Sale Of Main Home Worksheet

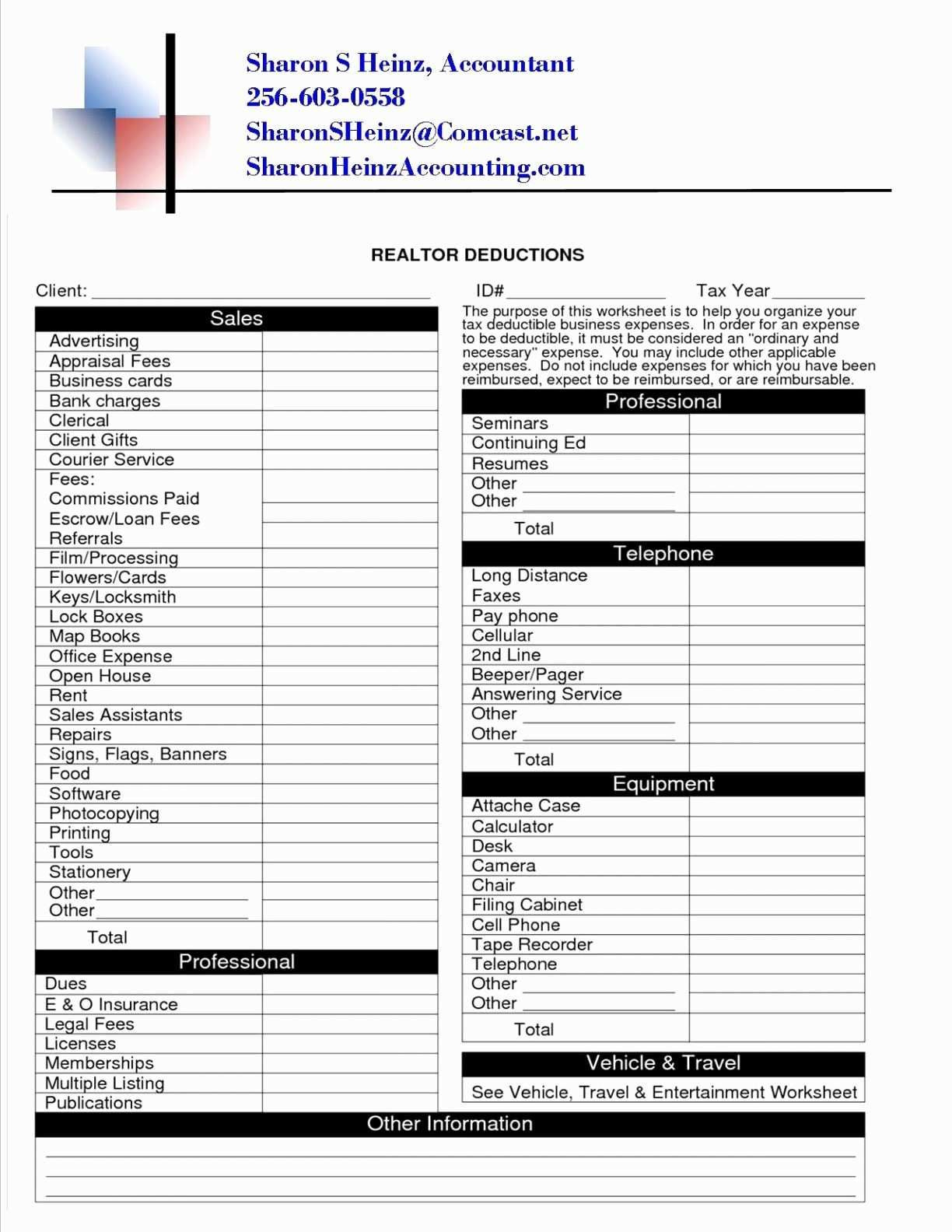

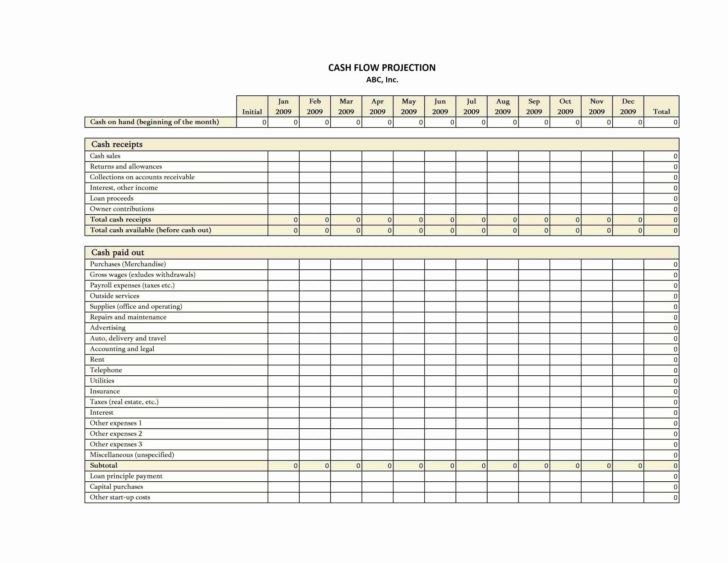

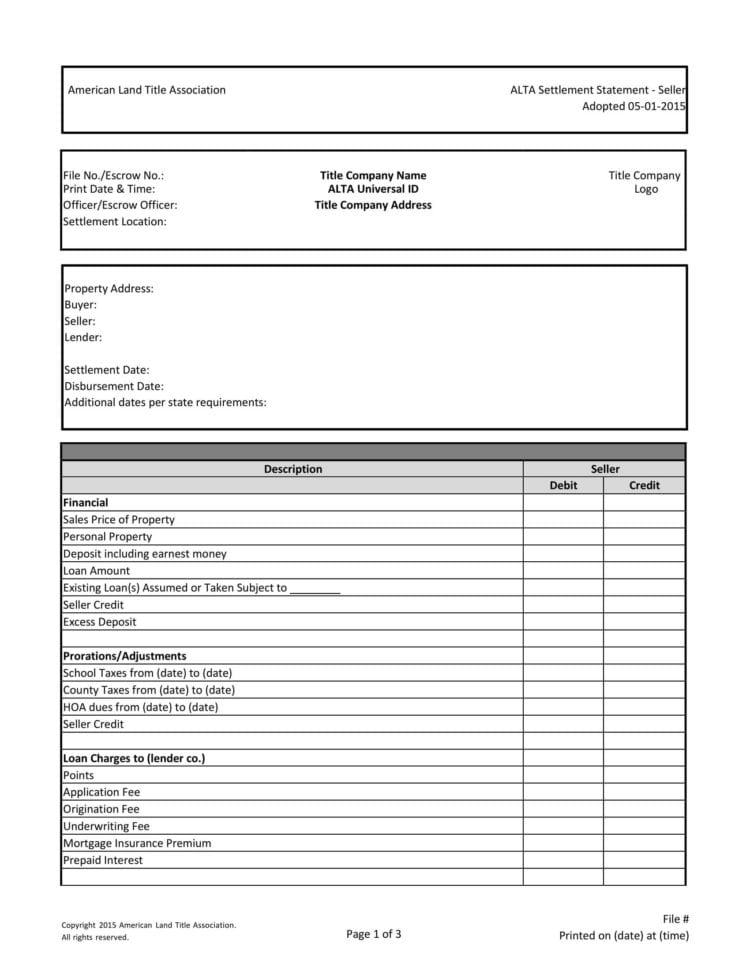

Sale Of Main Home Worksheet - If you sell your main home during the tax year, you should report the gain or loss on the return. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule d, part ii, line 8. The sale of your main home is recorded by following this path: You sell your home within 2 years of the death of your spouse. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: Basic information about your home: Fill out the sale of main home worksheet in the schedule d, ‘ other ‘ menu to see if any of the. Federal section income investments sale of. This publication explains the tax rules that apply when you sell (or otherwise give up. Web worksheets are included in publication 523, selling your home, to help you figure the: Income menu capital gain/loss (sch d) other. If you sell your main home during the tax year, you should report the gain or loss on the return. Enter the proceeds as reported in box 1d. Web sale of main home worksheet; Web a main home is the one in which the taxpayer lives most of the time. The exclusion is increased to $500,000 for a married couple filing jointly. Expat used for expatriates to report foreign income, dates. This publication explains the tax rules that apply when you sell (or otherwise give up. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you. Web gain from the sale of your home from your income and avoid paying taxes on it. Income menu capital gain/loss (sch d) other. Web publication 523 explains tax rules that apply when you sell your main home. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule. Web property sale (this one) used for reporting real estate sales, home and rental. Basic info about the sale: Federal section income investments sale of. Income menu capital gain/loss (sch d) other. Web taxslayer support selling your home if you sell your home during the year, you may be able to exclude some or all of the gain from your. Web gain from the sale of your home from your income and avoid paying taxes on it. Web worksheets are included in publication 523, selling your home, to help you figure the: Web a main home is the one in which the taxpayer lives most of the time. Fill out the sale of main home worksheet in the schedule d,. Web up to 24% cash back a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan, or any other factor you may be keeping. Fill out the sale of main home worksheet in the schedule d, ‘ other ‘ menu to see if any of the. Adjusted basis. Web to access the sale of main home worksheet for in the tax program, from the main menu of the tax return (form 1040) select: Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web use worksheet for basis adjustment in column (g) in instructions for form 8949, sale and other dispositions of capital. Web taxslayer support selling your home if you sell your home during the year, you may be able to exclude some or all of the gain from your return. Expat used for expatriates to report foreign income, dates. This publication explains the tax rules that apply when you sell (or otherwise give up. Enter the proceeds as reported in box. Web publication 523 explains tax rules that apply when you sell your main home. Neither you nor your late spouse took the exclusion. Web what is the sale of main home worksheet? Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: Income menu. Web gain from the sale of your home from your income and avoid paying taxes on it. If you sell your main home during the tax year, you should report the gain or loss on the return. Fill out the sale of main home worksheet in the schedule d, ‘ other ‘ menu to see if any of the. Answer. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule d, part ii, line 8. You sell your home within 2 years of the death of your spouse. The sale of your main home is recorded by following this path: Web worksheets are included in publication 523, selling your home, to help you figure the: Web publication 523 explains tax rules that apply when you sell your main home. Web question if i sell my home and use the money i receive to pay off the mortgage, do i have to pay taxes on that money? Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Adjusted basis of the home you sold gain (or loss) on the sale gain that you can. Basic information about your home: Answer the amount you realize on the. Web follow these steps to enter the sale of a home using the home sale worksheet: Web a main home is the one in which the taxpayer lives most of the time. Web what is the sale of main home worksheet? Expat used for expatriates to report foreign income, dates. Web property sale (this one) used for reporting real estate sales, home and rental. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of gain of $250,00 single ($500,000 married). Web use worksheet for basis adjustment in column (g) in instructions for form 8949, sale and other dispositions of capital assets. Web up to 24% cash back a home sale worksheet can help you compare real estate agents, sort out closing costs, track the status of the buyer's loan, or any other factor you may be keeping. If you sell your main home during the tax year, you should report the gain or loss on the return. The exclusion is increased to $500,000 for a married couple filing jointly. You haven't remarried at the time of the sale. Web to access the sale of main home worksheet for in the tax program, from the main menu of the tax return (form 1040) select: You sell your home within 2 years of the death of your spouse. You may qualify to exclude all or a. Web taxslayer support how do i report the sale of my main home? Fill out the sale of main home worksheet in the schedule d, ‘ other ‘ menu to see if any of the. Notes if the gain on your sale of home exceeds the maximum exclusion, the taxable gain will flow to the federal schedule d, part ii, line 8. Web taxslayer support selling your home if you sell your home during the year, you may be able to exclude some or all of the gain from your return. Adjusted basis of the home you sold gain (or loss) on the sale gain that you can. Web property sale (this one) used for reporting real estate sales, home and rental. Web up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: Web gain from the sale of your home from your income and avoid paying taxes on it. Enter the proceeds as reported in box 1d. Answer the amount you realize on the. Web sale of main home sale of main home if you owned your home for at least 2 of the last 5 years, you may qualify for an exclusion of gain of $250,00 single ($500,000 married).Parts of the House Activity Printables » Share & Remember Celebrating

Sale Of Main Home Worksheet —

My home interactive worksheet for beginners

Sale Of Main Home Worksheet —

Sale Of Home Worksheet —

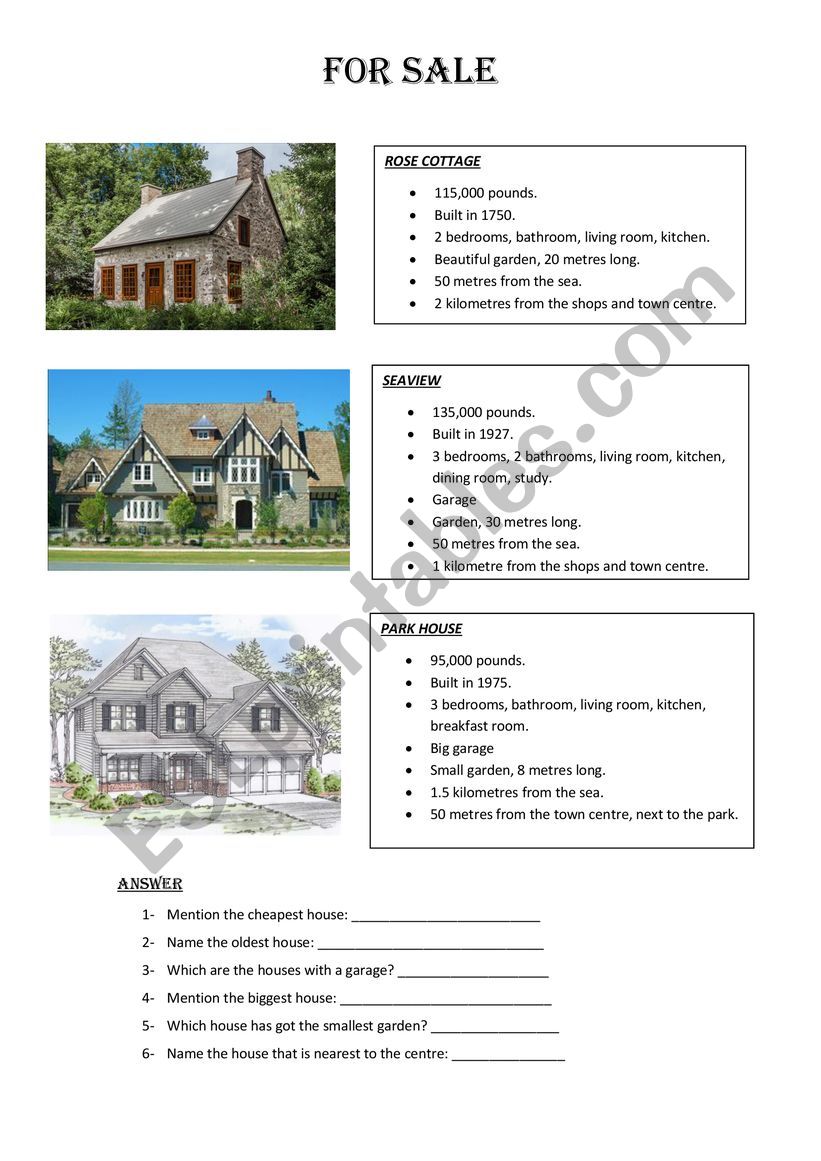

Sale Of Home Worksheet Maths Worksheets For Grade 3

Houses for sale ESL worksheet by robinbaby

Houses for sale ESL worksheet by emi7717

My house Interactive worksheet English worksheets for kids, English

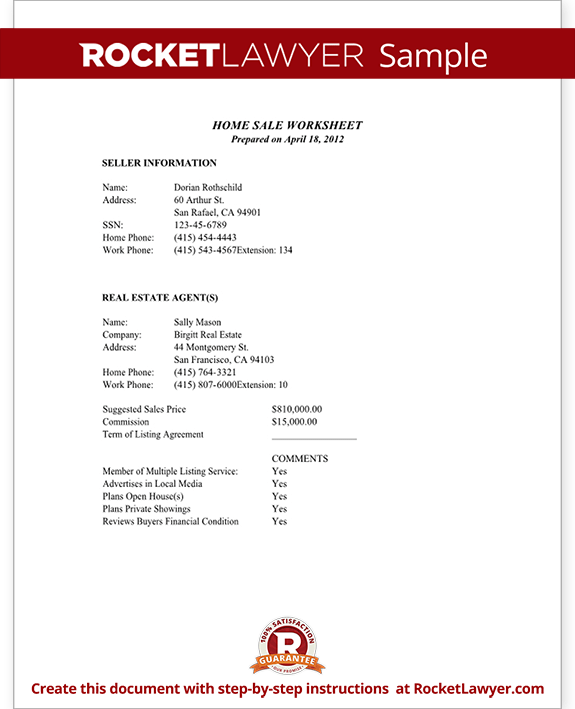

Home Sale Worksheet (Template With Sample)

Web Worksheets Are Included In Publication 523, Selling Your Home, To Help You Figure The:

Web Question If I Sell My Home And Use The Money I Receive To Pay Off The Mortgage, Do I Have To Pay Taxes On That Money?

Web Up To 24% Cash Back A Home Sale Worksheet Can Help You Compare Real Estate Agents, Sort Out Closing Costs, Track The Status Of The Buyer's Loan, Or Any Other Factor You May Be Keeping.

The Sale Of Your Main Home Is Recorded By Following This Path:

Related Post: