Railroad Retirement Taxable Income Worksheet

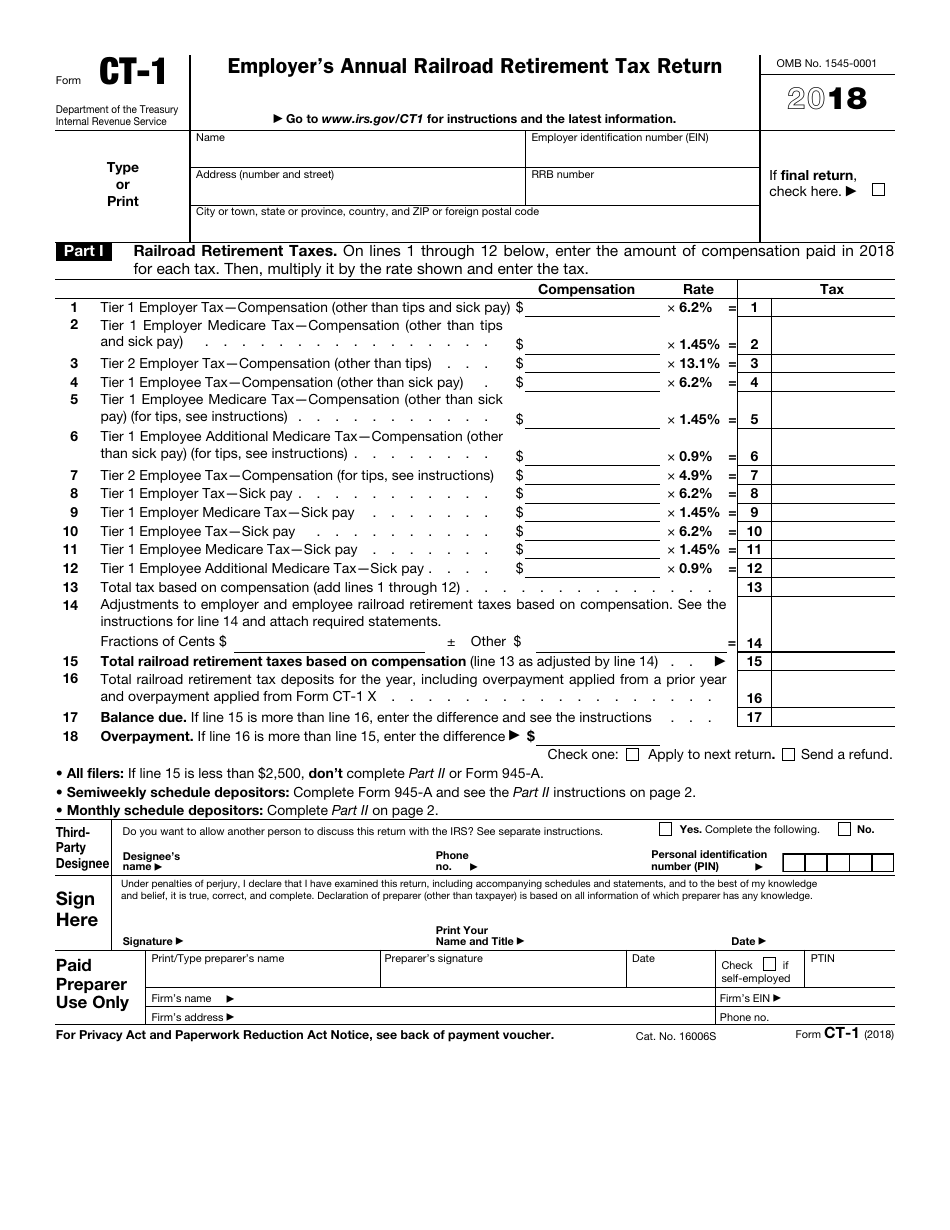

Railroad Retirement Taxable Income Worksheet - You can enter the railroad retirement. Web as a result, the unemployment insurance contribution rates on railroad employers in 2023 will range from the minimum rate of 2.15 percent to the maximum of. Railroad retirement employee annuities and pensions from work not covered by. Tp is age 65+ sp is age 65+. From within your taxact return (online or desktop),. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. Web information you'll need. Web jul 27, 2023 11:00 am edt. Fill in lines a through e. Employee contribution (eec) amount 1. Web railroad retirement payments are not taxable for state income tax purposes. Railroad retirement board (rrb) and represents payments made to you in the. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. Taxslayer incorrectly includes rr retirement benefits in the retirement. You can enter the railroad retirement. Web 2 nontaxable social security and/or railroad retirement board benefits received. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. From within your taxact return (online or desktop),. Tp is age 65+ sp is age 65+. Railroad retirement employee annuities and pensions from work not covered by. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. From within your taxact return. Taxslayer incorrectly includes rr retirement benefits in the retirement exclusion. Web nontaxable payment amounts are not reported on any federal income tax statement issued by the rrb. Web as a result, the unemployment insurance contribution rates on railroad employers in 2023 will range from the minimum rate of 2.15 percent to the maximum of. Web jul 27, 2023 11:00 am. Basic information to help you determine your gross income. Web calculating railroad retirement employee annuities. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. If social security benefits are received, amounts from box 5 on form ssa. To enter this information in. Fill in lines a through e. Basic information to help you determine your gross income. From within your taxact return (online or desktop),. Taxslayer incorrectly includes rr retirement benefits in the retirement exclusion. Web nontaxable payment amounts are not reported on any federal income tax statement issued by the rrb. See publication 915, social security and equivalent railroad retirement benefits, and publication 575, pensions and annuity income, for additional information. Railroad retirement employee annuities and pensions from work not covered by. Web calculating railroad retirement employee annuities. Tp is age 65+ sp is age 65+. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to. Web information you'll need. If social security benefits are received, amounts from box 5 on form ssa. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. Taxslayer incorrectly includes rr retirement benefits in the retirement exclusion. Web as a result, the unemployment. Web as a result, the unemployment insurance contribution rates on railroad employers in 2023 will range from the minimum rate of 2.15 percent to the maximum of. Web information you'll need. Employee contribution (eec) amount 1. Do not use the worksheet below if any of the following apply to you;. From within your taxact return (online or desktop),. Web 2 nontaxable social security and/or railroad retirement board benefits received. Railroad retirement employee annuities and pensions from work not covered by. To enter this information in your taxact return: Web as a result, the unemployment insurance contribution rates on railroad employers in 2023 will range from the minimum rate of 2.15 percent to the maximum of. Basic information to. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. Railroad retirement board (rrb) and represents payments made to you in the. Railroad retirement employee annuities and pensions from work not covered by. If social security benefits are received, amounts from box 5 on form ssa. Web nontaxable payment amounts are not reported on any federal income tax statement issued by the rrb. Taxslayer incorrectly includes rr retirement benefits in the retirement exclusion. Fill in lines a through e. Web information you'll need. Tp is age 65+ sp is age 65+. Web we developed this worksheet for you to see if your benefits may be taxable for 2022. To enter this information in your taxact return: See publication 915, social security and equivalent railroad retirement benefits, and publication 575, pensions and annuity income, for additional information. You can enter the railroad retirement. Web railroad retirement payments are not taxable for state income tax purposes. Basic information to help you determine your gross income. Web jul 27, 2023 11:00 am edt. Web calculating railroad retirement employee annuities. From within your taxact return (online or desktop),. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Employee contribution (eec) amount 1. Web calculating railroad retirement employee annuities. If social security benefits are received, amounts from box 5 on form ssa. Web 2 nontaxable social security and/or railroad retirement board benefits received. Web information you'll need. Definition the eec is the. Web railroad retirement payments are not taxable for state income tax purposes. Employee contribution (eec) amount 1. Web jul 27, 2023 11:00 am edt. Since 1984, social security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax. Railroad retirement employee annuities and pensions from work not covered by. You can enter the railroad retirement. From within your taxact return (online or desktop),. See publication 915, social security and equivalent railroad retirement benefits, and publication 575, pensions and annuity income, for additional information. Web introduction regular railroad retirement annuities consisting of tier 1, tier 2, and vested dual benefit components have been subject to united states federal income tax since. Basic information to help you determine your gross income. Web we developed this worksheet for you to see if your benefits may be taxable for 2022.Form CT1 Employer's Annual Railroad Retirement Tax Return (2014

IRS Form CT1 Download Fillable PDF or Fill Online Employer's Annual

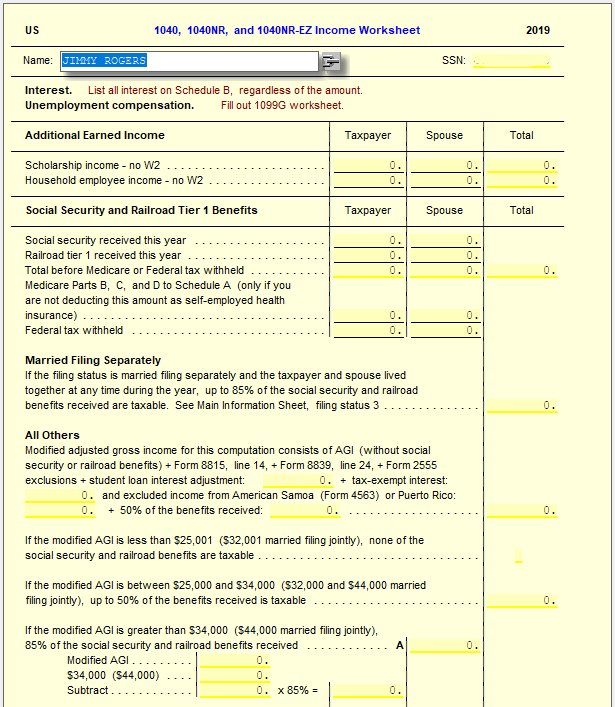

Railroad Benefits (RRB1099) UltimateTax Solution Center

Publication 915 Social Security and Equiv Railroad Retirement Benefits

Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for

Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for

Form RRB1099R Railroad Retirement Benefits Keystone Support Center

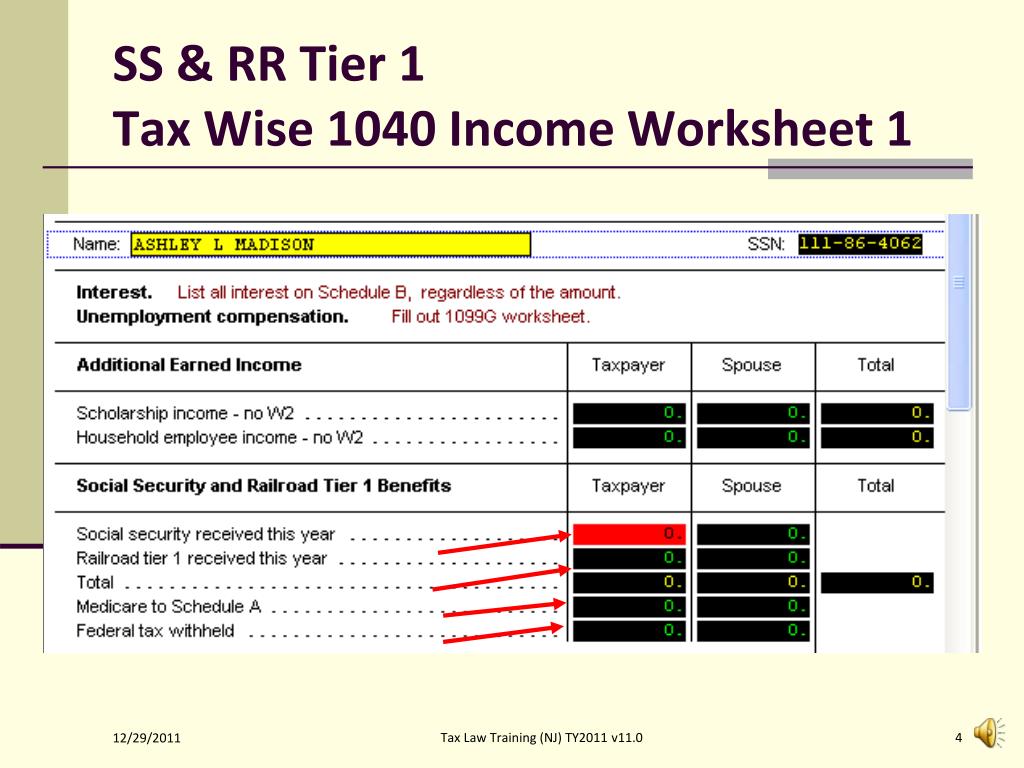

PPT Social Security & RR Retirement Tier 1 (Blue Form) PowerPoint

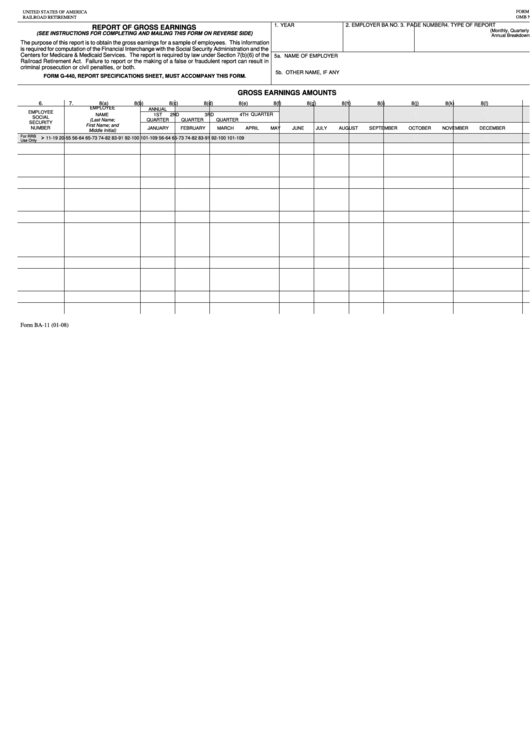

Form Ba11 Report Of Gross Earnings Railroad Retirement printable

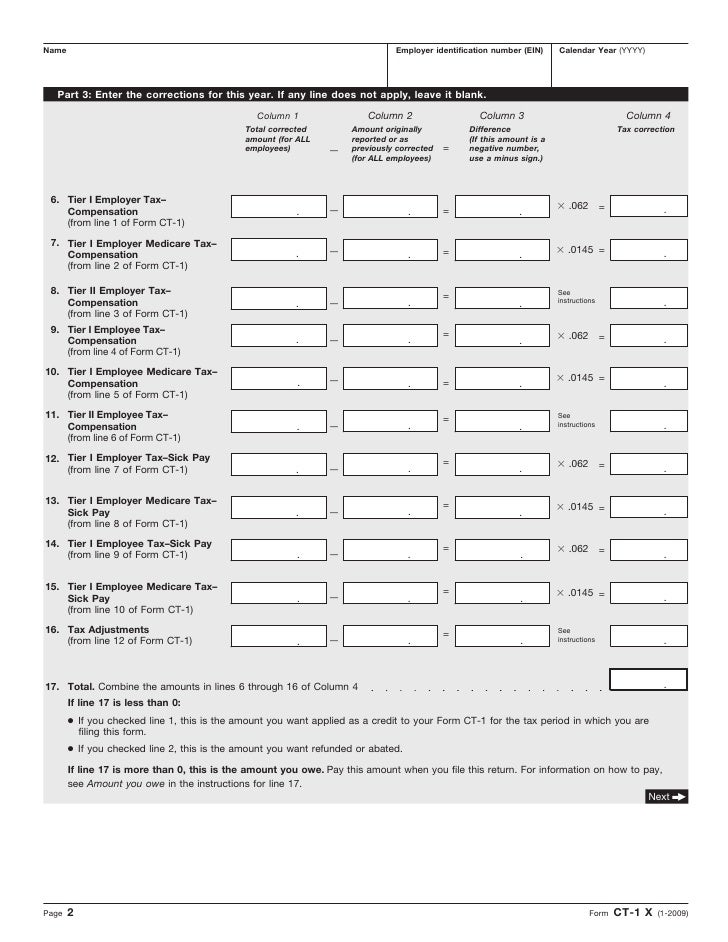

Form CT1X Adjusted Employer's Annual Railroad Retirement Tax Return…

Fill In Lines A Through E.

Tp Is Age 65+ Sp Is Age 65+.

To Enter This Information In Your Taxact Return:

Railroad Retirement Board (Rrb) And Represents Payments Made To You In The.

Related Post: