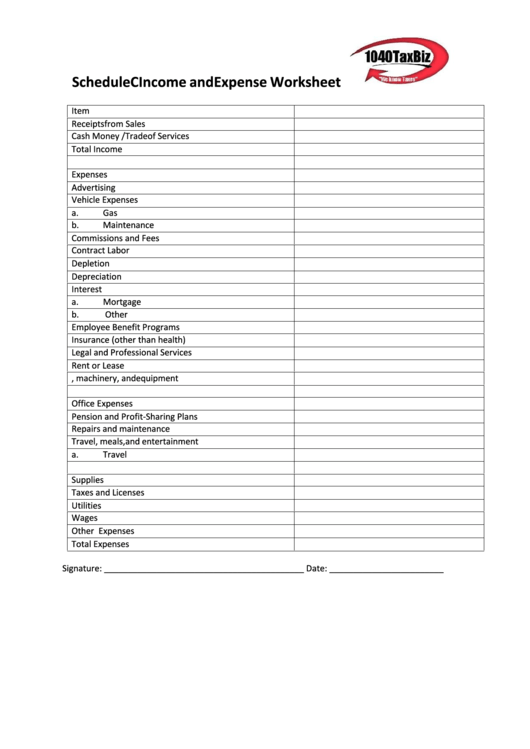

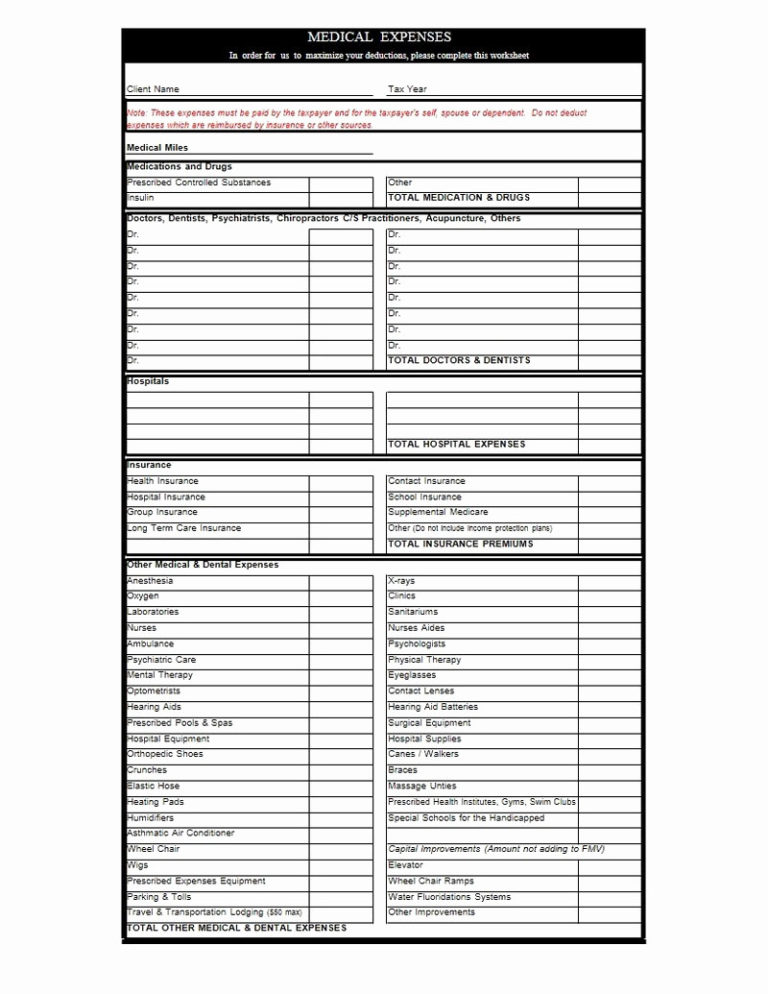

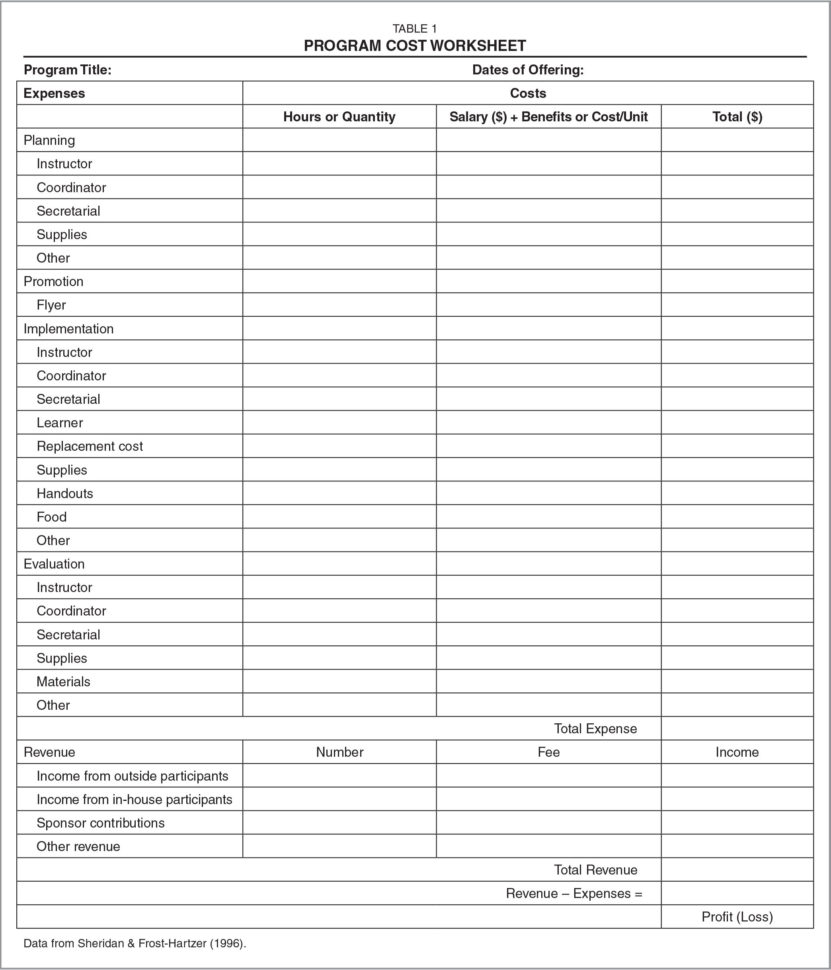

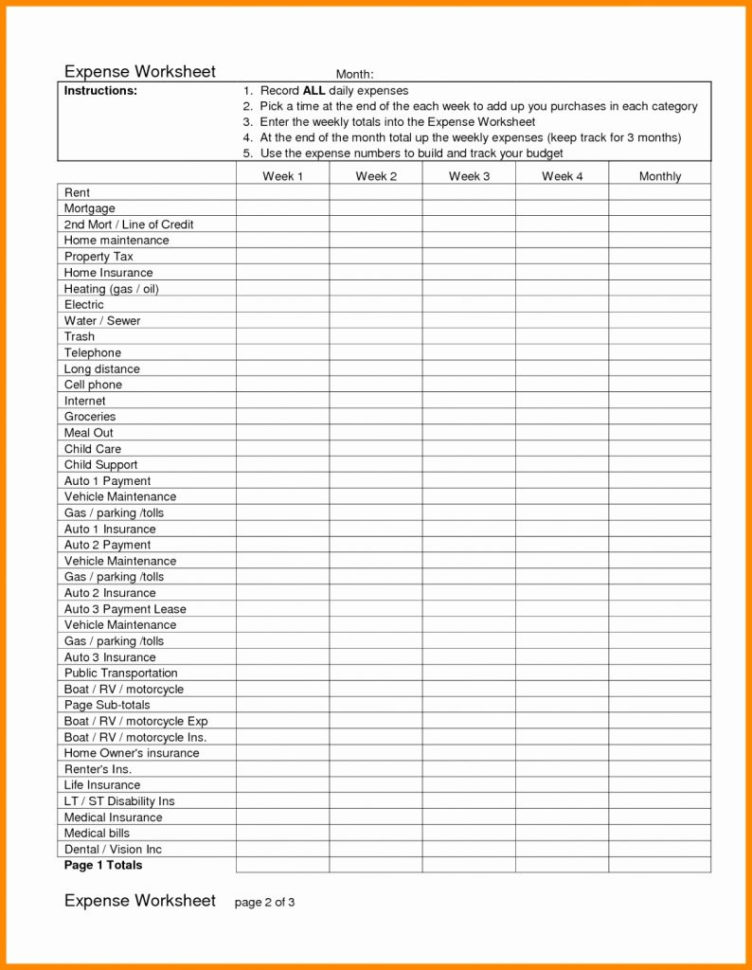

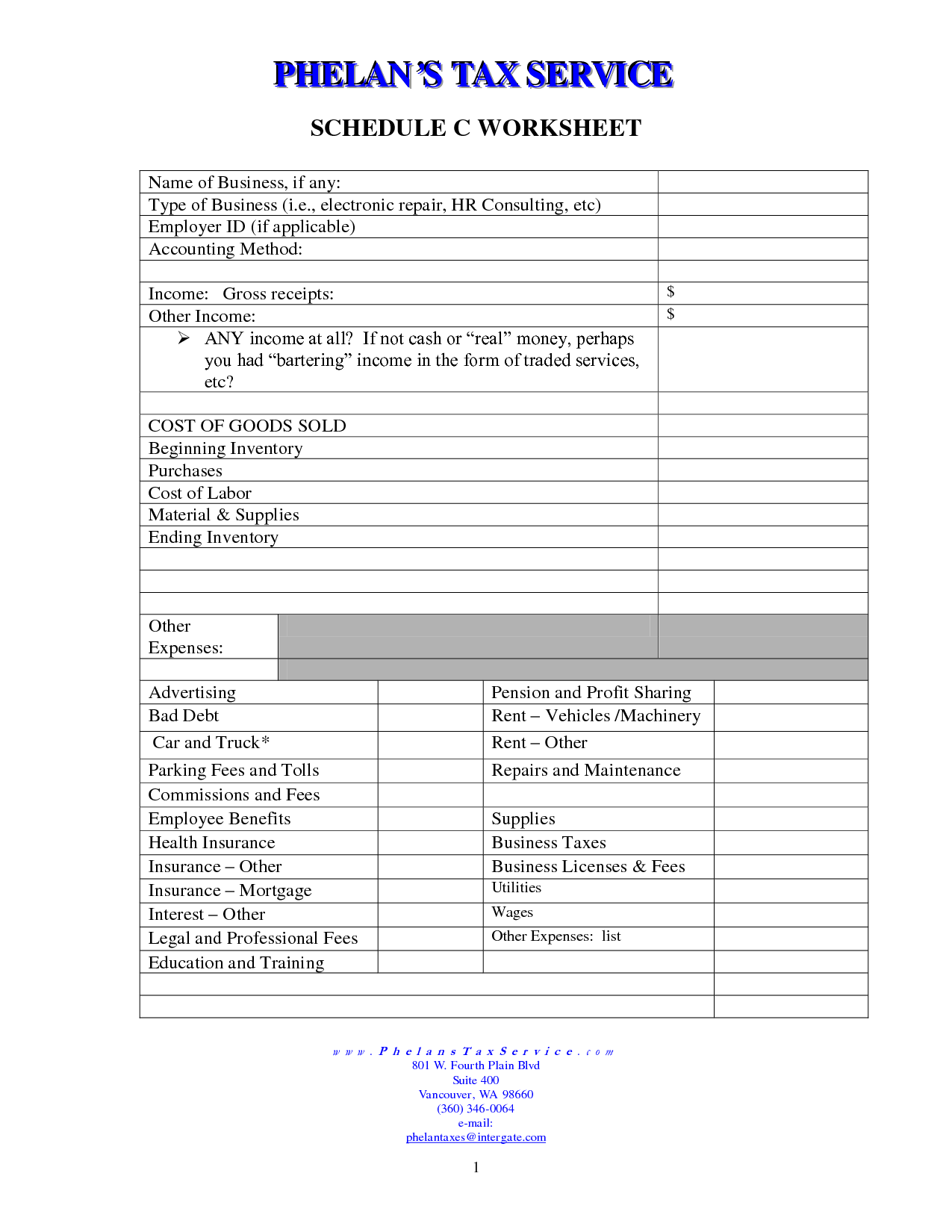

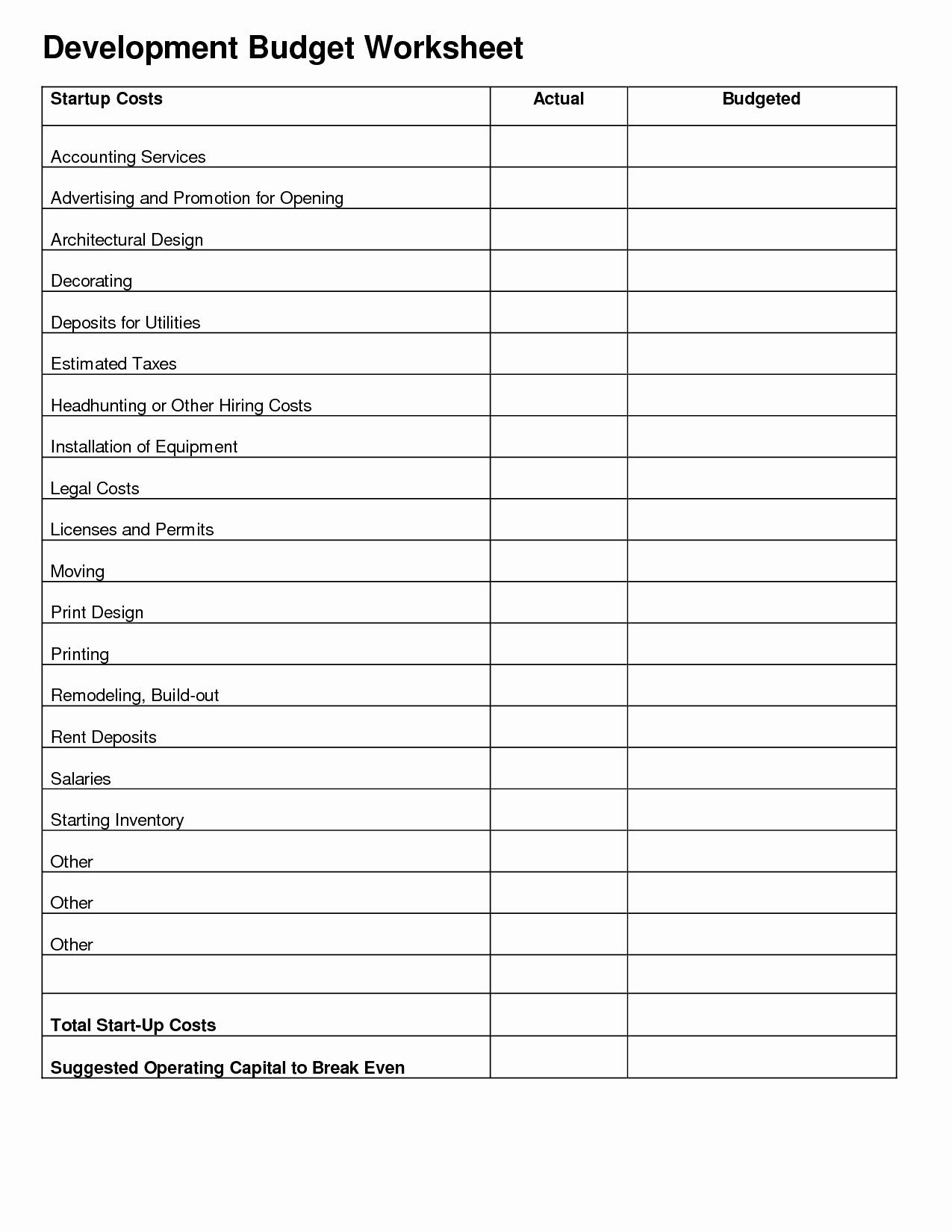

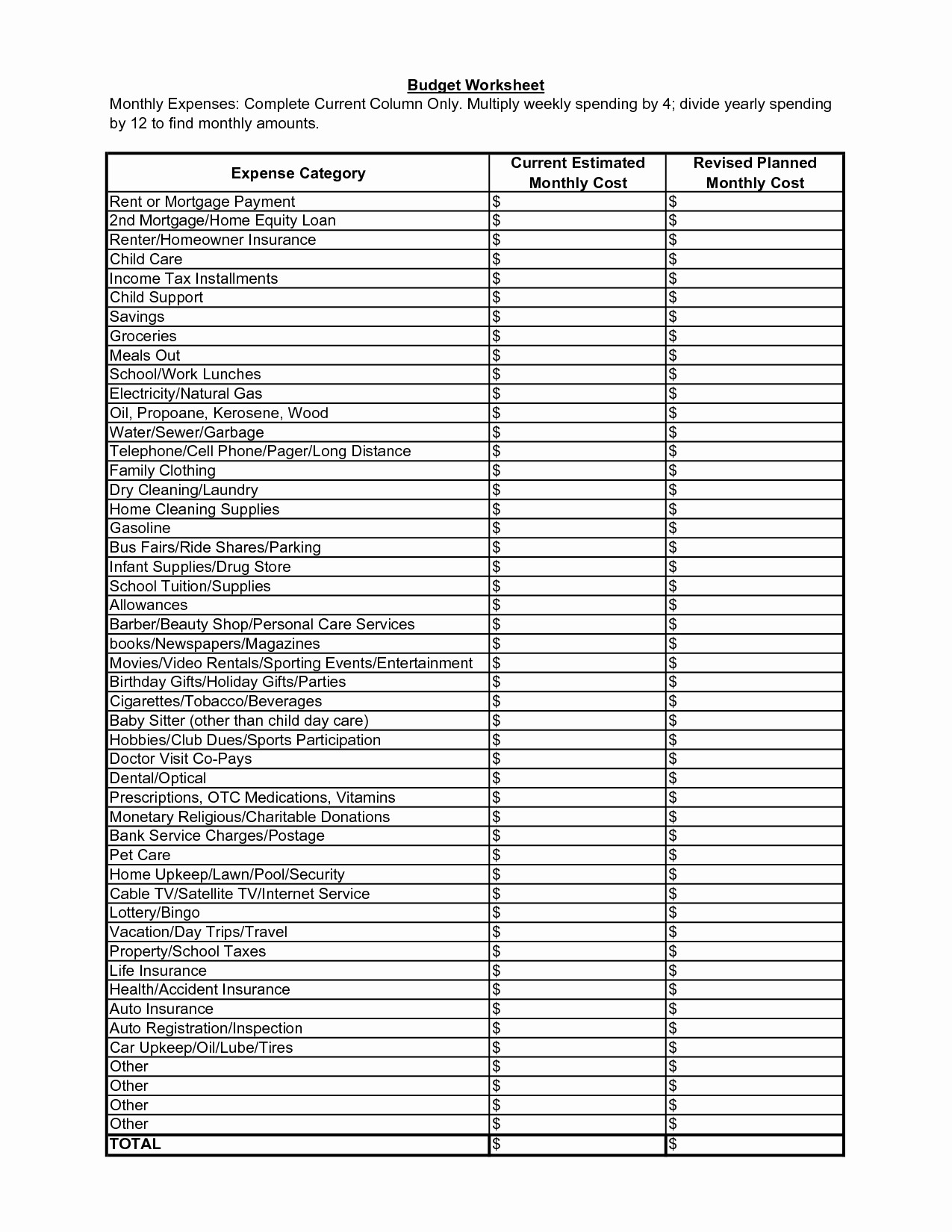

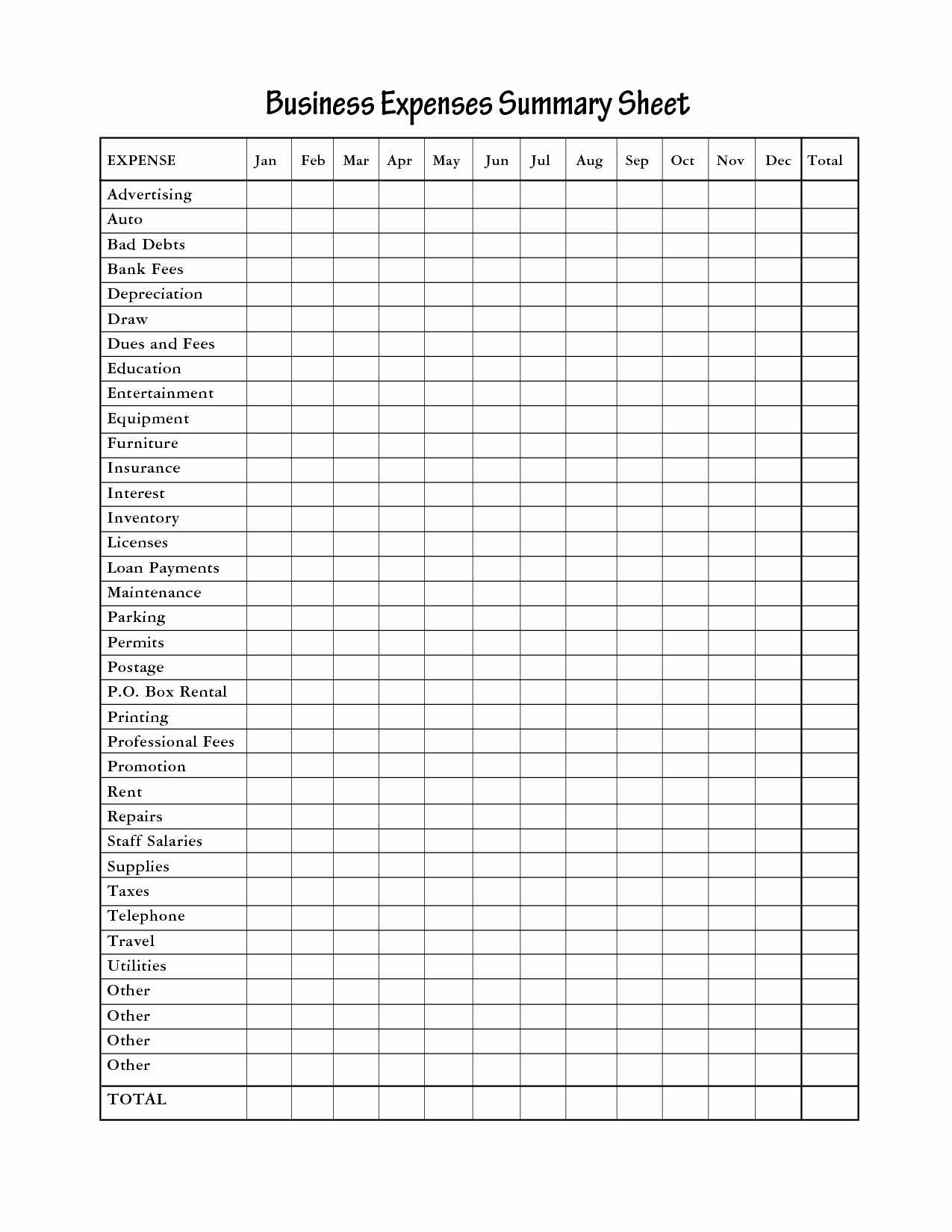

Schedule C Expense Worksheet

Schedule C Expense Worksheet - Department of the treasury internal revenue service. Use separate sheet for each business. Before jumping into the details of schedule c, it’s important to note that if you have $5,000 or less in business expenses, you may be able to file a. The worksheet simplifies the process of. Web the best way to track income & expenses for tax form 1040. Web the listed federal schedule c expense amounts will flow to the pa schedule c, however, pa has additional lines that are not specifically detailed on the federal schedule c. For most people, the answer to the question ' did you use less than 5 vehicles for business at a time '. Web schedule c (child care) —car & truck expenses worksheet (volvo xc 90) less than 5 at a time. Get out your shoebox of 2022 receipts and let’s get organized. Name & type of business: Worksheets are schedule c work, schedule c work for self e. Web the listed federal schedule c expense amounts will flow to the pa schedule c, however, pa has additional lines that are not specifically detailed on the federal schedule c. Payments made to employees for reimbursement of tuition, books, and other materials are deductible. Web schedule c (form 1040).. Web you can enter the amount in the check entry screen, if you know what expense doesn't have an amount. The worksheet simplifies the process of. (b) income and deductions of certain qualified joint ventures; Web schedule c (child care) —car & truck expenses worksheet (volvo xc 90) less than 5 at a time. Ultratax cs uses worksheets 1 and. Web the listed federal schedule c expense amounts will flow to the pa schedule c, however, pa has additional lines that are not specifically detailed on the federal schedule c. Web real estate agent small business/schedule c worksheet send last year’s schedule c or tax return if you operated the business previously and we did not prepare the previous tax.. Refer to irs publication 517 , for details. If you don't know what expense the check entry is referring to, you can navigate back to your business and review the other miscellaneous expenses you have entered to find the one without an amount. Use separate sheet for each business. Web sections of the report. Partnerships must generally file form 1065. Web schedule c (child care) —car & truck expenses worksheet (volvo xc 90) less than 5 at a time. Download the excel worksheet here. Ultratax cs uses worksheets 1 and 2 from publication 517 to figure the deductible portion of a. Web the best way to track income & expenses for tax form 1040. Business name (if any)__________________________________________ address (if. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; Profit or loss from business. For most people, the answer to the question ' did you use less than 5 vehicles for business at a time '. Web the listed federal schedule c expense amounts will flow to the pa schedule c, however,. Web according to irs publication 517, expenses related to a minister's schedule c income (e.g. The worksheet simplifies the process of. Use separate sheet for each business. Business name (if any)__________________________________________ address (if any) _________________________________________. For instructions and the latest information. Web schedule c worksheet hickman & leckrone, pllc. Web schedule c worksheet hickman & hickman, pllc. Use separate sheet for each business. Web schedule c (child care) —car & truck expenses worksheet (volvo xc 90) less than 5 at a time. Before jumping into the details of schedule c, it’s important to note that if you have $5,000 or less. Irs requires we have on file your own information to support all schedule c’s. For self employed businesses and/or independent contractors. If you don't know what expense the check entry is referring to, you can navigate back to your business and review the other miscellaneous expenses you have entered to find the one without an amount. Web schedule c worksheet. I do not understand the question. Web the listed federal schedule c expense amounts will flow to the pa schedule c, however, pa has additional lines that are not specifically detailed on the federal schedule c. Or keyword “sc” refer to publication 463, travel, entertainment, gift, and car expenses, for help determining deductible business mileage and nondeductible commuting mileage. Worksheets. Manually enter the mileage and square footage values into the worksheet to calculate the mileage expense for line 9. Web sections of the report. The worksheet simplifies the process of. If you don't know what expense the check entry is referring to, you can navigate back to your business and review the other miscellaneous expenses you have entered to find the one without an amount. It allows taxpayers to easily track the expenses that are deductible on their schedule c, profit or loss from business, which is part of their personal income tax return. Business name (if any)__________________________________________ address (if any) _________________________________________. Schedule c worksheet hickman & hickman, pllc. Use this schedule to complete part i income and part ii expenses of your client’s schedule c. Before jumping into the details of schedule c, it’s important to note that if you have $5,000 or less in business expenses, you may be able to file a. Web you can enter the amount in the check entry screen, if you know what expense doesn't have an amount. Web according to irs publication 517, expenses related to a minister's schedule c income (e.g. For most people, the answer to the question ' did you use less than 5 vehicles for business at a time '. Download the excel worksheet here. For self employed businesses and/or independent contractors. June 3, 2019 12:32 pm. Get out your shoebox of 2022 receipts and let’s get organized. Irs requires we have on file your own information to support all schedule c’s. Expense category amount comments parking fees and tolls fuel repairs tires insurance. Web the schedule c expenses worksheet is a tool used to help taxpayers organize their business expenses for filing with form 1040. Name & type of business: For most people, the answer to the question ' did you use less than 5 vehicles for business at a time '. Year & make and model vehicle do you have evidence to support the deduction? I do not understand the question. Web schedule c worksheet hickman & hickman, pllc. If you don't know what expense the check entry is referring to, you can navigate back to your business and review the other miscellaneous expenses you have entered to find the one without an amount. Worksheets are schedule c work, schedule c work for self e. Use separate sheet for each business. Web also, use schedule c to report (a) wages and expenses you had as a statutory employee; See the instructions on your form 1099 for more information about what to report on schedule c. Web these worksheets are used to calculate: For self employed businesses and/or independent contractors. Web you can enter the amount in the check entry screen, if you know what expense doesn't have an amount. Business name (if any)__________________________________________ address (if any) _________________________________________. Use a separate worksheet for each business owned/operated. Federal section>income>profit or loss from a business>car and truck expenses; For instructions and the latest information.Schedule C Expenses Spreadsheet —

Schedule C And Expense Worksheet printable pdf download

Schedule C Expenses Spreadsheet Of Schedule C Expenses —

Schedule C Spreadsheet Of Schedule C Expenses Spreadsheet —

Schedule C Expenses Worksheet Home Design Ideas Home —

Schedule C Spreadsheet —

15 Best Images of Monthly Business Expenses Worksheet Printable Free

Schedule C Expenses Worksheet —

Schedule C Expenses Worksheet —

schedule c expense worksheet excel

Partnerships Must Generally File Form 1065.

June 3, 2019 12:32 Pm.

Web The Listed Federal Schedule C Expense Amounts Will Flow To The Pa Schedule C, However, Pa Has Additional Lines That Are Not Specifically Detailed On The Federal Schedule C.

(B) Income And Deductions Of Certain Qualified Joint Ventures;

Related Post: