Salon Tax Worksheet

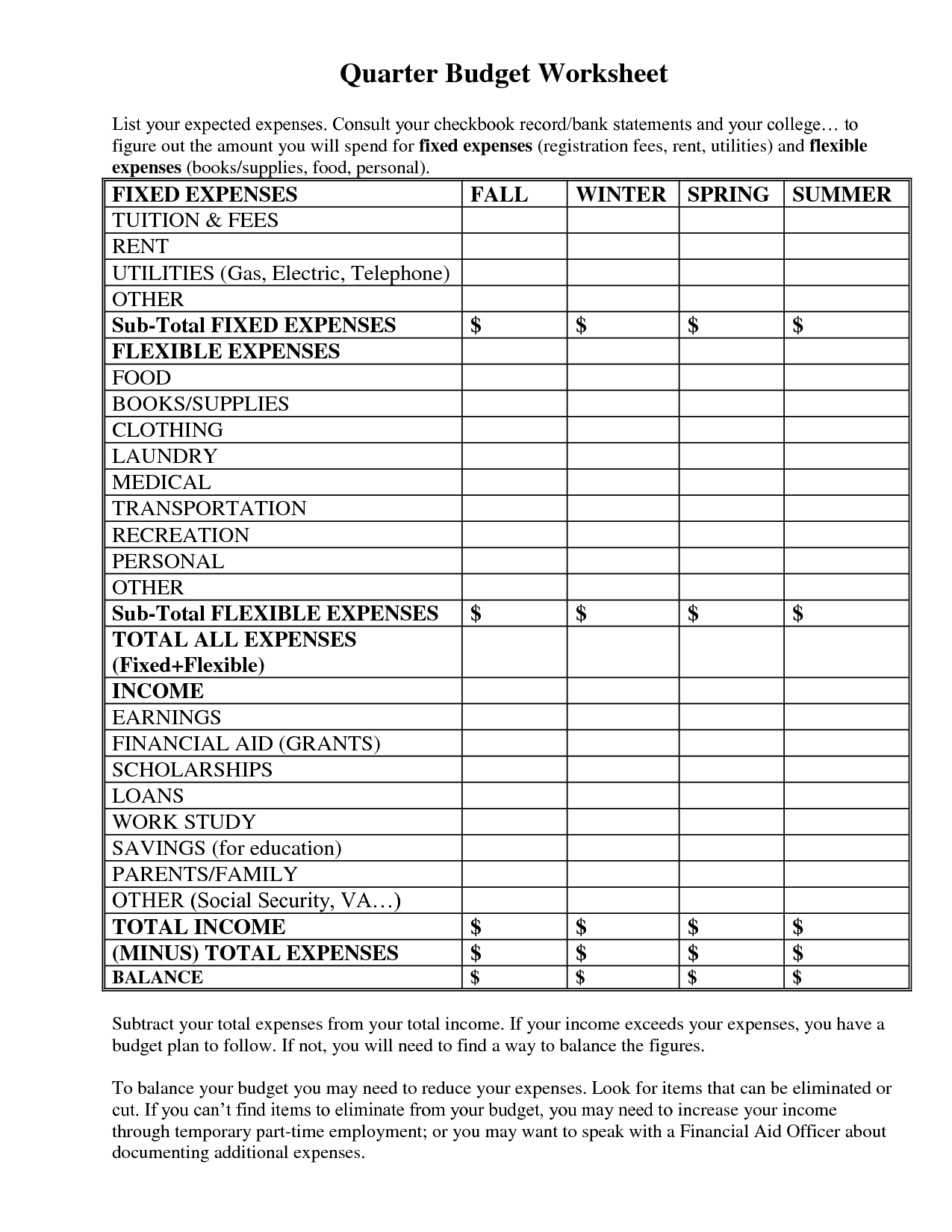

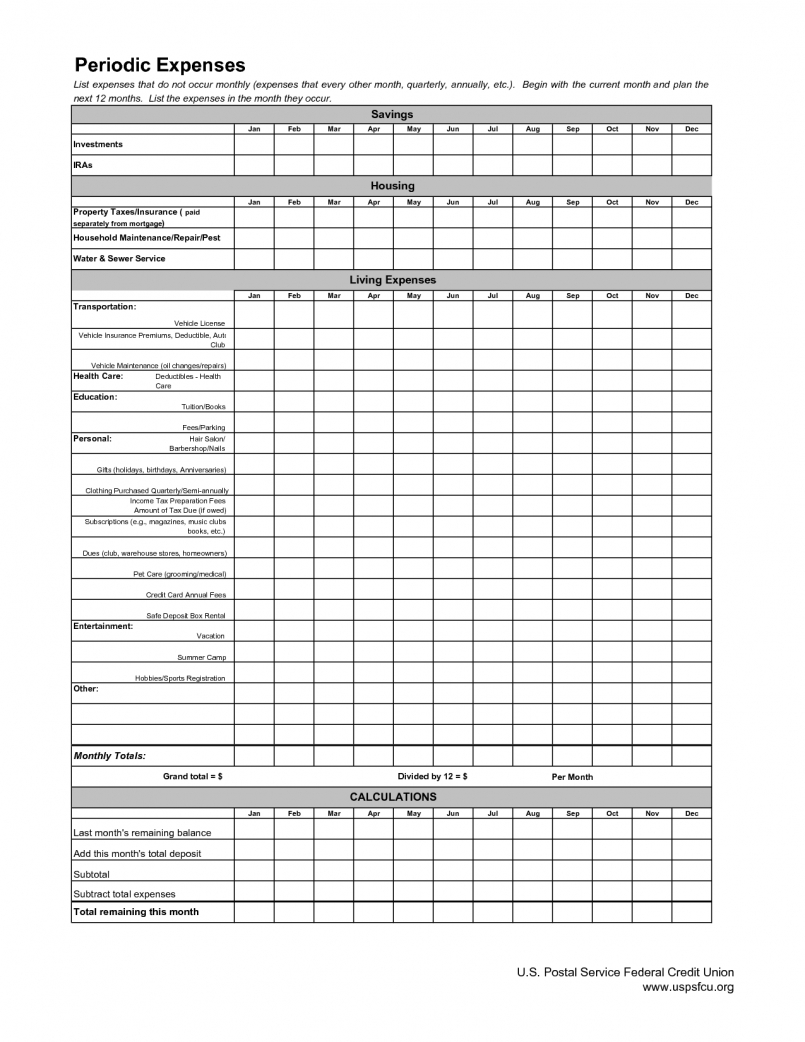

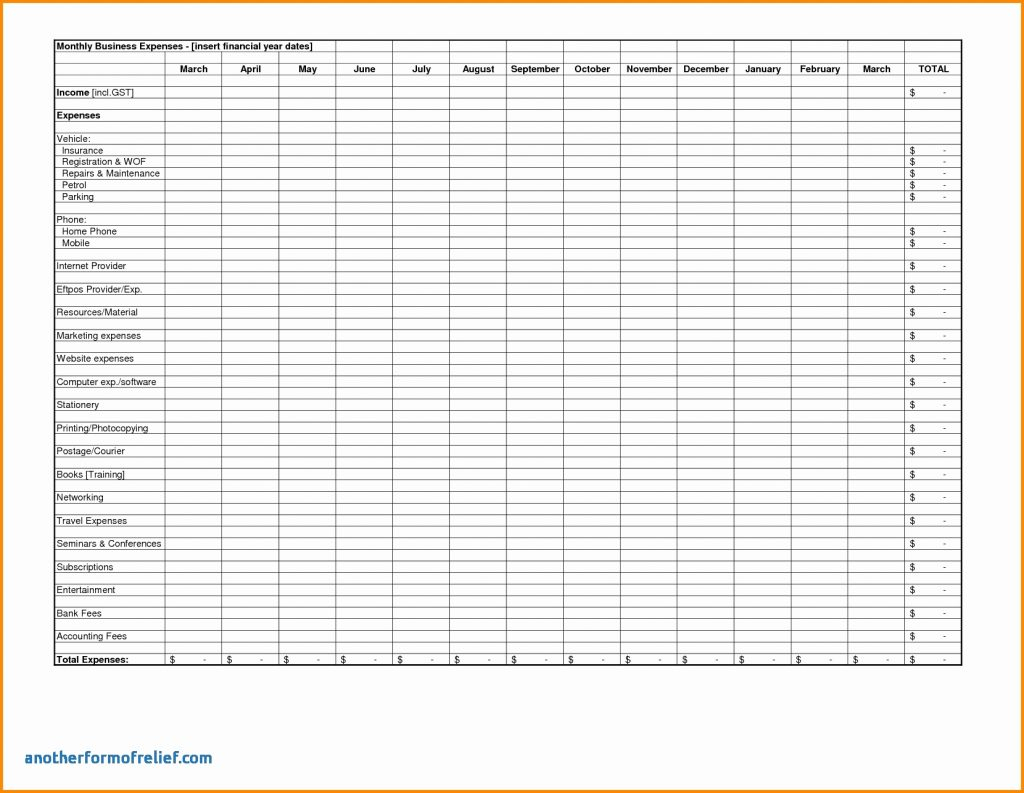

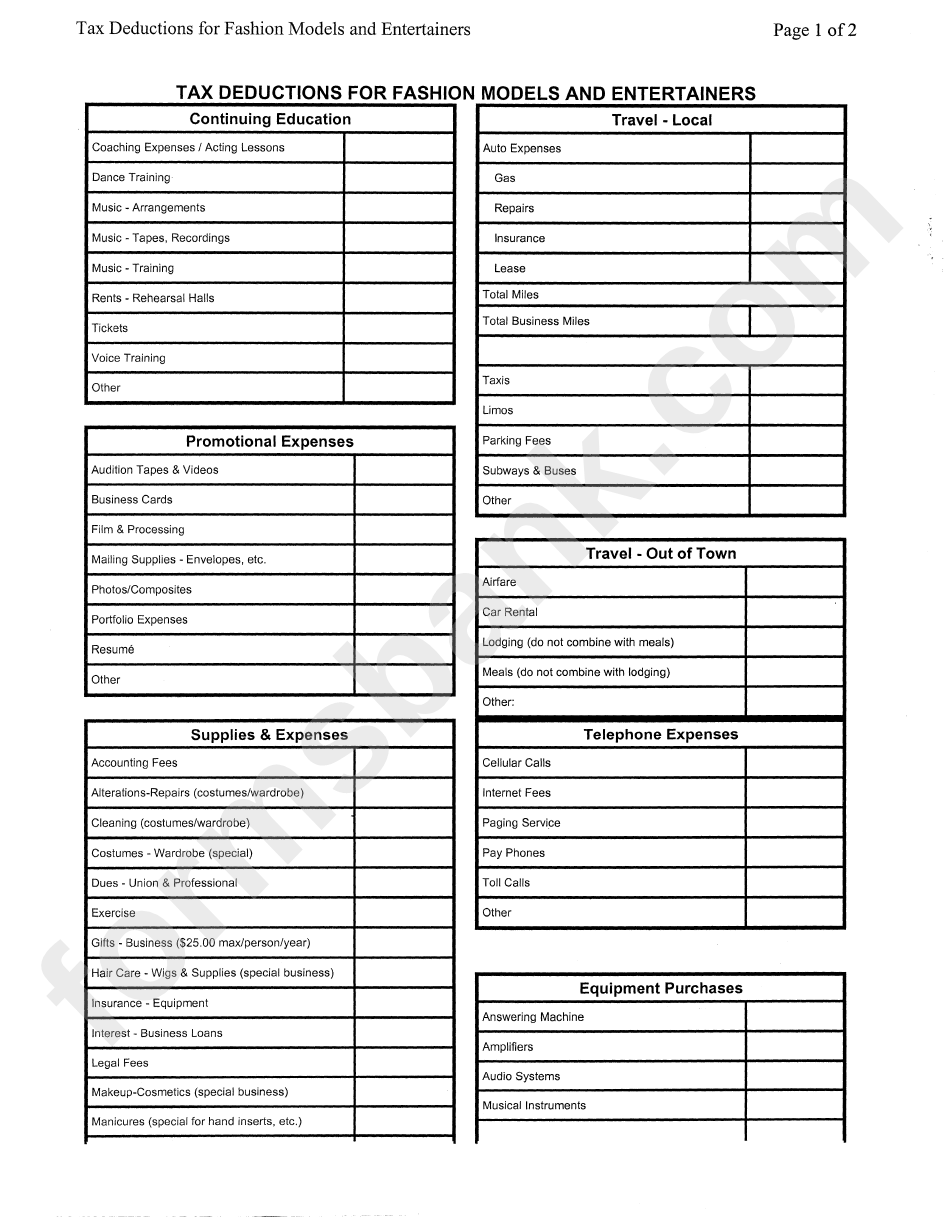

Salon Tax Worksheet - Calculate your total income as a hair stylist, including tips and any other additional sources of income. Open your salon tax worksheet in the editor, which is very easy to use and understand. Salon station chairs, carts, and stools used by your stylists facial and massage tables used by your practitioners For hair salons, barber shops, beauty salons, hairdressers & beauticians in illinois, usa. Qualified dividends and capital gain tax worksheet. No customer registation is required, finish your order fast and quick! Easy salon accounting software for less than the price of a haircut! You can also add sticky notes and text boxes. Child tax credit and credit for other dependents. Download your bookkeeping spreadsheets now! Foreign earned income tax worksheet—line 16; Web is it the case that you are looking for salon tax worksheet to fill? Web your hair stylist tax deduction checklist. Web sales tax) item traded additional cash paid traded with related property other information *1099s: But fret not because we have you covered! If you’re a hair stylist, here are 14 deductible expenses you should keep track of throughout the year. Access and customize the below sheet: When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. Salon station chairs, carts, and stools used by your stylists facial and massage. Web is it the case that you are looking for salon tax worksheet to fill? Web with pdffiller, it's easy to make changes. Web how to fill out hair stylist tax deduction: Salon expenses cost of goods sold $ uniform items $ acrylic/gel powder $ uniform maintenance $ styling products $ beauty equipment $ skin care supplies $. Its complete. Salon station chairs, carts, and stools used by your stylists facial and massage tables used by your practitioners Web schedule d tax worksheet. Salon expenses cost of goods sold $ uniform items $ acrylic/gel powder $ uniform maintenance $ styling products $ beauty equipment $ skin care supplies $. Salon income spreadsheet customizable template income spreadsheet explanation cost of goods. Figure out your employment status early. Web hair stylist + salon 2019 tax deduction checklist. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Some of the worksheets for this concept are salon, salon work, hair and beauty, hair dresserbarber income work, pennys hair salon, salon maths costing equipment, hairstyles and make. Web looking for hairstylist tax write offs checklist? Furniture and equipment did you know that you can write off necessary equipment purchases to support your business? Qualified dividends and capital gain tax worksheet. Web illinois salon accounts & sales tax spreadsheet for 2021 year end. Due date of return is january 31. Web your hair stylist tax deduction checklist. Salon income spreadsheet customizable template income spreadsheet explanation cost of goods sold spreadsheet ( if you’re generating extra income by selling retail products in your salon like shampoos, nail polishes, hair oils, etc.) customizable template Web sales tax) item traded additional cash paid traded with related property other information *1099s: A simple template. Use our detailed instructions to fill out and esign your documents online. Web your tax obligations, stay in compliance with the law, and enjoy the benefits! Web with pdffiller, it's easy to make changes. Web suitable for all self employed hairdressers, beauticians, hair salons, barber shops, tattoo studios, tattoo artists. Qualified dividends and capital gain tax worksheet. Zolmi salon software will show different costs that can be written off when filing a self employed hairdresser tax return, some common expenses that cannot be deducted and how to prove your income. You may include other applicable expenses. If you’re a hair stylist, here are 14 deductible expenses you should keep track of throughout the year. Web your hair. Its complete collection of forms can save. No customer registation is required, finish your order fast and quick! For hair salons, barber shops, beauty salons, hairdressers & beauticians in illinois, usa. Beginning inventory should be the same as ending inventory for the previous tax year. Foreign earned income tax worksheet—line 16; Access and customize the below sheet: Calculate your total income as a hair stylist, including tips and any other additional sources of income. Due date of return is january 31. Salon station chairs, carts, and stools used by your stylists facial and massage tables used by your practitioners Figure out your employment status early. Web hair stylist + salon 2019 tax deduction checklist. Web how to fill out hair stylist tax deduction: Download your bookkeeping spreadsheets now! Salon expenses cost of goods sold $ uniform items $ acrylic/gel powder $ uniform maintenance $ styling products $ beauty equipment $ skin care supplies $. Inventory at beginning of year. Open your salon tax worksheet in the editor, which is very easy to use and understand. Do not include expenses for which you have been reimbursed, expect to be reimbursed, or are reimbursable. Web salon worksheet name of salon type of business gross income from services $ ein gross. Web looking for hairstylist tax write offs checklist? Web schedule d tax worksheet. A simple template to sort out your account! Web you need 3 main spreadsheets to keep track of salon revenue, expenses, and profits. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. But fret not because we have you covered! Web illinois salon accounts & sales tax spreadsheet for 2021 year end. If you own or work at a barbershop or hair salon, there may be tax deductions that you can take advantage of this tax season. In order for an expense to be deductible, it must be considered an ordinary and necessary expense. Use our detailed instructions to fill out and esign your documents online. Below are some acceptable deductions for. Web how to fill out hair stylist tax deduction: Salon station chairs, carts, and stools used by your stylists facial and massage tables used by your practitioners Total income from services $ total income from product sales $ total tip income $ educator income $ inventory if you purchase goods to have available for resale you will carry an inventory. But fret not because we have you covered! Foreign earned income tax worksheet. Inventory at beginning of year. Furniture and equipment did you know that you can write off necessary equipment purchases to support your business? Salon expenses cost of goods sold $ uniform items $ acrylic/gel powder $ uniform maintenance $ styling products $ beauty equipment $ skin care supplies $. Gather all necessary financial documents, such as income statements, receipts for business expenses, and tax forms provided by your employer. Web the purpose of this worksheet is to help you organize your tax deductible business expenses. Web hair stylist + salon 2019 tax deduction checklist. Easy salon accounting software for less than the price of a haircut!Hair Stylist Tax Deduction Worksheet Fill Online, Printable, Fillable

Beauty Salon Hair Salon Monthly Expenses Salon Expenses Spreadsheet

Hair Stylist Spreadsheet With Images Of Tax Spreadsheet

Salon Expenses Spreadsheet —

Keep a flawless record of hair stylist and expenses with the

Hair Stylist + Salon 2019 Tax Deduction Checklist Simply Organic

Hair Stylist and Expense Worksheets with Mileage Logs Hair

Tax Deductions Sheet For Fashion Models And Entertainers printable pdf

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

Hair Salon Expense Spreadsheet Google Spreadshee hair salon expense

Qualified Dividends And Capital Gain Tax Worksheet.

If You’re A Hair Stylist, Here Are 14 Deductible Expenses You Should Keep Track Of Throughout The Year.

Web With Pdffiller, It's Easy To Make Changes.

Web Your Tax Obligations, Stay In Compliance With The Law, And Enjoy The Benefits!

Related Post: