S Corp Shareholder Basis Worksheet Excel

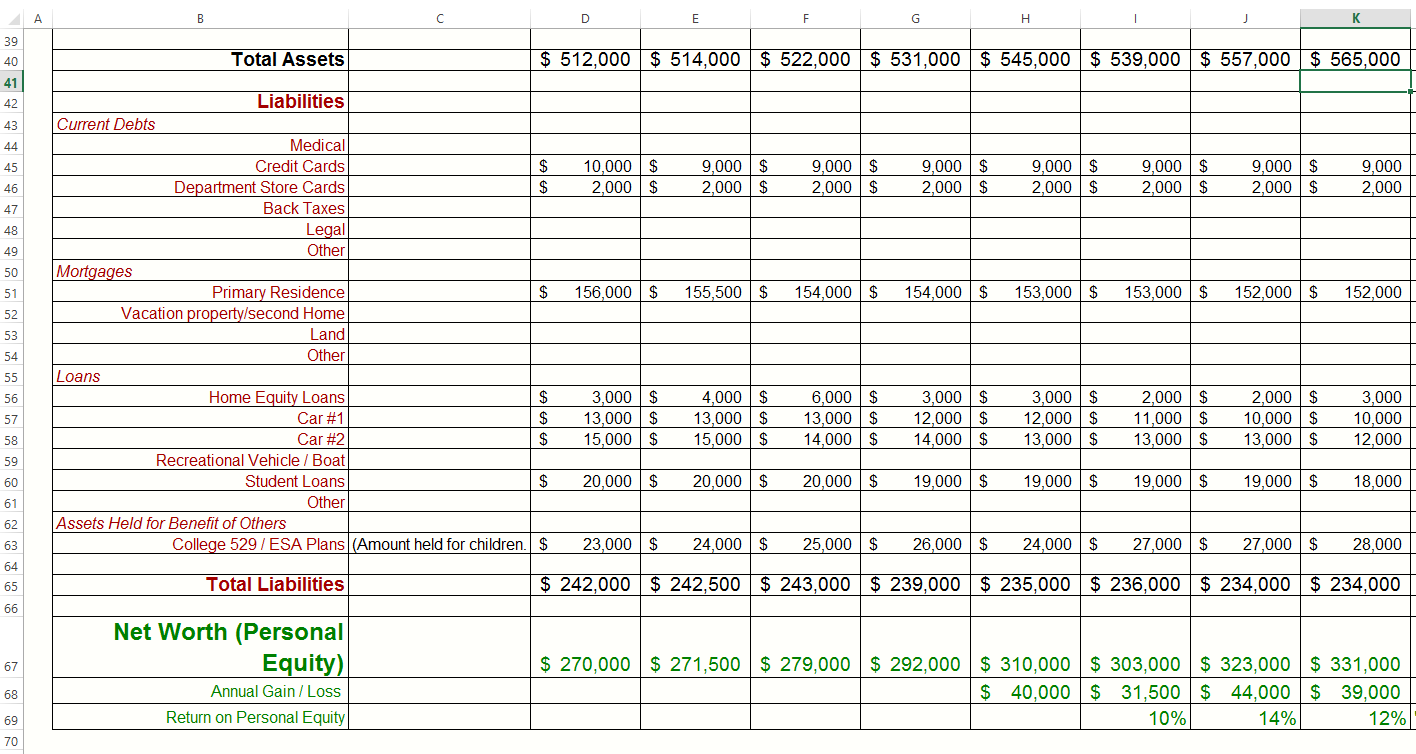

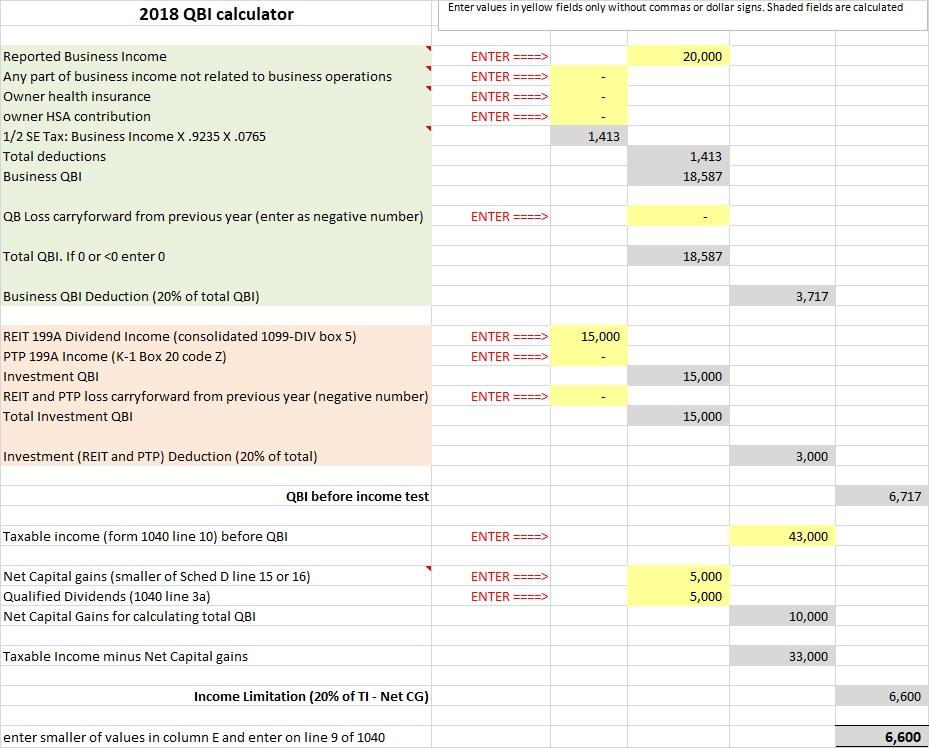

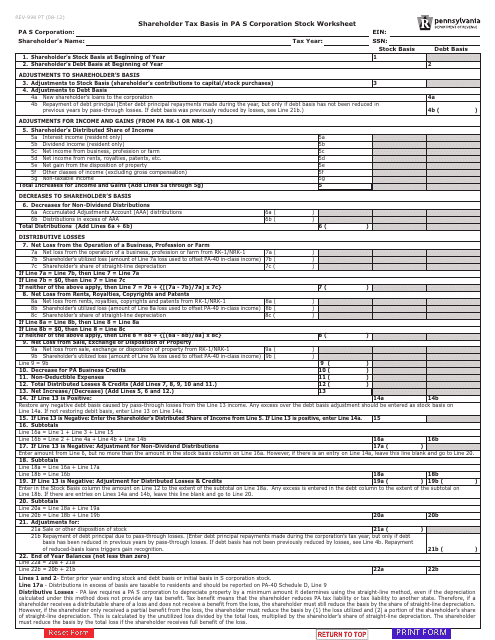

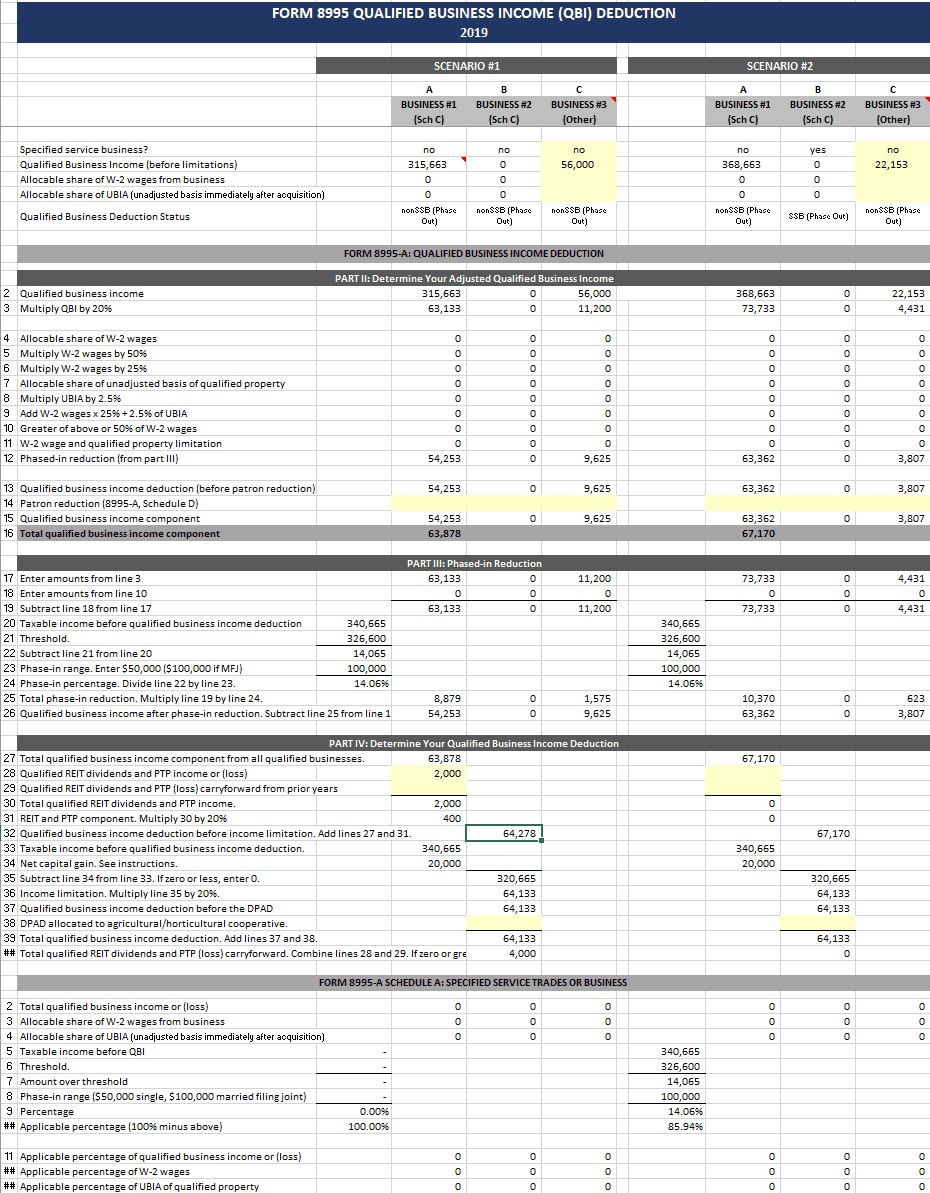

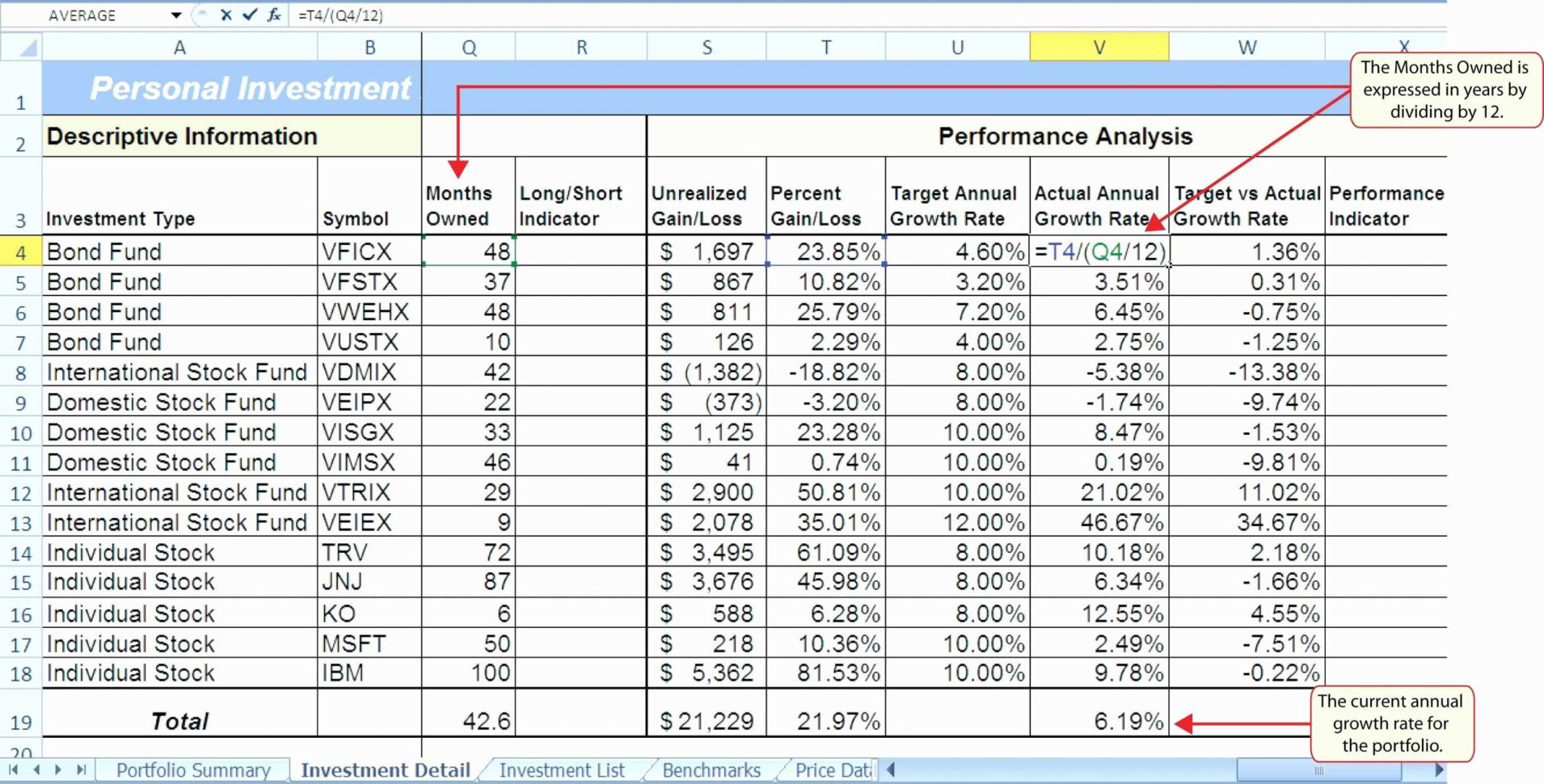

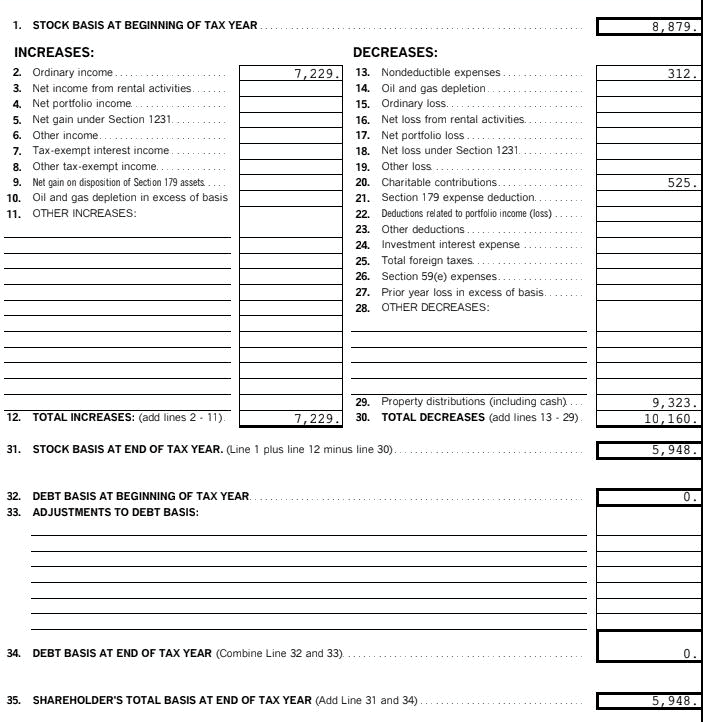

S Corp Shareholder Basis Worksheet Excel - Keep it for your records. Shareholders who have ownership in an s. Web the worksheet contains the nondeductible expense line in two places. Web updated july 14, 2020: Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a loan. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Use the second line if the. 49 (b), 50 (a), 50 (c). Web unfortunately, in most situations neither the shareholder nor the s corporation have been tracking this. Web level 15 @ptgeek wrote: Shareholders who have ownership in an s. Web about form 7203, s corporation shareholder stock and debt basis limitations. Original basis prior year losses stock $50,000 (50,000). Use the second line if the. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. Web unfortunately, in most situations neither the shareholder nor the s corporation have been tracking this. Web the worksheet contains the nondeductible expense line in two places. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. This number called “basis” increases and decreases. An south corp basis worksheet. An south corp basis worksheet is used to compute a shareholder's base in an s corporation. Web follow the instructions below to complete s corp shareholder basis worksheet excel online easily and quickly: Original basis prior year losses stock $50,000 (50,000). Because the society takes a step away from office work, the execution of documents. Web s corporation shareholder stock. Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Web to track shareholder stock basis, there is a worksheet within the taxact program that can be used to calculate the adjusted basis while selling or disposing shares. 49 (b), 50 (a), 50 (c). Web updated july 14, 2020: Web s corporation shareholder stock and debt. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. Don't file it with your tax. Shareholders who have ownership in an s. 49 (b), 50 (a), 50 (c). Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Web about form 7203, s corporation shareholder stock and debt basis limitations. Web example 1 losses offset stock basis first, then debt shareholder withdraws $25,000 of the current income of $40,000: Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a loan. 49 (b),. Web the following tips will allow you to fill in s corp shareholder basis worksheet excel quickly and easily: Web about form 7203, s corporation shareholder stock and debt basis limitations. Original basis prior year losses stock $50,000 (50,000). Web 4.7 satisfied 120 votes what makes the s corp basis worksheet excel legally valid? Shareholders who have ownership in an. Web the worksheet contains the nondeductible expense line in two places. Web unfortunately, in most situations neither the shareholder nor the s corporation have been tracking this. Sign in to your account. A new tax form is expected for 2021 that will bring. An south corp basis worksheet is used to compute a shareholder's base in an s corporation. Log in with your credentials or create. Web the worksheet contains the nondeductible expense line in two places. Keep it for your records. Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Use the first line if the taxpayer has not made an election under reg. Web this tax worksheet calculates an s corporation shareholder’s basis in stock and debt for transactions that occur during the year. This number called “basis” increases and decreases. Web 4.7 satisfied 120 votes what makes the s corp basis worksheet excel legally valid? Keep it for your records. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. A new tax form is expected for 2021 that will bring. Original basis prior year losses stock $50,000 (50,000). Web a free excel based template to track s corporation shareholder basis. Use the first line if the taxpayer has not made an election under reg. Web about form 7203, s corporation shareholder stock and debt basis limitations. Don't file it with your tax. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a loan. Shareholders who have ownership in an s. Web the worksheet contains the nondeductible expense line in two places. Web the following tips will allow you to fill in s corp shareholder basis worksheet excel quickly and easily: An south corp basis worksheet is used to compute a shareholder's base in an s corporation. 49 (b), 50 (a), 50 (c). Because the society takes a step away from office work, the execution of documents. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Web updated july 14, 2020: Web the worksheet contains the nondeductible expense line in two places. Web level 15 @ptgeek wrote: Web unfortunately, in most situations neither the shareholder nor the s corporation have been tracking this. Web 4.7 satisfied 120 votes what makes the s corp basis worksheet excel legally valid? Keep it for your records. Web a shareholder needs to know the basis, including when the s corporation allocates a net loss to the shareholder, makes a nondividend distribution, makes a loan. Web s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax return. Original basis prior year losses stock $50,000 (50,000). Log in with your credentials or create. 49 (b), 50 (a), 50 (c). Web follow the instructions below to complete s corp shareholder basis worksheet excel online easily and quickly: Sign in to your account. Web the adjusted basis of the shareholder's stock of the s corporation is calculated without regard to the shareholder's share of the losses and deductions. Web a shareholder's beginning basis in s corporation stock is the original capital contribution. Web to track shareholder stock basis, there is a worksheet within the taxact program that can be used to calculate the adjusted basis while selling or disposing shares. Use the second line if the.Shareholder Basis Worksheet Excel Promotiontablecovers

Shareholder Basis Worksheet Excel Promotiontablecovers

REV998 Shareholder Tax Basis in PA S Corporation Stock Worksheet

REV999 Partner's Outside Tax Basis in a Partnership Worksheet Free

S Corp Basis Worksheet Studying Worksheets

36 Shareholder Basis Worksheet Excel support worksheet

S Corp Basis Calculation Worksheets

Stock Cost Basis Spreadsheet —

Shareholder Basis Worksheet Excel Escolagersonalvesgui

S Corp Basis Worksheet Studying Worksheets

Use The First Line If The Taxpayer Has Not Made An Election Under Reg.

Don't File It With Your Tax.

A New Tax Form Is Expected For 2021 That Will Bring.

Web About Form 7203, S Corporation Shareholder Stock And Debt Basis Limitations.

Related Post: