Realtor Tax Deductions Worksheet

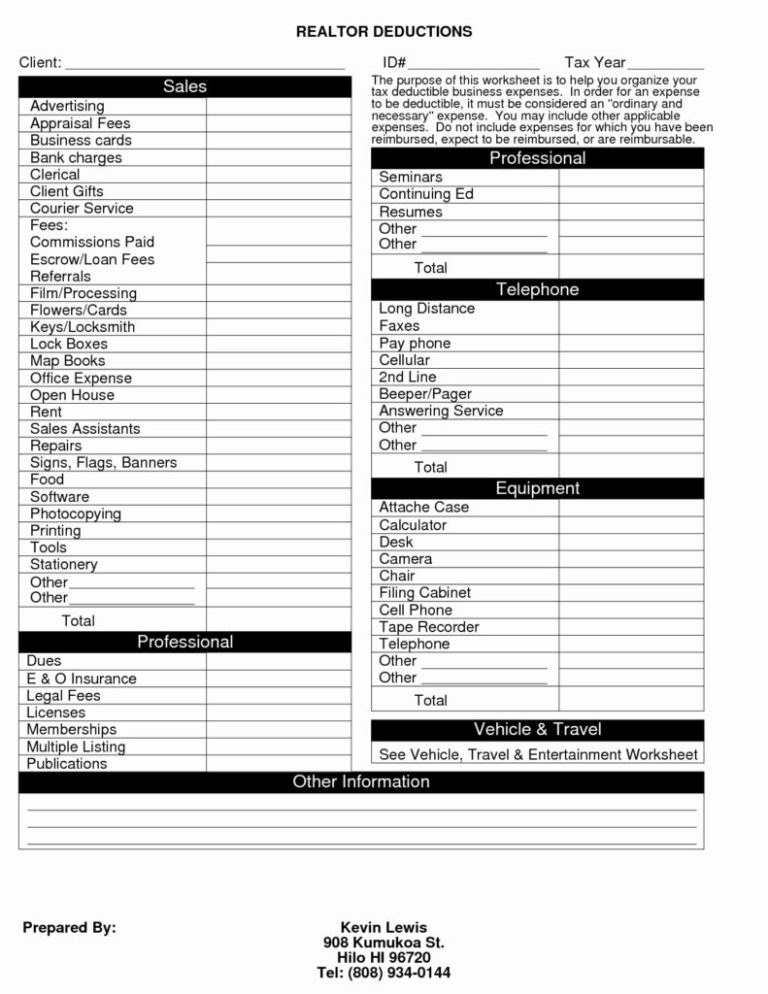

Realtor Tax Deductions Worksheet - Web realtors tax deduction worksheet due to the overwhelming response to last month’s realtor “tax tip” article, daszkal bolton llp has created this realtors’ tax deduction. You can deduct all your business expenses as long as they. The worksheet can help real estate professionals to:. Get everything done in minutes. Sign it in a few clicks draw your. Expenses for travel between business. Web utilizing a real estate agent tax deductions worksheet can be an efficient way to manage and organize deductible expenses. Web this worksheet provides a way for you to organize your credit and deduction information only. Ultimate guide” that can help you lower your tax burden. Edit your realtors tax deductions online type text, add images, blackout confidential details, add comments, highlights and more. Read the instructions tab of the workbook, before completing the schedule. Web real estate agent tax deductions worksheet 2022. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Web to figure your state and local general sales tax deduction using the tables, complete the. Web to figure your state and local general sales tax deduction using the tables, complete the state and local general sales tax deduction worksheet or use the sales tax. Download the schedule a excel workbook using the link below. To avoid errors, a new download of the schedule a excel workbook should be done for each reporting period. Web you. Web here are some of the most common real estate agent and broker deductions: The worksheet can help real estate professionals to:. For additional help with this process, please see our video. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Chapter 2 discusses. To avoid errors, a new download of the schedule a excel workbook should be done for each reporting period. Read the instructions tab of the workbook, before completing the schedule. Chapter 2 discusses depreciation as it applies to your rental real estate activity—what property can be depreciated and how much it can be depreciated. Web you figure the business portion. Web you figure the business portion of your real estate taxes using form 8829 (if you file schedule c (form 1040)) or the worksheet to figure the deduction for business use of your home in this publication (if you file schedule f (form 1040)). Web here are some of the most common real estate agent and broker deductions: Web if. The worksheet can help real estate professionals to:. Web realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive. Marketing expenses such as sales and open house signs and flyers, your website. Web it examines some common types of rental income and when each is reported, as well as some. Web sheet1 sales,professional advertising,seminars appraisal fees,continuing ed business cards,resumes bank charges,teleophone clerical,cell phone client gifts,cell plan courier services,equipment commission fees,office supplies escrow fees,computer referral fees,tablet flim production,vehicle flowers Read the instructions tab of the workbook, before completing the schedule. Chapter 2 discusses depreciation as it applies to your rental real estate activity—what property can be depreciated and how much it. Web here are the top tax deductions for real estate agents in 2023. Web realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive. For additional help with this process, please see our video. Marketing expenses such as sales and open house signs and flyers, your website. The worksheet can. Download the schedule a excel workbook using the link below. Edit your realtors tax deductions online type text, add images, blackout confidential details, add comments, highlights and more. Read the instructions tab of the workbook, before completing the schedule. Web cheat sheet of 100+ legal tax deductions for real estate agents. Sign it in a few clicks draw your. Web realtors tax deduction worksheet due to the overwhelming response to last month’s realtor “tax tip” article, daszkal bolton llp has created this realtors’ tax deduction. Web cheat sheet of 100+ legal tax deductions for real estate agents. Web 5 tax deductions to take when selling a home your home tax deduction checklist a homeowner's guide to taxes 7 tax. Expenses for travel between business. Web if you receive a refund or rebate of real estate taxes this year for amounts you paid this year, you must reduce your real estate tax deduction by the amount refunded to you. Web this worksheet provides a way for you to organize your credit and deduction information only. Web you figure the business portion of your real estate taxes using form 8829 (if you file schedule c (form 1040)) or the worksheet to figure the deduction for business use of your home in this publication (if you file schedule f (form 1040)). Web real estate agent tax deductions worksheet: Web here are some of the most common real estate agent and broker deductions: Web utilizing a real estate agent tax deductions worksheet can be an efficient way to manage and organize deductible expenses. Web cheat sheet of 100+ legal tax deductions for real estate agents. Web 5 tax deductions to take when selling a home your home tax deduction checklist a homeowner's guide to taxes 7 tax benefits of owning a home mortgage interest. Web it examines some common types of rental income and when each is reported, as well as some common types of expenses and which are deductible. Web realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive. Web realtors tax deduction worksheet due to the overwhelming response to last month’s realtor “tax tip” article, daszkal bolton llp has created this realtors’ tax deduction. Ultimate guide” that can help you lower your tax burden. Web real estate agent tax deductions worksheet 2022. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Download the schedule a excel workbook using the link below. Web sheet1 sales,professional advertising,seminars appraisal fees,continuing ed business cards,resumes bank charges,teleophone clerical,cell phone client gifts,cell plan courier services,equipment commission fees,office supplies escrow fees,computer referral fees,tablet flim production,vehicle flowers Marketing expenses such as sales and open house signs and flyers, your website. Get everything done in minutes. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web to figure your state and local general sales tax deduction using the tables, complete the state and local general sales tax deduction worksheet or use the sales tax. Download the schedule a excel workbook using the link below. Web realtors tax deductions worksheet auto travel your auto expense is based on the number of qualified business miles you drive. Marketing expenses such as sales and open house signs and flyers, your website. Ultimate guide” that can help you lower your tax burden. Web it examines some common types of rental income and when each is reported, as well as some common types of expenses and which are deductible. Web here are some of the most common real estate agent and broker deductions: Web utilizing a real estate agent tax deductions worksheet can be an efficient way to manage and organize deductible expenses. Edit your realtors tax deductions online type text, add images, blackout confidential details, add comments, highlights and more. To avoid errors, a new download of the schedule a excel workbook should be done for each reporting period. Chapter 2 discusses depreciation as it applies to your rental real estate activity—what property can be depreciated and how much it can be depreciated. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Web here are the top tax deductions for real estate agents in 2023. Web realtors tax deduction worksheet due to the overwhelming response to last month’s realtor “tax tip” article, daszkal bolton llp has created this realtors’ tax deduction. Web if you receive a refund or rebate of real estate taxes this year for amounts you paid this year, you must reduce your real estate tax deduction by the amount refunded to you. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor.Cheat Sheet Of 100+ Legal Tax Deductions For Real Estate Agents

Real Estate Agent Tax Deductions Worksheet 2021 Fill Online

Home Office Deduction Worksheet Studying Worksheets

Tax Deduction Cheat Sheet for Real Estate Agents Independence Title

Printable Real Estate Agent Tax Deductions Worksheet Printable Word

10 Business Tax Deductions Worksheet /

Realtor Expenses Spreadsheet pertaining to Realtor Expense Deductions

Realtor tax deductions worksheet Fill out & sign online DocHub

39 realtor tax deduction worksheet Worksheet Master

43 realtor tax deduction worksheet Worksheet Information

Items To Consider Advertising Expenses As A Real Estate Agent, Advertising Is An Essential Part Of Your.

Web Real Estate Agent Tax Deductions Worksheet:

Web Sheet1 Sales,Professional Advertising,Seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

Web 5 Tax Deductions To Take When Selling A Home Your Home Tax Deduction Checklist A Homeowner's Guide To Taxes 7 Tax Benefits Of Owning A Home Mortgage Interest.

Related Post: