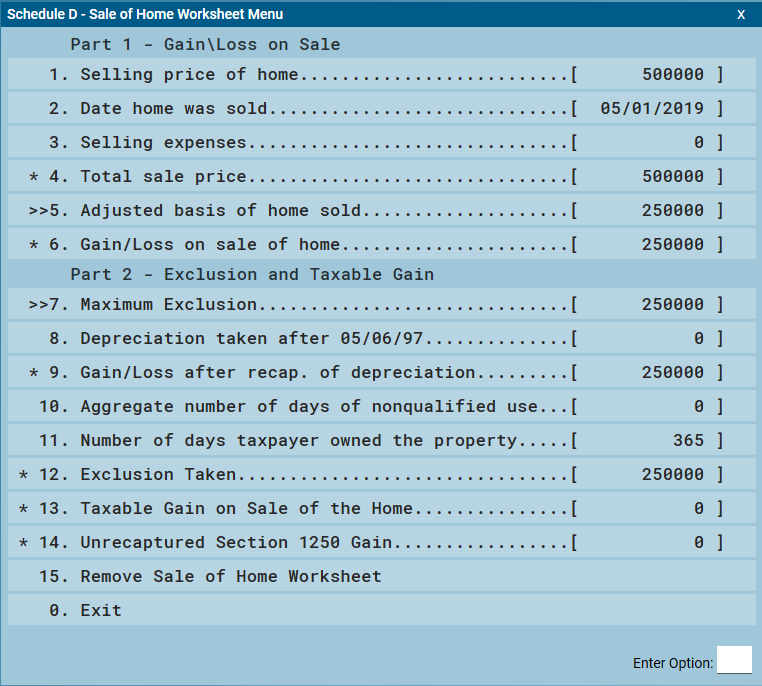

Sale Of Home Worksheet

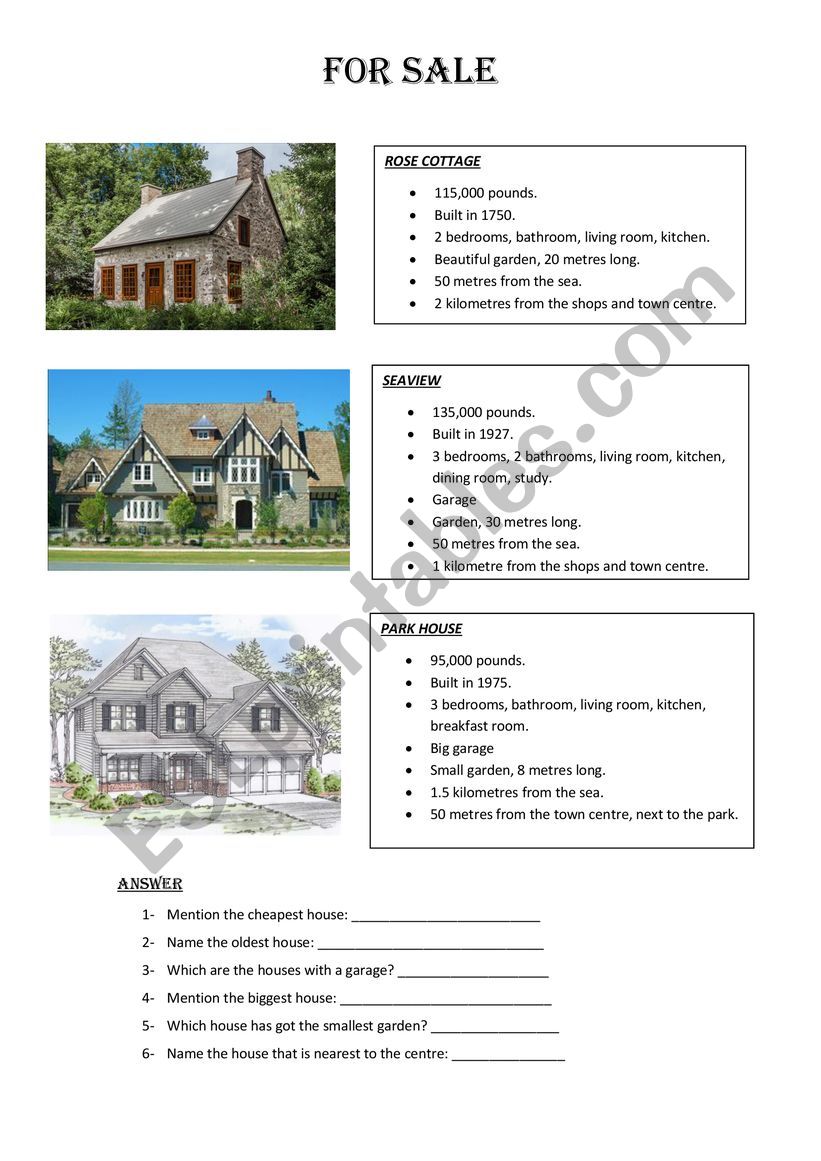

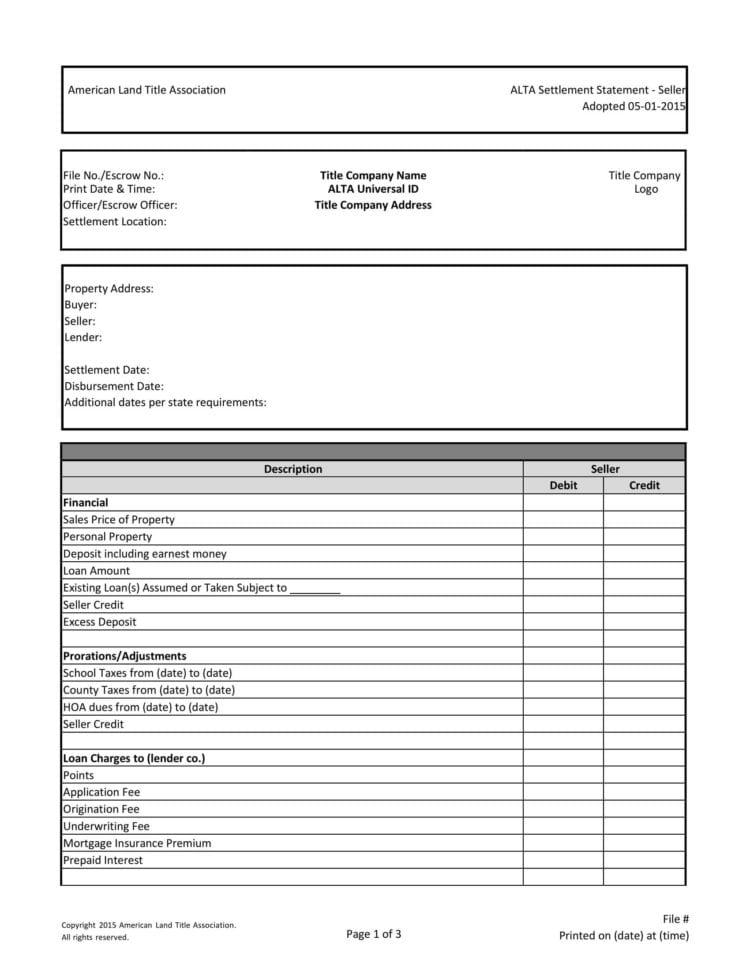

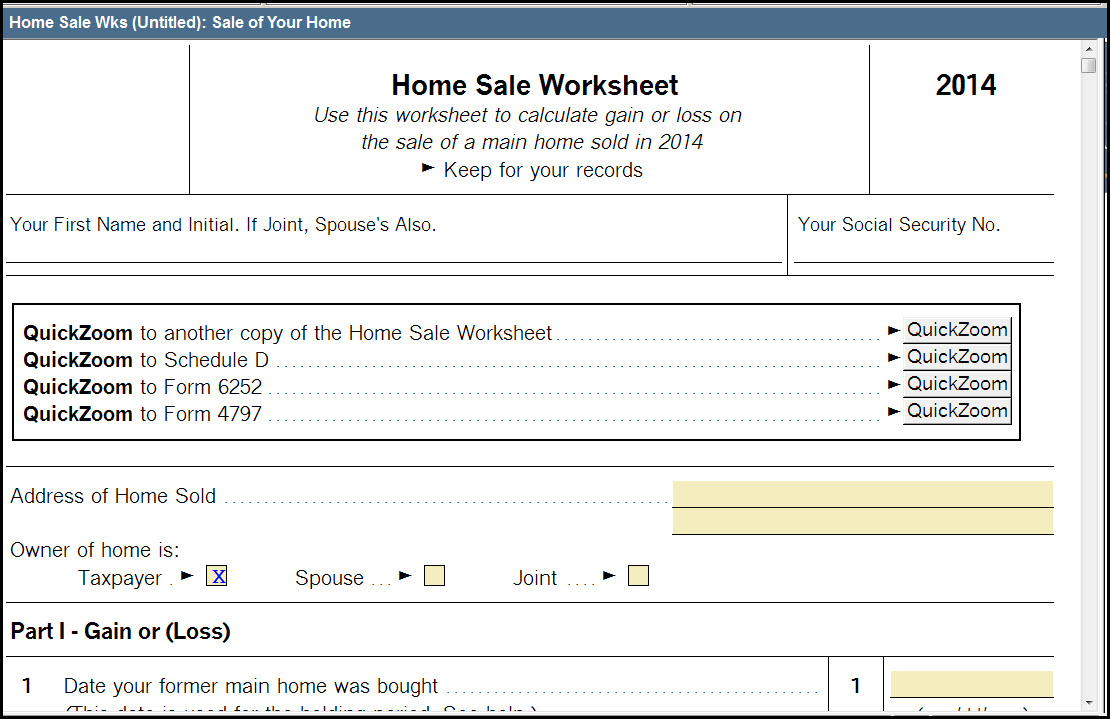

Sale Of Home Worksheet - See worksheet 1 instructions before you use this worksheet. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes, condominiums, mobile homes, and all other types of. You haven't remarried at the time of the sale. Web question if i sell my home and use the money i receive to pay off the mortgage, do i have to pay taxes on that money? Web use this screen to complete sale of your home worksheets and form 6252, installment sale income, if applicable. If so, only the excess amount is. Web introduction these instructions explain how to complete schedule d (form 1040). Learn more about the home sale calculator line items to understand the true costs of selling a house and. Web net proceeds are profits you'll walk away with after the sale of your home. Answer the amount you realize on the. Ultratax cs allows you to enter information for the sale of. (a) cost of new home (current primary residence) (a)$ if. Answer the amount you realize on the. Learn more about the home sale calculator line items to understand the true costs of selling a house and. Web use this screen to complete sale of your home worksheets and form. Web follow these steps to enter the sale of a home using the home sale worksheet: If so, only the excess amount is. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: You haven't remarried at the time of the sale. The. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. Web sale or within the same calendar year in a different principal residence; If so, only the excess amount is. Web sale of main home worksheet; Web question if i sell. Expat used for expatriates to report foreign income, dates. Learn more about the home sale calculator line items to understand the true costs of selling a house and. Web introduction these instructions explain how to complete schedule d (form 1040). See worksheet 1 instructions before you use this worksheet. I sold a home during income year(s). Web net proceeds are profits you'll walk away with after the sale of your home. Calculate capital gains download doc when you sell a stock, you owe taxes on the difference between what you paid for the stock and how much you got for the. Web introduction these instructions explain how to complete schedule d (form 1040). Web just remember. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Enter the purchase price of the home sold. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Basic info about the sale: Web property sale. Learn more about the home sale calculator line items to understand the true costs of selling a house and. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Expat used for expatriates to report foreign income, dates. Web sale of home worksheet how to compute gain or loss worksheet the process is. Web question if i sell my home and use the money i receive to pay off the mortgage, do i have to pay taxes on that money? Enter the purchase price of the home sold. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Calculate capital gains download doc when you sell. Web sale of main home worksheet; If so, only the excess amount is. Web property sale (this one) used for reporting real estate sales, home and rental. Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: I sold a home during income. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule d, part ii, line 8. Web follow these steps to enter the sale of a home using the home sale worksheet: To access the sale of main home worksheet for in the tax program, from the main menu. Learn more about the home sale calculator line items to understand the true costs of selling a house and. Web just remember that under the 2017 tax code, new homeowners (and home sellers) can deduct the interest on up to only $750,000 of mortgage debt, though homeowners who. The exclusion is increased to $500,000 for a married couple filing jointly. Web gain from the sale of your home from your income and avoid paying taxes on it. If so, only the excess amount is. Answer the amount you realize on the. Web to view/print the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Web follow these steps to enter the sale of a home using the home sale worksheet: Enter the purchase price of the home sold. Web sale or within the same calendar year in a different principal residence; Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule d, part ii, line 8. (a) cost of new home (current primary residence) (a)$ if. Web question if i sell my home and use the money i receive to pay off the mortgage, do i have to pay taxes on that money? Web use this screen to complete sale of your home worksheets and form 6252, installment sale income, if applicable. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes, condominiums, mobile homes, and all other types of. Web net proceeds are profits you'll walk away with after the sale of your home. Web introduction these instructions explain how to complete schedule d (form 1040). Web sale of main home worksheet; I sold a home during income year(s). Enter the purchase price of the home sold. See worksheet 1 instructions before you use this worksheet. Web sale of home worksheet how to compute gain or loss worksheet the process is the same for single family homes, condominiums, mobile homes, and all other types of. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. To access the sale of main home worksheet for in the tax program, from the main menu of the tax return (form 1040) select: Web to view the schedule d home sale worksheet which shows the calculation of the gain/loss, exclusion and/or taxable gain of the entries made in the return: Answer the amount you realize on the. You sell your home within 2 years of the death of your spouse. Expat used for expatriates to report foreign income, dates. Web gain from the sale of your home from your income and avoid paying taxes on it. Web introduction these instructions explain how to complete schedule d (form 1040). Basic information about your home: Web use this screen to complete sale of your home worksheets and form 6252, installment sale income, if applicable. Learn more about the home sale calculator line items to understand the true costs of selling a house and. I sold a home during income year(s). You haven't remarried at the time of the sale.Houses for sale ESL worksheet by emi7717

Sale Of Home Worksheet —

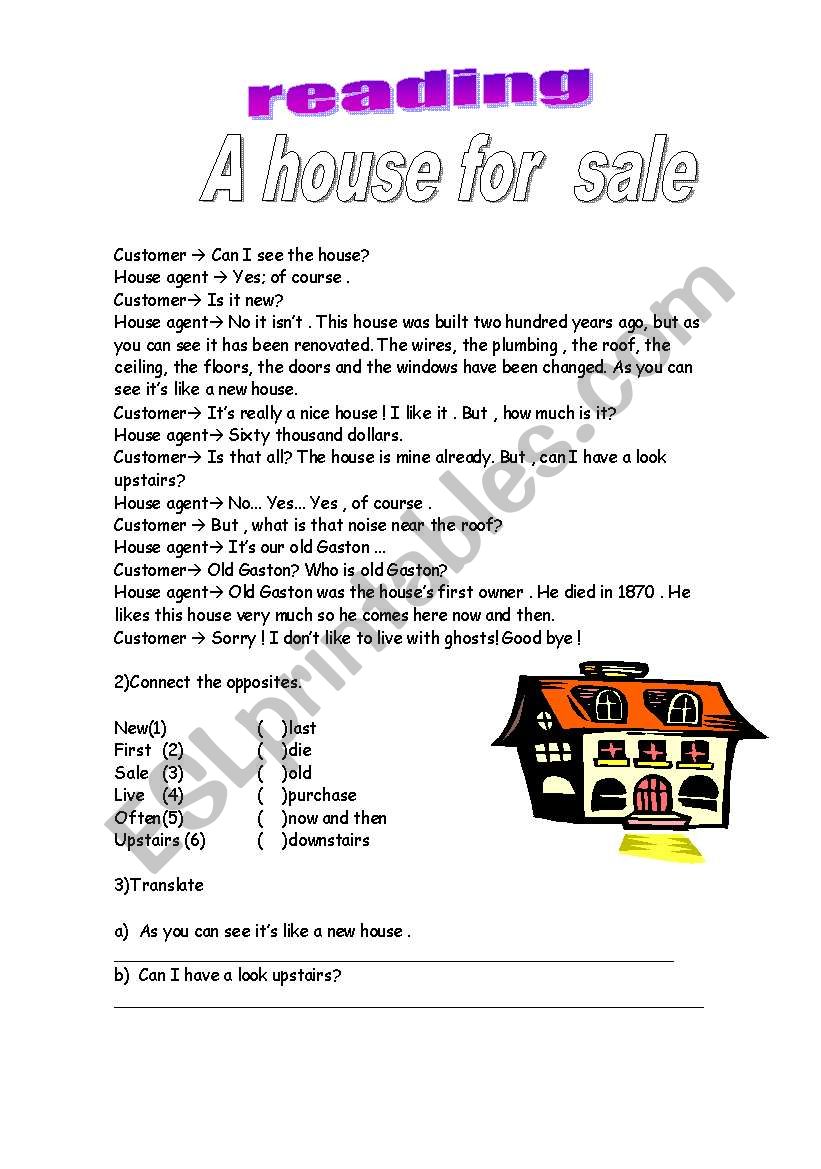

a house for sale ESL worksheet by eugeniapaxeco

Entering A Sale of Home With Section 121 Exclusion Accountants Community

Sale Of Main Home Worksheet —

Excluding the Sale of Main Home Support

Home Sale Worksheet (Template With Sample)

Sale Of Main Home Worksheet —

Sale Of Main Home Worksheet —

Quiz & Worksheet Home Sale as

If So, Only The Excess Amount Is.

Calculate Capital Gains Download Doc When You Sell A Stock, You Owe Taxes On The Difference Between What You Paid For The Stock And How Much You Got For The.

Notes If The Gain On Your Sale Of Home Exceeds The Maximum Exclusion, The Taxable Gain Will Flow To The Federal Schedule D, Part Ii, Line 8.

Ultratax Cs Allows You To Enter Information For The Sale Of.

Related Post: