Rental Property Tax Deductions Worksheet

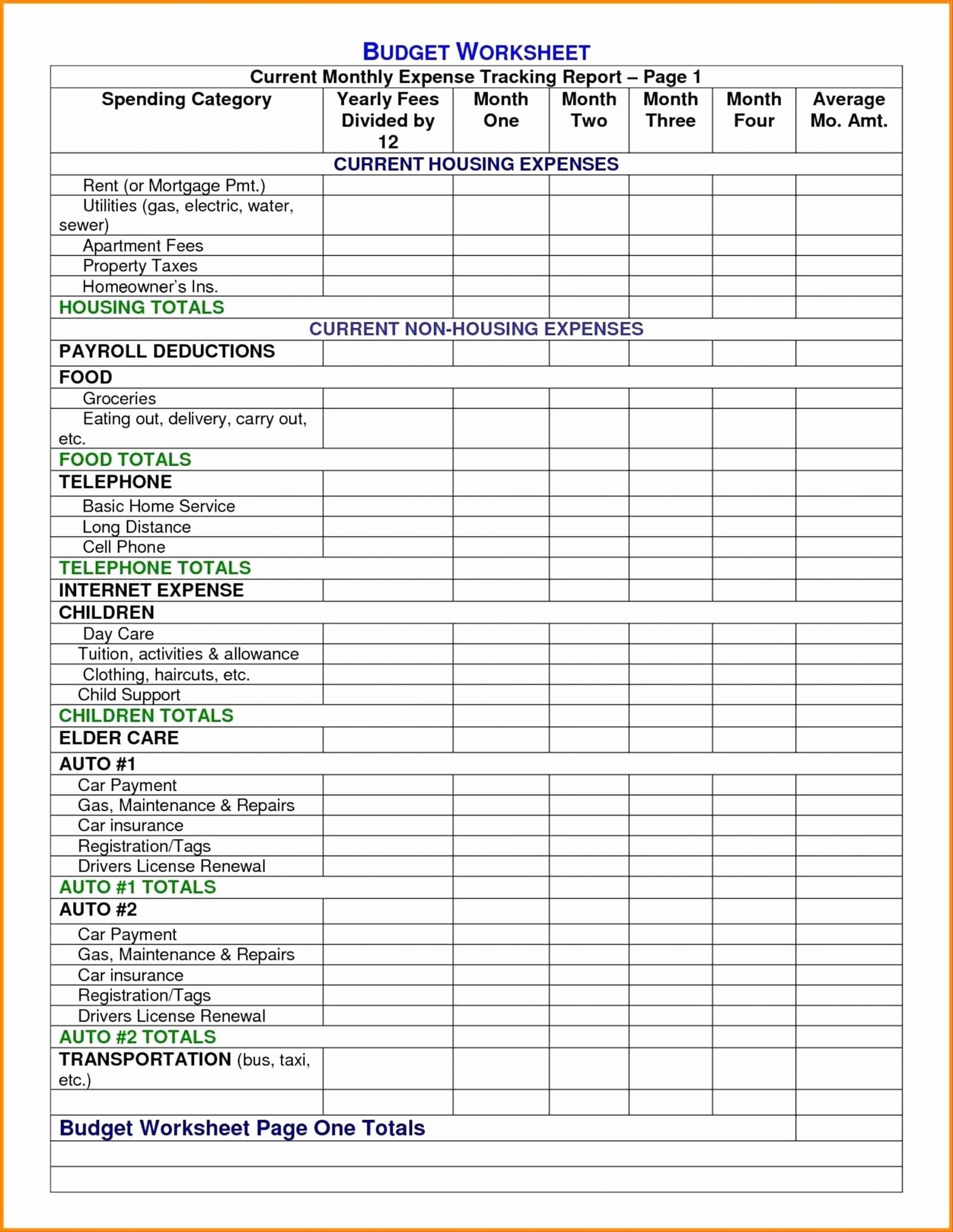

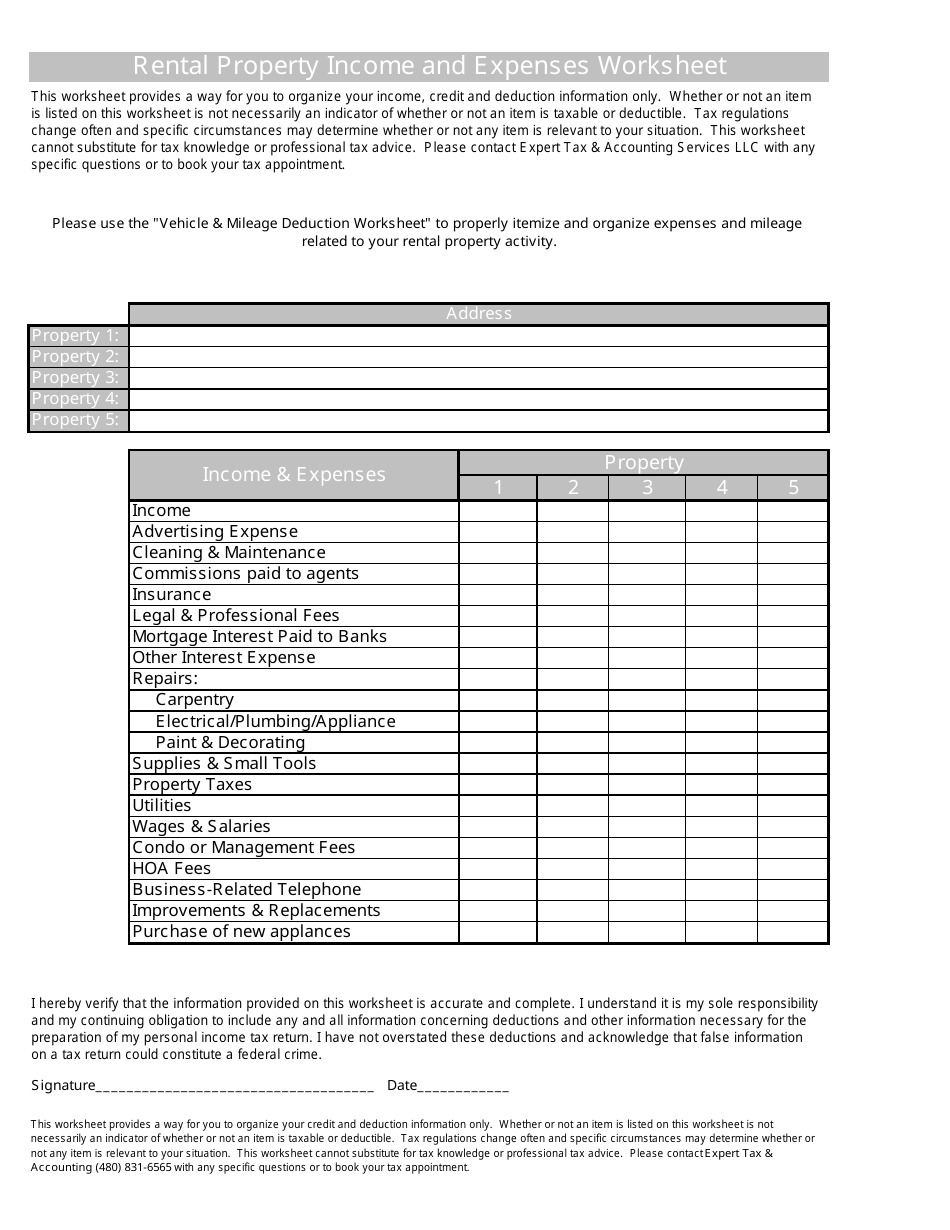

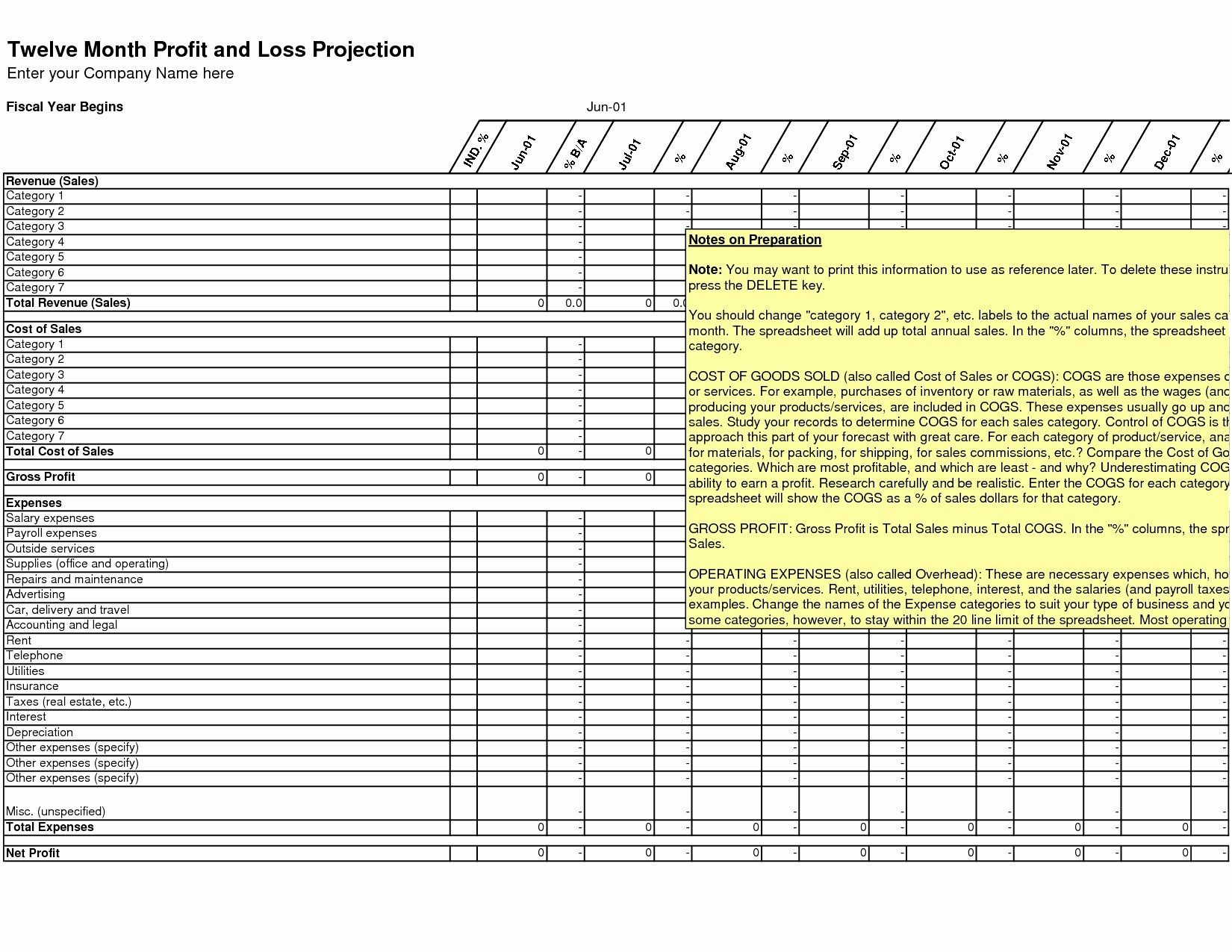

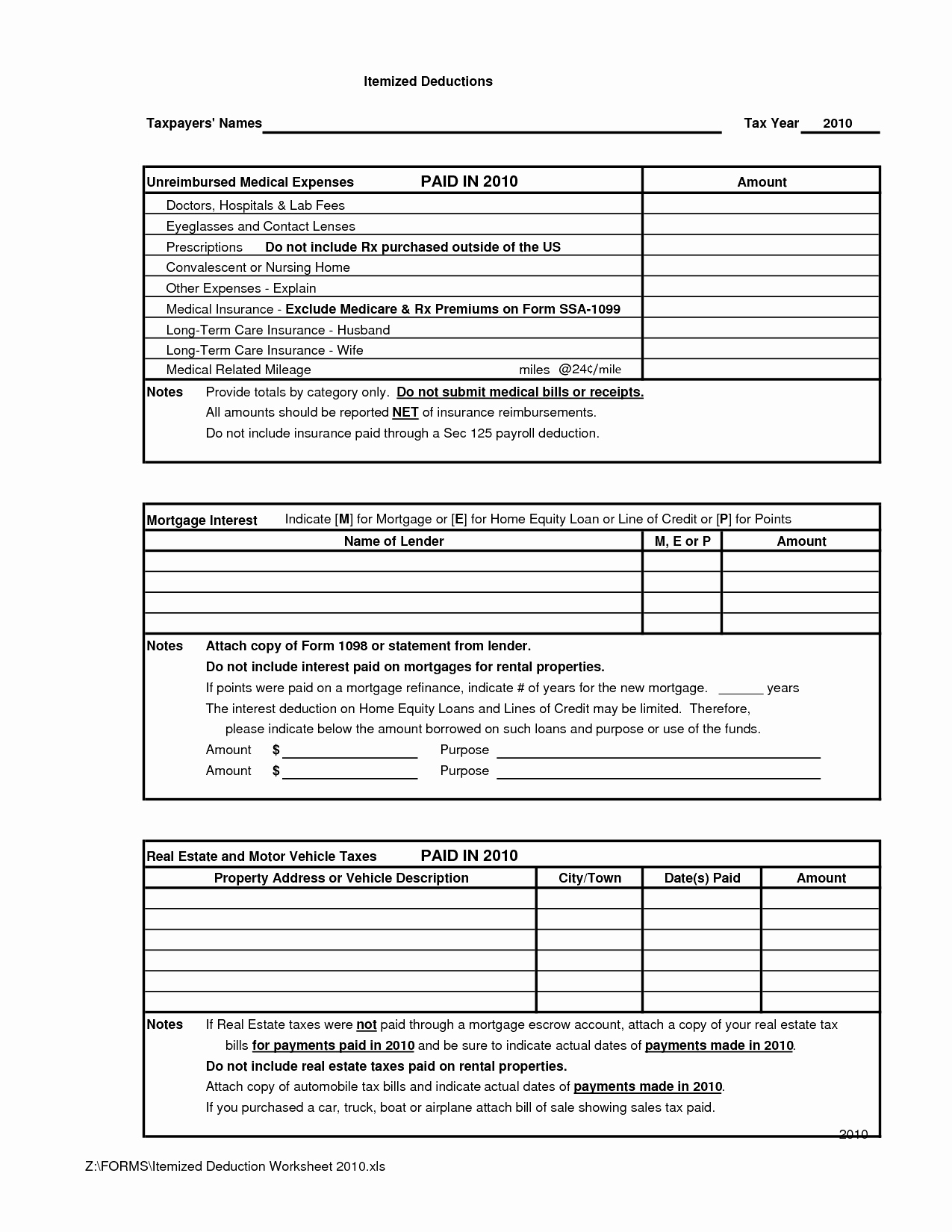

Rental Property Tax Deductions Worksheet - Web about form 2106, employee business expenses. Web worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. Use this worksheet only if your parent, or someone else, can claim you (or your spouse/rdp) as. An ordinary expense is one that is. Individual states have laws requiring payment of interest by property owners who hold security deposits. Generally, you can depreciate your rental property value minus. Web s corporations reduce their wage deduction by 1/3 of the amount on worksheet ia, section a, line 6. How to get tax help.23 index.26 future developments for. Web you're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Please download, open in adobe, complete and securely upload the. Web determine the amount of real estate tax deductions associated with your home sale. Employees file this form to deduct ordinary and necessary expenses for their job. Web worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. .6 7 subtraction for 65 or. Web how property taxes are assessed and calculated. (if you are a renter and this line is less than the rent you paid, enclose an explanation). Web please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Web 3 deduction for contributions to a qualified retirement plan. Web please use this worksheet to give us your rental income and expenses. Use this worksheet only if your parent, or someone else, can claim you (or your spouse/rdp) as. Web real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or “roi,” identify opportunities. .6 7 subtraction for 65 or. Web you're allowed to reduce your rental income by. Web how property taxes are assessed and calculated. Web determine the amount of real estate tax deductions associated with your home sale. This is the ratio of the home value as determined by an official. Commissions you pay a real estate agent to find and lease a vacant property to a new tenant are another rental property tax deduction. Web. Web 3 deduction for contributions to a qualified retirement plan. .6 7 subtraction for 65 or. Web please use this worksheet to give us your rental income and expenses for preparation of your tax returns. An ordinary expense is one that is. Web please use this worksheet to give us your rental income and expenses for preparation of your tax. Web s corporations reduce their wage deduction by 1/3 of the amount on worksheet ia, section a, line 6. Web determine the amount of real estate tax deductions associated with your home sale. .6 7 subtraction for 65 or. Rental property calculation worksheet template; Web worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. Sample rental property worksheet template; Web how property taxes are assessed and calculated. Rental property calculation worksheet template; Web california standard deduction worksheet for dependents. Web you're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Web determine the amount of real estate tax deductions associated with your home sale. Sample rental property worksheet template; Web california standard deduction worksheet for dependents. A non‐fillable pdf (what you. How to get tax help.23 index.26 future developments for. Generally, you can depreciate your rental property value minus. Web worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. Web please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Real estate rentals you can generally use schedule e (form 1040), supplemental income. How to get. Web 3 deduction for contributions to a qualified retirement plan. Web california standard deduction worksheet for dependents. Web you're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Depending on your circumstances, you may need to figure your real estate tax. Real. Use this worksheet only if your parent, or someone else, can claim you (or your spouse/rdp) as. Web real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or “roi,” identify opportunities. Web 3 deduction for contributions to a qualified retirement plan. Web about form 2106, employee business expenses. Individual states have laws requiring payment of interest by property owners who hold security deposits. Web worksheet for figuring rental deductions for a dwelling unit used as a home.20 chapter 6. This is the ratio of the home value as determined by an official. .6 7 subtraction for 65 or. Web 2020 tax year rental income and expenses note: Web california standard deduction worksheet for dependents. Web please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Depending on your circumstances, you may need to figure your real estate tax. Commissions you pay a real estate agent to find and lease a vacant property to a new tenant are another rental property tax deduction. Web you're allowed to reduce your rental income by subtracting expenses that you incur to get your property ready to rent, and then to maintain it as a rental. Sample rental property worksheet template; Web determine the amount of real estate tax deductions associated with your home sale. Rental property tax deduction worksheet template; Web in general, you can deduct expenses of renting property from your rental income. An ordinary expense is one that is. Employees file this form to deduct ordinary and necessary expenses for their job. Sample rental property worksheet template; Web in general, you can deduct expenses of renting property from your rental income. An ordinary expense is one that is. Web determine the amount of real estate tax deductions associated with your home sale. Commissions you pay a real estate agent to find and lease a vacant property to a new tenant are another rental property tax deduction. Generally, you can depreciate your rental property value minus. (if you are a renter and this line is less than the rent you paid, enclose an explanation). .6 7 subtraction for 65 or. Web how property taxes are assessed and calculated. Web california standard deduction worksheet for dependents. How to get tax help.23 index.26 future developments for. Rental property tax deduction worksheet template; Web please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Rental property calculation worksheet template; Please download, open in adobe, complete and securely upload the. Individual states have laws requiring payment of interest by property owners who hold security deposits.Rental Property Tax Deductions Worksheet Yooob —

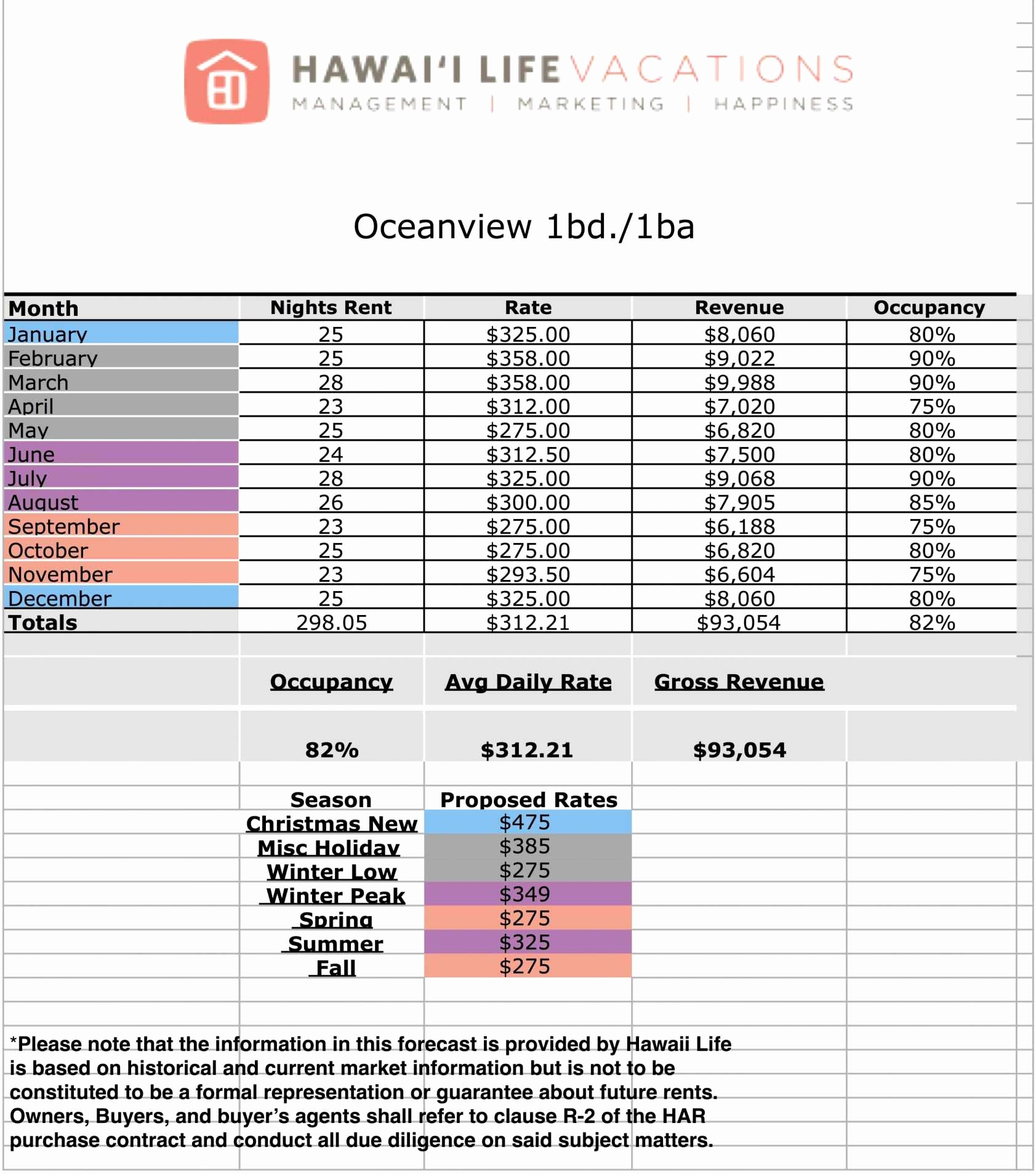

Rental Property and Expenses Worksheet Expert Tax & Accounting

Rental Property Tax Deductions Worksheet —

Printable yearly itemized tax deduction worksheet Fill out & sign

Rental Property Tax Deductions Worksheet Beautiful Rental Property and

Rental Property Tax Deductions Worksheet Elegant Rental Property inside

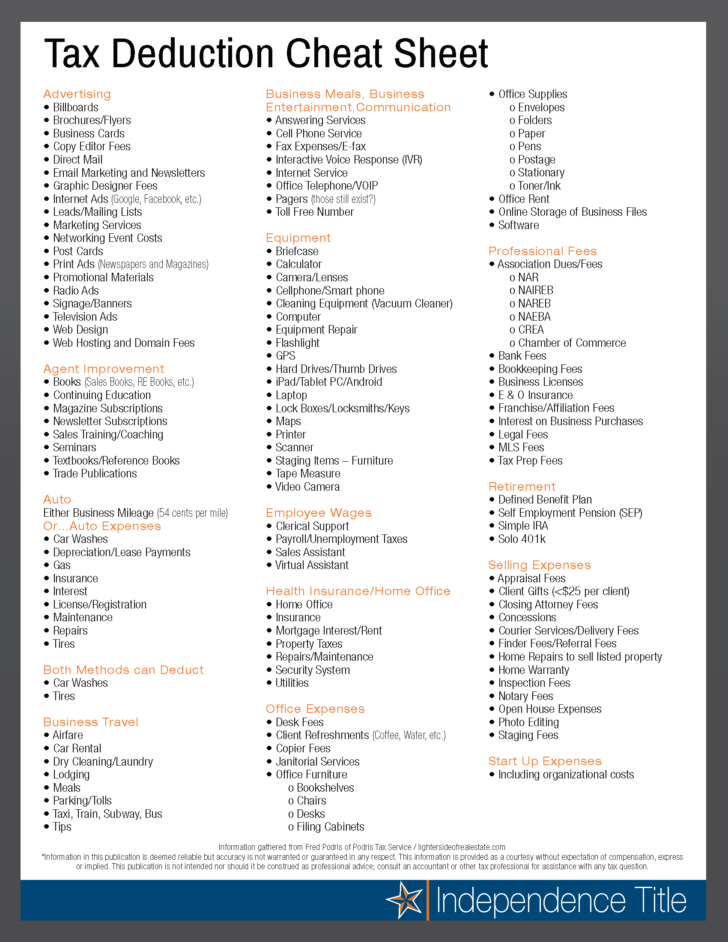

Printable Tax Deduction Worksheet —

rental property tax deductions worksheet

Real Estate Agent Tax Deductions Worksheet 2021 Fill Online

Truck Driver Tax Deductions Worksheet

Real Estate Rentals You Can Generally Use Schedule E (Form 1040), Supplemental Income.

There Are Two Versions Of This Worksheet;

Web You're Allowed To Reduce Your Rental Income By Subtracting Expenses That You Incur To Get Your Property Ready To Rent, And Then To Maintain It As A Rental.

Web S Corporations Reduce Their Wage Deduction By 1/3 Of The Amount On Worksheet Ia, Section A, Line 6.

Related Post: