Schedule C Expenses Worksheet

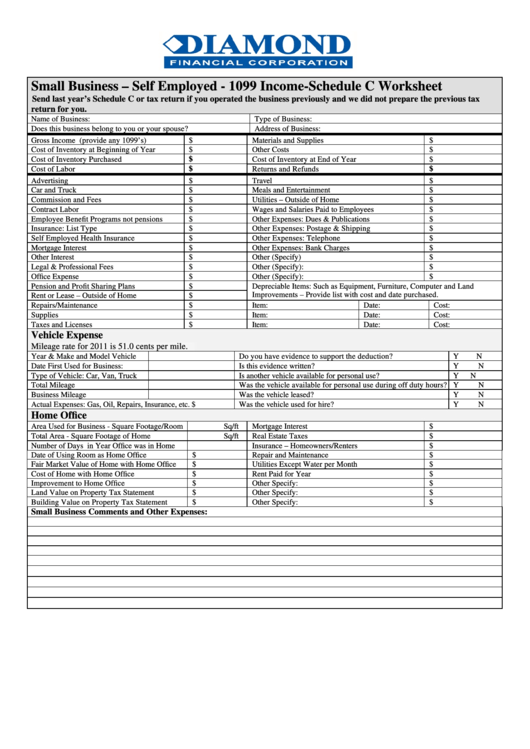

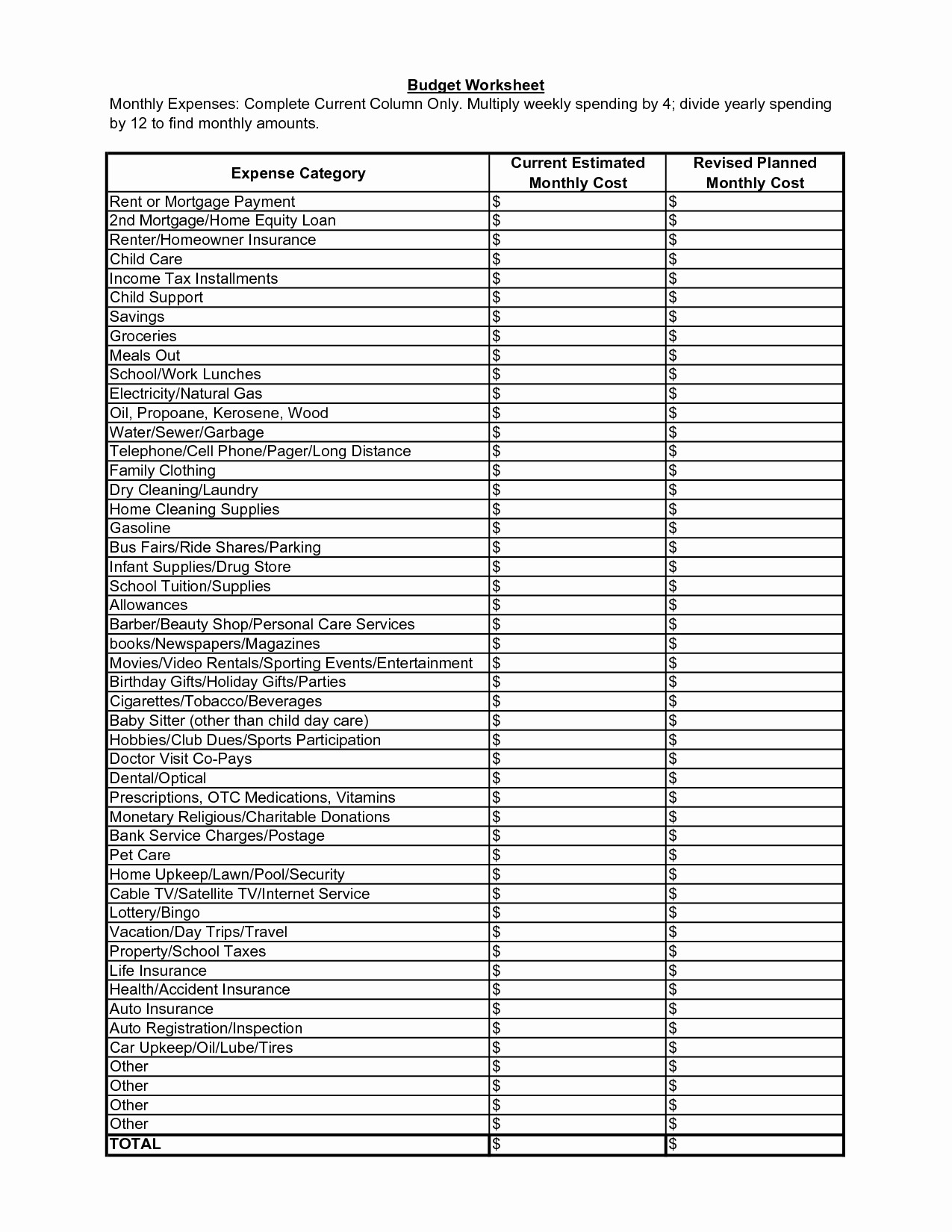

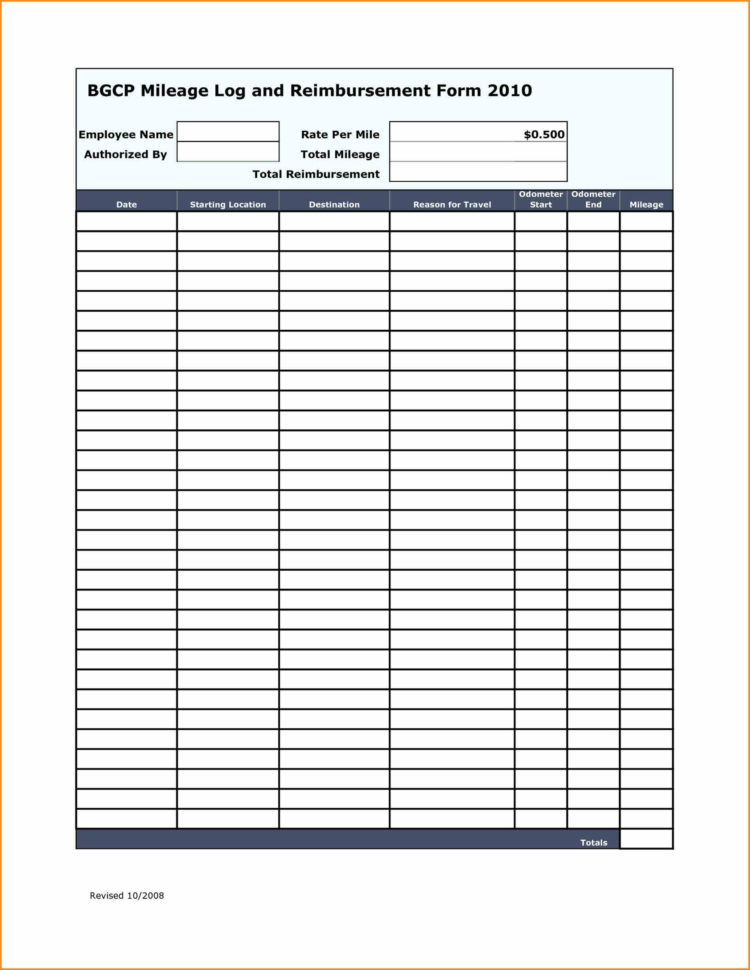

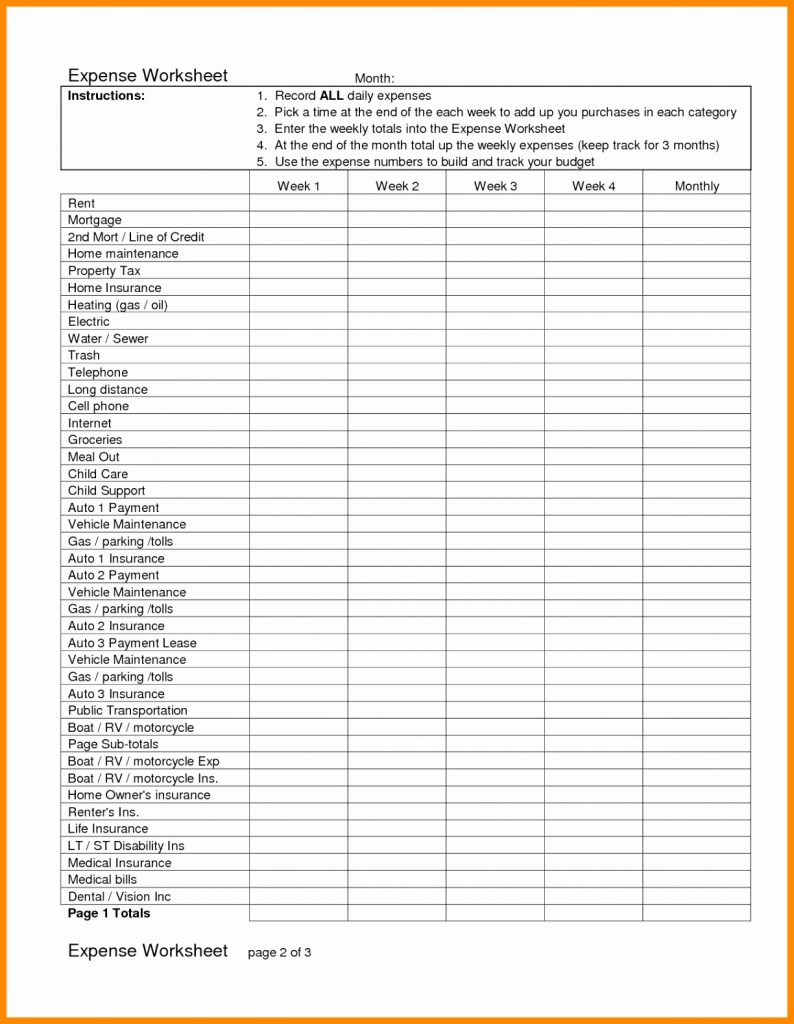

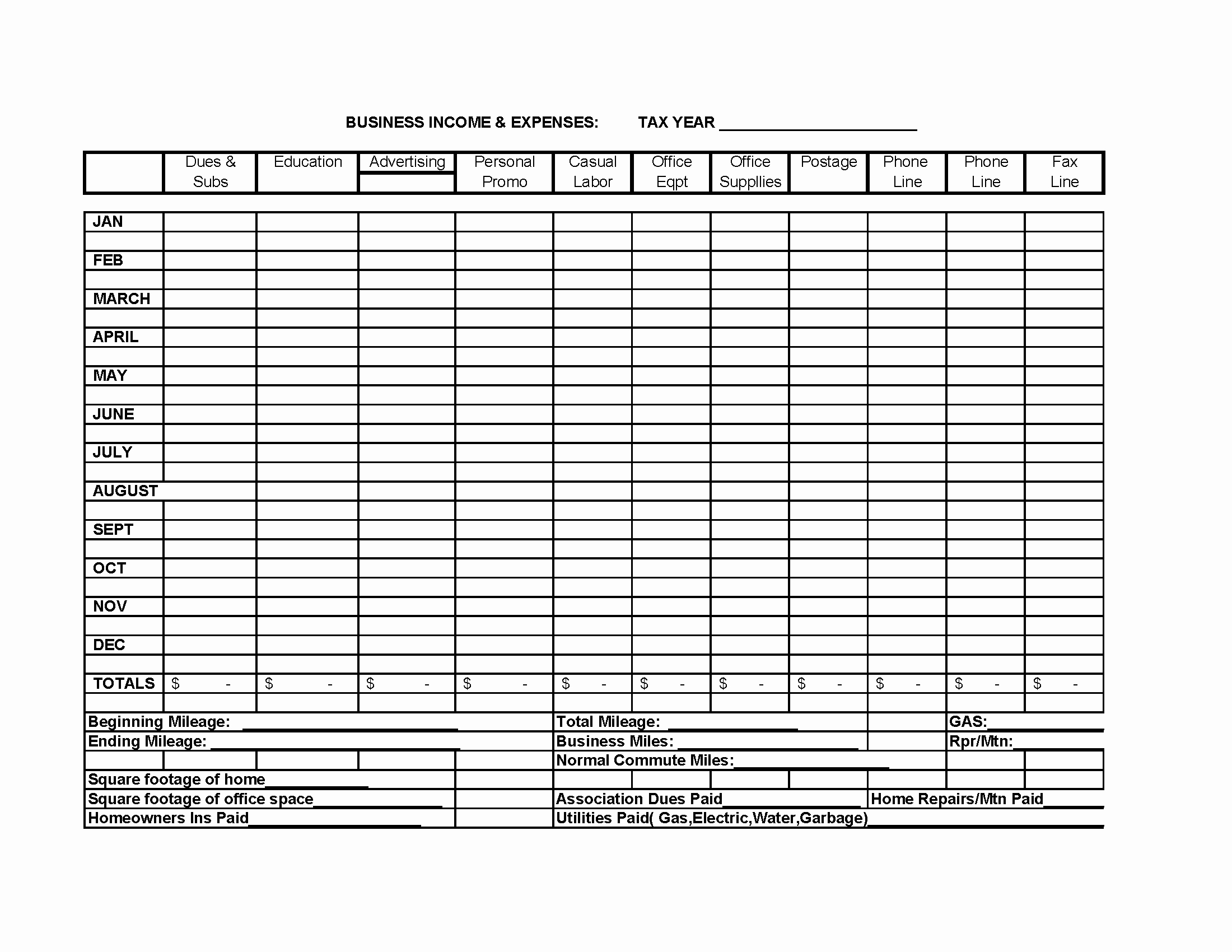

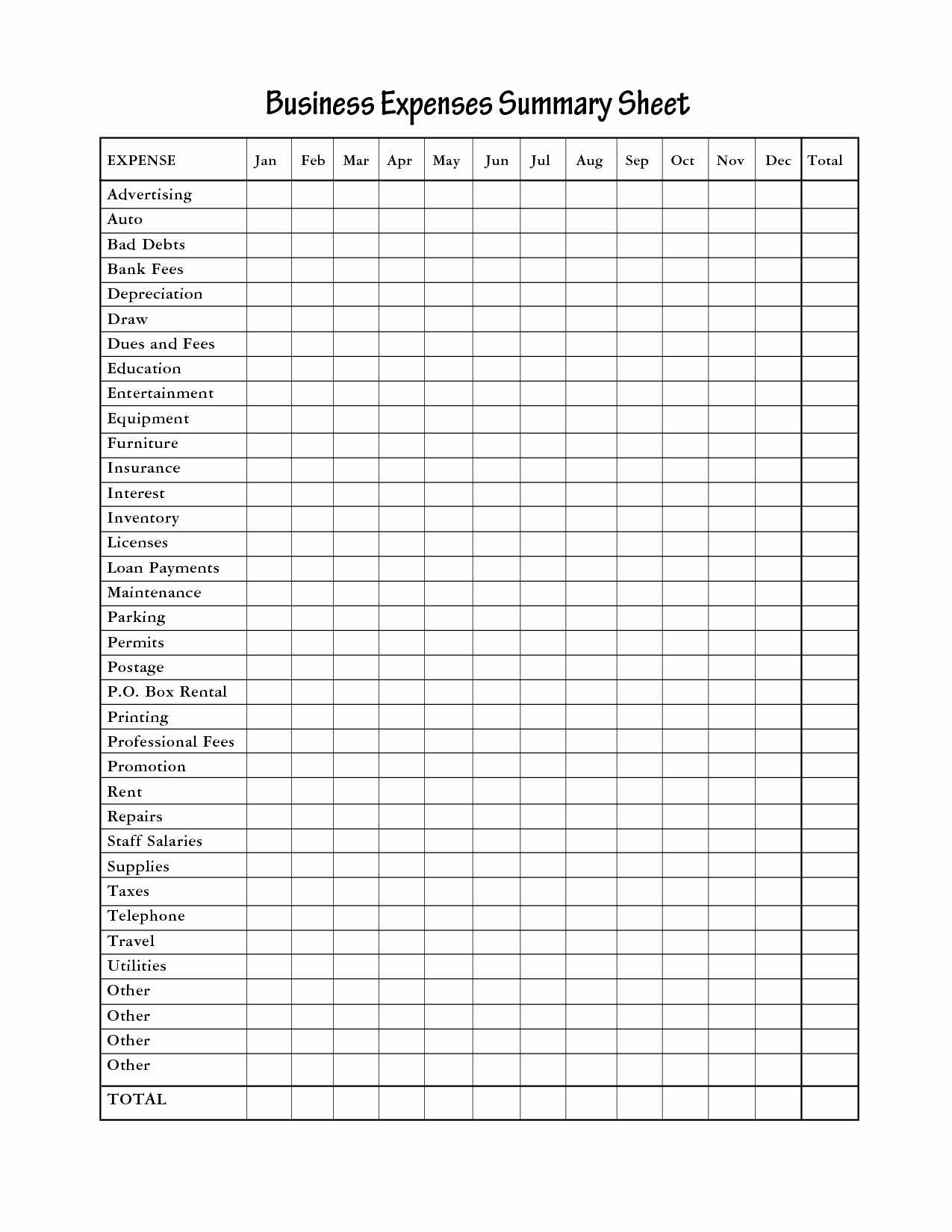

Schedule C Expenses Worksheet - Web quick steps to complete and design schedule c tax form online: It is up to you to determine into what categories your individual expenses fall. Web schedule c cheat sheet part ii: Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. In the section for expenses, there will be a quickzoom to enter auto information. Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Expense category amount comments fuel repairs tires insurance fixed. Start completing the fillable fields. Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Use get form or simply click on the template preview to open it in the editor. Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Bank/credit card statements with expenses highlighted other. (b) income and deductions of certain qualified joint ventures; Expense category amount comments fuel repairs tires insurance fixed. (b) income and deductions of certain qualified joint ventures; Expense category amount comments fuel repairs tires insurance fixed. Web the expense categories used on the schedule c are listed below, with examples and notes. Business owned and operated by spouses if you and your spouse jointly own and operate an. Start completing the fillable fields. Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Web the expense categories used on the schedule c are listed below, with examples and notes. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Use get form. Web with expenses highlighted mileage log and receipts for actual car/truck expenses. Bank/credit card statements with expenses highlighted other. Web schedule c cheat sheet part ii: Web expenses or collections of receipts to organize or subtotal your expenses for you. Start completing the fillable fields. Start completing the fillable fields. The expense categories used on the schedule c are listed below, with examples and notes. Web the expense categories used on the schedule c are listed below, with examples and notes. Web schedule c cheat sheet part ii: Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Expense category amount comments fuel repairs tires insurance fixed. Use get form or simply click on the template preview to open it in the editor. Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Web schedule c cheat sheet part ii: Web department of the treasury internal revenue service profit or loss. In the section for expenses, there will be a quickzoom to enter auto information. Federal section>income>profit or loss from a business>general expenses; Web expenses or collections of receipts to organize or subtotal your expenses for you. Web quick steps to complete and design schedule c tax form online: It is up to you to determine into what categories your individual. (b) income and deductions of certain qualified joint ventures; Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web the expense categories used on the schedule. Web statutory employees use schedule c to report their wages and expenses. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web schedule c cheat sheet part ii: Business owned and operated by spouses if you and your spouse jointly own and operate an. It. Web quick steps to complete and design schedule c tax form online: (b) income and deductions of certain qualified joint ventures; Web schedule c cheat sheet part ii: Web statutory employees use schedule c to report their wages and expenses. Bank/credit card statements with expenses highlighted other. Use get form or simply click on the template preview to open it in the editor. Web the expense categories used on the schedule c are listed below, with examples and notes. Web quick steps to complete and design schedule c tax form online: Business owned and operated by spouses if you and your spouse jointly own and operate an. Expenses here’s where you enter all those business deductions you’ve been keeping excellent track of all year! Federal section>income>profit or loss from a business>general expenses; Expense category amount comments fuel repairs tires insurance fixed. Web schedule c cheat sheet part ii: Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Bank/credit card statements with expenses highlighted other. It is up to you to determine into what categories your individual expenses fall. Web statutory employees use schedule c to report their wages and expenses. (b) income and deductions of certain qualified joint ventures; Start completing the fillable fields. In the section for expenses, there will be a quickzoom to enter auto information. Web department of the treasury internal revenue service profit or loss from business (sole proprietorship) go to www.irs.gov/schedulec for instructions and the latest information. Web expenses or collections of receipts to organize or subtotal your expenses for you. The expense categories used on the schedule c are listed below, with examples and notes. Web with expenses highlighted mileage log and receipts for actual car/truck expenses. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. (b) income and deductions of certain qualified joint ventures; In the section for expenses, there will be a quickzoom to enter auto information. The expense categories used on the schedule c are listed below, with examples and notes. It is up to you to determine into what categories your individual expenses fall. Start completing the fillable fields. Federal section>income>profit or loss from a business>general expenses; Expense category amount comments fuel repairs tires insurance fixed. Business owned and operated by spouses if you and your spouse jointly own and operate an. Bank/credit card statements with expenses highlighted other. Web schedule c cheat sheet part ii: Web information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;. Web schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business. Web expenses or collections of receipts to organize or subtotal your expenses for you. Web with expenses highlighted mileage log and receipts for actual car/truck expenses. Web statutory employees use schedule c to report their wages and expenses. Use get form or simply click on the template preview to open it in the editor.Fillable Small Business Self Employed 1099 C

Schedule C Expenses Worksheet —

Schedule C Expenses Spreadsheet Download Laobing Kaisuo —

Printable Schedule C Form Fill Online, Printable, Fillable, Blank

Schedule C Spreadsheet —

Schedule C Expenses Spreadsheet Spreadsheet Softwar schedule c expenses

Schedule C (Form 1040) Expense Cost Of Goods Sold

schedule c expense worksheet excel

Schedule C Excel Template Lovely Schedule C Expense Excel Template

What Does Schedule C Mean On 1099 Nec Paul Johnson's Templates

Web The Expense Categories Used On The Schedule C Are Listed Below, With Examples And Notes.

Expenses Here’s Where You Enter All Those Business Deductions You’ve Been Keeping Excellent Track Of All Year!

Web Department Of The Treasury Internal Revenue Service Profit Or Loss From Business (Sole Proprietorship) Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

Web Quick Steps To Complete And Design Schedule C Tax Form Online:

Related Post:

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)