Rental Income Expense Worksheet

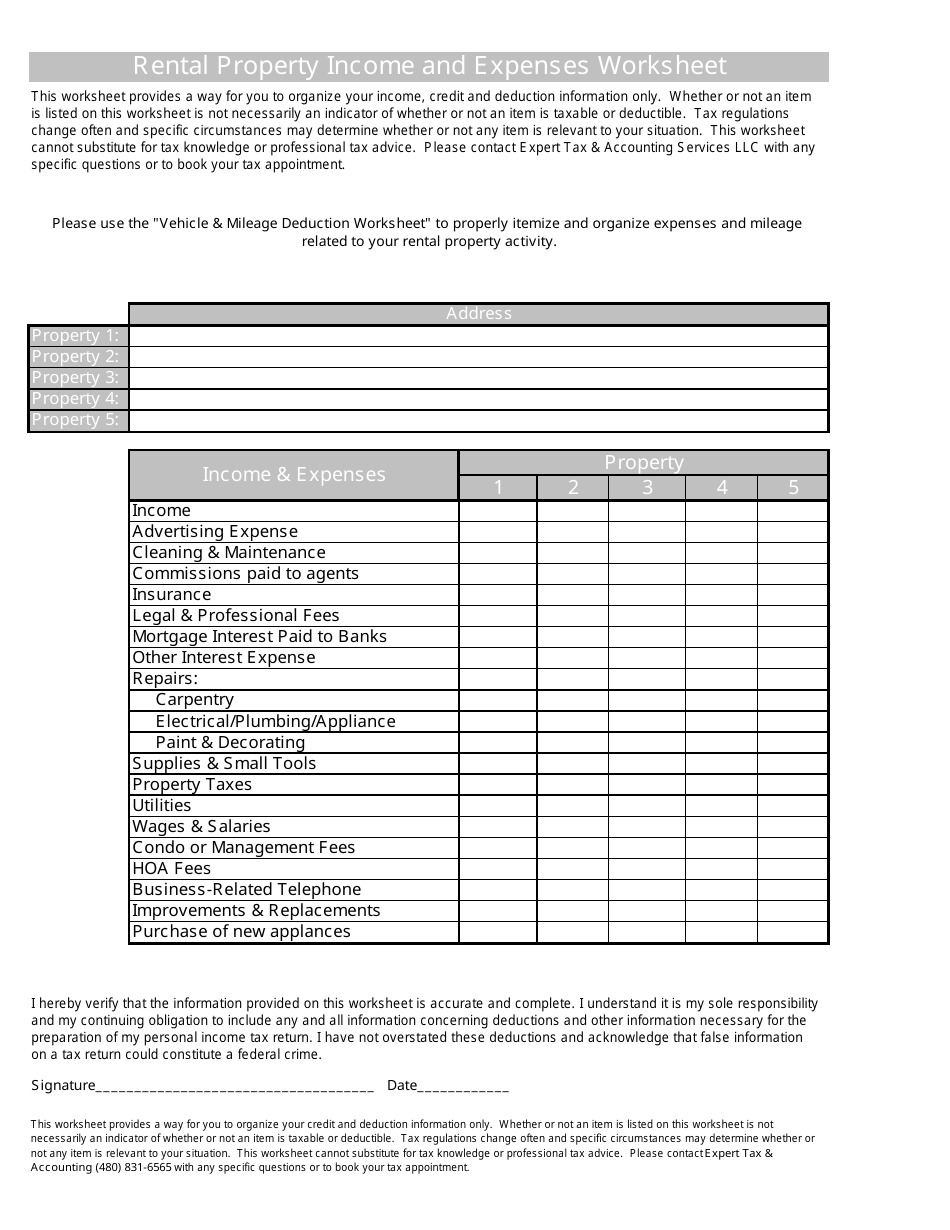

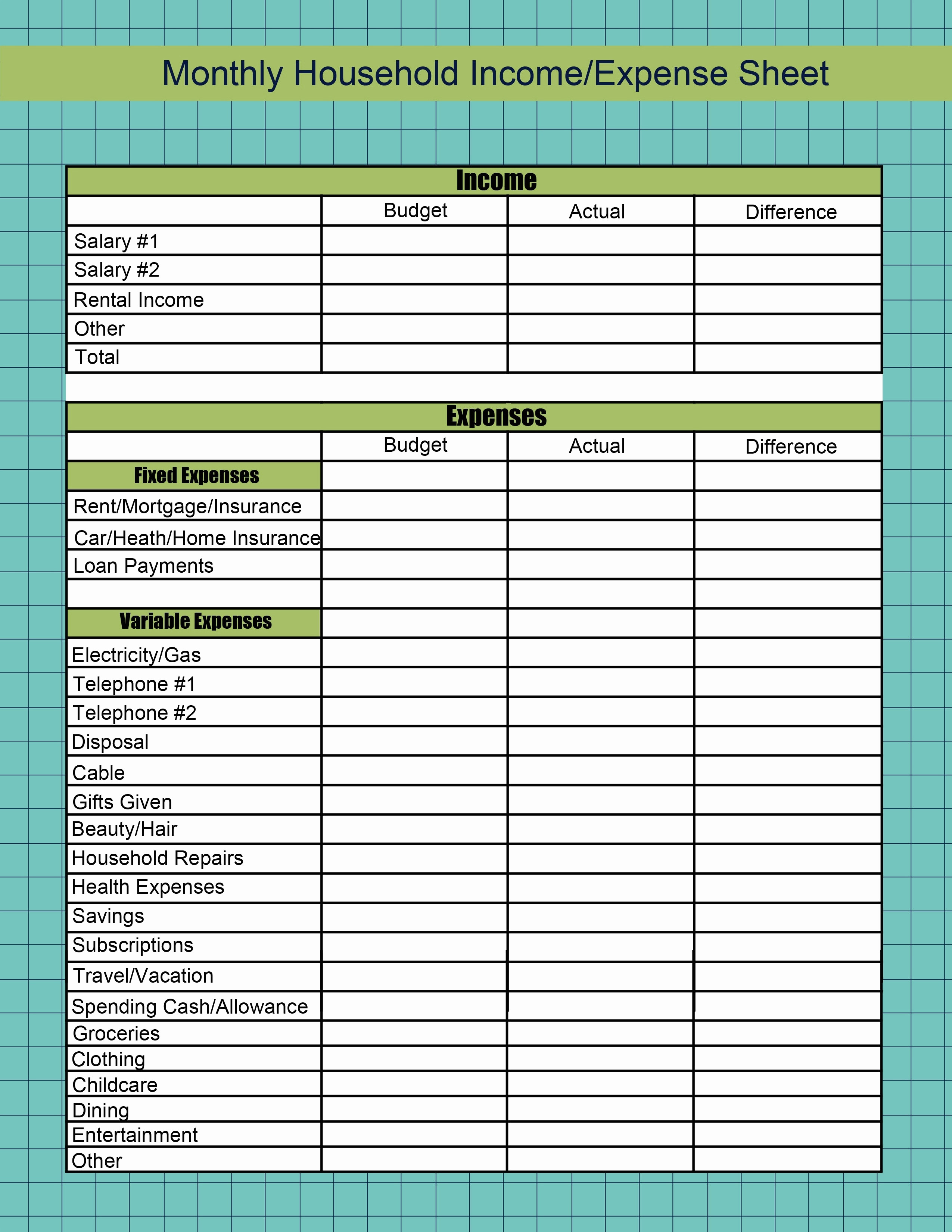

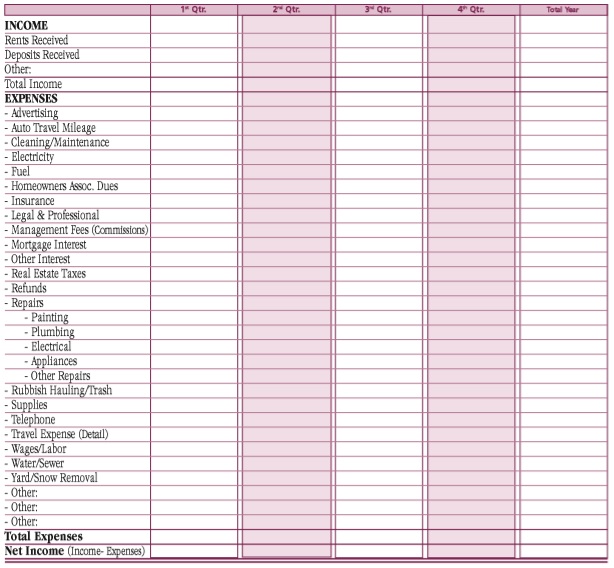

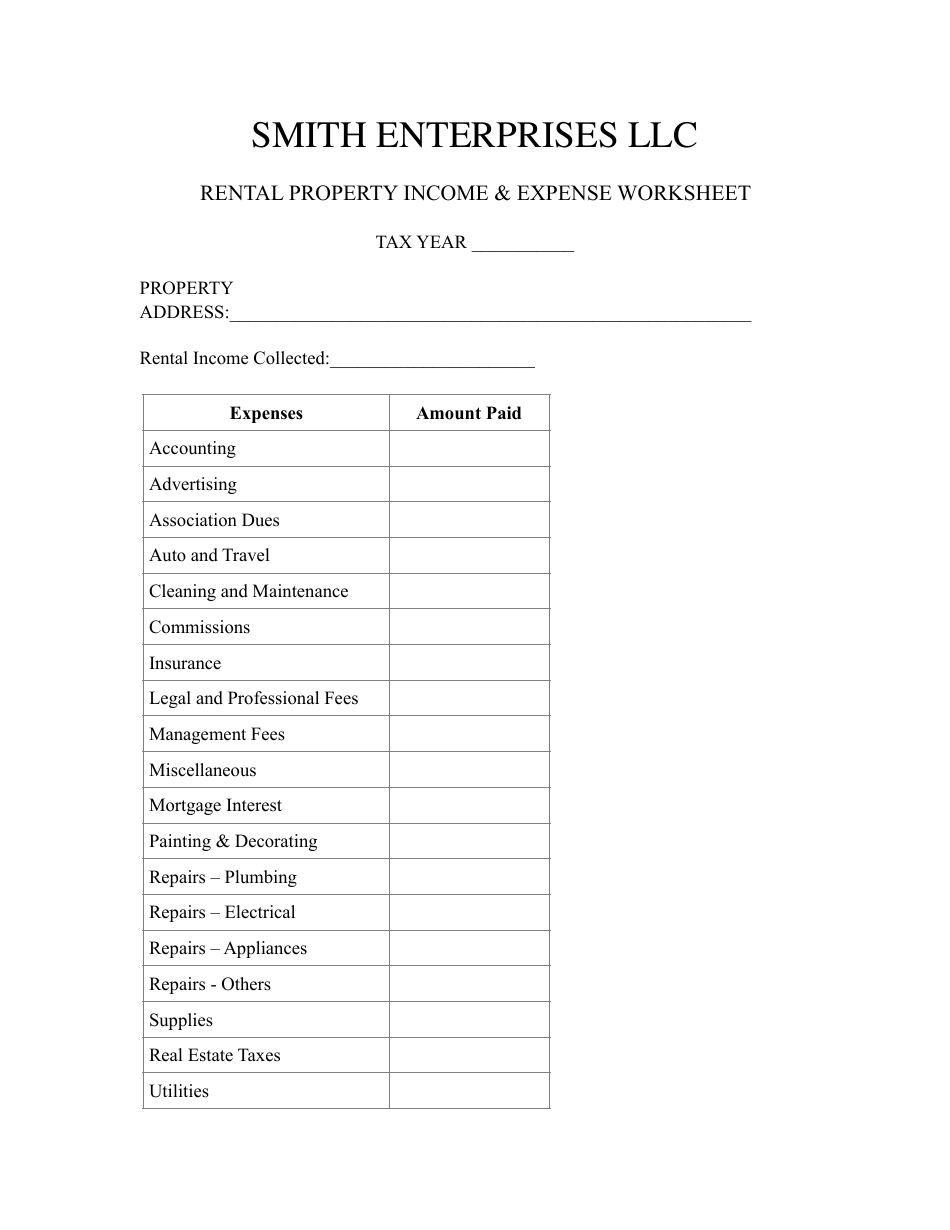

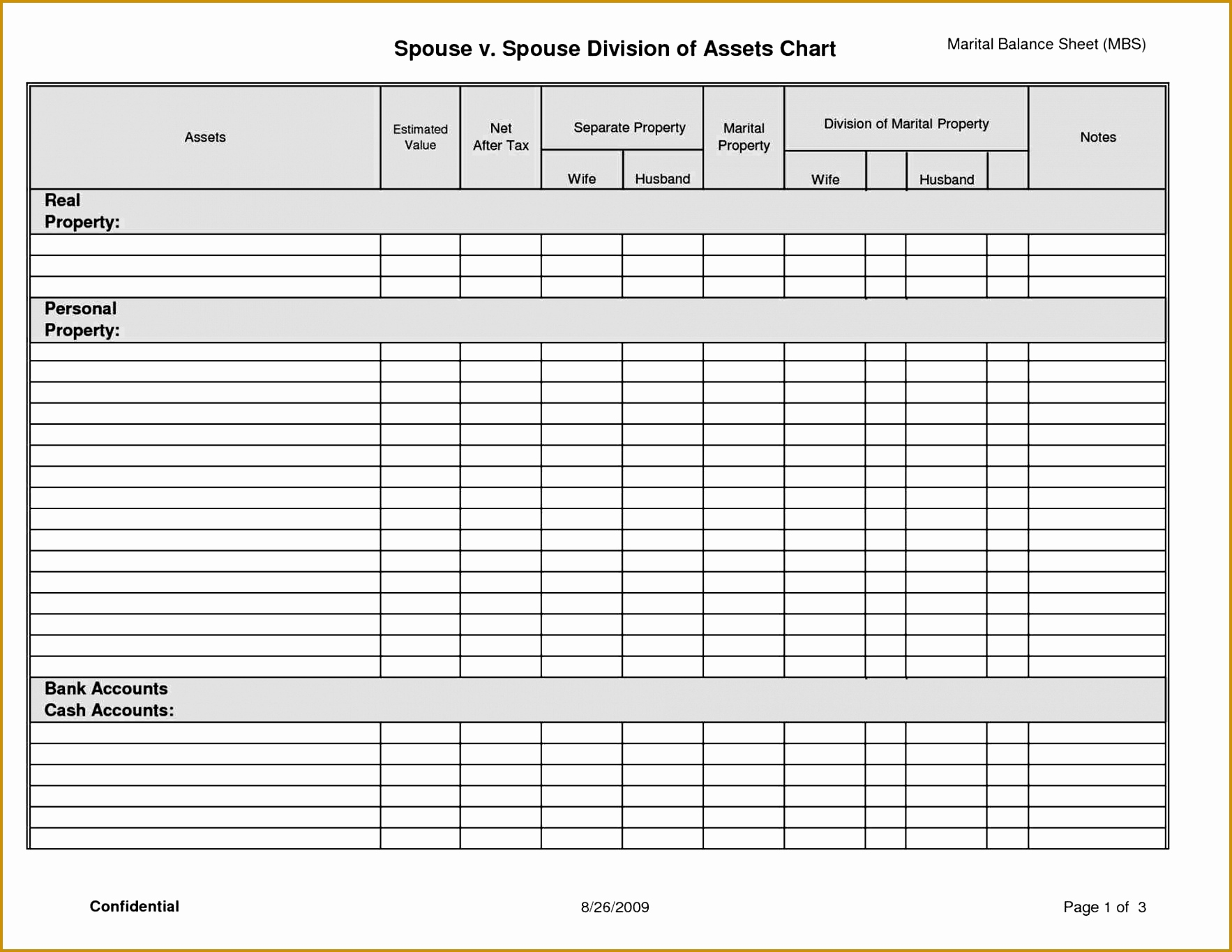

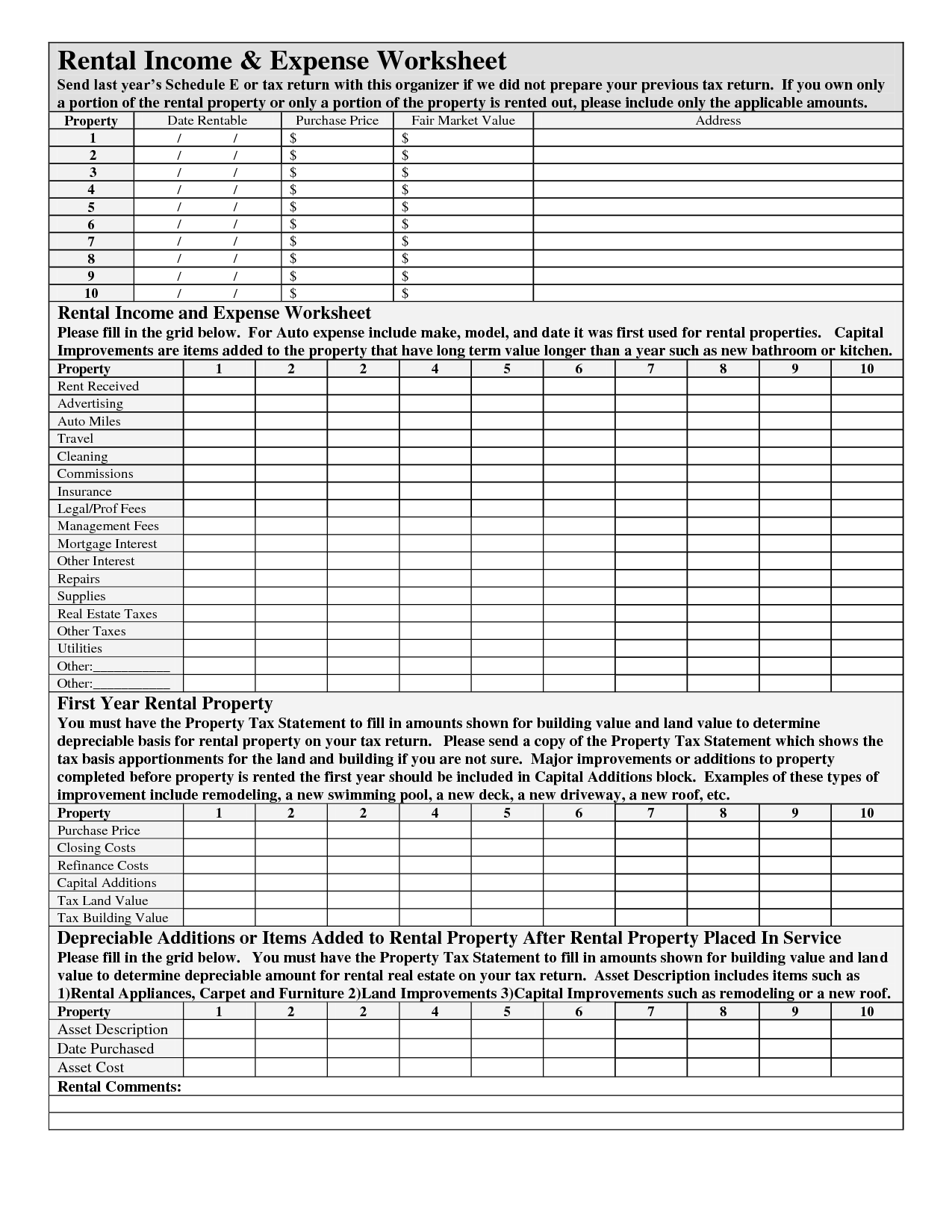

Rental Income Expense Worksheet - 4 this sheet will also track late fees and any maintenance costs. Worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. 1 income and expenses are an essential part of effectively managing your rental. Use our free rental income and expense worksheet to keep track of your monthly cash flow. Learn more about how to use a rental property analysis spreadsheet. Any additional money earned from the tenant like income from utilities, laundry, storage or parking fees. Helpful and appropriate for work. Web use rental income and expenses to analyze rental property. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. In general, you can deduct. First, calculate the return on investment by subtracting the total gains. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Web to download the free rental income and expense worksheet template, click the green button at the top of the page.. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Helpful and. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) Web a good rental property spreadsheet organizes income and expense data from each real estate investment and forecasts their potential profitability. 3 totals are automatically calculated as you enter data. Stessa has a simple rental property analysis spreadsheet that you can download for free. In general, you can deduct. Learn more about how to use a rental property analysis spreadsheet. 1 income and expenses are an essential part of effectively managing your rental. Common and accepted in the taxpayer’s line of work, and necessary. Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. Helpful and appropriate for work. Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. 4 this sheet will also track. 2 personalize your expenses with this worksheet. Stessa has a simple rental property analysis spreadsheet that you can download for free. Common and accepted in the taxpayer’s line of work, and necessary. Helpful and appropriate for work. Web use rental income and expenses to analyze rental property. In general, you can deduct. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. Use our free rental income and expense worksheet to keep track of your monthly cash flow. 3. A good rental income and expense worksheet makes analyzing the current performance of property and additional investments much easier. How to calculate roi on rental property. Web additional rental income: In general, you can deduct. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) Web to download the free rental income and expense worksheet template, click the green button at the top of the page. 1 income and expenses are an essential part of effectively managing your rental. Learn more about how to use a rental property analysis spreadsheet. Stessa has a simple rental property analysis spreadsheet that you can download for free. Cash. Web additional rental income: Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Stessa has a simple rental property analysis spreadsheet that you can download for free. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) How. 3 totals are automatically calculated as you enter data. 414 rental income and expenses. Web to download the free rental income and expense worksheet template, click the green button at the top of the page. In general, you can deduct. Use our free rental income and expense worksheet to keep track of your monthly cash flow. How to calculate roi on rental property. Stessa has a simple rental property analysis spreadsheet that you can download for free. Worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. Helpful and appropriate for work. A good rental income and expense worksheet makes analyzing the current performance of property and additional investments much easier. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) Web additional rental income: Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. 1 income and expenses are an essential part of effectively managing your rental. Any additional money earned from the tenant like income from utilities, laundry, storage or parking fees. Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. First, calculate the return on investment by subtracting the total gains. Web use rental income and expenses to analyze rental property. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: 4 this sheet will also track late fees and any maintenance costs. Web a good rental property spreadsheet organizes income and expense data from each real estate investment and forecasts their potential profitability. How to calculate roi on rental property. 1 income and expenses are an essential part of effectively managing your rental. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: Use our free rental income and expense worksheet to keep track of your monthly cash flow. Web additional rental income: 414 rental income and expenses. Learn more about how to use a rental property analysis spreadsheet. Web use rental income and expenses to analyze rental property. Helpful and appropriate for work. First, calculate the return on investment by subtracting the total gains. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the “rental income” category or hoa dues, gardening service and utilities in the “monthly expense” category. Common and accepted in the taxpayer’s line of work, and necessary. Web rentalproperty tracking orksheet (usetheworksheetbelowtorecordandtrackyourrentalpropertyincomeandexpenses.allowableexpensesmaybedeductedfromyourgrossrentalincometoderiveyouradjusted grossrentalincome.trackingyourrentalincomeandexpensesquarterlywillassistinderivingyourestimatedquarterlytaxesowed.useaseparateworksheetforeachrentalproperty) Any additional money earned from the tenant like income from utilities, laundry, storage or parking fees. Web to download the free rental income and expense worksheet template, click the green button at the top of the page.Rental Property and Expenses Excel Templates

Rental Property and Expenses Worksheet Expert Tax & Accounting

Rental Property and Expenses Worksheet »

Rental And Expense Worksheet —

5+ Free Rental Property Expenses Spreadsheets Excel TMP

36 Rental And Expense Worksheet support worksheet

Rental Property & Expense Worksheet Template Smith Enterprises

Expense Spreadsheet For Rental Property —

Rental And Expense Spreadsheet Template —

Zillow Rental And Expense Worksheet

In General, You Can Deduct.

Worksheet For Figuring Rental Deductions For A Dwelling Unit Used As A Home.20 Chapter 6.

4 This Sheet Will Also Track Late Fees And Any Maintenance Costs.

A Good Rental Income And Expense Worksheet Makes Analyzing The Current Performance Of Property And Additional Investments Much Easier.

Related Post: