Qualified Education Expenses Worksheet

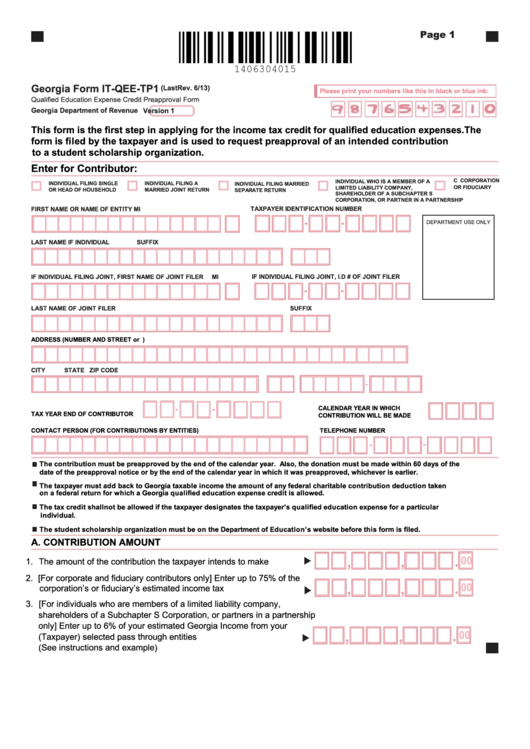

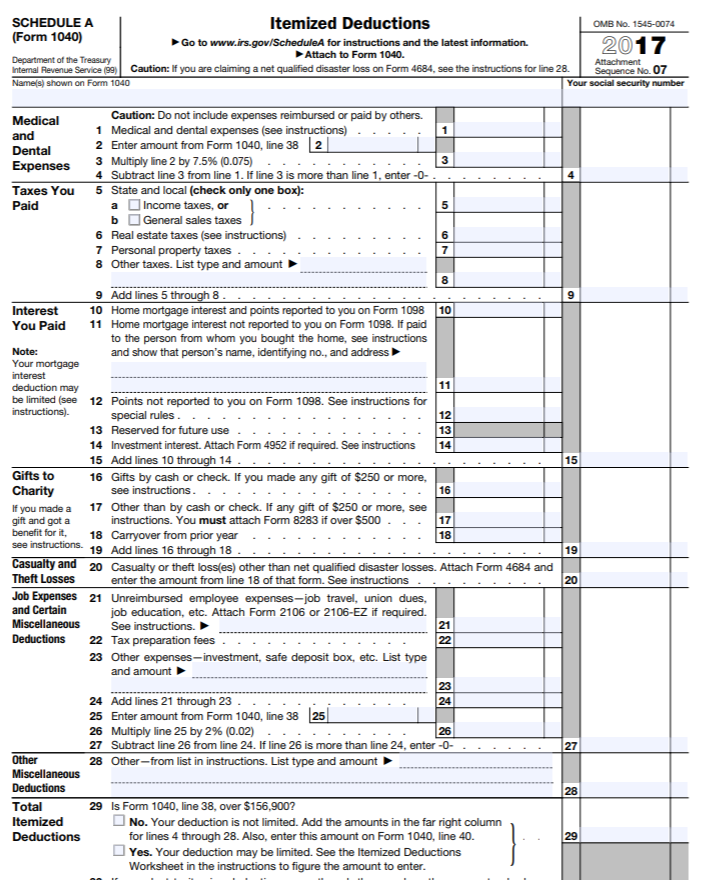

Qualified Education Expenses Worksheet - • the eligible student is either the taxpayer, taxpayer’s. Click ok to open the educator expense workhseet. Web qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. Web have paid “qualified education expenses” during the year for that child’s education. Web the eligible student is yourself, your spouse, or your dependent for whom you claim an exemption on your income tax return. You meet certain income limitations. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Use fill to complete blank online h&rblock pdf forms for free. • tuition and fees required to enroll at or attend an eligible educational. Web an option in the qualified expenses row, allows you to use all available funds to be spent on the qualified expenses (often results in no additional taxable income) or to use only. Click ok to open the educator expense workhseet. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. • tuition and fees required to enroll at or attend an eligible educational. Web fill online, printable, fillable, blank 2020 education expense worksheet (h&rblock) form. Use fill. First, when you entered the education expense credit of $700 under take a look at georgia credits,. Web determine if eligible, go to the u.s. Web there are several issues, all of which can be surmounted. • the eligible student is either the taxpayer, taxpayer’s. • tuition and fees required to enroll at or attend an eligible educational. Web qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. Amounts actually paid during 2020 for qualified tuition. You meet certain income limitations. Click ok to open the educator expense workhseet. Web qualified higher education expense: Click ok to open the educator expense workhseet. You meet certain income limitations. Amounts actually paid during 2020 for qualified tuition. Use fill to complete blank online h&rblock pdf forms for free. Web add the amounts in the “total amount of qualified expenses paid by parent or guardian” column for each student. Web the eligible student is yourself, your spouse, or your dependent for whom you claim an exemption on your income tax return. First, when you entered the education expense credit of $700 under take a look at georgia credits,. Press f6 to bring up open forms. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for. Web to enter expenses: Web qualified higher education expense: Use fill to complete blank online h&rblock pdf forms for free. Web add the amounts in the “total amount of qualified expenses paid by parent or guardian” column for each student. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Web qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. Web have paid “qualified education expenses” during the year for that child’s education. • the eligible student is either the taxpayer, taxpayer’s. Use fill to complete blank online h&rblock pdf forms for free. Web an option in. You meet certain income limitations. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. • tuition and fees required to enroll at or attend an eligible educational. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for an eligible student.. • the eligible student is either the taxpayer, taxpayer’s. Web the eligible student is yourself, your spouse, or your dependent for whom you claim an exemption on your income tax return. That sounds like it covers. Web fill online, printable, fillable, blank 2020 education expense worksheet (h&rblock) form. First, when you entered the education expense credit of $700 under take. That sounds like it covers. Web fill online, printable, fillable, blank 2020 education expense worksheet (h&rblock) form. You meet certain income limitations. Web there are several issues, all of which can be surmounted. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Web have paid “qualified education expenses” during the year for that child’s education. Web you can find the actual computation method in the adjusted qualified education expenses worksheet on page 8 of the 2021 instructions for form 8863. Web generally, qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student at any accredited college, vocational school, or. Web qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. Expenses such as tuition and tuition related expenses that an individual, spouse, or child must pay to an eligible post. “qualifying” education expenses are amounts paid for tuition, fees and other related expenses for an eligible student. Click ok to open the educator expense workhseet. Payments received for qualified tuition and related expenses (total from column b above) 1. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. Web add the amounts in the “total amount of qualified expenses paid by parent or guardian” column for each student. First, when you entered the education expense credit of $700 under take a look at georgia credits,. Web an option in the qualified expenses row, allows you to use all available funds to be spent on the qualified expenses (often results in no additional taxable income) or to use only. Use fill to complete blank online h&rblock pdf forms for free. Amounts actually paid during 2020 for qualified tuition. Web qualified higher education expense: • tuition and fees required to enroll at or attend an eligible educational. Web to enter expenses: Press f6 to bring up open forms. Web there are several issues, all of which can be surmounted. You meet certain income limitations. Web there are several issues, all of which can be surmounted. Click ok to open the educator expense workhseet. Amounts actually paid during 2020 for qualified tuition. Web generally, qualified education expenses are amounts paid for tuition, fees and other related expenses for an eligible student at any accredited college, vocational school, or. Use fill to complete blank online h&rblock pdf forms for free. Web to enter expenses: Web fill online, printable, fillable, blank 2020 education expense worksheet (h&rblock) form. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution. • the eligible student is either the taxpayer, taxpayer’s. Press f6 to bring up open forms. Web qualified tuition expenses include only tuition paid for the undergraduate enrollment or attendance of the student at an institution of higher education. Web qualified higher education expense: Web the eligible student is yourself, your spouse, or your dependent for whom you claim an exemption on your income tax return. Web you can find the actual computation method in the adjusted qualified education expenses worksheet on page 8 of the 2021 instructions for form 8863. Web add the amounts in the “total amount of qualified expenses paid by parent or guardian” column for each student. Expenses such as tuition and tuition related expenses that an individual, spouse, or child must pay to an eligible post.Fillable Form ItQeeTp1 Qualified Education Expense Credit

Adjusted Qualified Education Expenses Worksheet Breadandhearth

FREE 12+ Expense Worksheet Samples & Templates in PSD PDF

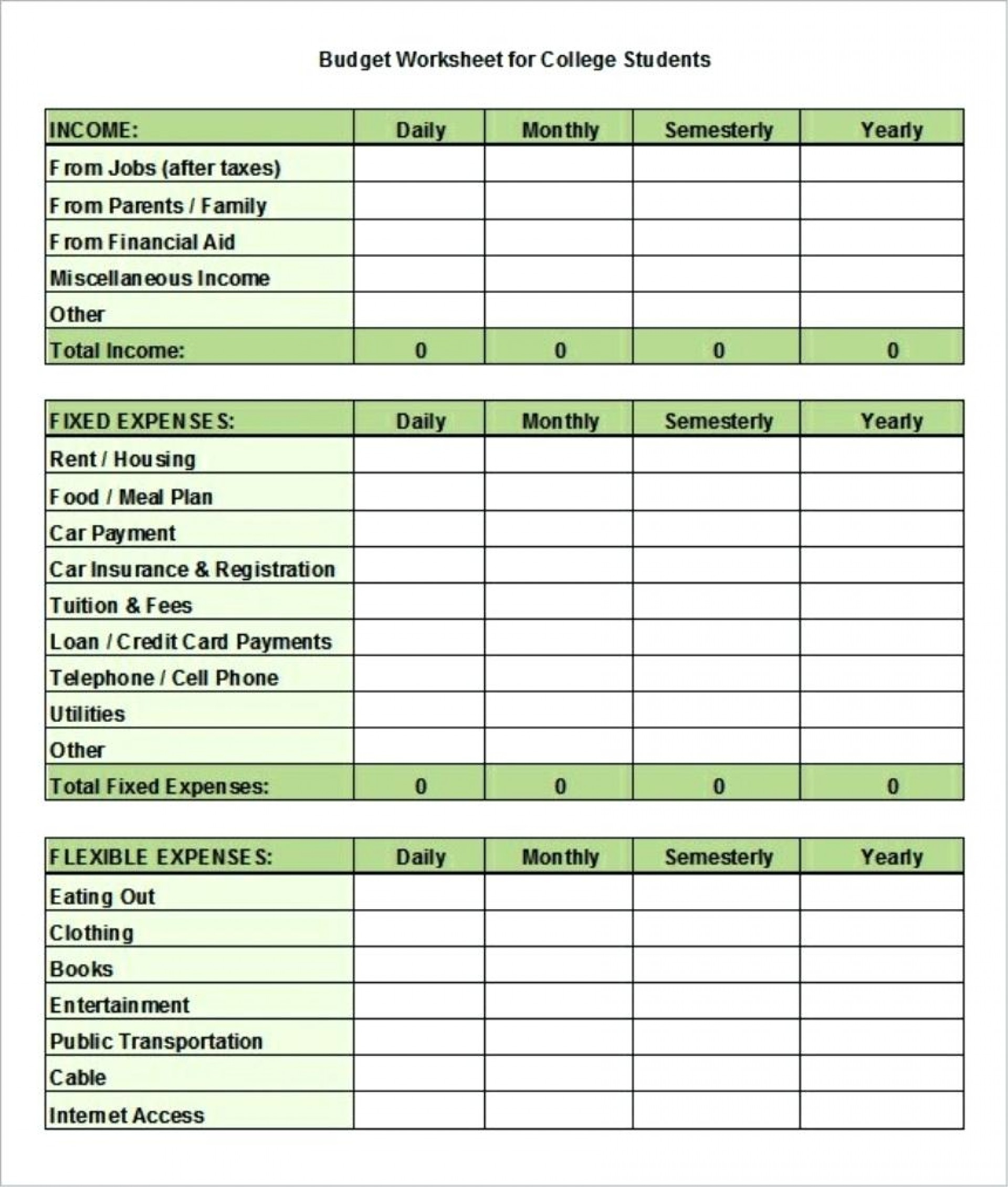

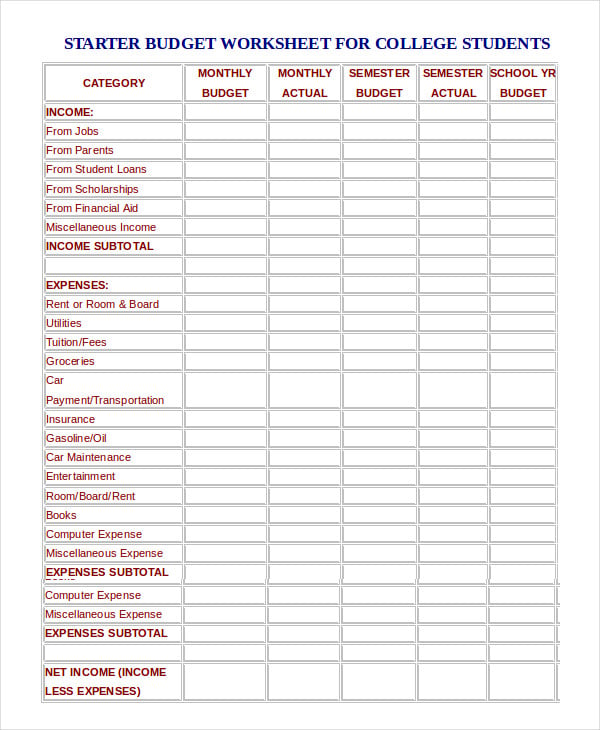

College Student Expenses Spreadsheet regarding 020 Template Ideas

Fill Free fillable H&Rblock PDF forms

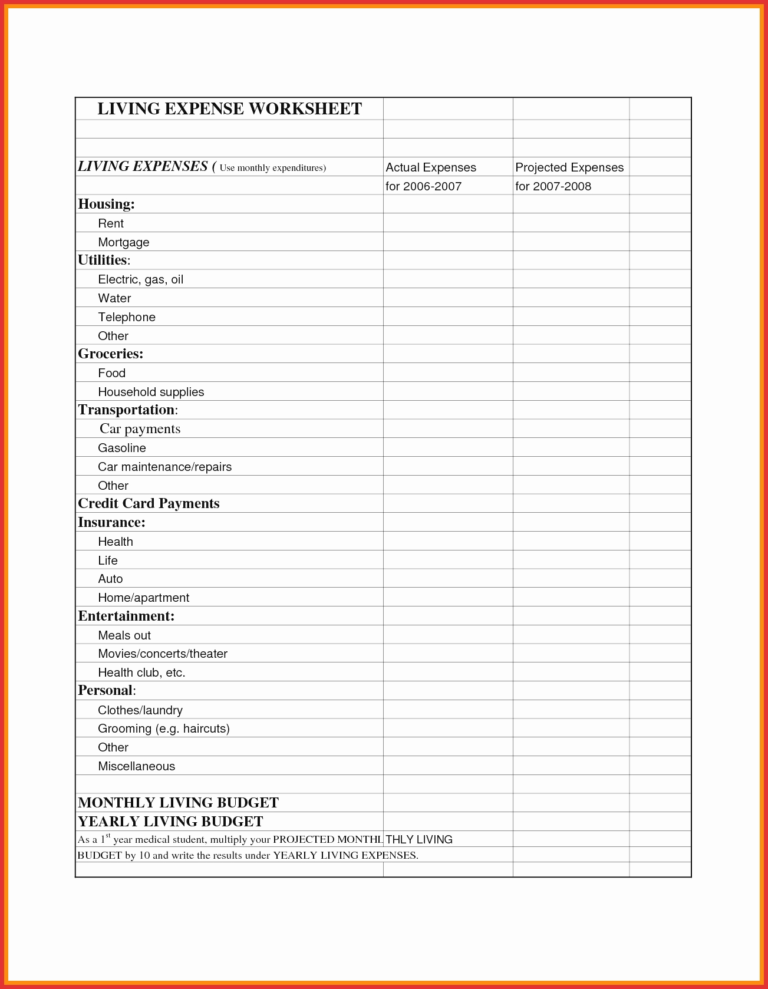

Worksheet Monthly Expenses Worksheet Printable Monthly —

College Student Budget Worksheet Free Printable Worksheet from

Ssurvivor Form 2106 Instructions Line 6

18+ Monthly College Expense Calculator Worksheet Sample Templates

Receipt for qualified education expenses Fill out & sign online DocHub

Web Have Paid “Qualified Education Expenses” During The Year For That Child’s Education.

“Qualifying” Education Expenses Are Amounts Paid For Tuition, Fees And Other Related Expenses For An Eligible Student.

Payments Received For Qualified Tuition And Related Expenses (Total From Column B Above) 1.

• Tuition And Fees Required To Enroll At Or Attend An Eligible Educational.

Related Post: