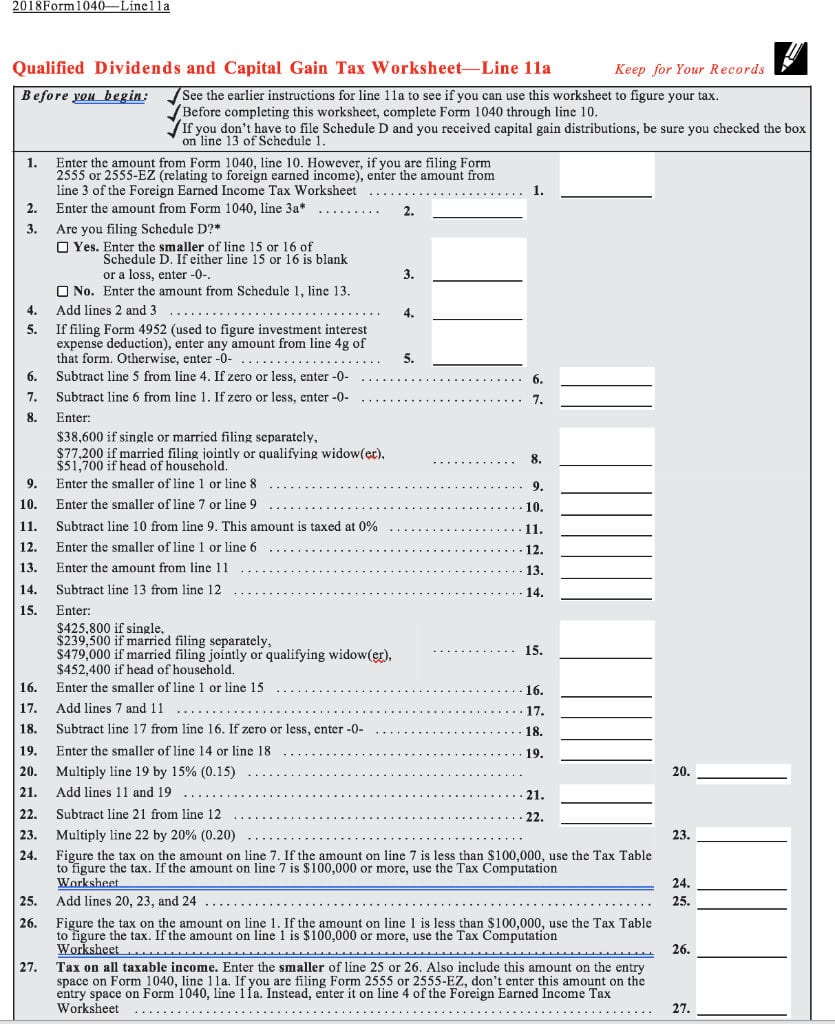

Qualified Dividends Worksheet

Qualified Dividends Worksheet - Turbo tax describes one method for your dividends to be qualified is that you must have held the stock in the. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? The tax rate on nonqualified dividends is the same as. If “yes,” attach form 8949 and see its instructions for additional requirements. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. Web what is the qualified dividend and capital gain tax worksheet? ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. Income tax return for electing alaska native settlement trusts, as a. Web • see the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Turbo tax describes one method for your dividends to be qualified is that you must have held the stock in the. • if you don’t have to file schedule d and. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. • if you don’t have to file schedule d and you. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Web • see the earlier instructions for line 16 to see. Web • see the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. You can find them in the form 1040 instructions. Income tax return for electing alaska native settlement trusts, as a. • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. Web qualified dividends or a net capital gain for 2023. Income tax return for electing alaska native settlement trusts, as a. Turbo tax describes one method for your dividends to be. Web the tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. These tax rates are lower than the income tax rate on ordinary or unqualified. • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked the box See the earlier instructions for. Turbo tax describes one method for your dividends to be qualified is that you must have held the stock in the. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked the box Web what. Web how do you know if your dividend is qualified? You can find them in the form 1040 instructions. Income tax return for electing alaska native settlement trusts, as a. Web • see the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Figuring out the tax on your qualified dividends can. Web report your qualified dividends on line 9b of form 1040 or 1040a. Web what is the qualified dividend and capital gain tax worksheet? Income tax return for electing alaska native settlement trusts, as a. ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. This guide will provide an. • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked the box You can find them in the form 1040 instructions. If “yes,” attach form 8949 and see its instructions for additional requirements. This guide will provide an overview of the form and instructions on how to complete it. Figuring out. This guide will provide an overview of the form and instructions on how to complete it. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked the box These tax rates are lower than the income tax rate on ordinary or unqualified. Web • see the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web how do you know if your dividend is qualified? Turbo tax describes one method for your dividends to be qualified is that you must have held the stock in the. Web the tax computation for line 16 of form 1040 can be calculated in one of four ways: Web report your qualified dividends on line 9b of form 1040 or 1040a. Web what is the qualified dividend and capital gain tax worksheet? Figuring out the tax on your qualified dividends can be difficult for even the most experienced. Income tax return for electing alaska native settlement trusts, as a. See the earlier instructions for line 12a to see if you can use this worksheet to figure. ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. If “yes,” attach form 8949 and see its instructions for additional requirements. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. The tax rate on nonqualified dividends is the same as. You can find them in the form 1040 instructions. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. • if you don’t have to file schedule d and you received capital gain distributions, be sure you checked the box Use the qualified dividends and capital gain tax worksheet in the instructions for form 1040 or 1040a. Income tax return for electing alaska native settlement trusts, as a. Figuring out the tax on your qualified dividends can be difficult for even the most experienced. The tax rate on nonqualified dividends is the same as. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. See the earlier instructions for line 12a to see if you can use this worksheet to figure. This guide will provide an overview of the form and instructions on how to complete it. Web report your qualified dividends on line 9b of form 1040 or 1040a. These tax rates are lower than the income tax rate on ordinary or unqualified. You can find them in the form 1040 instructions. Web how do you know if your dividend is qualified? Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the. If “yes,” attach form 8949 and see its instructions for additional requirements. Turbo tax describes one method for your dividends to be qualified is that you must have held the stock in the. Web qualified dividends and capital gain tax worksheet—line 12a keep for your records.Qualified Dividends And Capital Gains Worksheet 2018 —

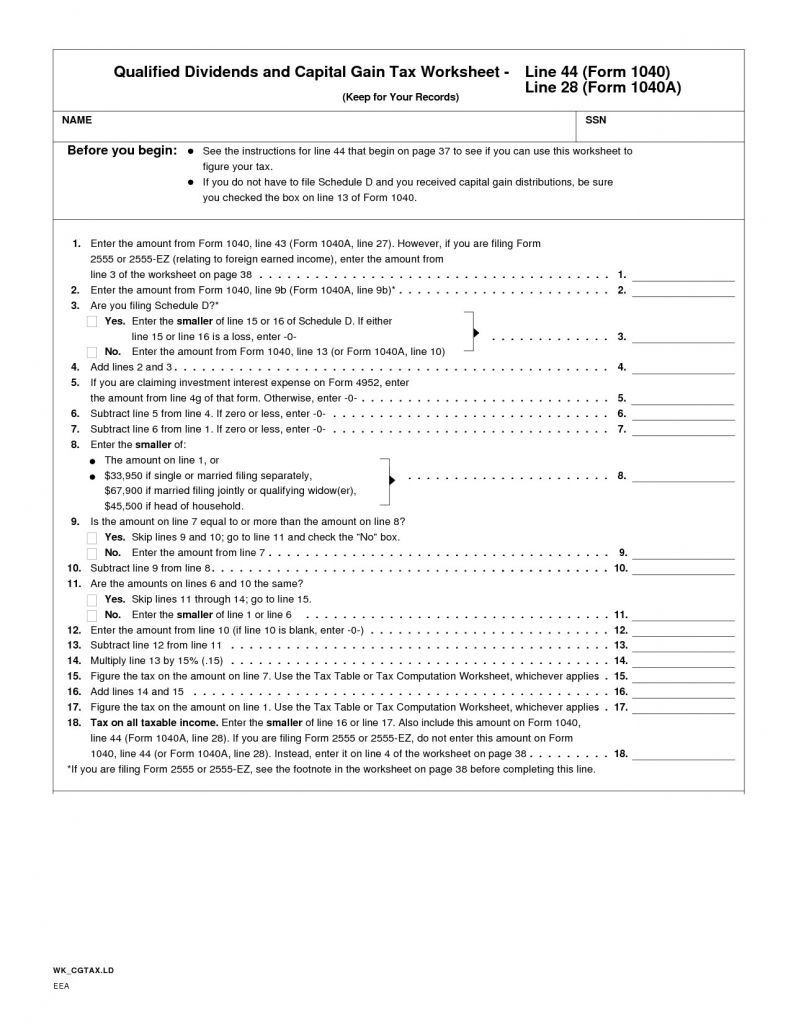

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

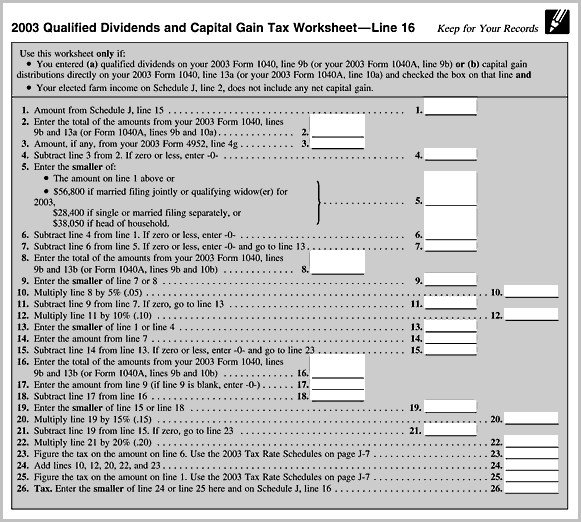

Qualified Dividends and Capital Gain Tax Worksheet 2019

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

20++ Qualified Dividends And Capital Gains Worksheet 2020

Qualified Dividends And Capital Gains Worksheet 2018 —

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Qualified Dividends and Capital Gain Tax Worksheet

Web • See The Earlier Instructions For Line 16 To See If You Can Use This Worksheet To Figure Your Tax.

Web Qualified Dividends Or A Net Capital Gain For 2023.

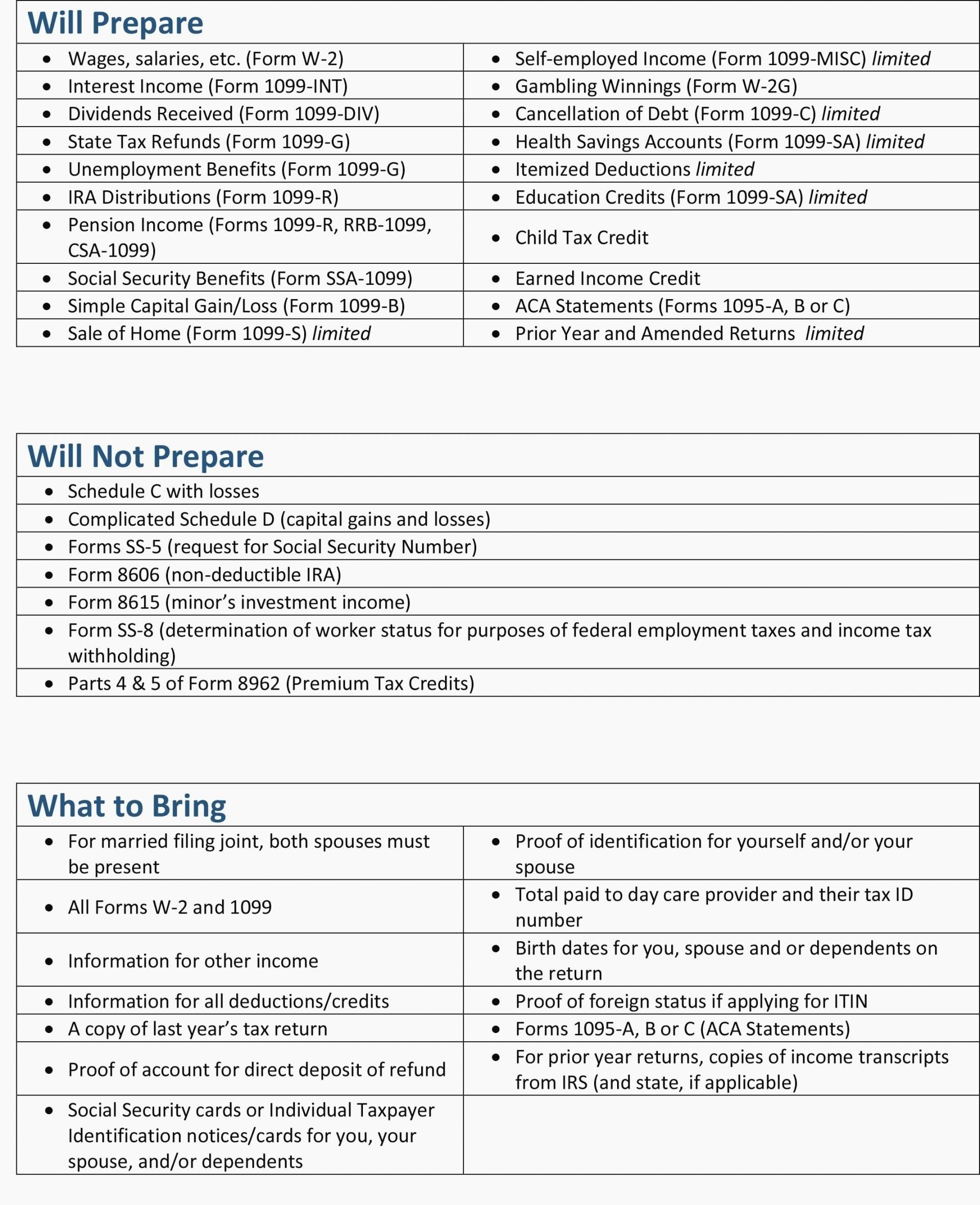

Web What Is The Qualified Dividend And Capital Gain Tax Worksheet?

Web Did You Dispose Of Any Investment(S) In A Qualified Opportunity Fund During The Tax Year?

Related Post: