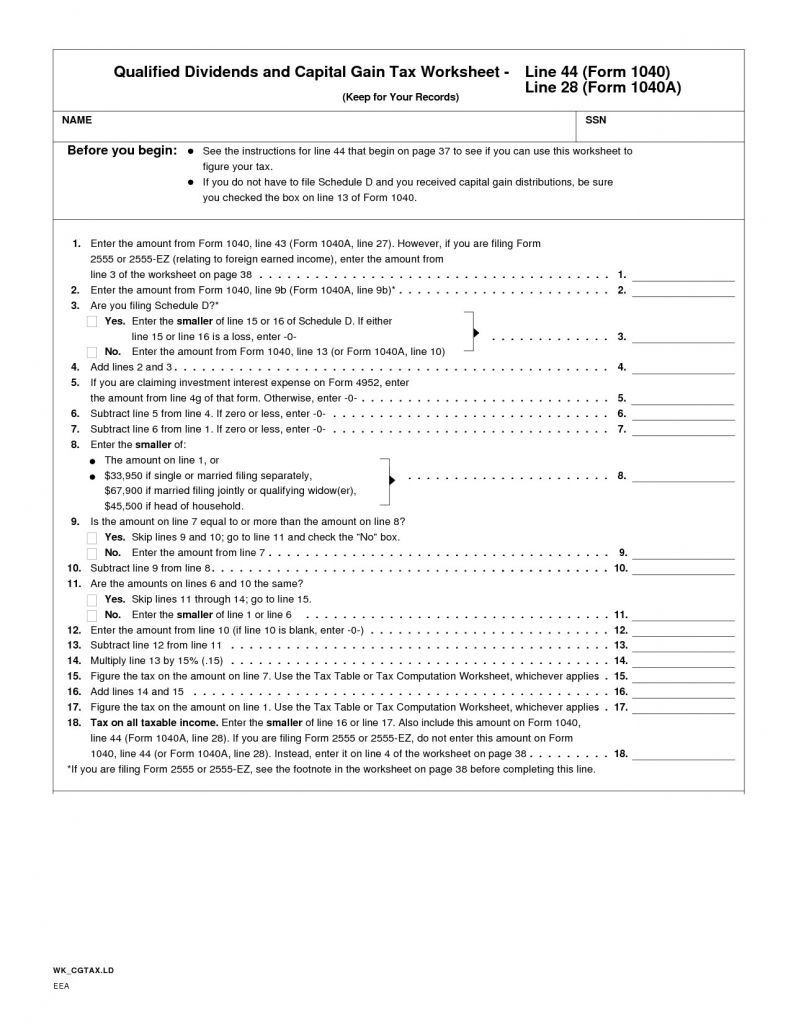

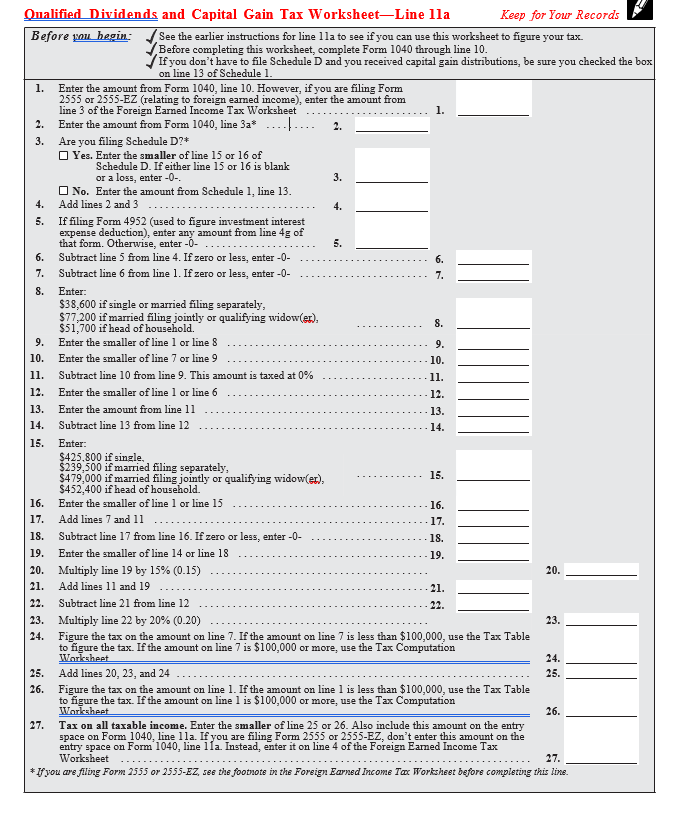

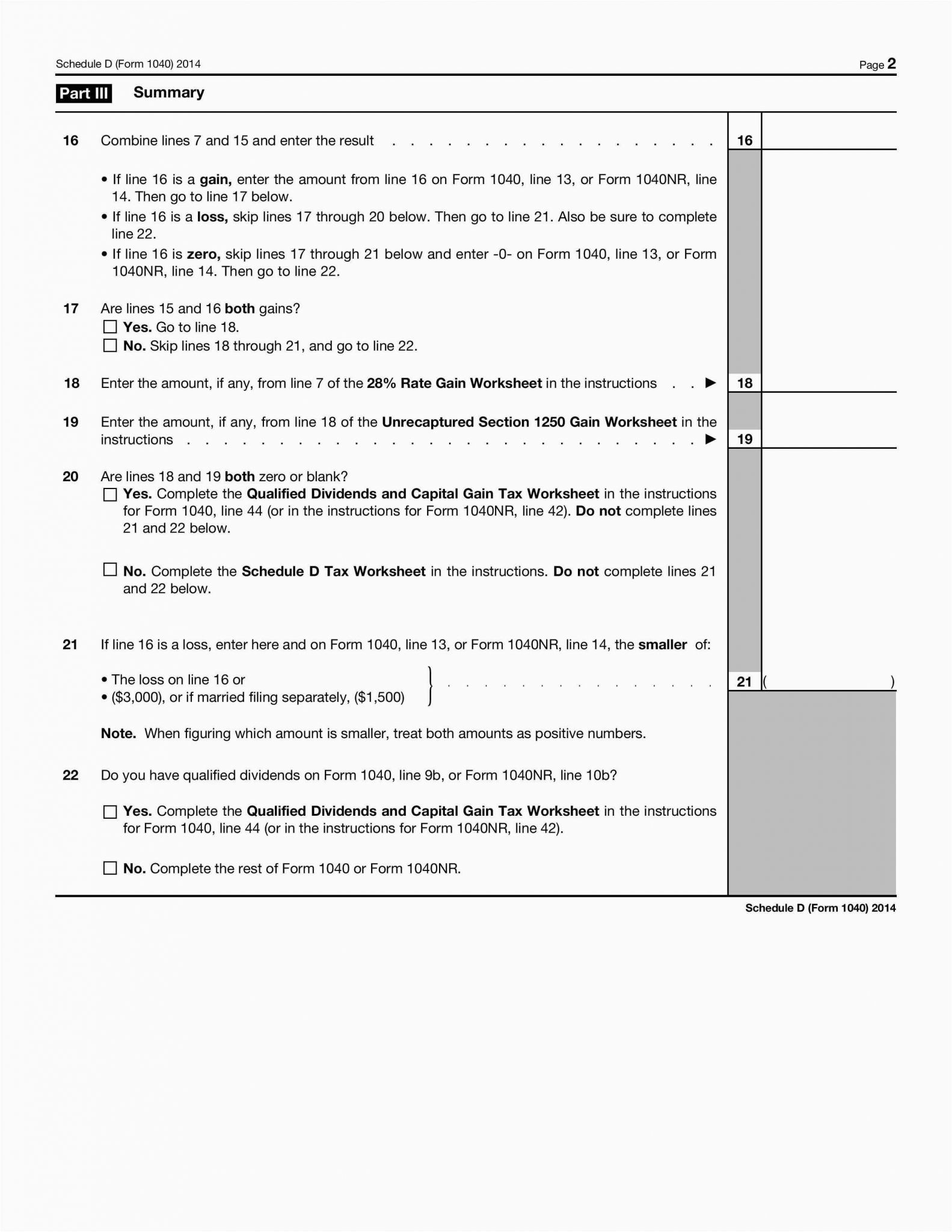

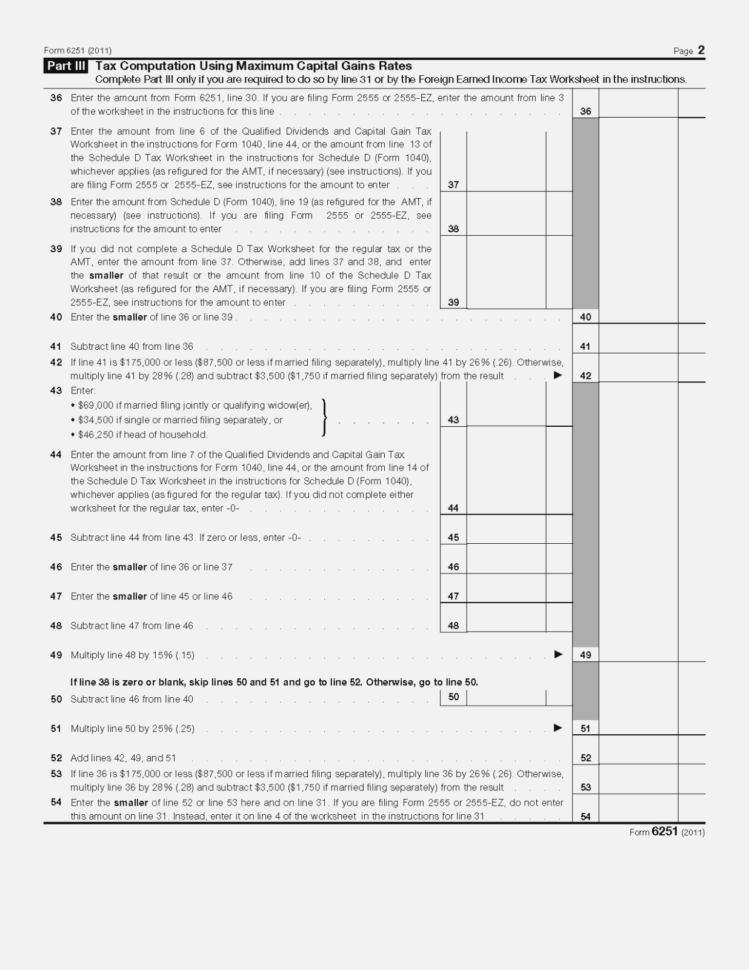

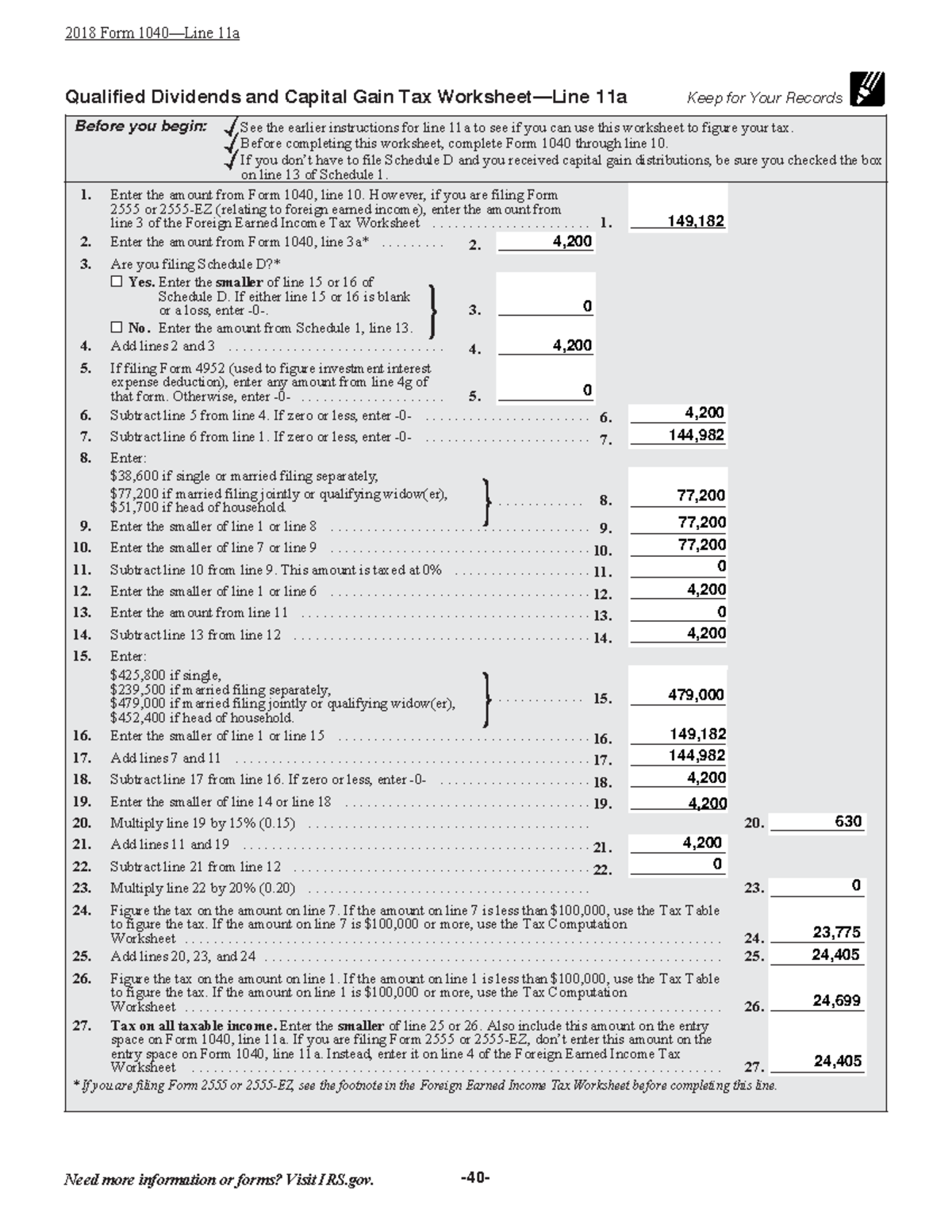

Qualified Dividends And Capital Gains Worksheet

Qualified Dividends And Capital Gains Worksheet - Before completing this worksheet, complete form 1040 through line 43. Web qualified dividends or a net capital gain for 2023. Explore updated credits, deductions, and exemptions, including the standard. Use fill to complete blank online. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Enter the amount from form 1040. Web qualified dividend and capital gain tax worksheet. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: See the earlier instructions for line 12a to see if you can use this. Per the irs form 1040. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Per the irs form 1040. Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Enter the amount from. Per the irs form 1040. If “yes,” attach form 8949 and see its instructions for additional requirements. Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Explore updated credits, deductions, and exemptions, including the standard. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: To see this select forms view, then the dtaxwrk folder, then the qualified div. Use fill to complete blank online. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. See the earlier instructions for line 12a to see if you can use this. Web qualified dividends or a net capital gain for 2023. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web what is the qualified dividend and capital gain tax worksheet? See the earlier instructions for line 12a to see if you can use this. Per the irs form 1040. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Per the irs form 1040. Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. But taxpayers can elect. Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Figuring out the tax on your qualified dividends can be difficult for even the most. Enter the amount from. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Income tax return for electing alaska native settlement trusts, as a. Web what is the qualified dividend and capital gain tax worksheet? Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends. But taxpayers can elect to include. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web in general,. Web what is the qualified dividend and capital gain tax worksheet? Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Line 15 or line 16 of schedule d is zero or less and you. To see this select forms view, then the dtaxwrk folder, then the qualified div & cap gain wrk tab. Web see the. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the. Before completing this worksheet, complete form 1040 through line 43. Figuring out the tax on your qualified dividends can be difficult for even the most. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Income tax return for electing alaska native settlement trusts, as a. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. See the earlier instructions for line 12a to see if you can use this worksheet to figure. Web the irs recently released the new inflation adjusted 2022 tax brackets and rates. See the earlier instructions for line 12a to see if you can use this. But taxpayers can elect to include. Line 15 or line 16 of schedule d is zero or less and you. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. Explore updated credits, deductions, and exemptions, including the standard. Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web qualified dividends or a net capital gain for 2023. Enter the amount from form 1040. Web fill online, printable, fillable, blank 2020 qualified dividends and capital gain tax worksheet (h&rblock) form. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure. Don’t use the qualified dividends and capital gain tax worksheet or this worksheet to figure your tax if: Web qualified dividends or a net capital gain for 2023. Explore updated credits, deductions, and exemptions, including the standard. To see this select forms view, then the dtaxwrk folder, then the qualified div & cap gain wrk tab. Income tax return for electing alaska native settlement trusts, as a. Enter the amount from form 1040. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web see the instructions for line 44 to see if you can use this worksheet to figure your tax. Web in general, qualified dividends and net capital gains from the disposition of property held for investment are excluded from investment income. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Before completing this worksheet, complete form 1040 through line 43. Use fill to complete blank online. Web qualified dividend and capital gain tax worksheet. Web qualified dividends and capital gain tax worksheet (2020) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax.1040 Qualified Dividends And Capital Gains Worksheet Promotiontablecovers

Qualified Dividends and Capital Gains Worksheet Qualified Dividends

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

IN C++ Please Create A Function To Certify The Out...

Qualified Dividends And Capital Gain Worksheet

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Per The Irs Form 1040.

Web What Is The Qualified Dividend And Capital Gain Tax Worksheet?

Line 15 Or Line 16 Of Schedule D Is Zero Or Less And You.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The Qualified Dividends And New Rates To The.

Related Post: