Schedule C Excel Worksheet

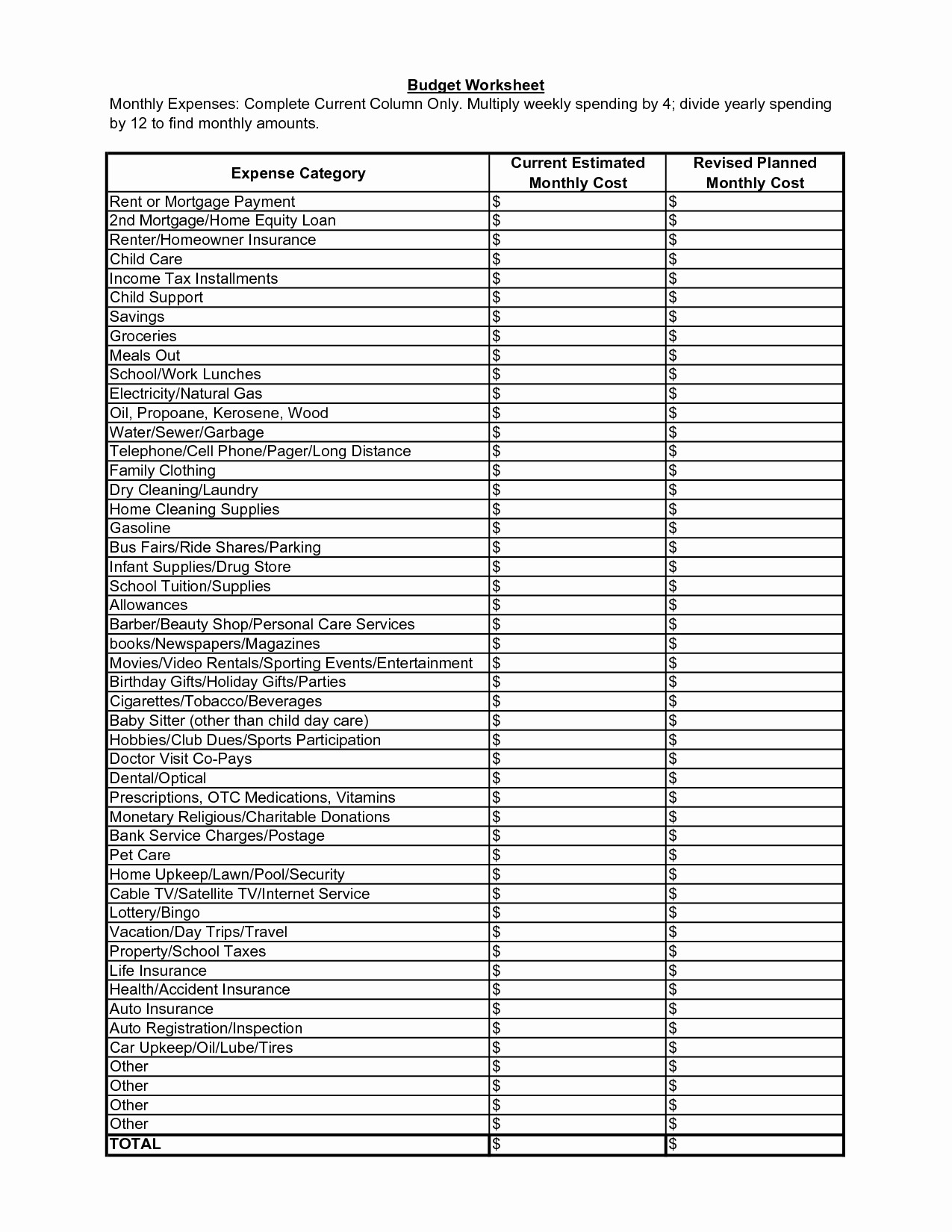

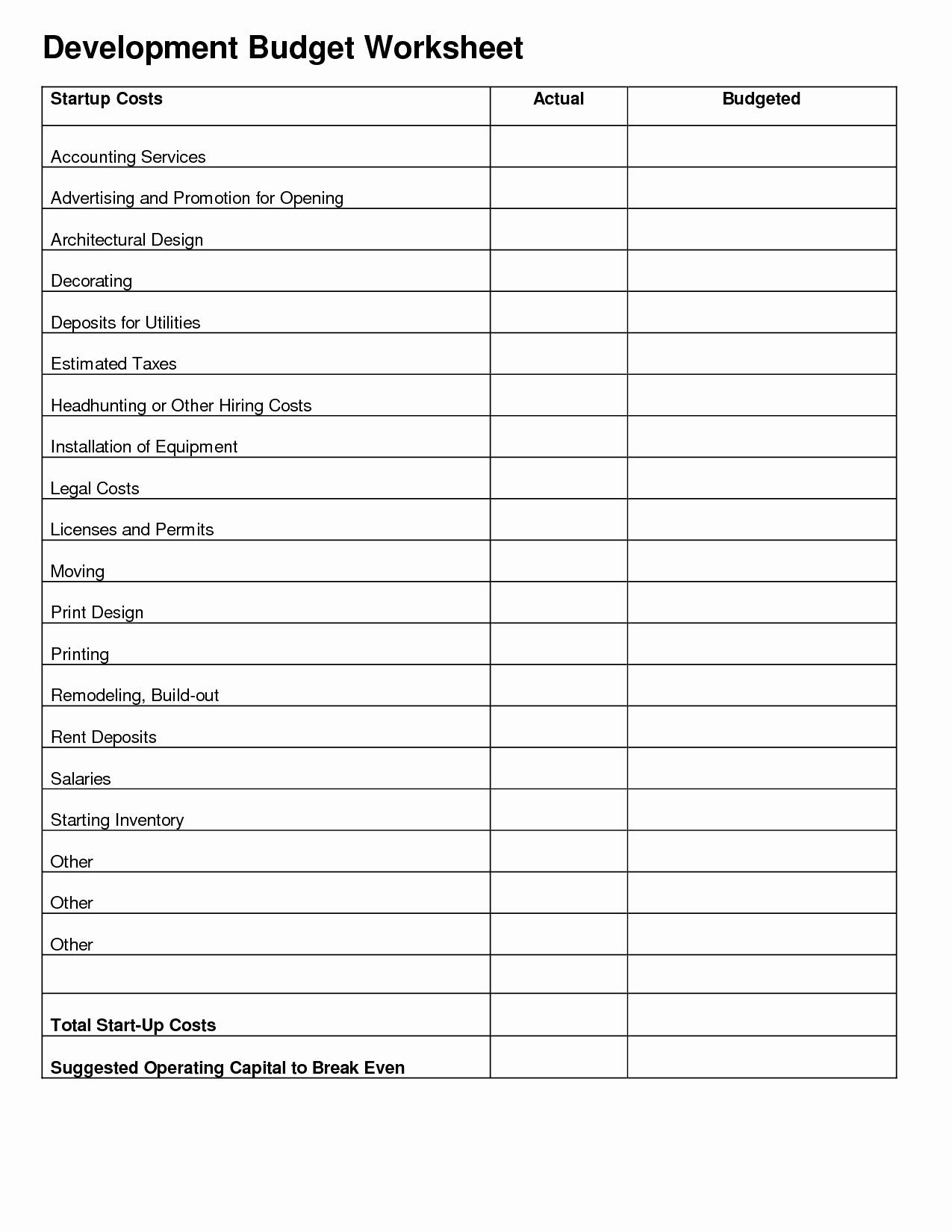

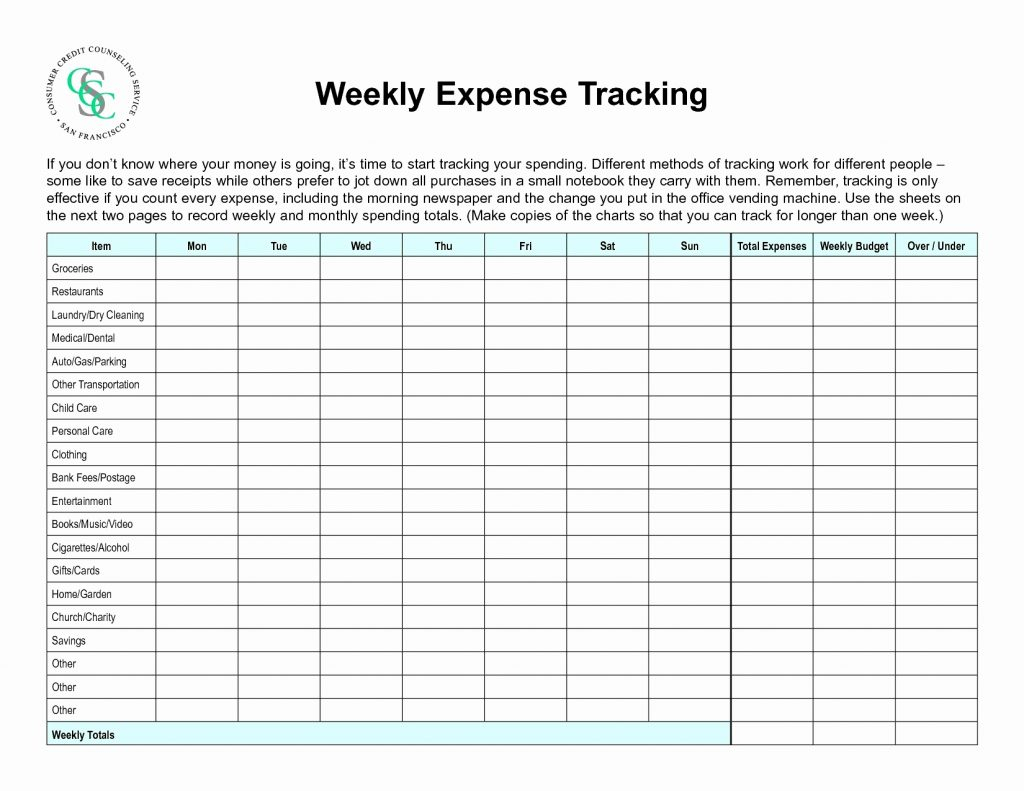

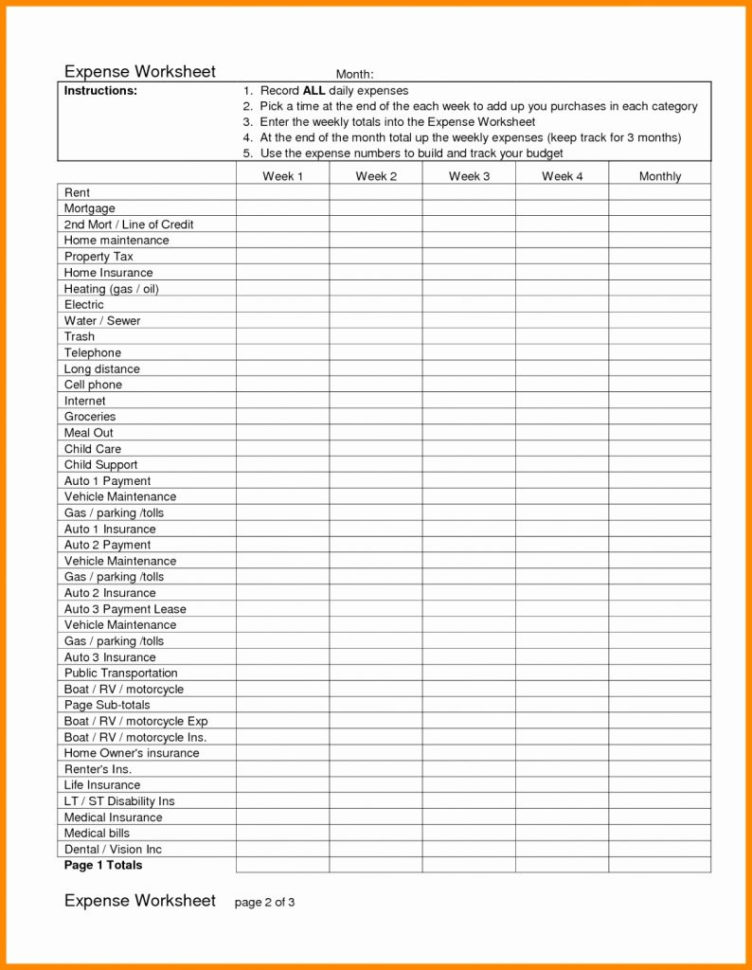

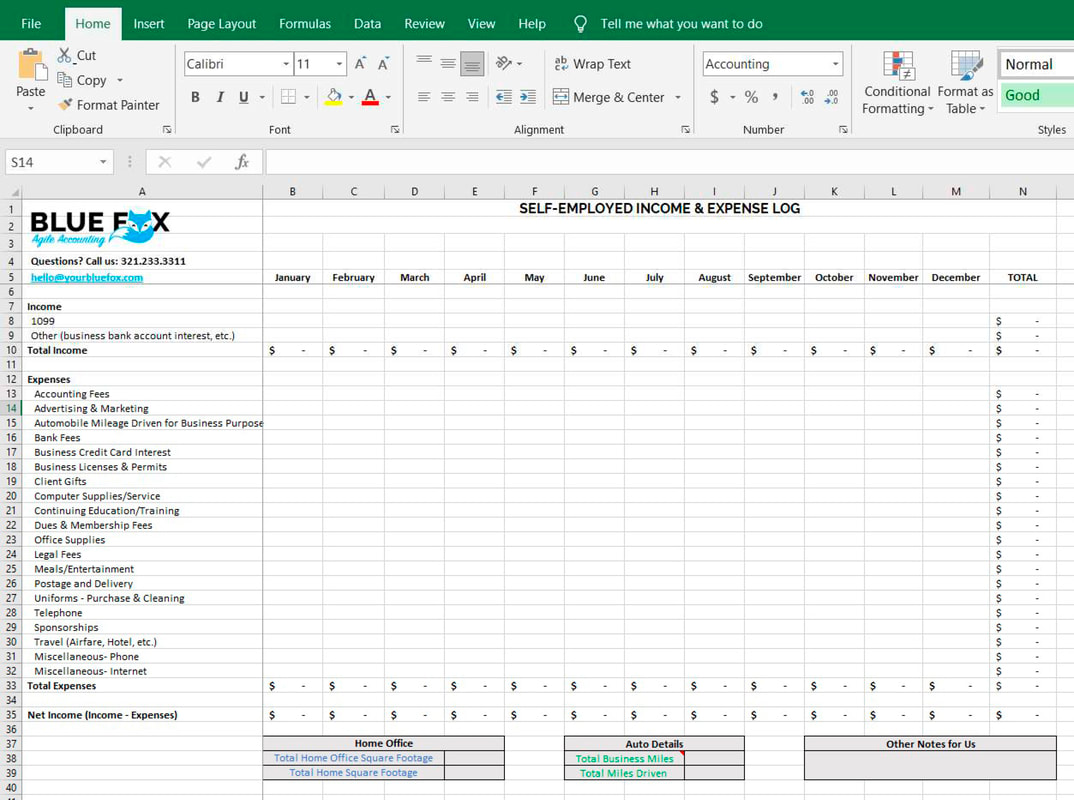

Schedule C Excel Worksheet - Download the excel worksheet here. Web download calculator (excel) sole proprietor schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Under advisor, click [year] schedule c. Partnerships must generally file form 1065. Web go to www.irs.gov/schedulec for instructions and the latest information. Most of the time, this will be an excel template because it is the simplest to use and easiest to customize based on your specific business. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. 7shifts.com has been visited by 10k+ users in the past month In the accounting menu, select reports. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. Signnow.com has been visited by 100k+ users in the past month Most of the time, this will be an excel template because it is the simplest to use and easiest to customize based on your specific business. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all. In the accounting menu, select reports. Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Web go to your client's xero organization. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in. Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. In the accounting menu, select reports. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any). I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Get out your shoebox of 2022 receipts and let’s get organized.. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web go to your client's xero organization. Get out your shoebox of 2022 receipts and let’s get organized. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file. Sections of the report use this schedule to complete part i income and part ii expenses of your client’s schedule c. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we. Sections of the report use this schedule to complete part i income and part ii expenses of your client’s schedule c. Web download calculator (excel) sole proprietor schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. In the accounting menu, select reports. Web schedule c worksheet for self employed businesses and/or independent contractors irs. Under advisor, click [year] schedule c. 7shifts.com has been visited by 10k+ users in the past month Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year. Get out your shoebox of. Web to make tracking schedule c expenses easier, the best option is to use a 1099 template (schedule c template). Web go to your client's xero organization. Web go to www.irs.gov/schedulec for instructions and the latest information. Square, paypal, etc.) business name: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a. Web download calculator (excel) sole proprietor schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web go to www.irs.gov/schedulec for instructions and the latest information. Sections of the report use this schedule to complete part i income and part ii expenses of your client’s schedule c. Web schedule c worksheet for self employed businesses. Web the best way to track income & expenses for tax form 1040. Most of the time, this will be an excel template because it is the simplest to use and easiest to customize based on your specific business. Sections of the report use this schedule to complete part i income and part ii expenses of your client’s schedule c. Under advisor, click [year] schedule c. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Web go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. Square, paypal, etc.) business name: Download the excel worksheet here. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Get out your shoebox of 2022 receipts and let’s get organized. In the accounting menu, select reports. Web go to your client's xero organization. 7shifts.com has been visited by 10k+ users in the past month Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. Web to make tracking schedule c expenses easier, the best option is to use a 1099 template (schedule c template). Web download calculator (excel) sole proprietor schedule c calculate the monthly qualifying income for a borrower who is a sole proprietor. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year. Signnow.com has been visited by 100k+ users in the past month Signnow.com has been visited by 100k+ users in the past month Web go to your client's xero organization. In the accounting menu, select reports. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if any)_____ address (if any) _____ is this your first year. I also put together a guide to help her know which categories to choose for each item so it’ll correspond to the tax return. Under advisor, click [year] schedule c. Download the excel worksheet here. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Get out your shoebox of 2022 receipts and let’s get organized. Square, paypal, etc.) business name: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Sections of the report use this schedule to complete part i income and part ii expenses of your client’s schedule c. Web go to www.irs.gov/schedulec for instructions and the latest information. Web i put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Partnerships must generally file form 1065. Web to make tracking schedule c expenses easier, the best option is to use a 1099 template (schedule c template).self employed expenses worksheet

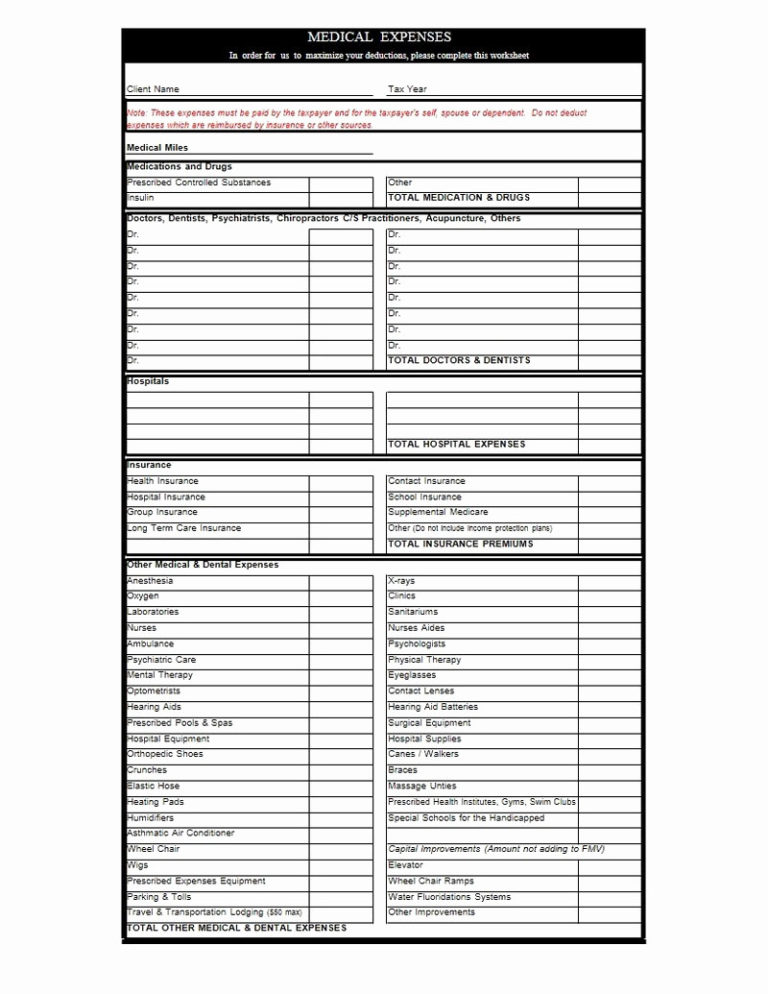

Schedule C Expenses Worksheet —

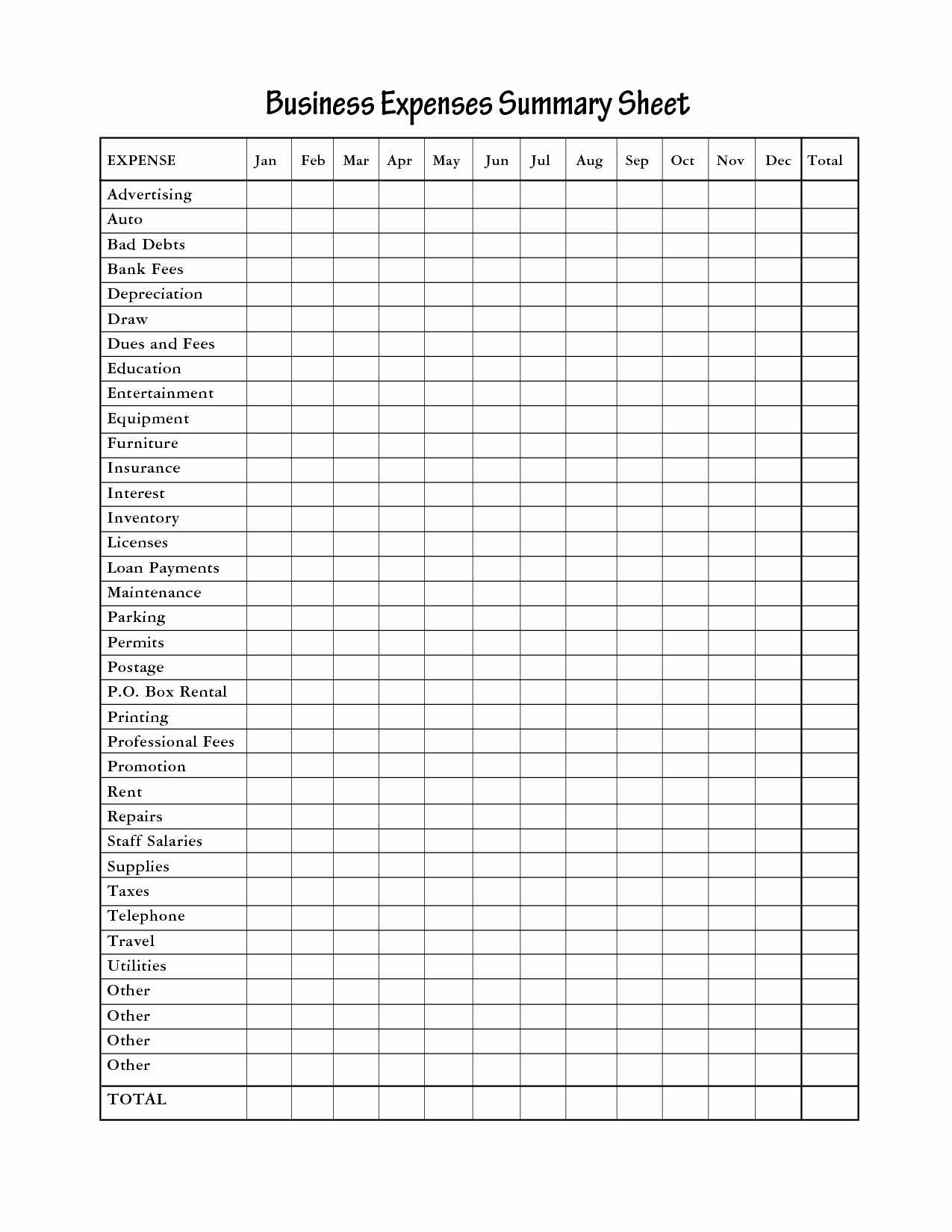

Schedule C Spreadsheet within Schedule C Expenses Spreadsheet Car And

Schedule C Spreadsheet pertaining to Schedule C Expenses Spreadsheet

Schedule C Worksheet Excel

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Schedule C Expenses Spreadsheet —

Schedule C Spreadsheet Of Schedule C Expenses Spreadsheet —

schedule c worksheet excel

erc form download romanholidayvannuys

Web The Best Way To Track Income & Expenses For Tax Form 1040.

7Shifts.com Has Been Visited By 10K+ Users In The Past Month

Most Of The Time, This Will Be An Excel Template Because It Is The Simplest To Use And Easiest To Customize Based On Your Specific Business.

Web Download Calculator (Excel) Sole Proprietor Schedule C Calculate The Monthly Qualifying Income For A Borrower Who Is A Sole Proprietor.

Related Post: