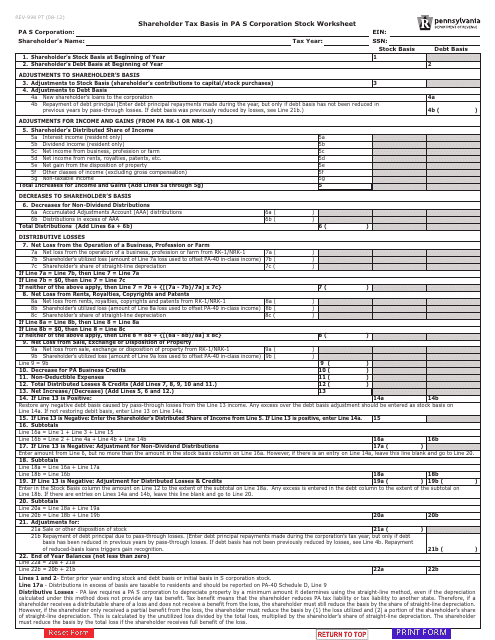

S Corp Basis Calculation Worksheet

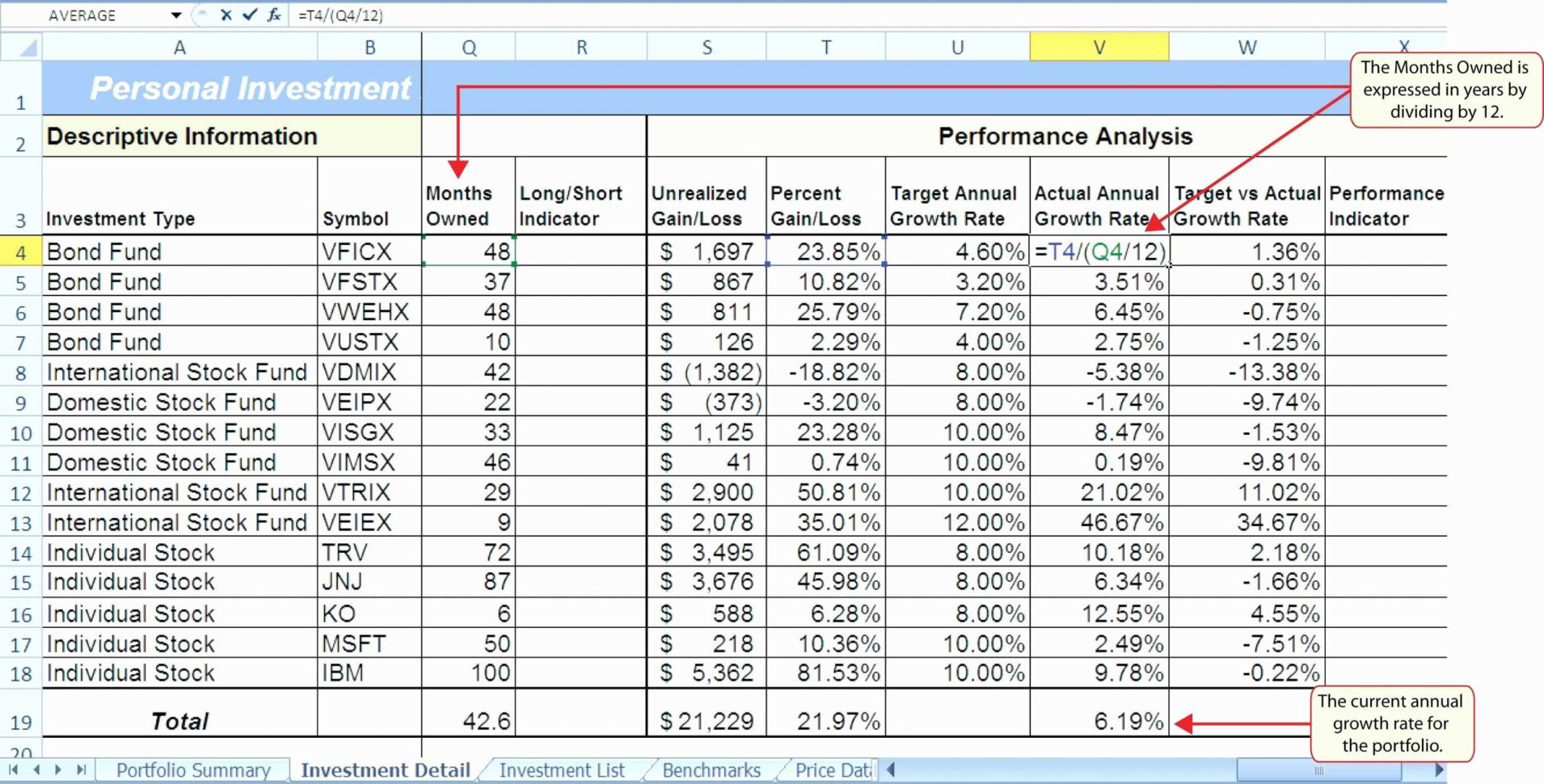

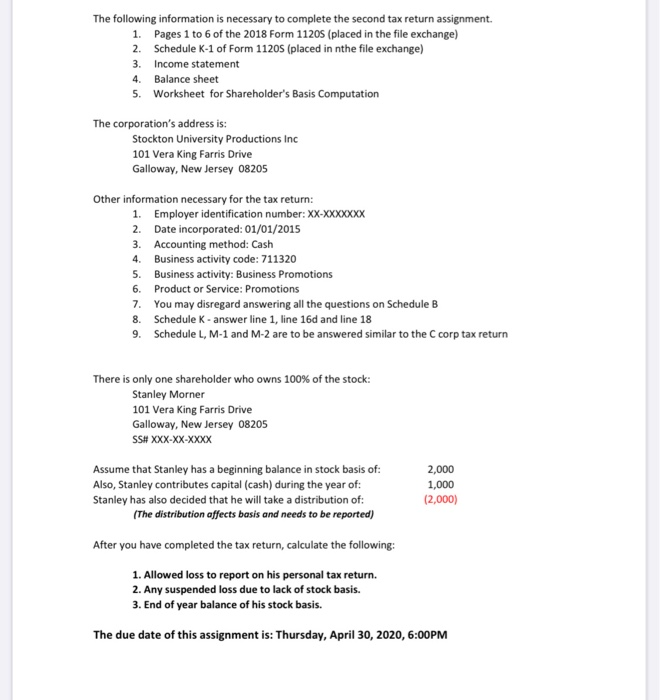

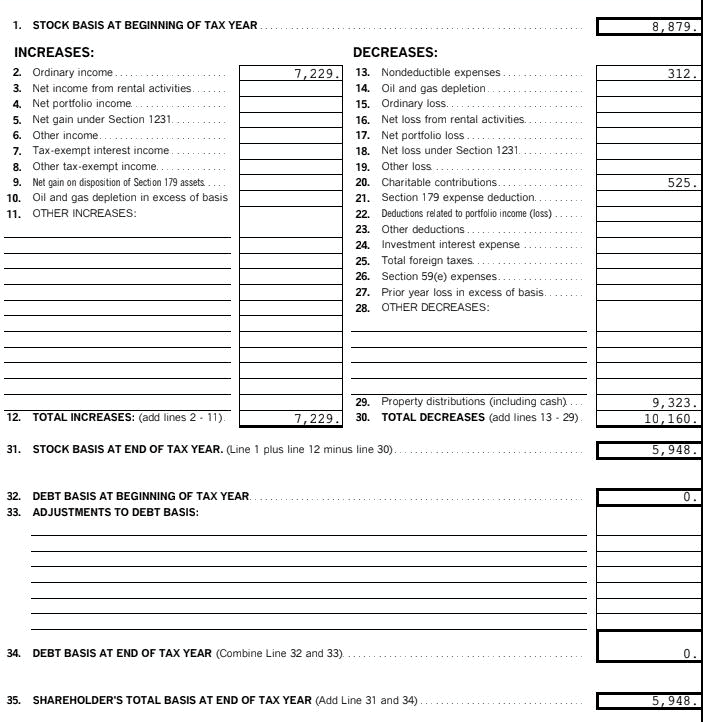

S Corp Basis Calculation Worksheet - Web how basis is calculated: $40,000 less distribution (25,000) excess restores basis in debt debt $100,000 (30,000) $15,000 shareholder stock basis calculated at shareholder level, per shareholder losses and deductions. Go to www.irs.gov/form7203 for instructions and the latest information. The account goes up and down, but can never go negative. Web stock $50,000 (50,000) current income: The basis of s corporation stock is adjusted on an ongoing basis (unlike for a c corporation, where stock basis remains constant unless additional capital contributions are made or stock is sold). Web enter your basis in the stock of the s corporation at the beginning of the corporation’s tax year. Because the entity was short on cash, you contributed $2,000 to boost cash reserves. When there is a payment of an expense, the basis goes down. You purchased your s corporation shares for $20,000. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Because the entity was short on cash, you contributed $2,000 to boost cash reserves. Web s corporation shareholder stock and debt basis limitations department of the treasury internal. Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. And, finally, by any other loss and deduction items. Because the entity was short on cash, you contributed $2,000 to boost cash reserves. Web if you report a loss, receive a distribution, dispose of stock, or receive. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. $40,000 less distribution (25,000) excess restores basis in debt debt $100,000 (30,000) $15,000 shareholder stock basis calculated at shareholder level, per shareholder losses and deductions. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at. Shareholder tax basis in pa s corporation stock worksheet tax year: Web if you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in column (e) on line 28 and attach the required basis computation. Because the entity was short on cash, you contributed $2,000 to. Stock basis can’t be less than zero. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. The amount that the property's owner has invested into the property is considered the basis. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made. Web to understand what this basis calculation looks like in practice, let’s walk through a simple example: The amount that the property's owner has invested into the property is considered the basis. You purchased your s corporation shares for $20,000. And if i'm not mistaken, tt did not have any way of attaching this information in the past. Shareholder tax. The amount that the property's owner has invested into the property is considered the basis. Beginning capital stock beginning additional pd in capital beginning stock cost beginning aaa and oaa estimated beginning stock basis 45,000 0 45,000 (20,000) 25,000 factors that distort estimated initial basis Web stock $50,000 (50,000) current income: You purchased your s corporation shares for $20,000. Web. The account goes up and down, but can never go negative. Web shareholder basis input and calculation in the s corporation module of lacerte solved • by intuit • 149 • updated january 18, 2023 this article will help you generate shareholder basis statements that you can. Shareholders who have ownership in an s corporation must make a point to. Web use screen basis wks, to calculate a shareholder's new basis after increases and/or decreases are made to basis during the current year. The basis of s corporation stock is adjusted on an ongoing basis (unlike for a c corporation, where stock basis remains constant unless additional capital contributions are made or stock is sold). Web stock $50,000 (50,000) current. Since 2018, the irs has required shareholders of an s corporation to disclose a stock and debt basis computation with their return if the shareholder does any of the following: When there is a payment of an expense, the basis goes down. Web to understand what this basis calculation looks like in practice, let’s walk through a simple example: Web. According to the irs, basis is defined as the amount of investment that an individual makes in the business for the purpose of taxes. Don’t include any basis from indebtedness on this line. Beginning capital stock beginning additional pd in capital beginning stock cost beginning aaa and oaa estimated beginning stock basis 45,000 0 45,000 (20,000) 25,000 factors that distort estimated initial basis In year 1, the s corporation allocated $5,000 in ordinary income and $500 in capital loss to you. Web computing shareholder basis under the normal computation rules, basis is computed by taking beginning basis and adding the items of income, reducing that by nondividend distributions; Web calculate an s corporation's shareholder's basis using this customizable template and keep track of your client's ownership in their s corporation stock. Web stock $50,000 (50,000) current income: When there is a payment of an expense, the basis goes down. Web if you report a loss, receive a distribution, dispose of stock, or receive a loan repayment from an s corporation, you must check the box in column (e) on line 28 and attach the required basis computation. Web s corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s deductions, credits, and other items that can be deducted on their individual returns. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Go to www.irs.gov/form7203 for instructions and the latest information. Web this figure measures how much a shareholder can receive or withdraw from the s corporation without tracking the gain or income. Basis measures how much the owner has invested in the property. And, finally, by any other loss and deduction items. Current revision form 7203 pdf instructions for form 7203 (print version) pdf recent developments none at this time. Stock basis can’t be less than zero. Unless this is your initial year owning stock in the s corporation, this amount should be the same as your ending stock basis from the prior tax year. Each shareholder's basis represents their economic investment in the business. Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Each shareholder's basis represents their economic investment in the business. And, finally, by any other loss and deduction items. Stock basis can’t be less than zero. The basis of s corporation stock is adjusted on an ongoing basis (unlike for a c corporation, where stock basis remains constant unless additional capital contributions are made or stock is sold). $40,000 less distribution (25,000) excess restores basis in debt debt $100,000 (30,000) $15,000 shareholder stock basis calculated at shareholder level, per shareholder losses and deductions. Web the s corporation program in lacerte generates the shareholder basis computation worksheet. Beginning capital stock beginning additional pd in capital beginning stock cost beginning aaa and oaa estimated beginning stock basis 45,000 0 45,000 (20,000) 25,000 factors that distort estimated initial basis Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. And if i'm not mistaken, tt did not have any way of attaching this information in the past. Web shareholder basis input and calculation in the s corporation module of lacerte solved • by intuit • 149 • updated january 18, 2023 this article will help you generate shareholder basis statements that you can. The amount that the property's owner has invested into the property is considered the basis. Since 2018, the irs has required shareholders of an s corporation to disclose a stock and debt basis computation with their return if the shareholder does any of the following: Web an s corp basis worksheet is used to compute a shareholder's basis in an s corporation. Shareholders who have ownership in an s corporation must make a point to have a general understanding of basis. You purchased your s corporation shares for $20,000. Web this figure measures how much a shareholder can receive or withdraw from the s corporation without tracking the gain or income.s corp tax calculator Fill Online, Printable, Fillable Blank form

S Corp Basis Calculation Worksheets

S Corp Basis Worksheet Studying Worksheets

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

Stock Cost Basis Spreadsheet —

Using turbotax for s corp partner doppedia

More Basis Disclosures This Year for S corporation Shareholders Need

S Corp Basis Worksheet Studying Worksheets

What Is the Basis for My SCorporation? TL;DR Accounting

Stock Cost Basis Spreadsheet 1 Printable Spreadshee stock cost basis

Current Revision Form 7203 Pdf Instructions For Form 7203 (Print Version) Pdf Recent Developments None At This Time.

Web Stock $50,000 (50,000) Current Income:

In Year 1, The S Corporation Allocated $5,000 In Ordinary Income And $500 In Capital Loss To You.

Web Use Screen Basis Wks, To Calculate A Shareholder's New Basis After Increases And/Or Decreases Are Made To Basis During The Current Year.

Related Post: